By This Measure, US Unemployment Is About To Surge

One of the perplexing divergences about the ongoing economic slowdown is that whereas manufacturing, and increasingly, service surveys have shown the US economy is on the verge of a contraction, the US consumer remains quite healthy.

Indeed, as Morgan Stanley wrote yesterday, the strength of the US consumer has been the bedrock of the current economic expansion. Just a few weeks ago, in a CNBC interview, Fed Vice Chair Clarida said that “I cannot think of a time where in the aggregate the consumer has been in better shape.” With unemployment at 3.5%, the household savings rate ticking up to 8%, the aggregate debt-to-income ratio hovering around 40-year lows and consumer delinquencies at or near post-crisis lows, policy-makers’ comfort with the strength of the US consumer seems well grounded.

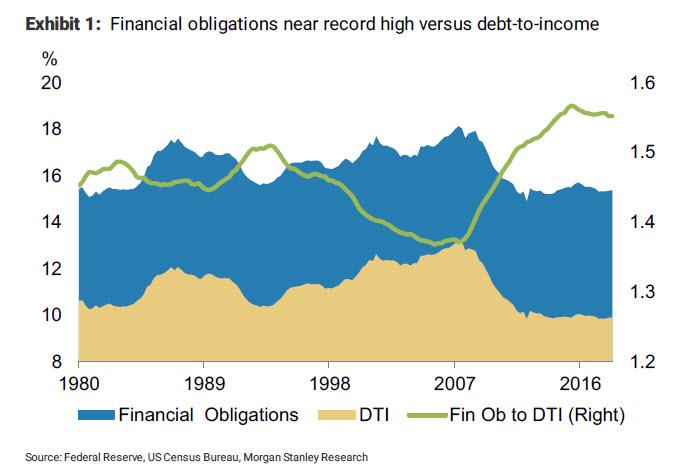

That said, cracks are appearing, and while aggregate consumer debt-to-income ratios and delinquency rates are indeed low, the New York Fed’s financial obligations ratio tells a different story. With the decline in homeownership, the share of rental households has risen, as have rents, which are not included in aggregate debt-servicing costs. In addition to standard debt payments, the financial obligations ratio includes payments towards rent, auto leases, homeowners’ insurance and property tax payments, with rents representing the bulk of these non-standard obligations.

Looking at this ratio together with debt-to-income, ONE can tease out the impact that increasing numbers of rental households paying progressively higher rent is having on the health of the consumer. The spread between these two ratios stands at the widest level since 1980. Renters generally tend to be younger, and at the lower end of the income spectrum versus homeowners. As such, as Morgan Stanley noted, “aggregate consumer metrics fail to capture the growing stress on rental households.”

Here Morgan Stanley made another striking observation, which we discussed yesterday: while the US consumer’s balance sheet is in fine shape overall, mainly because levels of debt and debt-servicing costs remain low, there’s a segment whose income statements are under stress –rental households with lower income and lower credit scores. How big are they? Not small, at least on one metric: borrowers with FICO scores below 650 account for about 28% of the population.

As Morgan Stanley’s economist Ellen Zentner concluded, “if the direction of gains in employment reverses, look for the cracks to widen.”

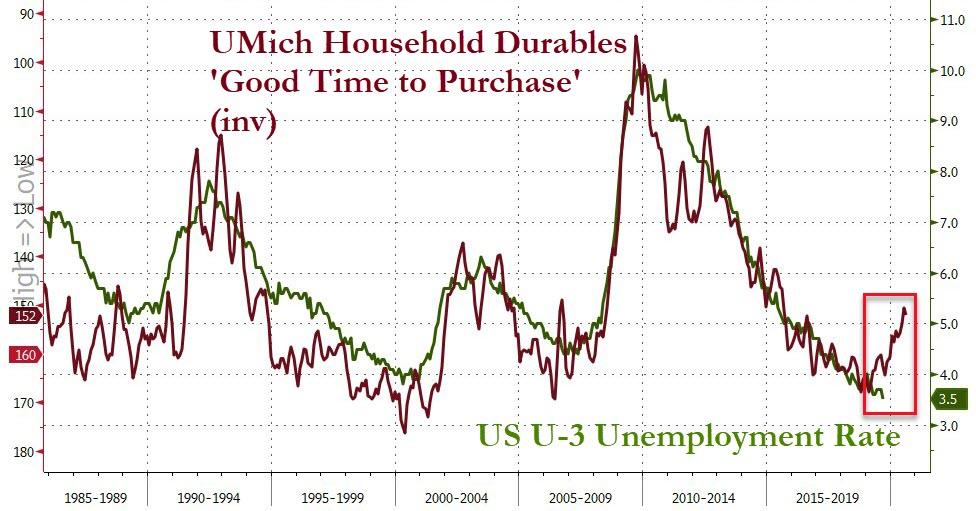

So with that, we bring readers’ attention to another remarkable chart, one which suggests that the cracks are indeed about to widen as the US unemployment rate is set to spike, perhaps signaling the long overdue start of the recession. Specifically, we show the relationship between the US unemployment rate (U-3) and the University of Michigan Consumer Confidence Survey response to the question that it is “a good time to purchase household durables.” The results of this question, which are shown on an inverted axis, tend to correlate closely with overall economic confidence overall economic and market conditions, and – most of all – with the unemployment rate which they tend to lead by about 10 months.

The logic is simple: US consumers spend less on critical household purchases when their economic situation deteriorates; alternatively, the decision to reduce spending on key household products, which may come amid concerns for future income and wealth, creates a feedback loop which ultimately results in an economic contraction.

More ominously, major reversal inflection points in the consumer spending intentions have been a clear leading indicator to what awaits the US unemployment rate, and as the chart below shows…

… all else equal US unemployment is about to jump by roughly a third, from 3.5% currently to just shy of 5.0%.

Finally, if the 10 month lead time on this metric is accurate, expect US unemployment to spike just as the national debate turns to the Nov 2020 presidential election. Needless to say, a sudden spike in the unemployment rate in mid/late 2020 will not help Trump’s reelection chances.

Tyler Durden

Mon, 10/14/2019 – 16:50

via ZeroHedge News https://ift.tt/2oKOvmm Tyler Durden