Brace For A Market Tantrum: Why One Bank Expects The Fed To Disappoint This Wednesday

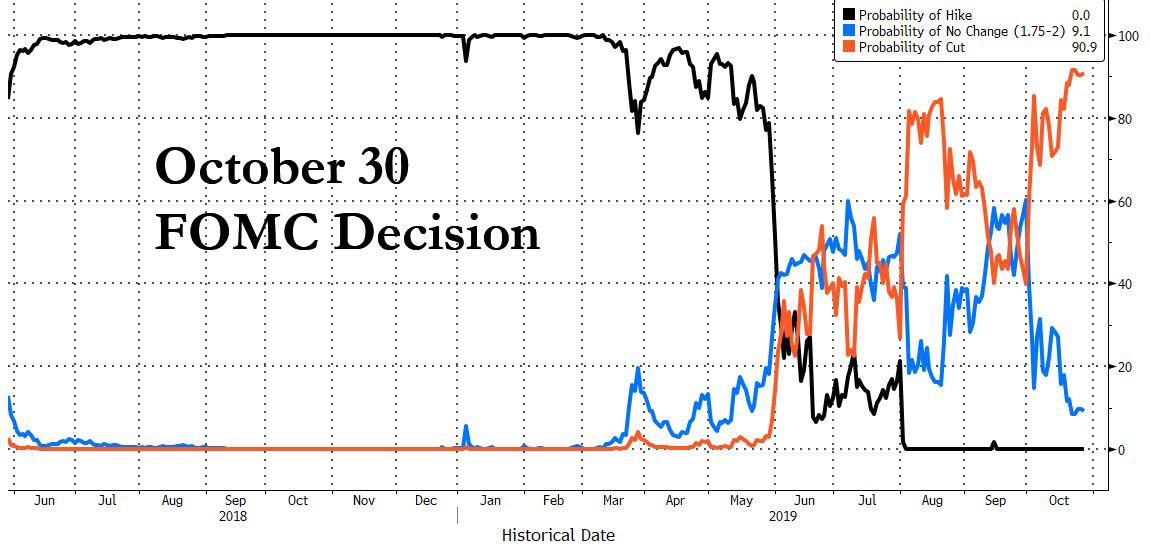

When it comes to the Fed’s next rate decision, the market has made up its mind: as of this morning, the fed funds futures market is pricing in a probability of 91% that the Fed announces another 25bps rate cut at 2pm on Wednesday, with odds of no cut at just 9%.

So certain are strategists that the Fed will deliver another “insurance” cut – the third in a row – that discussion has now firmly shifted to what the Fed will do in its next, December, meeting with the FT writing that the “Federal Reserve faces the thorny decision of whether to signal an interruption to its monetary easing after it delivers what is widely expected to be a third consecutive cut to its main interest rate this week.”

If the Federal Open Market Committee presses ahead with a new rate reduction on Wednesday afternoon, it will have already notched up 75 basis points of monetary stimulus this year — and to some economists and Fed officials that should be sufficient to accomplish the goal.

Needless to say, the prevailing consensus is that Powell will cut, with Scott Anderson, chief economist at Bank of the West, summarizing it best: “I think they will end up cutting another 25 basis points [this week] and then pause for the rest of this year.”

Yet not everyone agrees.

According to Jefferies money-market economist Thomas Simons, the headwinds that pushed the central bank to cut rates in July and September have “abated somewhat” as U.S.-China trade tensions and Brexit uncertainty have also diminished, while the gap between the Fed’s policy stance and that of other central banks has narrowed.

As a result, Simon takes on the wildly contrarian view that the Fed will keep rates unchanged this week while leaving a December cut on the table; in doing so, the Fed would spark a “temper tantrum” in markets, while pushing back against aggressive Fed pricing and cement the idea of a mid-cycle policy adjustment.

“If they continue with so many consecutive rate cuts, they can never break the cycle of market expectations thinking more are coming,” Simons said in a Bloomberg interview, adding that “it’s time for the Fed to take a step back and see if the prior cuts are going to have an effect before moving forward with another one.”

