Trucking Slowdown Ahead Of Holiday Season Suggests Consumer Is Faltering

The trucking industry continues to decelerate into year-end at a time when it should be rocketing higher ahead of the holiday season.

Old Dominion Freight Line reported 3Q19 earnings last Thursday and warned the domestic economy is slowing. The freight company reported revenue declines Y/Y for the quarter, which was the first drop since 2016.

The rare decline in revenue from Old Dominion is a sign that the domestic economy is faltering, and it’s likely being led lower by deteriorating consumer demand. This means the manufacturing recession has successfully transmitted weakness into the consumer segment of the economy, which accounts for 70% of GDP.

This comes at a time when Wall Street is betting on Federal Reserve easing and a healthy consumer to rebound the economy between 4Q19 and 1Q20.

However, there’s a significant problem, for the Federal Reserve to be successful in a quick economic rebound, the latest interest rate cut cycle should’ve started when inflation turned lower in October 2018.

Essentially this means the cut cycle, which began on July 2019, was way too late, at most a ten-month policy error, suggesting that stimulative cuts won’t filter into the economy until next summer. Monetary policy works in 12-month lags, so Wall Street’s optimism about an economic rebound in the near term will likely end in disappointment.

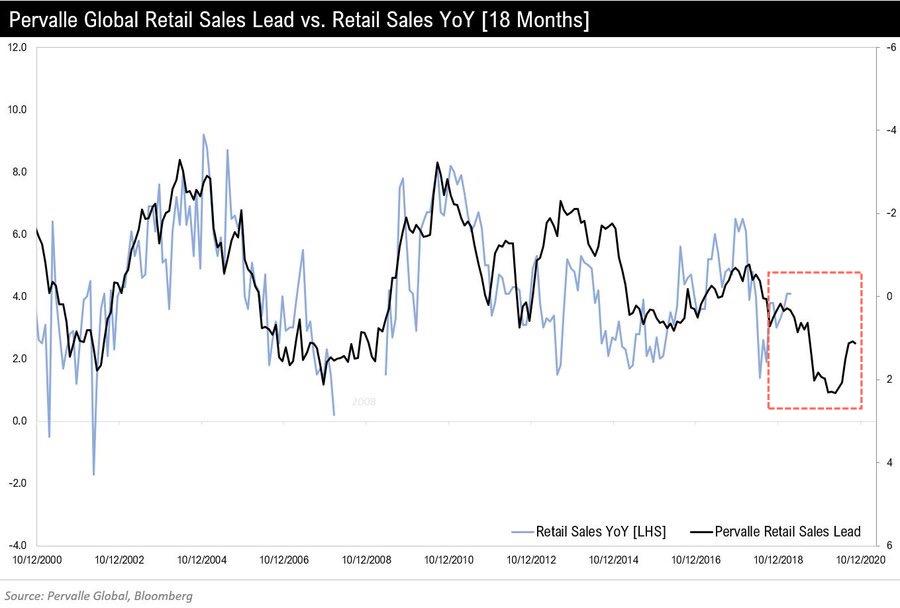

“Our leads still point to a leg lower in consumption into the middle of next year, as prior Fed policy still comes through the economic data,” said Teddy Vallee, CIO of Pervalle Global.

As stocks zoom to new highs with anticipation of an imminent economic revival, today’s trucking industry woes are suggesting that the economy isn’t going to rebound this year as Wall Street believes. Also, it indicates that the consumer is fragile and will likely result in lackluster holiday sales for retailers.

FreightWaves published a new report Thursday that detailed how trucking “load volumes continue to decelerate into the peak holiday shopping season.”

The DHL Supply Chain/FreightWaves Pricing Power Index, a real-time demand and supply indicator of the trucking industry, recorded 25 late last week, less than 50 means demand is lackluster and overcapacity plagues the industry. A score above 50 means demand is higher than capacity.

