China Braces To Unveil 5%-GDP Growth At Two Key Meetings In Coming Weeks

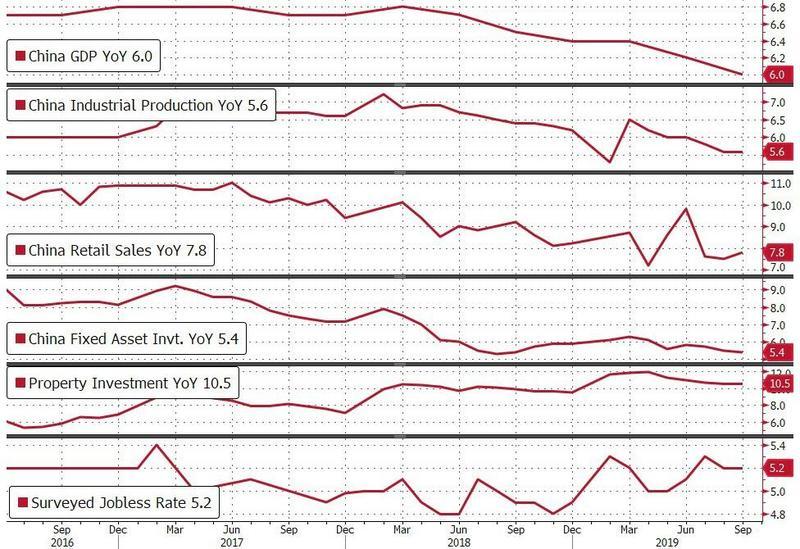

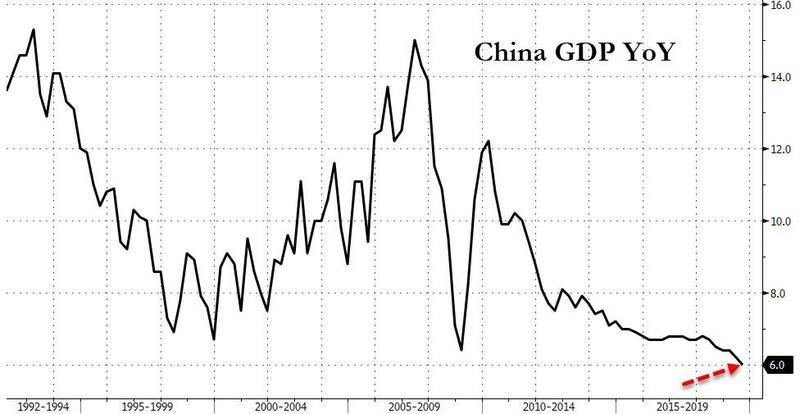

Earlier this month, Beijing marked the 70th anniversary of the People’s Republic of China with huge military parades, showing off its hypersonic weapons and weaponized drones. But behind the scene’s China’s economy is quickly decelerating, and fresh evidence last week shows GDP could slip under 6%. China’s GDP, published last Friday, showed 6% growth for 3Q, the weakest quarterly prints since 1992 and down from 6.2% in 2Q.

“Trade tension with the US is the key factor weighing on business sentiment and investment activities, although domestic stimulus policies are providing some buffer from the downside,” said Chaoping Zhu, a global market strategist for JP Morgan.

