Mission Accomplished JPMorgan: Repo Market Eases Sharply As Mnuchin Says May Loosen GSIB Regs

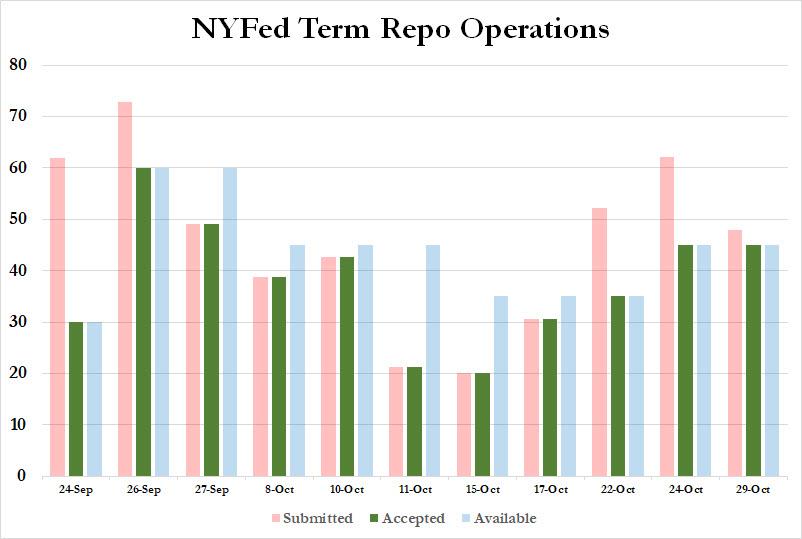

Just days after the Fed’s most oversubscribed term repo operation since the peak of the repo crisis in mid-September, coupled with the most overallotted T-Bill POMO as part of “Not QE”, the funding pressures in the interbank market appear to have eased somewhat based on the latest developments in the Fed’s “temporary” liquidity injections, where today’s first term repo saw “only” $47.9BN in dealer demand for the maximum $45 billion in liquidity, making it “just” 1.06x oversubscribed, the least since Oct 17…

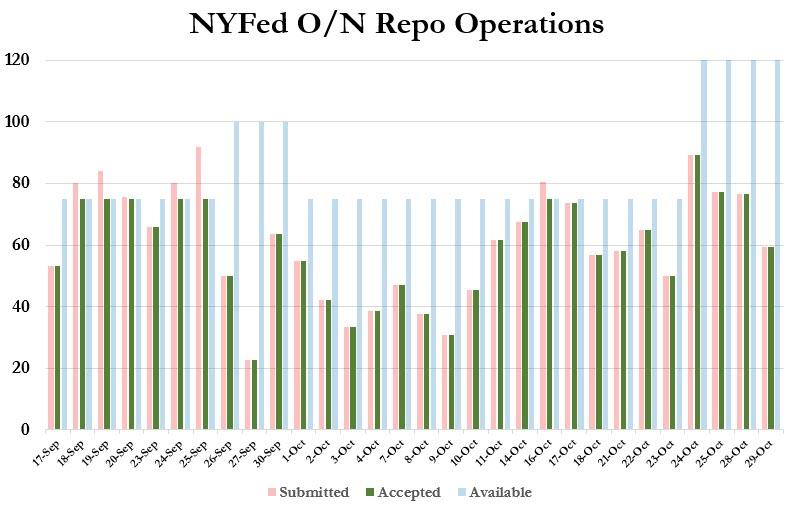

… while today’s overnight repo saw $59.5BN in collateral submitted ($50.4BN in TSYs, and $9BN in MBS), more than 50% below the maximum $120BN available on the recently upsized operation.