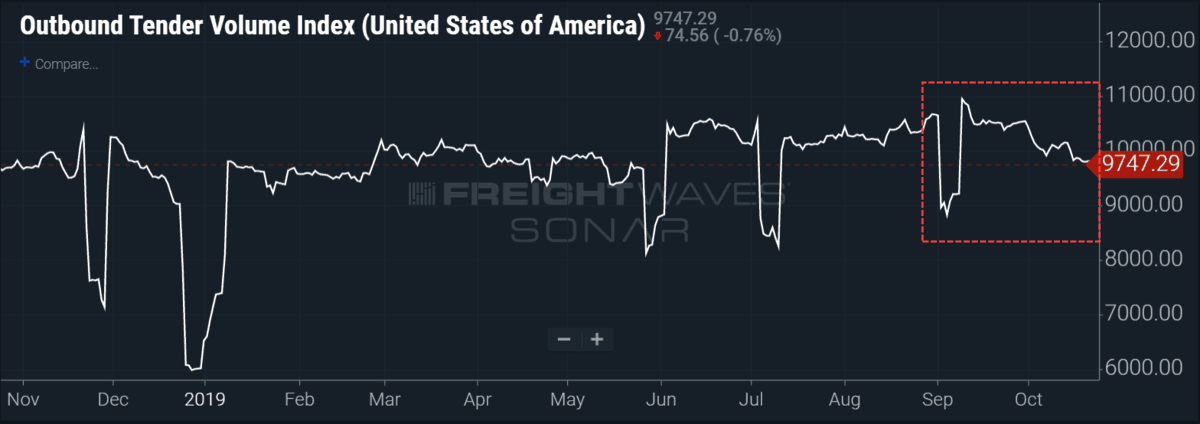

The Outbound Tender Volume Index, a real-time monitor of trucking load volumes across the US, showed demand is in decline entering the holiday season. The index significantly weakened in October, and coupled with an economy that is stalling, these trends have become “worrisome” to Freight Waves analysts.

