Liz Warren Wants To Know If JPMorgan Caused Repo Turmoil To Force Fed Into Launching QE

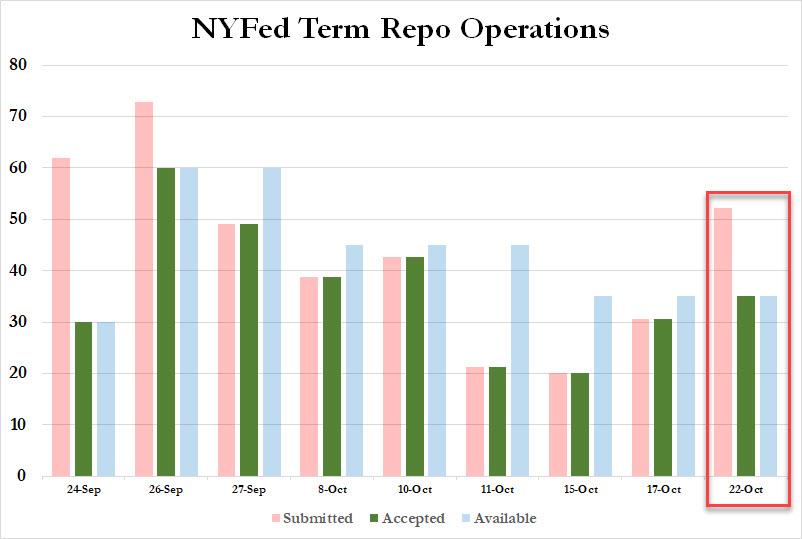

As we reported earlier today, the turmoil in the dollar funding markets has returned, with the Fed’s term repo (which covers the Oct 31 “no deal” Brexit date) oversubscribed for the first time since the repo crisis started in mid-September…

… while the overnight repo operation saw increased usage, bringing today’s total injection to $99.9 billion.

And while market participants, who erroneously believed the repo flare up was a one-time event driven by some spurious tax payments in mid-September, are scratching their heads to explain why the dollar funding shortage refuses to abate, today none other than frontrunning Democratic presidential candidate, Elizabeth Warren, sent a letter to Treasury Secretary Mnuchin, in which she said she was “seeking clarity” on why the Fed’s crisis-era actions “were necessary,” while questioning the “the implications of the cause of the spikes.”

In her letter, Warren correctly notes that neither September’s tax payment deadlines, nor the Treasury auction settlements – which many claimed catalyzed the surge in the overnight repo rate from 2% to 10%, were a surprise; it also wasn’t a surprise that the Fed’s reserve shrinkage, i.e. Quantitative Tightening, which were on “autopilot” as recently as last December, surprised Wall Street professionals and were not “the type of unforeseeable circumstance that would have rattled markets so suddenly.”

Instead, what Warren – who very well may be president of the US in just over a year’s time – indirectly suggests, and which we thoroughly agree with, is that one bank – which on October 2 we disclosed was JPMorgan – deliberately yanked cash from money markets in order to “suddenly” tighten financial conditions, in the process causing a funding crisis and and sparking the Sept 16 repocalypse (which “coincidentally” took place on the 11th anniversary of the Lehman collapse). This is what Warren said:

I am also concerned that, “Big U.S. banks are using the recent chaos in short-term funding markets as an opportunity to pressure the Federal Reserve to ease liquidity requirements they have long despised,” and that the FSOC might support these efforts. These rules were designed to ensure that banks have enough cash on hand to meet their obligations in the event of another market crash.”

And the punchline: “Banks are reporting profits at record levels, and it would be painfully ironic if unexplained chaos in a small corner of the banking market became an excuse to further loosen rules that protect the economy from these types of risks.”