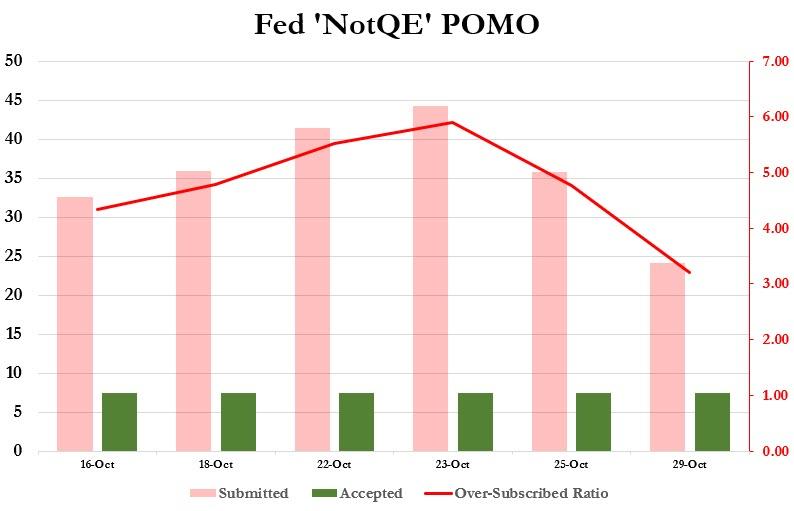

Meanwhile, today’s “permanent” liquidity injection in the form of the 5th consecutive Bill POMO saw the lowest overallotment since “Not QE” restarted, with just $24.1BN in demand for the $7.5BN in Fed liquidity, the resulting 3.21x oversubscription the lowest yet.

One possible reason why the market may have reassessed its liquifity posture is because as Bloomberg reports, Treasury Secretary Steven Mnuchin is said to be open to easing crisis-era regulations “that have stiffened liquidity rules for big banks to relieve possible cash crunches in short-term funding markets.”

Mnuchin said that he had spoken to JPMorgan CEO Jamie Dimon, and other banks about how to avoid liquidity problems such as those observed in September: their answer – in addition to boosting reserves, the Treasury should eliminate liquidity buffers the banks need to hold as precaution for a possible crisis.

“The banks have raised an issue around intra-day liquidity, and that is something that makes sense for regulators to look at,” Mnuchin said in Tel Aviv, on day one of his 11-day trip through the Middle East and India, adding that there may be a way around current regulations that creates more intra-day liquidity without raising risks, according to Mnuchin.

While Mnuchin said he believes the Fed resolved the technical issues that caused the glitch and he doesn’t expect them to happen again, with consensus emerging that the liquidity squeeze was the result of too few reserves (even though the system currently has roughly $1.5 trillion in excess reserves, which apparently are not enough), while issues with regulations are separate.

Specifically, banks point to a strict liquidity requirement instituted after the financial crisis is also a contributing factor, and one meant to keep GSIB, or Global Systematically Important Bank, supported with excess liquidity. As part of the overhaul of financial regulations in the post-Lehman word, financial institutions are meant to hold more cash and cash-like assets as a buffer against times of stress. Systemically important banks – JPMorgan is the largest in the U.S. – face year-end reviews to determine how much more common equity they must carry.

As usual passing the buck and putting the blame for JPM stepping away from the repo market – and catalyzing the Sept 16 repo rate explosion – on regulators, Dimon said his firm had the cash and willingness to calm repo markets when they went haywire in September, but regulations held it back.

Meanwhile, as part of stepping away from the repo market, JPMorgan succeeded in forcing the Fed to restart not only repo operations, but also QE. As a result, the Fed began daily liquidity injections, and even as repo rates have since returned to more normal levels, the Fed has also resumed purchases of Treasuries to bolster bank reserves.

And so as JPMorgan – the bank with the largest US balance sheet – is building its case for eased regulatory requirements, analysts, starting with BofA’s Mark Cabana who first correctly predicted last month’s repo fireworks, are warning that money-market stress is likely to get much worse despite the Fed’s attempts to fix the problem. Conviction is also lacking that the central bank has resolved the issues in the funding markets. “It’s a reasonable question: Have we gone too far in the other direction in requiring the banks to maintain this excess liquidity for intra-day operations?” Mnuchin said.