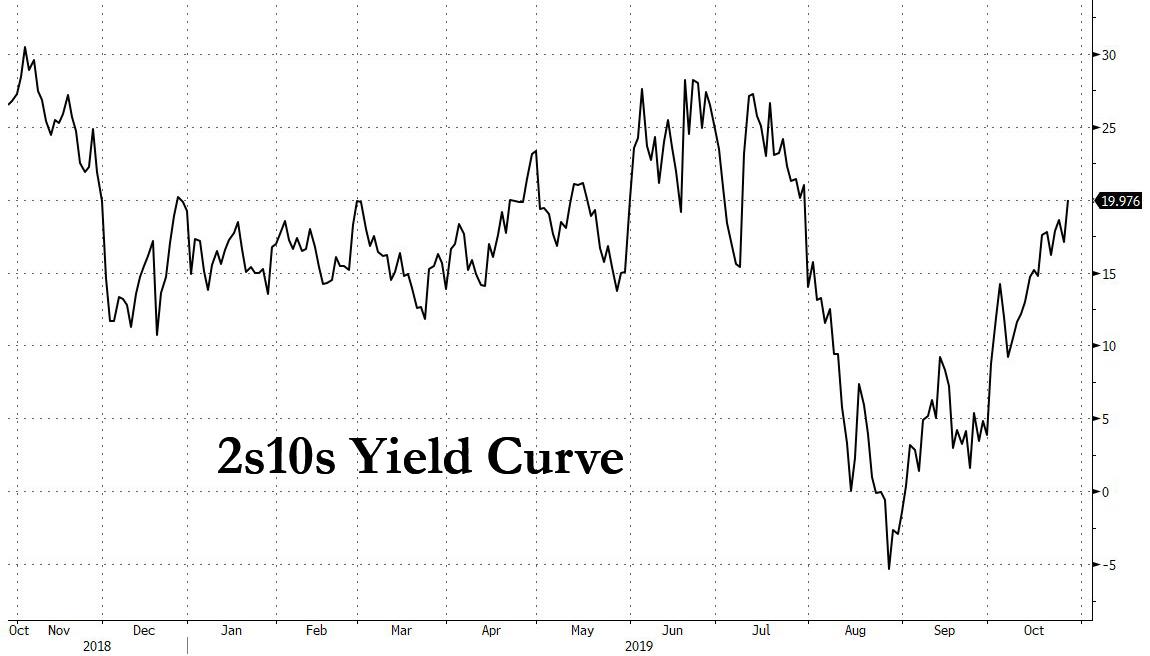

Holding fire on more rate cuts will likely have the added benefit of further steepening the yield curve, a critical condition for US banks to return to profit growth: with yields on the short-end depressed thanks to the Fed’s “Not QE”, which will soon spill over from purchasing merely Bills into the 2Y (if not longer maturity) sector, longer-dated yields will likely jump should the Fed surprise markets by not cutting rates in 48 hours. This would serve to further steepen the 2s10s yield curve, which after inverting briefly in August is back to level last seen at the start of the year (here we ignore the discussion that it is the re-steepening of the yield curve following an inversion that is the true recession signal, as it is a topic we have covered extensively in the past).

Helping the steeper yield curve is the recent rise in 10-year Treasury yields which printed a six-week high of 1.86% on Monday as President Trump touted trade progress and the EU granted the U.K. a three-month Brexit delay. Meanwhile, rates on 2-year Treasuries climbed a more modest 3 bps.

To be sure, it is unclear if Powell would be willing to risk a market tantrum just to prove that he is not at the mercy of the market. As Jefferies points out, a knee-jerk response to the Fed standing pat would likely see U.S. stocks sink and the yield curve “twist.” Or, as Bloomberg explains, “while the Fed’s bill purchases and lower inflation expectations should continue to suppress short- and long-dated yields, 3- to 7-year Treasuries may sell off, he said.”

“There will be a little bit of a temper tantrum, but I think the volatility will be short-lived,” Simons said. “Stocks won’t like it, but it isn’t exactly going to set off a prolonged sell-off.”

There is another reason why Simons’ view is in the minority: as the FT noted over the weekend, the drumbeat of relatively soft economic data, and fears of a negative market reaction, could make Mr Powell and other Fed policymakers wary of indicating that this round of “insurance” cuts is already over. Furthermore, the latest truce in the US-China trade war is only tentative, and even if it is signed by Trump and Xi Jinping, in Chile next month, many of the tariffs and the tensions in transpacific trade are set to linger.

“The Fed runs the risk of an unnecessary tightening of financial conditions. We are hopeful that Chair Powell avoids such a mistake,” said Natixis economist Joe Lavorgna.

As such, whereas most dismiss Jefferies’ suggestion, all will be focused on whether the FOMC statement changes it pledge to “act as appropriate to sustain the expansion” widely seen as an indicator of future rate cuts, to wording that appears less committed to further easing.

