Consumer Activity Falters In California’s Largest Metros, Yelp Warns

The US economy is rapidly decelerating into year-end. Inflation, industrial, and employment down cycles are well underway, which is expected to deepen in the near term. This fall, the economy experienced a rare transmission of weakness from manufacturing into services and the consumer. Contagion is here — and there are minimal measures the government and central banks, at the moment, can do to prevent the slowdown from broadening.

To get a more precise picture of consumer health, which powers about 70% of the economy. We turn to new alternative data from Yelp, that is showing, economic stagnation across major metropolitan areas in California, the country’s most populous state and largest economy.

The report is intriguing because it indicates that California’s massive economy and all the hot money from the tech boom is cooling — an ominous sign that suggests a countrywide consumer slowdown is imminent. And to make matters worse — the slowdown in consumer activity is happening right before the holiday season.

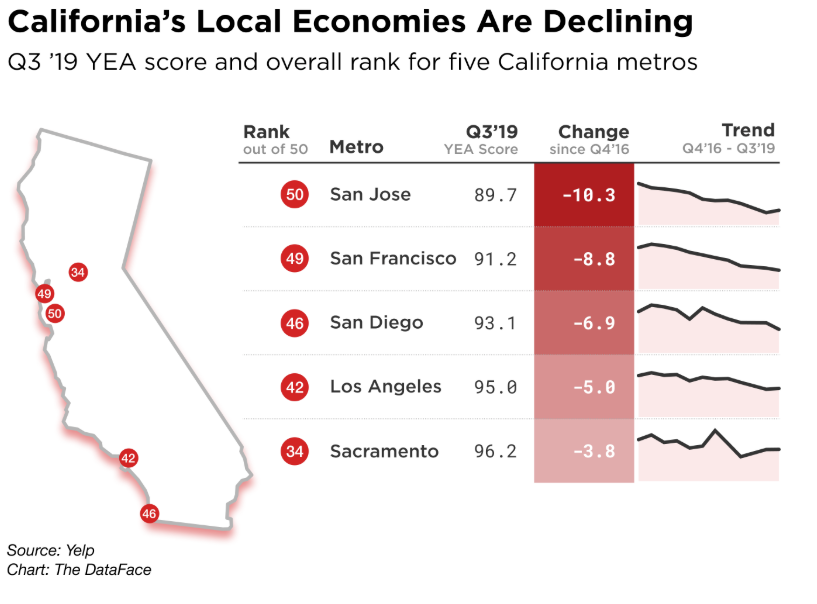

Yelp data from 3Q19 shows the brunt of the consumer activity slowdown is in San Jose, San Francisco, San Diego, and Los Angeles. These four cities had the weakest consumer activity not seen since 4Q16.

“California’s biggest local economies are continuing to struggle,” Carl Bialik, Yelp’s data science editor, told Bloomberg.

“Construction limits and increasing rent are pushing consumers and workers farther from businesses, contributing to continued quarterly declines in some of the state’s biggest metro areas, with retail and restaurants taking the biggest hits.”

Yelp tracks over 100 million users across the US and can track users in specific regions and metro areas. Researchers track users based on their activity in various sectors of the local economy, including shopping, automotive, local services, home services, professional services, restaurants, food, and nightlife.

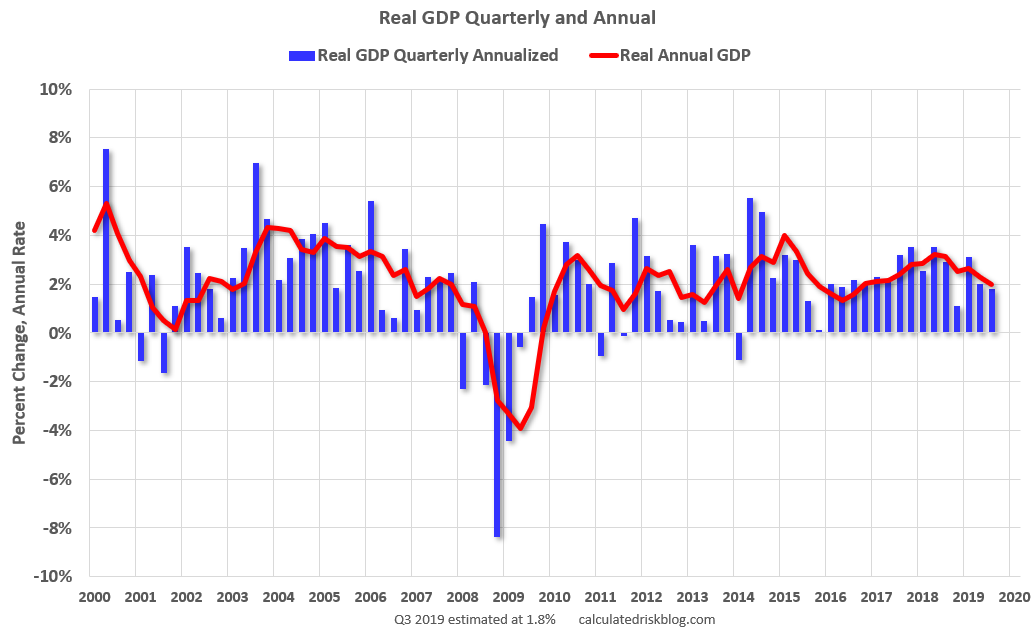

Yelp’s consumer data shows that it’s likely inline with declining 3Q19 GDP figures, expected to print at an annualized pace of 1.8%.

