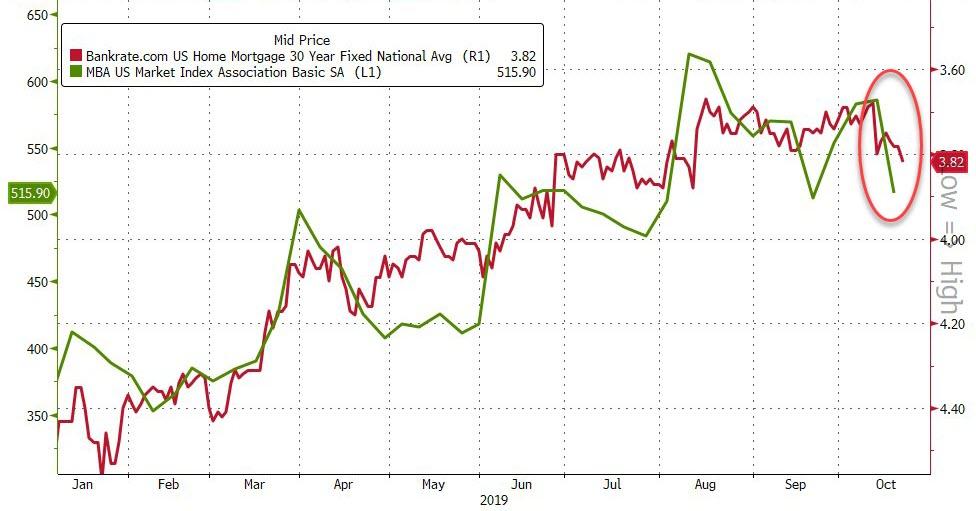

Refis Collapse Most In 3 Years As Mortgage Rates Tick Higher

Mortgage applications plunged 11.9% from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 18, 2019. But it was the Refinance Index that got really hit, crashing 17% from the previous week.

Source: Bloomberg

All of which should make housing market enthusiasts more than a little worried, as if the marginal mortgage applicant is this sensitive to rates – near record lows – then what happens if we see an upturn in growth (which is apparently priced into homebuilder stocks) and rates really rise?

Source: Bloomberg

“Interest rates continue to be volatile, with Brexit votes and ongoing trade negotiations swinging rates higher or lower on any given day. Last week, mortgage rates jumped 10 basis points and were above 4 percent for the first time since September,” said Mike Fratantoni, MBA Senior Vice President and Chief Economist.

“The increase in mortgage rates caused refinance applications to drop 17 percent, and by more than 20 percent for conventional loans. Borrowers with larger loans are the most sensitive to rate changes, and with rates climbing higher last week, the average size of a refinance loan application fell to its lowest level this year.”

Fratantoni had a modest silver lining however:

“Although purchase applications declined, application volume is still running about 6 percent ahead of this time last year. Low mortgage rates continue to fuel buyer interest, but supply and affordability challenges persist.”

Source: Bloomberg

So let’s just hope that growth hope doesn’t return and/or Powell keeps pushing rates lower.

Tyler Durden

Wed, 10/23/2019 – 09:50

via ZeroHedge News https://ift.tt/2pHnuAG Tyler Durden