Rates Tumbling Everywhere, Except Credit Cards Where They’ve Never Been Higher

Submitted by Joseph Carson, Former Director of Global Economic Research, Alliance Bernstein

The State of the Consumer: Views From Retail & Banks

How strong is the consumer sector? It depends on where you sit in the food chain of consumer sales and finance.

Nominal growth of consumer spending in 2019 has slowed to its weakest growth rate in three years, with many traditional retailers seeing no growth in top-line sales. And yet large commercial banks indicate that their consumer finance arm shows a “healthy consumer”.

The difference in the direction and tone of business is very straightforward; retail is counting how much consumers are spending at their establishments, while commercial banks are counting how much consumers are paying in interest when they borrow to spend.

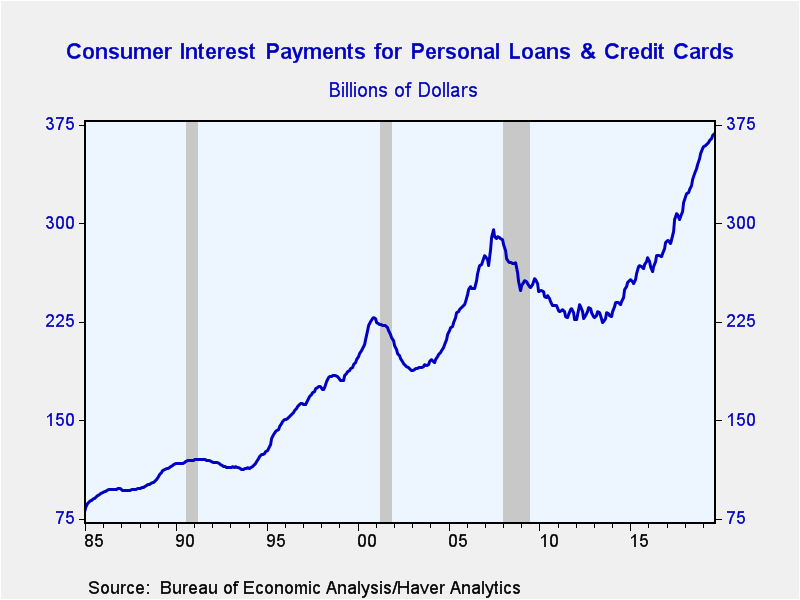

Banks are happy (for now) as consumer interest payments at record levels are rising more than twice as fast as consumer spending. Yet, that trend can’t continue for long as rising interest expense drains consumer liquidity, weakens the consumer ability to spend, dampens growth and eventually ends up impacting retail and banks alike.

Painting By The Numbers

Through the first 9 months of 2019, nominal consumer spending—which includes all goods and services and traditional and e-commerce retailers— is running less than 4%, a drop-off of roughly 125 basis points from the 2018 performance.

Although nominal income growth is running close to 5%, consumers still saw the need to increase consumer borrowing (i.e., personal loans and credit cards) by 5% in order to support spending. Perhaps that reflects the unevenness of income growth and lack of a liquidity buffer among various income groups.

On the surface, the growth of consumer borrowing is not excessive, but what is excessive is how much it costs consumers to borrow.

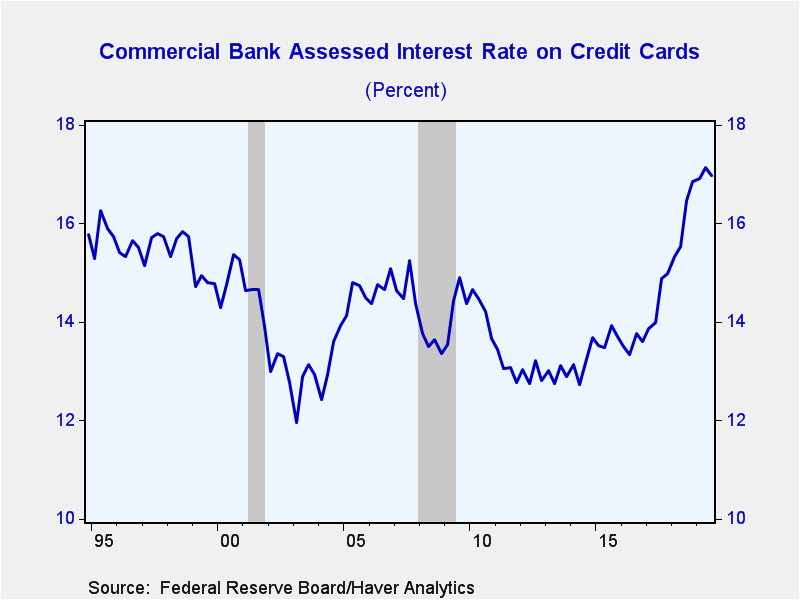

Personal loan rates at commercial banks stand at 10%, and average credit card rates stand at 15%. However, the actual cost of credit card borrowing is much higher, since banks charge interest not only on the daily balance but also on prior months interest rate charges, along with other fees.

The Federal Reserve has estimated the true cost of credit card borrowing. The assessed interest rate charges on all credit card accounts averaged 17% in 2019 (200 basis points above published average rates), and represent the highest assessed rate since the Federal Reserve started measuring the all-in-costs of credit card borrowing in 1995.

Record high rates for credit card borrowers runs counter to the JP Morgan view that “consumer remains healthy, with growth in wages and spending, combined with strong balance sheets”. A “good” consumer borrower, with “good” wage growth and “good” balance sheets should not be paying record high interest rates.

According to the Bureau of Economic Analysis, consumer interest rate payments hit a new record high of $368 billion in Q3 2019, more than one third above the peak of the 2008 financial crisis, and 10% above what consumers paid in 2018.

In short, rising interest expenses are sucking the “spending power” out of the consumer. Retail is already seeing the impact and banks will soon see it as well.

Tyler Durden

Wed, 10/23/2019 – 11:25

via ZeroHedge News https://ift.tt/2BwuoLL Tyler Durden