US PMIs Rebound In October But Employment, New Orders Slump

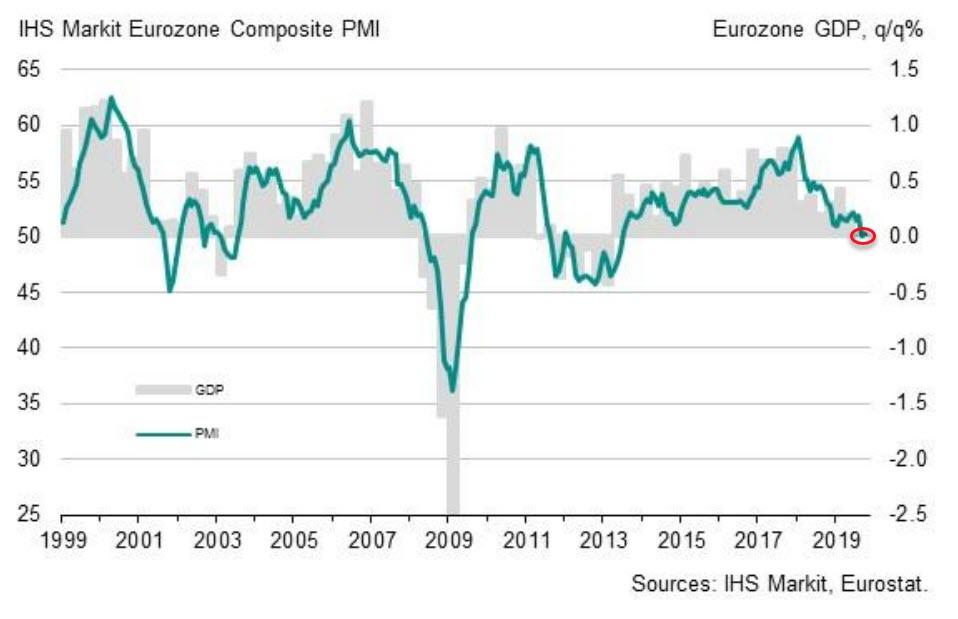

After September’s bounce, expectations for preliminary US PMIs in October are mixed (better for Services, worse for Manufacturing) as Eurozone PMIs stagnated at multi-year lows this morning.

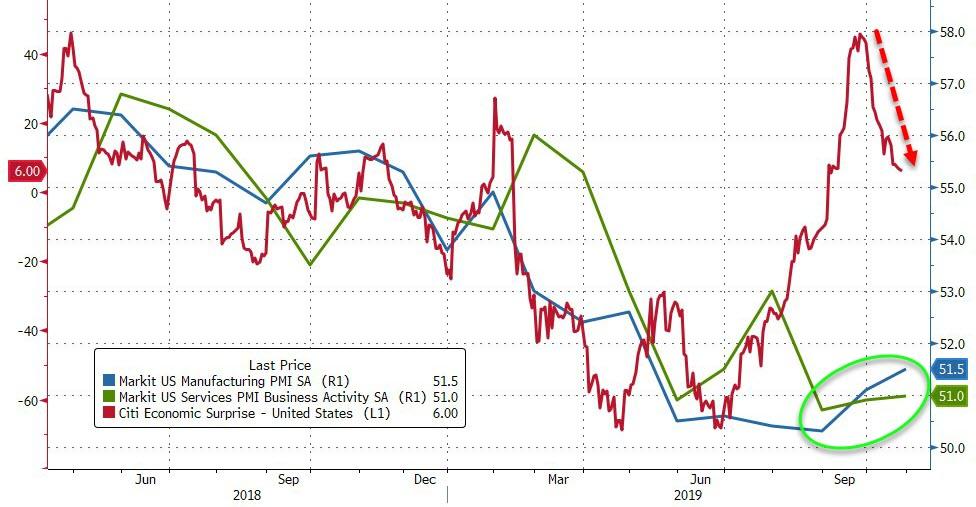

In the US, the flash October data was better than expected…

-

US Manufacturing PMI 51.5 (51.1 prior, 50.9 exp)

-

US Services PMI 51.0 (50.9 prior, 51.0 exp)

This is the 2nd month in a row of rebound…

Source: Bloomberg

However, Employment tumbled to 47.5 vs 48.6 in September, the lowest reading since Dec. 2009 (and second consecutive month of contraction) and new business falls vs prior month (lowest reading since series began).

With US macro surprise data increasingly disappointing, we wonder how long this shallow bounce can be sustained.

Commenting on the flash PMI data, Chris Williamson, Chief Business Economist at IHS Markit, said:

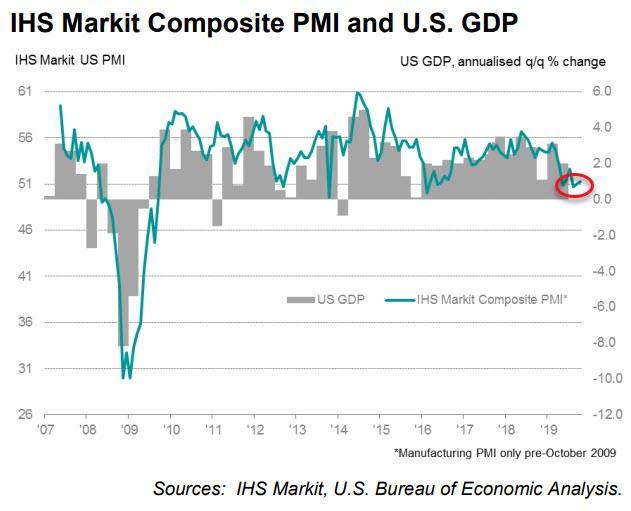

“Despite business activity lifting from recent lows, the survey data point to annualized GDP growth of just under 1.5% at the start of the fourth quarter, and a near-stalling of new order growth to the lowest for a decade suggests that risks are tilted toward growth remaining below trend in coming months.

Additionally, Williamson notes…

“An increased rate of job culling adds to the gloomy picture, with jobs being lost among surveyed companies at a rate not seen since 2009. At current levels, the survey’s employment gauge indicates non-farm payroll growth slipping below 100,000.

“The overall subdued picture reflects a spreading of economic weakness from manufacturing to services, but encouragingly we are now seeing some signs of manufacturing pulling out of its downturn, in part driven by a return to growth for exports and improved sentiment about the year ahead, linked to hopes that trade war tensions are starting to ease.

“If manufacturing can continue to gain momentum this should hopefully feed through to stronger jobs growth and an improved service sector performance, leading to better GDP growth, but it remains too early to determine whether the economy has truly turned a corner.”

Is this rebound enough to stall The Fed’s dovish rate-cycle hopes?

Tyler Durden

Thu, 10/24/2019 – 09:52

via ZeroHedge News https://ift.tt/32J3JY5 Tyler Durden