As Liquidity Evaporates, Fed’s Third Bill POMO Is 5.5 Oversubscribed, Most Yet

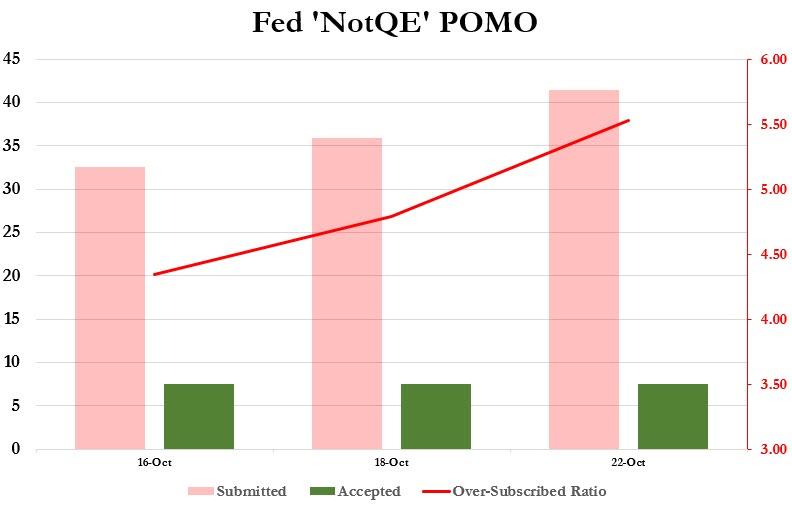

Earlier this morning, when discussing today’s oversubscribed term repo and latest funding squeeze, we previewed today’s T-Bill POMO saying, “and now we await today’s T-Bill Pomo result for the final proof of funding deterioration, as we expect today’s operation will be the most oversubscribed yet, confirming that dealers are scrambling to convert their “safe” assets into dollars as fast as possible.”

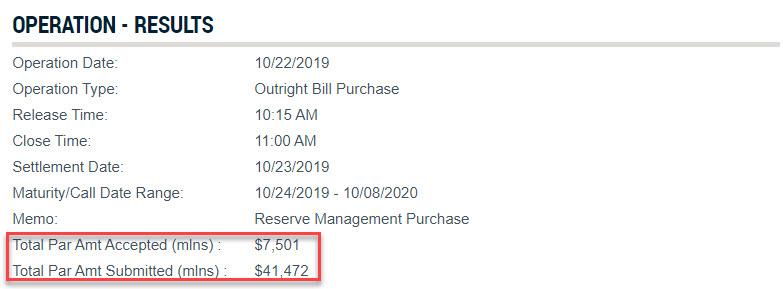

Less than two hours, that’s precisely what happened, when the Fed announced that in its third $7.5 Billion Treasury Bill POMO, the Fed received a whopping $41.472 billion in “liquidity” requests, i.e. Dealers submitted $41.5BN in bids for the maximum $7.5BN in Fed “Reserve Management” (note: not QE) purchases.

As such, the operation was 5.5x oversubscribed, a notable increase from the first two POMOs conducted last week, when operations were 4.3x and 4.8x oversubscribed.

While we already predicted the punchline earlier, here it is again: demand for the Fed’s permanent liquidity injection is increasing with every operation, even as overnight repo saw a modest increase in dealer interest while term repo was oversubscribed for the first time in 4 weeks.

As such the question we have been asking for the past month – and one which Elizabeth Warren should also consider asking of Steven Mnuchin – remains: why are banks still so desperate for liquidity even though the Fed has now made clear the Fed’s balance sheet will expand to accommodate all reserve needs, and why do they so stubbornly refuse to approach the interbank market for their funding needs? In short, what do they know about the banking system that we don’t?

Tyler Durden

Tue, 10/22/2019 – 11:32

via ZeroHedge News https://ift.tt/2qB9c4Z Tyler Durden