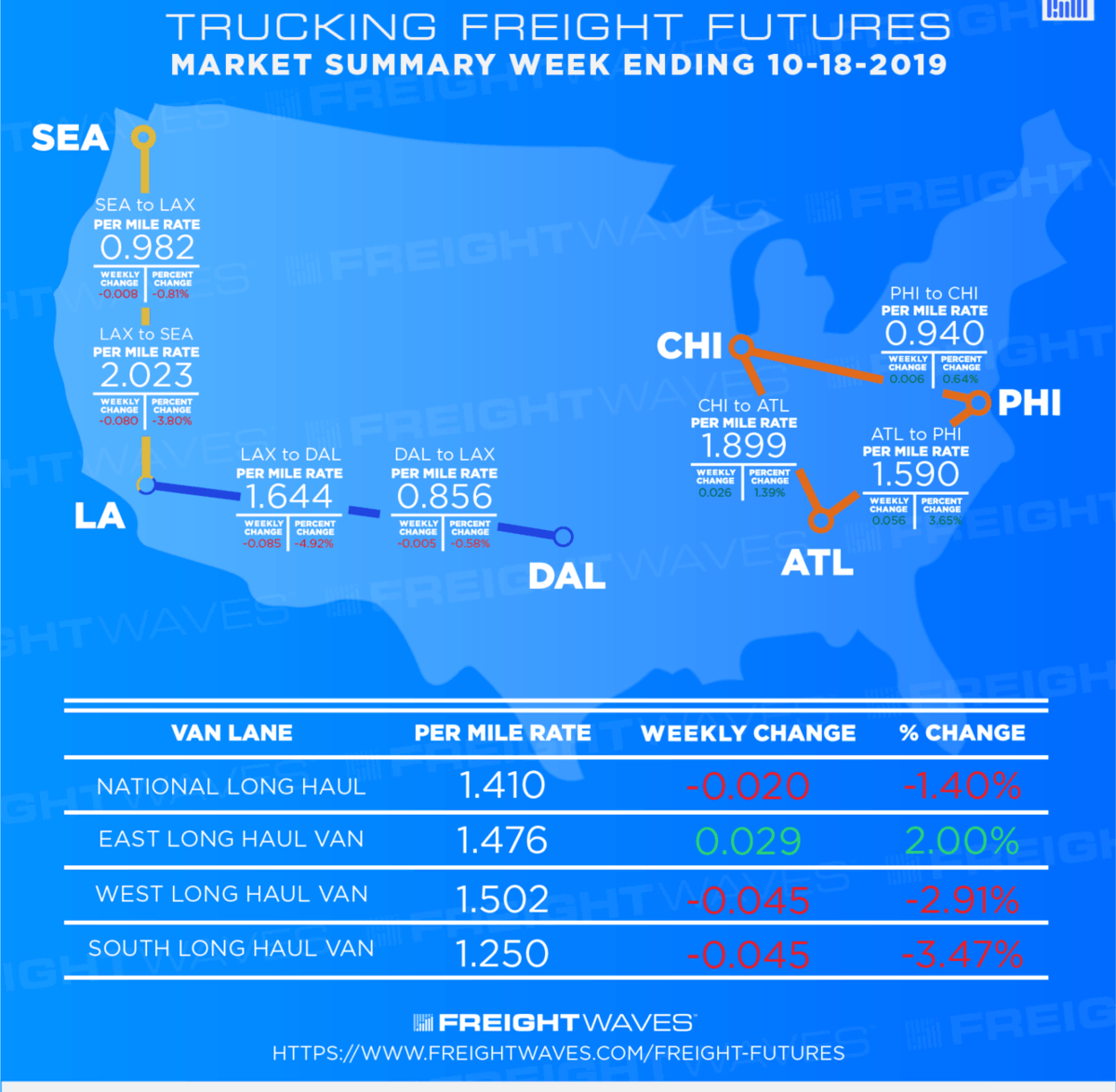

Freight spot rates continued to slide into October. Rates are expected to remain on a downward trajectory as freight demand slumps, and overcapacity remains an issue in 2020.

The slowdown in the domestic trucking industry suggests the consumer is likely to disappoint this holiday season.

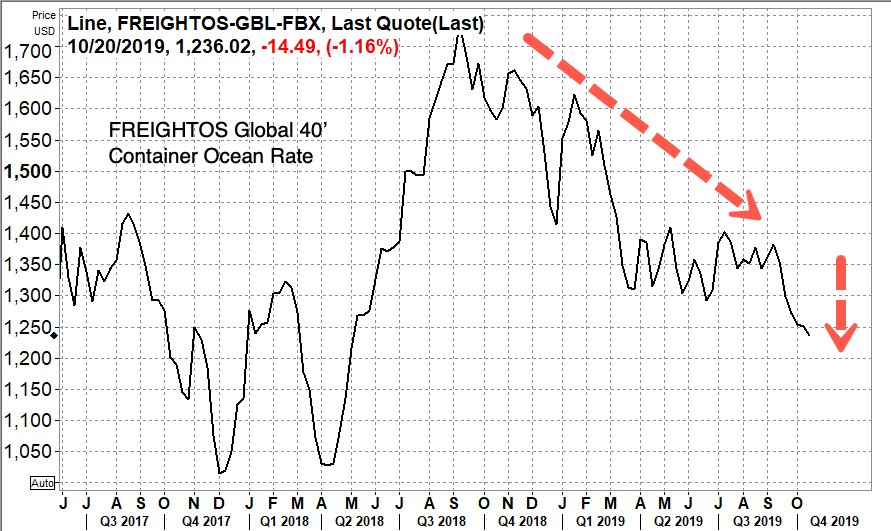

And for more color on consumer trends, not just in the US but perhaps on a global view, the global shipping container industry is sounding an alarm.

Shipping rates for 40′ containers have taken another leg lower in the last several months. This means retailers are ordering fewer consumer goods from China and other emerging markets, a clear indication the consumer is weakening.

Last week, Amazon guided its forecast for the holiday season lower. Analysts were absolutely shocked, but it marks the beginning of a new trend where the consumer is expected to come under financial stress, pull back on spending, and could start saving as the next recession nears. Tracking freight rates and volumes of various forms of transportation in domestic and global supply chains have given us perhaps an idea of what’s to come, that is, an underwhelming holiday season for retailers.

Tyler Durden

Tue, 10/29/2019 – 15:40

via ZeroHedge News https://ift.tt/31TpRxv Tyler Durden