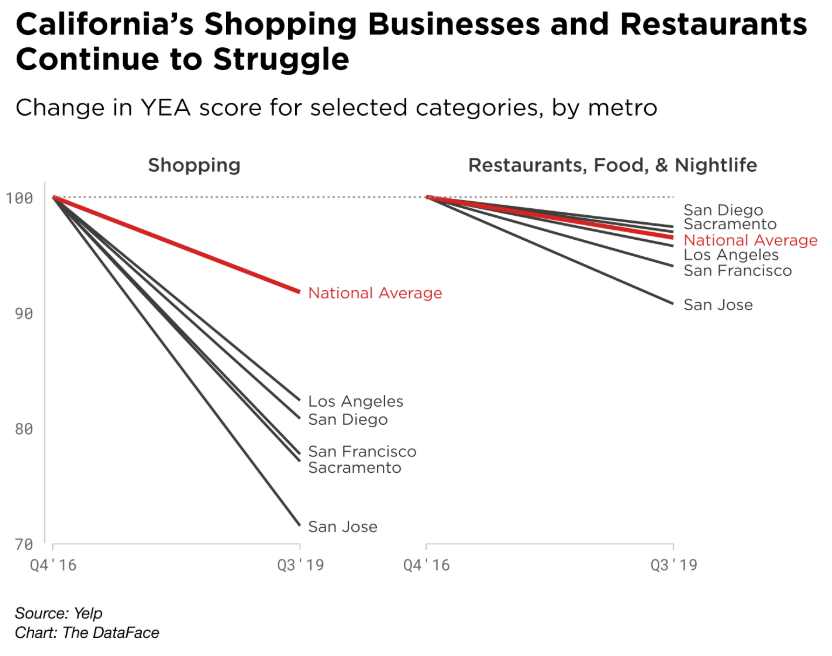

Yelp said, “California’s shopping businesses have been hit the hardest. Shopping ranks at the bottom in each of the five Golden State metros we track, among the six major sectors of the local economy included in YEA (the other sectors are auto; restaurants, food, and nightlife; professional services; home services; and local services). Stores selling shoes, cellphones, and women’s clothing have fallen sharply in all five California metros. Retail rents in San Jose and San Francisco have surged in the last decade. The fate of retail and restaurants is intertwined: Retail stores attract foot traffic which benefits nearby restaurants, and restaurants similarly bring business to neighboring stores. The rise of food-delivery services can separate restaurant customers from after-dinner shopping. And our data bears this out, with restaurants, food, and nightlife categories struggling in all five California cities. The declines range from 2.6% in San Diego to 9.3% in San Jose, with San Francisco near the upper end at 6%.”

It’s believed that California consumer activity is a lead on the rest of the country.

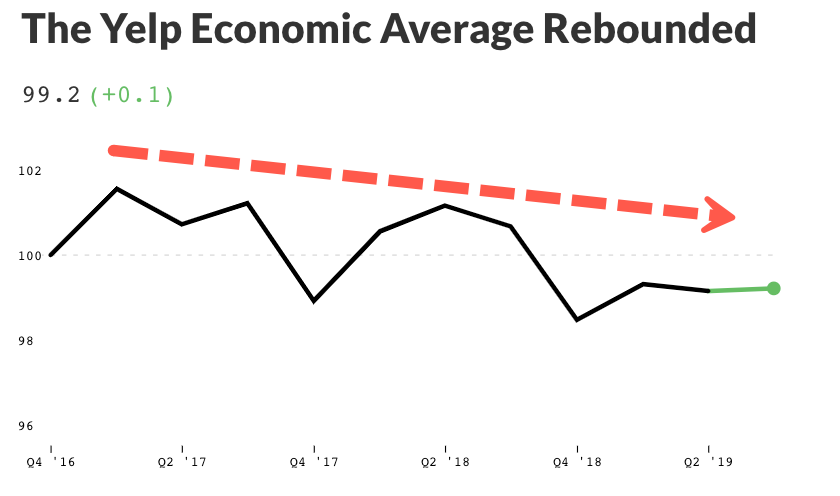

Yelp Economic Average (YEA), a benchmark of consumer strength countrywide, barely rose in 3Q, up .07% above 2Q levels. Yelp blames the trade war, recession fears, impeachment fears, out of control rents, and surging health care costs on a weakening consumer.

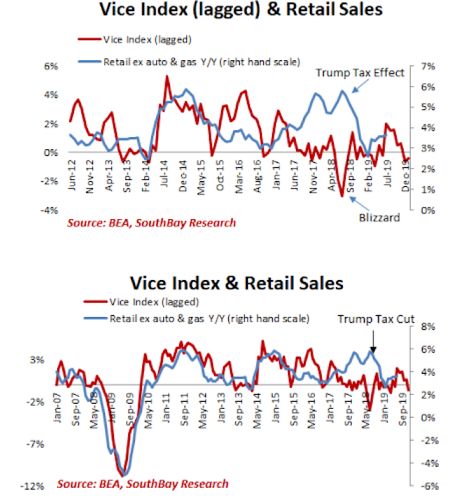

For more color on the overall US consumer health, SouthBay Research has a “Vice Index” that tracks spending on gambling, alcohol, drugs, and prostitution. The index shows the consumer has been weakening for nearly a year thanks to a hangover after President Trump’s tax cut.

Shown below is SouthBay’s proprietary Vice Index (lagged by six months), which dropped to its weakest level since February of this year. Might indicate that retail sales for the final stretch of this year will remain weak through the holiday season.

Alternative data, if it’s from Yelp or SouthBay, is showing that consumer weakness could persist through year-end. This could undoubtedly spoil the hopes for stock market bulls who now suggest that consumers will power the economy through 2020. Betting on the consumer this late in the cycle could be dangerous.

Tyler Durden

Wed, 10/23/2019 – 20:50

via ZeroHedge News https://ift.tt/2NcCXk2 Tyler Durden