Crypto Crashes, Black-Gold Bid, & Lira Lifted As Yields, Stocks Shrug

Once again, bonds were dumped and every effort was made to pump the S&P back above 3,000 (again)…

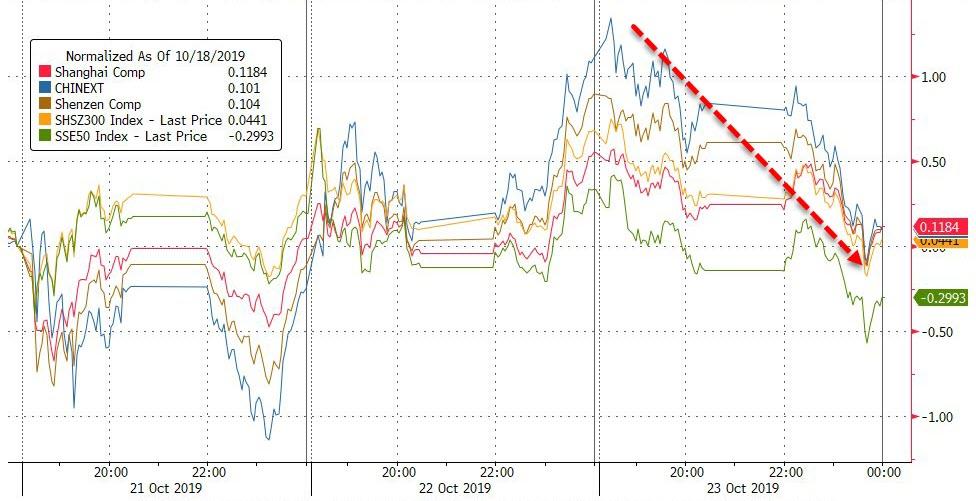

Chinese stocks were weak overnight…

Source: Bloomberg

European stocks were mixed with Germany’s DAX leading and UK’s FTSE lagging on the week…

Source: Bloomberg

US equity markets were unable to make any progress today, losing early gains (but managed a small gain into the close as The Fed unveiled even bigger repo operations)…

US Futures markets were chaotic again overnight – panic-puked at the Japan open (mirroring the panic-bid the previous night)…

Boeing and Caterpillar initially whacked Dow futures but were miraculously bid (until the EU close after which stocks faded)…

