Stellar Demand For 2 Year Treasuries As Dealers Buy Ahead Of Fed’s QE Expansion

In a curious twist, just two hours after Dealers were falling over themselves to sell Bills to the Fed (at the highest Bid to Cover yet for the Fed’s recently relaunched POMO of 5.5x), moments ago the US Treasury sold $40BN in 2Y paper to what was stellar demand for the short-end.

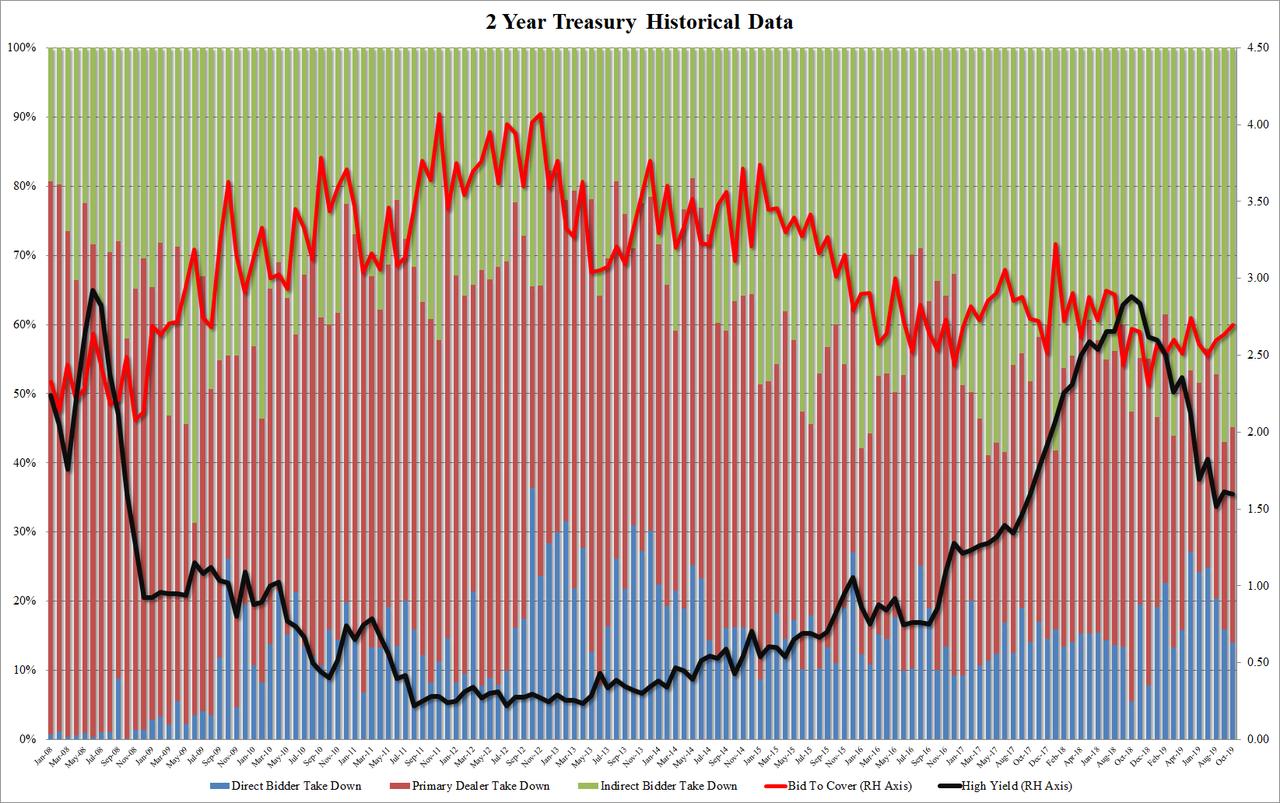

The auction stopped at 1.594%, the second lowest yield since October 2017, with only August’s 1.516% lower, and also stopped through the When Issued by a whopping 1.2 bps. This was tied with the biggest stop through since March, with only May 2016 notably greater at 2.3bps.

The bid to cover of 2.695 was also a solid improvement to last month’s 2.695, and was notably above the 6-auction average of 2.59. In fact, only May’s 2.745 was higher going back to last August.

Finally, the internals were also quite solid, with Indirects taking down 54.83%, slightly below last month’s 57.01% but far above the recent average of 48.40%. And with Directs taking down 14.0%, below the six auction average of 21.4%, Dealers were left holding 31.2%, one pp above the 30.2% average.

Why the dramatic spike in demand? It was not immediately clear, however with banks such as JPMorgan expecting the Fed to branch out beyond just buying Bills (or else risk more money market turmoil), it is quite likely that the Fed will have to purchase 2Y TSYs in the coming months, and so primary buyers are just arbing the upcoming selling prices, which since the Fed is perfectly price indiscriminate, would mean a guaranteed profit to anyone who buys today unless, of course, there is a burst of inflation hitting the US economy which would force the Fed to halt both QE and raise rates. And since that is very unlikely, today’s buyers are merely locking in assured profits from flipping this paper back to the Fed in a few months time.

Tyler Durden

Tue, 10/22/2019 – 13:18

via ZeroHedge News https://ift.tt/32Jt4Be Tyler Durden