770,000 Indexes Just Died, But There’s Still 2.96 Million Left

An astonishing 770,000 benchmark indexes were scrapped around the world in 2019, according to Bloomberg, possibly signaling a retreat from passive investing.

But even more ridiculous than the nearly three quarters of a million indexes that were done away with is the fact that there are still 2.96 million indexes globally, according to a new report from the Index Industry Association.

It’s just another indicator of how the world’s obsession with passive investing has become a farce. For comparison, there’s an estimated 630,000 stocks that trade globally, including only about 2,800 stocks on the NYSE and 3,330 on the NASDAQ. This means that there’s still about five times as many indexes as there are securities globally.

For the first time since the IIA has been providing data, decommissioned indexes outweighed the creation of new benchmarks.

Rick Redding, the IIA’s chief executive officer, said:

“Every firm continuously evaluates their indexes to see if they are redundant, which helps keep costs down for their clients. Ultimately, our members are focused on providing the quality of indexes investors demand that they administer and not necessarily the quantity.”

Despite the peel off in total indexes, the number of fixed income indexes was up 7.2% from a year earlier due to expansion in Europe, the Middle East and Africa. The region now has nearly as many debt gauges as the Americas, according to the report.

Indexes measuring environmental, social and governance metrics also grew, up 14% from a year prior.

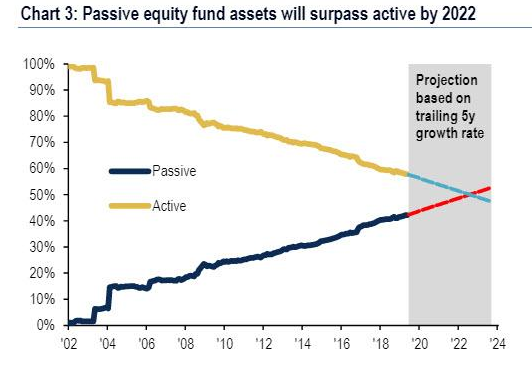

Just last month, we pointed out Bank of America’s prediction that robots and algorithms would overtake humans in asset allocation by 2022 as passive investing continued to grow in popularity.

Tyler Durden

Fri, 10/18/2019 – 14:38

via ZeroHedge News https://ift.tt/2MrkK30 Tyler Durden