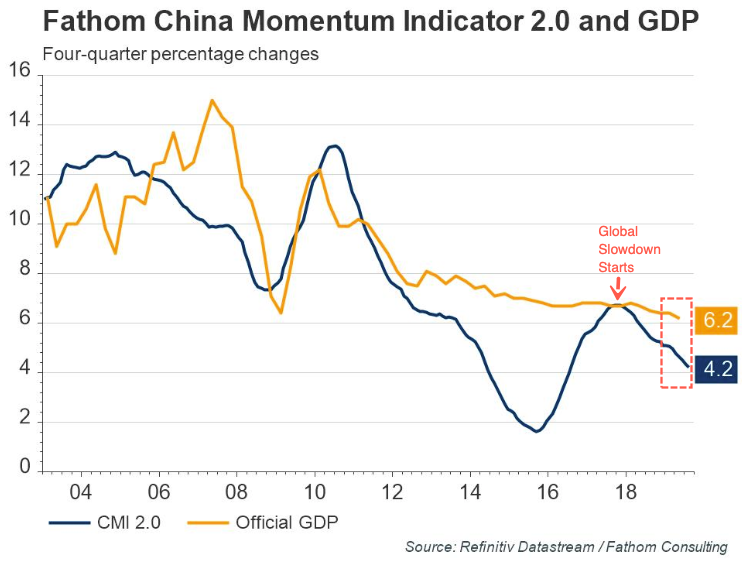

The latest growth (and trade) figures suggest China’s economy is slowing even more as we enter 4Q. In fact, according to Lipper Alpha Insight’s China Momentum Indicator (CMI) 2.0, the latest China GDP was likely at 4.2%, a third below the official print.

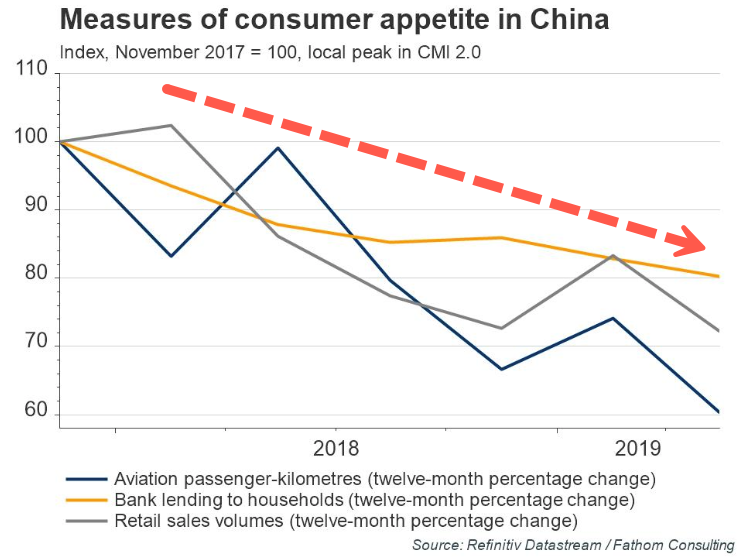

Lipper Alpha Insight told their clients that the slowdown in China’s economy isn’t a “consequence of rebalancing; China abandoned its half-hearted attempt to reform the economy in a bid to cushion the slowdown last year. Recent measures of consumer appetite have reinforced this message. Retail sales, bank lending to households and aviation passenger numbers have all slowed since the end of 2017 (when our CMI last peaked), despite being key indicators of a more consumer-led economy.”

Lipper Alpha Insight adds that while the “pursuit of growth at the expense of reform is the wrong medicine; it will work for a time, but allocative inefficiencies and diminishing returns mean that unless something changes China is destined for perennially lower economic growth. This idea is reflected in our forecast, with the path into the future expected to be one that winds to and fro, with key events likely to intensify China’s prioritization of growth, regardless of the long-term cost.”