Algos were once again focused on getting S&P back above 3,000…

Another day, another short-squeeze…

Source: Bloomberg

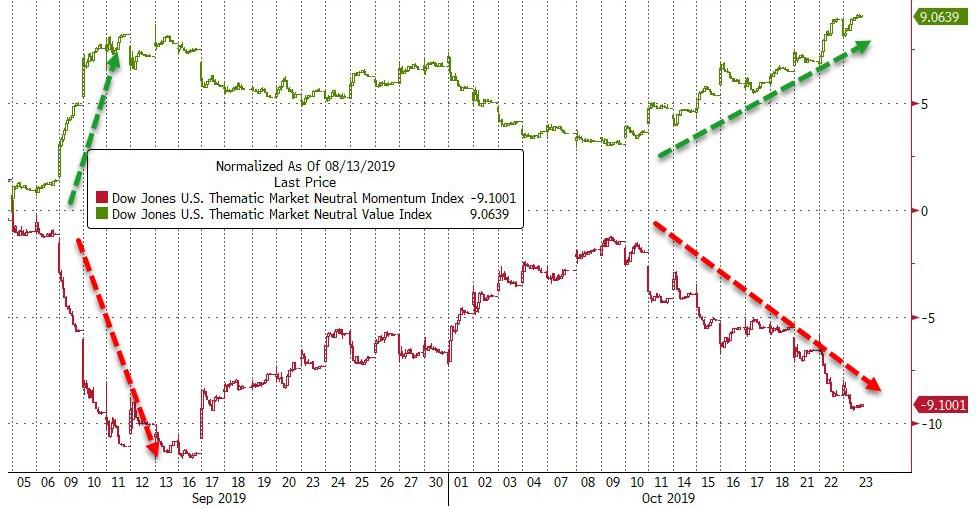

Momo was dumped once again…

Source: Bloomberg

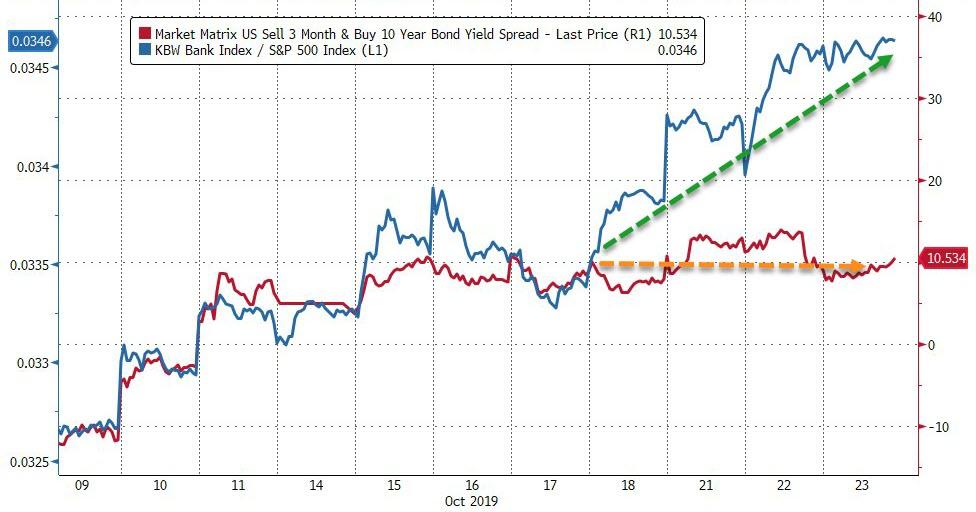

Bank stocks continue to outperform but have decoupled from the yield curve…

Source: Bloomberg

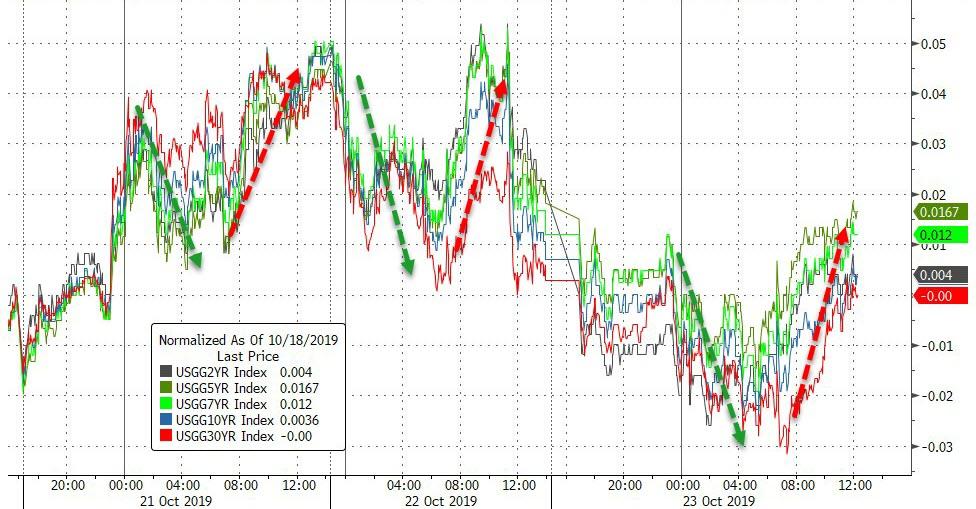

Treasury yields ended the day practically unchanged, roundtripping from overnight bond buying to selling during the US day session…(NOTE – same pattern for 3 days)

Source: Bloomberg

30Y Yields returned to unchanged on the week…

Source: Bloomberg

The market is now almost entirely convinced that The Fed will cut rates next week… and The Fed never lets the market down at this level of certainty…

