NYC Housing Bubble Implodes: Tribeca Home Prices Plunge 28% As New Taxes Bite

When NYC Mayor Bill de Blasio pushed through the controversial “mansion tax” hike on expensive NYC properties (what properties in the city aren’t?), real-estate experts warned that it would hurt he housing market. But their pleas that it could cause the unceremonious end of one of the frothiest property bubbles since the crisis fell on deaf ears.

De Blasio’s decision raised the mansion tax rate – officially known as the ‘transfer tax’ rate – from a 1% flat rate to a tiered system. The higher mansion tax rates mean higher closing costs for buyers: For example, the transfer tax due on a $5 million property used to be $50,000. Now, it’s more than double that at $112,500.

It’s easy to brush this off as more rich people crying over unsubstantial sums, in reality, many of the people who are buying homes in the $2 million to $3 million range in NYC are (by the city’s standards) middle class. They don’t always have an extra $50,000 just sitting around. That, and this tax arrived not long after President Trump and the Congressional Republicans decided to punish their blue-state opponents by capping SALT deductions in their 2017 tax plan.

And now, Bloomberg warns that prices in some of the city’s trendiest neighborhoods are in free fall.

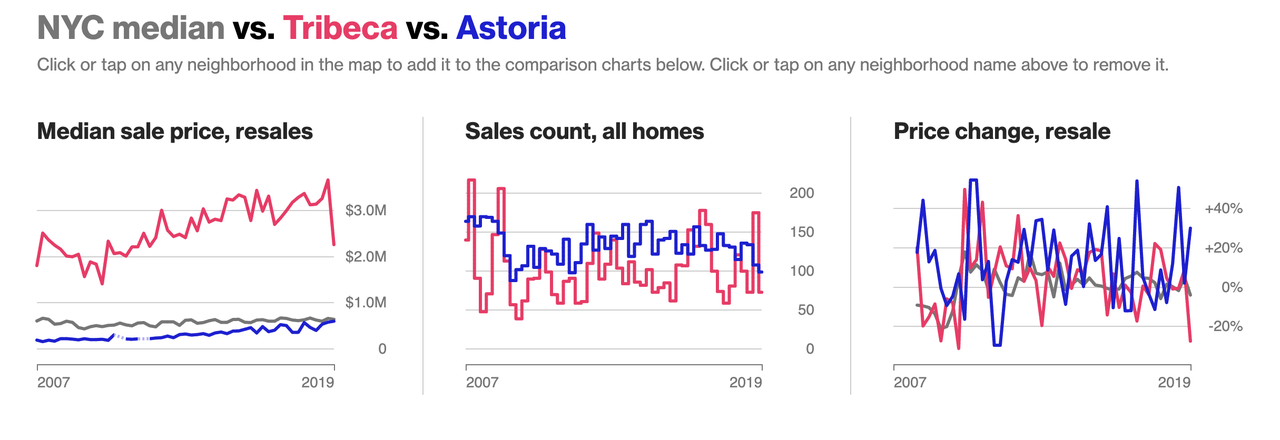

In Tribeca, prices for used homes plunged 28% YoY, the largest drop of any neighborhood in the city. The latest median sales price on record was $2.25 million in Q3, according to property listings website StreetEasy. Values in both Greenwich Village and Chelsea also dropped by 15%. Meanwhile, the Upper West Side and the area that includes Soho were each down 14%.

For a more in-depth look at how the NYC housing market has changed, check out this Bloomberg piece, which features an interactive map allowing users to compare different neighborhoods. A quick scan of the data for TriBeCa, one of the city’s most established neighborhoods, compared with Astoria, Queens’s most up-and-coming-neighborhood, reveals a stunning divide.

While prices climbed for Astoria homes in Q3, prices fell for homes in TriBeCa. And while sales slowed in TriBeCa (only slightly), they effectively ground to a halt on TriBeCa.

While the NYC housing market is collapsing, and certain other tony areas like Greenwich, CT and municipalities out east in the Hamptons, are also struggling, Goldman analysts pointed out that sales prices in other nearby counties are holding up OK.

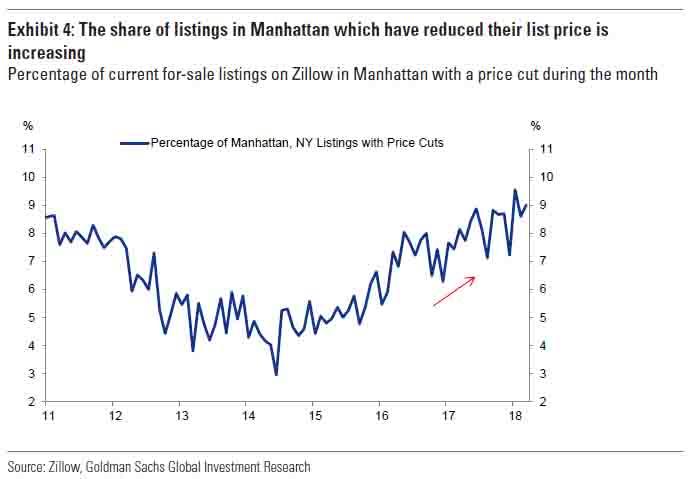

Meanwhile, as we’ve mentioned before, the share of listings in Manhattan (presumably including new condos and existing homes) that are seeing their current for-sale listing price on Zillow being lowered is expanding at an increasingly rapid rate.

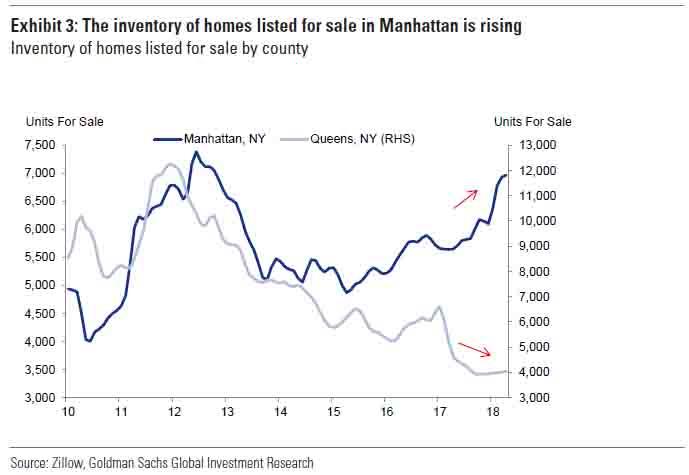

Just as the inventory of homes being listed for sale is also climbing.

It doesn’t take a PhD in economics to understand what happens when listings – i.e. supply – expand while demand, both domestic and foreign (thanks again, Mr. President) – drops off.

Tyler Durden

Thu, 10/24/2019 – 22:15

via ZeroHedge News https://ift.tt/2Wgz1mv Tyler Durden