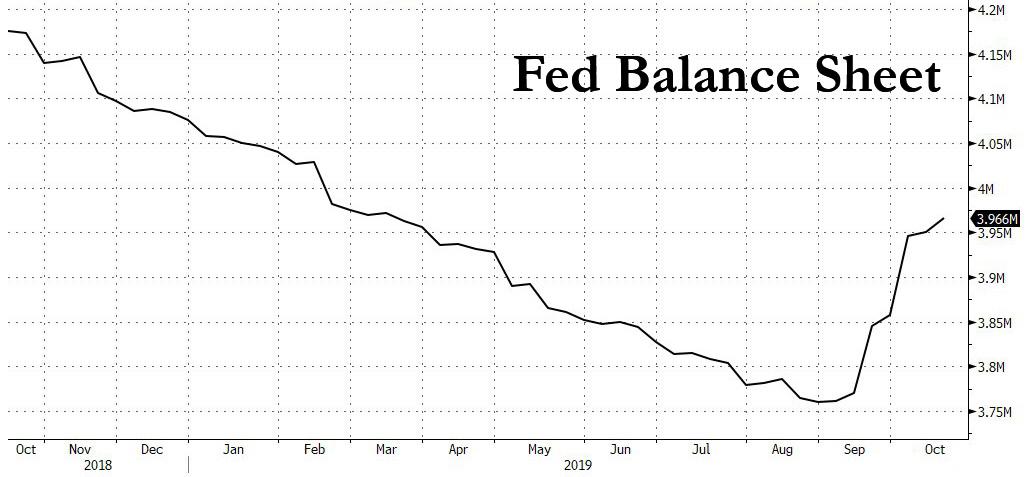

Warren is almost right: where she is wrong is that banks could care less about liquidity requirements. What they do want, however, is for liquidity to be greater; much, much greater and that’s precisely what they acehieved as a result of last month’s repo crunch. After all, less than a month later, the Fed shocked markets by announcing it was launching $60BN in T-Bill purchases per month, just the thing the US financial system ordered, in the process expanding the Fed’s balance sheet by over $200BN in just 4 weeks.

Just don’t call it QE4.

As a result, Warren had 3 questions for Mnuchin:

- What are the underlying causes of the spike in borrowing rates for overnight repurchase agreements?

- Has FSOC learned why the Fed announced on Oct. 11 that overnight operations meant to keep the calm would be extended at least through January of next year?

- How will FSOC and Treasury use data on centrally cleared repo transactions to gain a further understanding of the market? Is further information needed to sufficiently monitor the short-term lending market?

And since we would like to assist Warren get to the bottom of this issue, we will help her ask the 4th, missing, question which she almost does, but is missing two key aspects: the culprit and the motive.

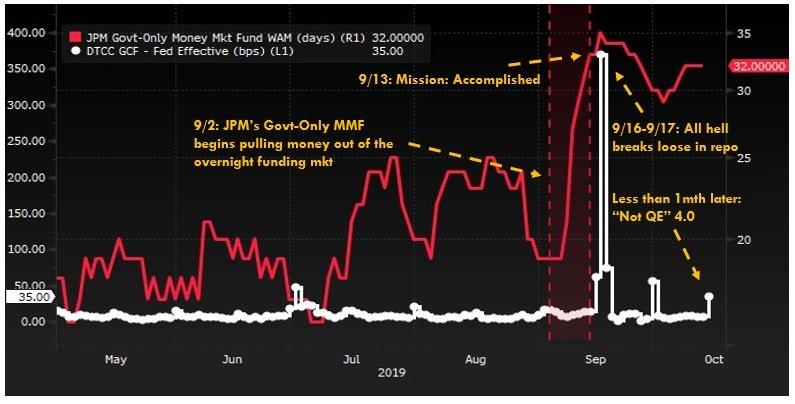

Here’s what happened: starting in early September, JPMorgan’s government-only money-market fund started pulling money out of overnight markets, in this case by yanking short-term Bills and pushing the fund’s Weighted Average Maturity sharply higher, with WAM peaking on Sept 13 just one day before all hell broke loose in Repo as overnight repo rates exploded as dealers suddenly found themselves without access to liquidity. This is shown in the following chart, courtesy of Monday Morning Macro.

The rest is, of course, history: first the Fed launched overnight repo, then term repo, and just days later, Powell announced he would bring back POMO (i.e., “Not QE4“).

And while we appreciate Warren’s line of inquiry into what caused the September repo spike, we already know the answer. As such, the real question Warren should be asking is “did JPMorgan intentionally collapse liquidity in money and funding markets, setting off a chain reaction that culminated with the Fed resuming QE4 less than a month later?”

We eagerly look forward to Mnuchin’s answer.

Warren’s full letter can be read below (pdf link).

Tyler Durden

Tue, 10/22/2019 – 10:41

via ZeroHedge News https://ift.tt/32CmPix Tyler Durden