Source: Bloomberg

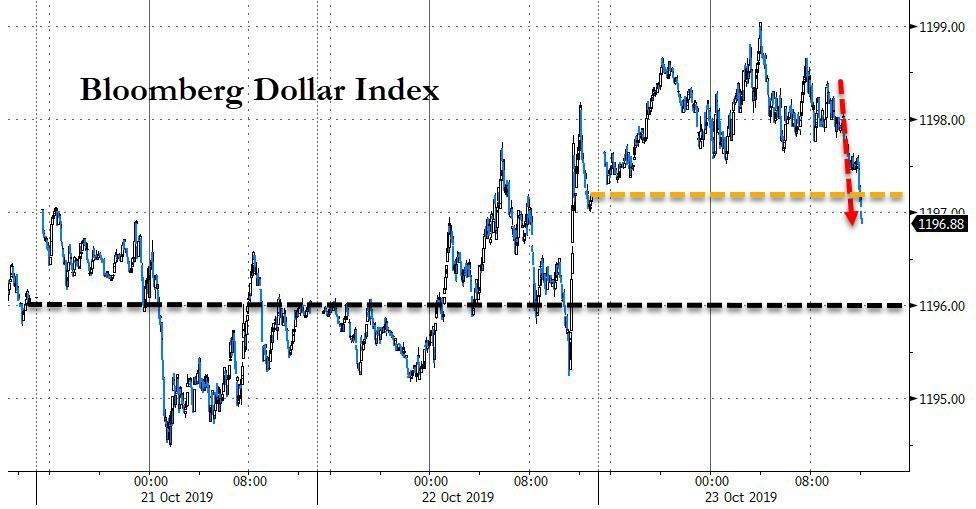

The dollar ended the day weaker after overnight gains were erased late-on…

Source: Bloomberg

Offshore Yuan surged to 2-week highs…

Source: Bloomberg

The Turkish Lira spiked after Trump lifted sanctions…

Source: Bloomberg

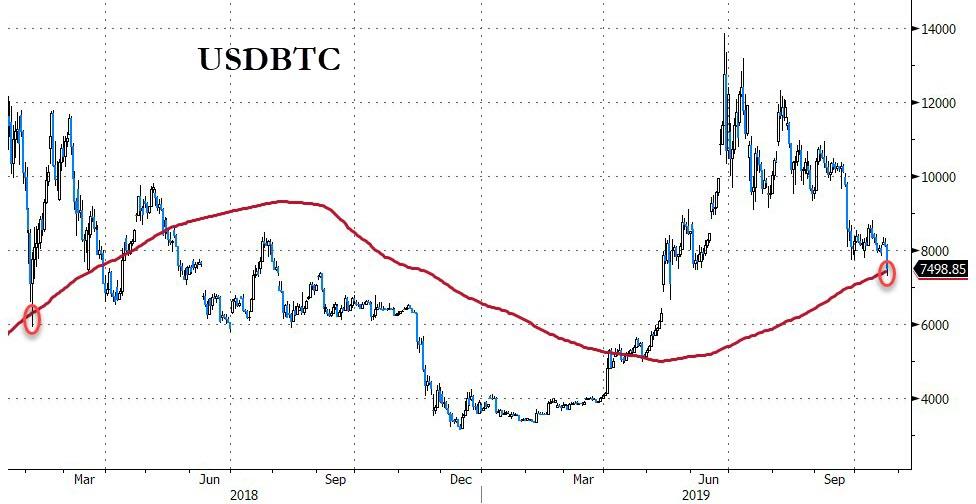

Cryptos were smacked three times in the last 24 hours…

Source: Bloomberg

Bitcoin broke below $8000…

Source: Bloomberg

Testing down to its 200-day moving-average…

Source: Bloomberg

Copper and Crude surged today as PMs largely flatlined…

Source: Bloomberg

And aside from the surprise crude inventory draw, WTI surged above $56 on the back of Dennis Gartman’s short positioning early on…

Gold tested up towards $1500 once again but failed to cross it…

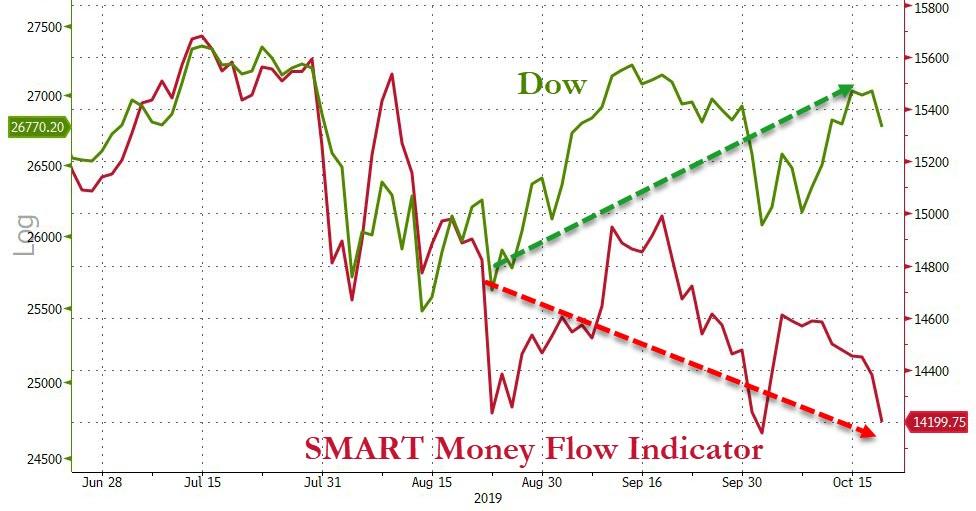

Finally, the SMART money flow continues to diverge (weaker) than the market…

Source: Bloomberg

And then there’s this – Warren leaking lower as Hillary’s odds surge…

Source: Bloomberg

Tyler Durden

Wed, 10/23/2019 – 16:01

via ZeroHedge News https://ift.tt/31FfRb2 Tyler Durden