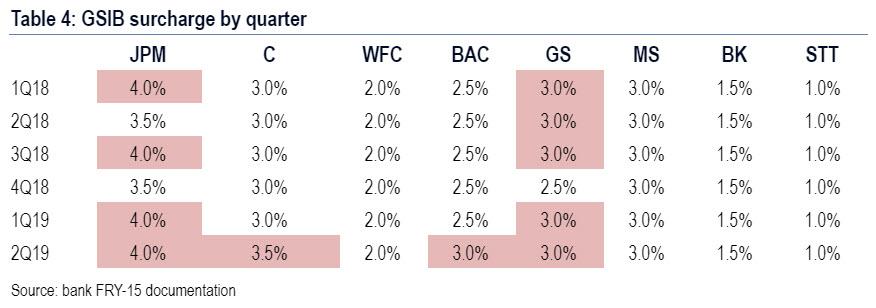

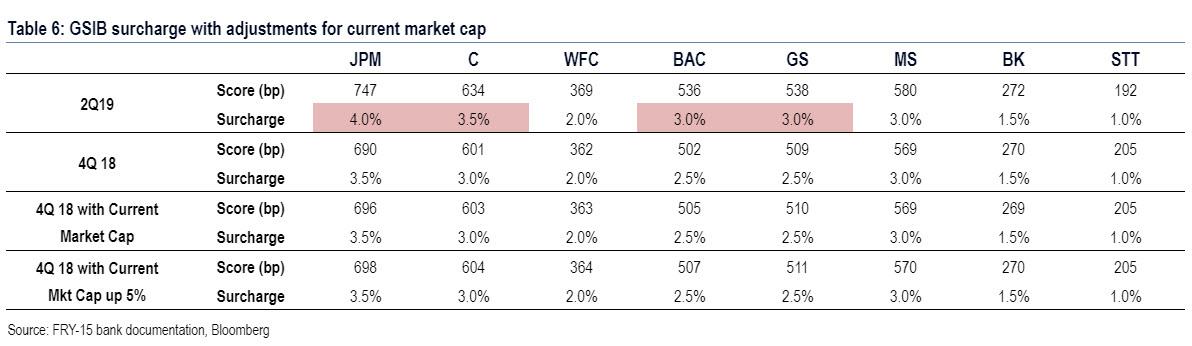

Which brings up the real reason why JPM is hoping to ease GSIB regulations: as BofA notes, as of Q2 ’19, four of the eight GSIBs were in a higher GSIB surcharge bucket versus 2018 year end.

The fact that there are four US GSIBs running high in their surcharge bucket as of Q2 ’19 stands in stark contrast to the fact that there was only 1 US GSIB that was running high in its target range as of Q2 ’18. This, to BofA’s Mark Cabana, suggests “there will likely be greater year-end funding strains in ’19 vs ’18 regardless of how the Fed manages their reserves.”

It’s also why Jamie Dimon is hoping to fully deregulate the financial system, so that he has no longer has any constraints on what his balance sheet should look like. And if regulators needs a little more “convincing”, JPM is happy to crash the repo market as many times as is necessary.

And while undoing post-crisis GSIB regulations will mean that banks earn more – even if it infuriates Liz Warren to no end – it will also make the financial system once again prone to bank failure, as the big systematically important banks are no longer penalized if they don’t have enough liquidity on their balance sheet. None of that matters to Dimon, however, who has just one mission: to be allowed to do whatever he wants, again. If and when this leads to another global financial crisis, well Jamie will be long retired. Plus the Fed will simply bail out everyone again.

Incidentally, the only hope that the Treasury will prevent this major regulatory overhaul, is Democratic presidential candidate Elizabeth Warren, who last week waded into the debate around last month’s repo turmoil, warning Mnuchin not to use the incident as a rationale for weakening post-crisis regulations. Ironically, just a few days later, that’s precisely what Mnuchin is doing.

Tyler Durden

Tue, 10/29/2019 – 12:48

via ZeroHedge News https://ift.tt/36f0hGL Tyler Durden