“Keeping the forward guidance as is is the path of least resistance. If they take it out they are being unintentionally hawkish,” said Michelle Meyer, an economist at Bank of America Merrill Lynch. “The data now is softening so I think they have to give some nod in that direction.”

Boosting the dovish case, it is likely that just hours before the Fed’s announcement, the US will announce that Q3 GDP rose just 1.6%, which would be the slowest pace so far this year; In fact, since the Trump election, there has been just one quarter of GDP growth below 2%, and analysts will be looking out for what this might mean for the economy heading into next year’s election. And then there is the October US jobs report on Friday, where consensus expects a paltry +90k print following the previous month’s +136k increase. If accurate, that would be the weakest pace of monthly jobs growth since May but the recent GM strike complicates the analysis with a 46k hit expected from this. Explanations aside, however, Trump will be sure to put the squeeze on the Fed to cut rates even more after such a poor number, and for Powell the question will be whether he wishes to do so after he has just cut again for the third time, or after giving himself some breathing space by not cutting rates this week, even if it means a modest “tantrum.”

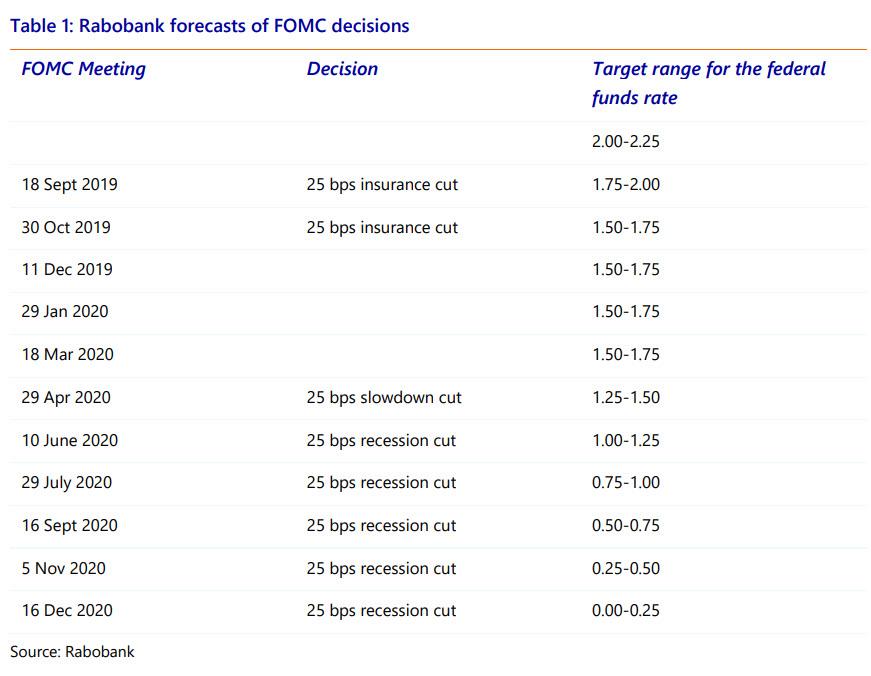

While it is unknown what Powell will decide on Wednesday, the best summary of the choices facing the Fed chair comes from the former head of the NY Fed’s market team, Brian Sack, who is currently director of global economics at DE Shaw, and who two weeks ago told an Institute of International Finance conference that “we either stabilize with one more cut, or I think we’re going to go all the way to the lower bound.”

The problem for the Fed is that even if it cuts on Wednesday, the probability of a quick “stabilization” is virtually nil, for one simple reason: China refuses to join the global reflation party, which has resulted in its credit impulse barely rebounding from cycle lows.

As long as Beijing refuses to lend a helping hand to the global reflation effort, it will be up to the Fed. And should Powell use up his last “insurance” cut for nothing – because after three cuts as Sack said, the Fed will likely have no choice but to cut all the way to zero, something which Rabobank predicted some time ago, the Fed chair will have no choice but to capitulate.

And, as an added consideration, this will be Trump’s preferred outcome, because what better way to ensure that the S&P is at all time highs and the US economy avoids recession ahead of the Nov 2020 election, than the Fed cutting rates to 0% by December 2020.

What happens then?

Well, with “Not QE” already active, and the Fed out of ammo when it comes to more rate cuts, what happens in 2021 will depend on one simple choice: will the Fed follow Europe and Japan into negative rates, or will the long delayed recession finally arrive.

Tyler Durden

Mon, 10/28/2019 – 14:49

via ZeroHedge News https://ift.tt/2pbgLPD Tyler Durden