China Just Injected The Most Liquidity Since January… And It’s Not Enough

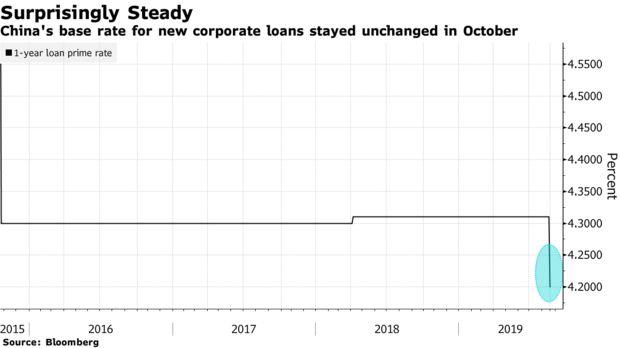

Just days after China’s GDP unexpectedly dropped to a sub-consensus 6.0%, the lowest in three decades (with Beijing now set to reveal a 5-handle GDP in the coming months), China watchers were convinced that this week would start with Beijing again lowering its “Libor rate“, i.e., the previously discussed Loan Prime Rate, especially with the Fed expected to cut rates once again next week. However, that did not happen as China kept its one-year prime rate for new corporate loans unchanged in October, at 4.2%, and above the 4.15% consensus estimate. The five-year benchmark was also kept unchanged at 4.85%.

As we reported previously, the Loan Prime Rate, also called China’s “Libor”, is a revamped market indicator of the price that lenders charge clients for new loans, and is linked to the rate at which the central bank will lend financial institutions cash for a year. The rate, which is updated once a month, is made up of submissions from a panel of 18 banks, although ultimately it is Beijing that sets the final rate.

Analysts were quick to step in and “explain” away the unexpected move: Commerzbank’s Zhou Hao said that a static one-year rate shows China “may be trying to balance the shrinking margins of banks with support to the real economy,” adding that “the PBOC remains restrained on policy easing.”

The market, however, was less sanguine, as the PBOC’s lack of easing was promptly taken as an ill-omen: China’s government bonds dropped while money-market rates climbed, amid bets that the policy makers are not in a rush to loosen monetary policy (why? perhaps China’s gargantuan debt load and rapidly devaluing currency have something to do with it). On Monday, the yield on 10-year sovereign notes rose three basis points to 3.22%, the highest since July 1, while the costs on 12-month interest-rate swaps advanced to the highest level since late May.

While the Chinese economy has been under pressure amid a prolonged trade dispute with the US, many have expected that the central bank would match the Fed’s easing and lower corporate borrowing costs and further cut bank reserve ratios. However, so far the PBOC hasn’t embarked on an aggressive stimulus program as some market watchers had hoped.

“It’s not in line with market expectations,” said ANZ Bank China economist Zhaopeng Xing. “The PBOC intends to reserve room for future headwinds.”

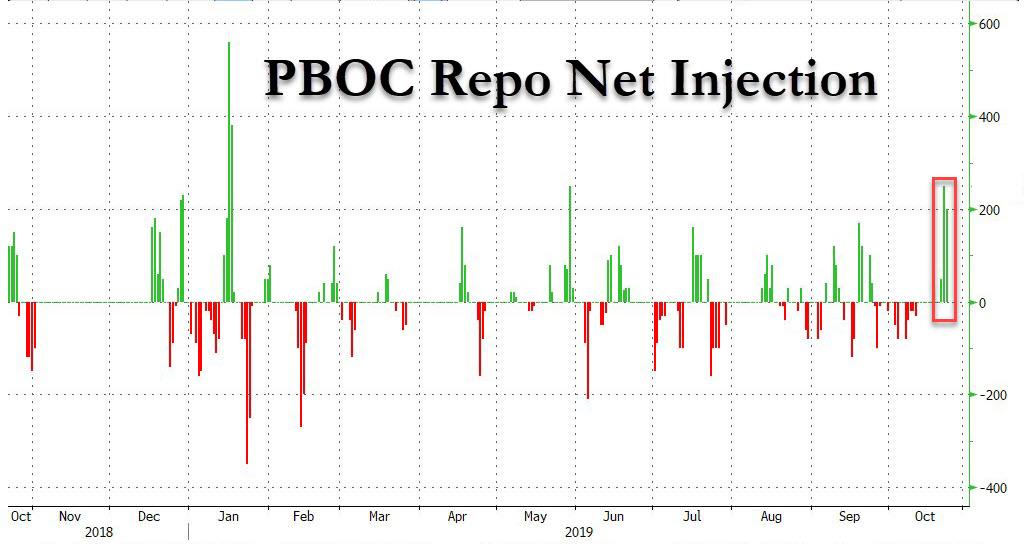

Well, if that’s the case, then the headwinds hit just one day later, when the PBOC used open market operations to inject the largest amount of cash into the banking system since May, flooding the local financial system with a net 250 billion in reverse repos (for those confused, a reverse repo in China is the equivalent of a repo in the US, and vice versa). One day later, on Wednesday, the PBOC injected another 200 billion in net liquidity: the biggest two-day liquidity injection since January.

Yet despite the significant 2-day liquidity injection on part with the Fed’s own “Not QE” which is injecting no less than $60BN in new reserves into the economy every month, signs in China’s money markets pointed to expectations of continued liquidity tightness in the financial system. The cost of one-year interest rate swaps, a measure of traders’ expectations of liquidity tightness, climbed 2 basis points to 2.80%, the highest since late May, while the overnight repurchase rate climbed 11 bps to its highest level since July.

So why was this “strong” indication by Beijing that it would match the Fed’s own liquidity injections met with a collective shrug by the market? Because, similar to America’s repocalypse in September, it came just before an Oct. 24 deadline for companies to pay tax, which traditionally increases the demand for cash and tightens liquidity.

“It’s said to be hard to borrow money in the market this morning mainly due to the coming tax submission which was postponed to this Thursday”, said Zhaopeng Xing, markets economist at ANZ Bank China. Xing said he expected tightness in money market to continue this week.

In other words, despite hopes (and in some cases, prayers) that the PBOC will finally ease aggressively to stimulate Chinese, and global growth and capital markets, China’s credit impulse is set for another sharp drop…

… now that it has become very clear that at least until the 2020 US election, China refuses to aggressively ease, boosting the global and US economy in the process, even if it means its own economy is set to suffer more. The good news: at least Xi Jinping can blame ‘trade war’ for the upcoming lowest Chinese GDP print on record, even if by now everyone knows that trade war is China’s least worry.

Tyler Durden

Tue, 10/22/2019 – 22:47

via ZeroHedge News https://ift.tt/33VPDTj Tyler Durden