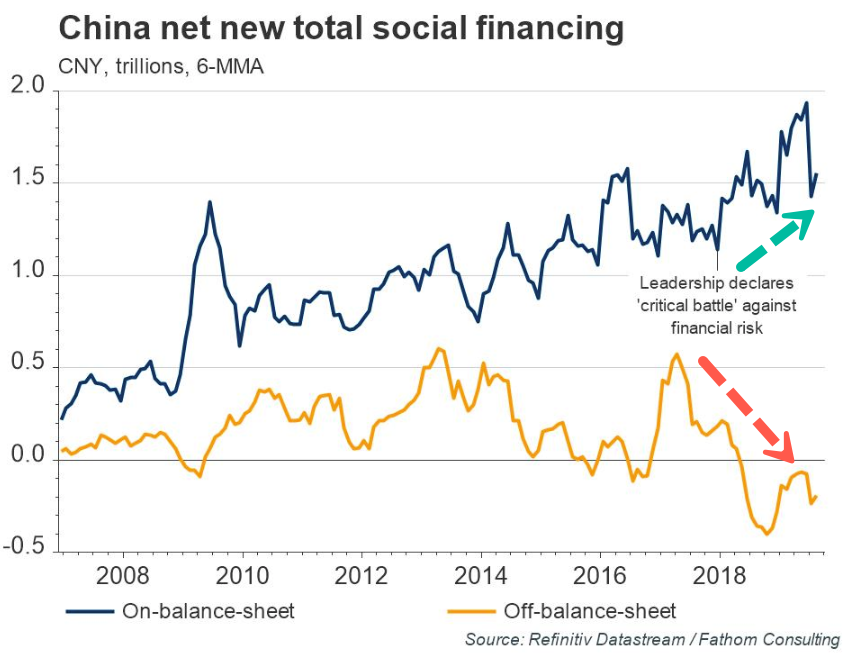

To be sure, this is something we have flagged repeatedly in recent weeks, when we pointed out that despite its best efforts, China is no longer able to reflate its all too critical credit impulse, which can barely stage a rebound from multi-year lows and appears to already be fading lower.

With that in mind, it is hardly a surprise that as Bloomberg reports, China’s policymakers are preparing for two key meetings in the coming weeks with fresh evidence that sooner rather than later, the GDP number will start with a 5-handle.

The People’s Bank of China Governor Yi Gang responded over the weekend to the deterioration in 3Q GDP data. Gang didn’t hint at more stimulus but said China would keep its debt situation under control. As seen in the chart below, China’s attempt to clean up imbalances and financial risk in the economy is being done through an increase in social credit by reducing off-balance-sheet risks.

Yi’s comments are setting the scene for a meeting of the Politburo, the Communist Party’s top leaders, and the ensuing Fourth Plenum of the Party’s Central Committee, a broader gathering that may mull longer-term questions of economic policy. While those events could produce a shift away from the current targeted, moderate stimulus regime, there have been few signals to date of any change.

Yao Wei, the chief China economist at Societe Generale in Paris, told reporters at the IMF meetings last week that Chinese leaders are “looking at a very long horizon,” and the intermediate fluctuations above or below 6% aren’t important at the moment.

“They measure the policy scope by looking at the overall debt, by looking at how much risk there is in shadow banking, in the housing sector and in inflation,” Yao said. “Looking at all these things, they judge they actually don’t have much scope from a long-term perspective. So they’re very careful about how to use it and when to use it.”

With growth estimates in China missing the mark in 3Q, it’s likely slippage below 6% could be seen in 4Q, as there is no indication that China, nor the global economy is turning up at the moment. There are some positive factors when it comes to the recent trade truce, or at least that’s what the market believes. Still, as we have repeatedly discussed, the global slowdown didn’t start because of the trade war but due to residual problems within China’s massively overlevered economy, so any resolution will likely only boost global growth for a brief period.

Bloomberg data shows China’s full-year expansion for 2019 to come in around 6.2% and will slow to 5.9% in 2020.

China can cut interest rates and unleash higher doses of monetary policy. But the problem China is running into today, as explained in our report Sunday night, is that monetary stimulus is becoming less effective than ever before.

As the world awaits the upcoming Politburo meeting for economic clarity and a medium-term outlook from Chinese leaders, China’s economy is rapidly deteriorating and will likely fall underneath 6% in the quarters ahead, and could even register full-year growth rates for 2020 under 6%.

The world, led by China, has already entered a new phase of below-trend growth, it’s just that equity markets haven’t yet figured this one out.

Tyler Durden

Mon, 10/21/2019 – 08:21

via ZeroHedge News https://ift.tt/2p3GSYm Tyler Durden