FOMC Preview: If The Fed Doesn’t Cut, Brace For Impact; If The Fed Cuts… Then What?

Press for time? Then the following excerpt from Curvative Securities’ Scott Skyrm is all you need to know what to expect tomorrow:

Given the Fed is in easing mode and dumping liquidity into the market, it is unlikely they will NOT ease tomorrow. With over $200 billion in RP operations and $60 billion a month of QE Lite, it would throw the markets in turmoil if the Fed did not ease. For tomorrow, look for guidance about future rate cuts.

The market is pricing about a 40% chance of another cut within the next five months, though I believe the Fed will pause easing after tomorrow and any future rate cuts will be “data dependent.”

Have a little more free time? Then read on the following FOMC preview, courtesy of RanSquawk:

The Fed is expected to lower rates by 25bps to 1.50-1.75%; key will be whether the Committee signals that it is now on pause, or whether the door to further cuts remains open. While market pricing and the analyst consensus are looking for a rate cut, some – such as Jefferies – have warned that there may be enough for the Fed to pause at this meeting. The FOMC will publish its rate decision on 31st October 2019 at 2:00pm EDT. Post-meeting press conference with Fed Chair Powell scheduled for 2:30pm EDT.

RATES:

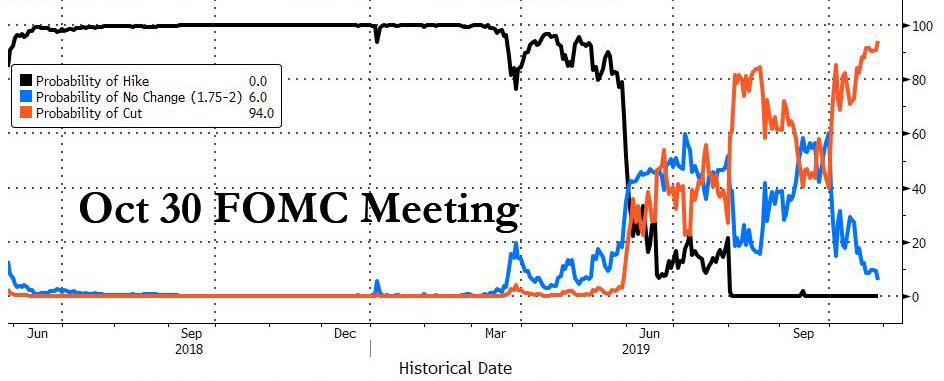

The Street expects the Fed to cut rates for the third straight meeting, lowering the federal funds rate target by 25bps to 1.50-1.75%; money markets price the cut with over 90% certainty.

Another two rate cuts are priced in by the end of 2020.

The Fed’s September economic projections envisaged the FFR target at 1.75-2.00% at end of both 2019 and 2020 (rates are currently within this bracket), rising to 2.00-2.25% by end-2021. Any decision to cut rates will likely face dissent from Eric Rosengren and Esther George, both of whom have dissented previously.

IS A CUT A DEAD CERT?

Given the two cuts already implemented, some question whether the FOMC needs to lower rates further. After all, consider that as BofA’s David Woo said earlier this week, “Over the past 30 years the Fed has never cut more than 75bp at a stretch without the US economy going into a recession.“

- Diminishing the case for a cut: data has generally held up well (payroll growth close to trend, jobless rate falling to 50-year lows; consumer spending has been stable, and confidence remains firm; CPI has been rising, though this is yet to be seen in PCE; however, internationally, downside surprises in China GDP growth and the subdued outlook in the Eurozone could add to the Fed’s caution, although US/China trade talks have been progressing well, as has Brexit, likely mitigating some of the Fed’s global concerns); meanwhile, equities are lingering near record highs, and financial conditions continue to loosen since September. Fed communications have also been generally constructive, with little signs that policymakers judge the outlook to have materially deteriorated since its last meeting.

- However, on the other side of the coin, analysts have noted that the Fed has historically not tended to lean against aggressive market pricing, supporting the case for a cut.

FUTURE SIGNALS:

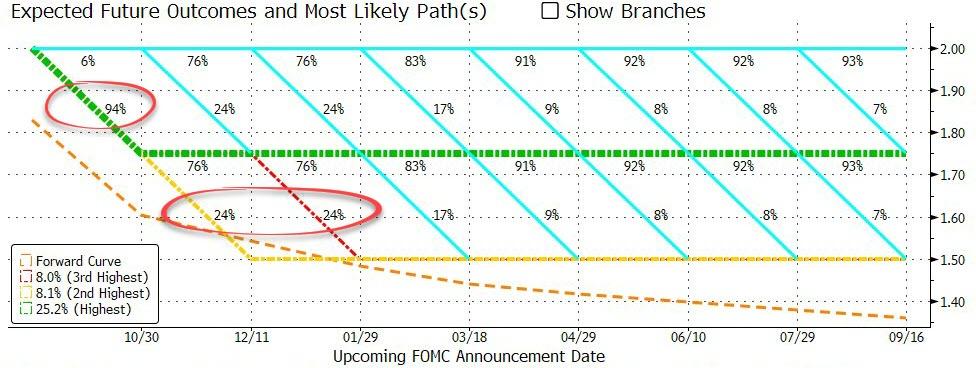

Looking ahead, markets are expecting just over one cut through the end of the year (including this week’s potential cut), suggesting there is be a feeling that the so-called ‘insurance cuts’/’mid-cycle adjustment’ are done; and looking to next year, markets price one to two rate cuts in 2020.

The notion that if the FOMC cuts, it will be on hold in December is given further credence by the Fed’s ‘insurance cut’ playbook in the 1990s, where on two occasions it cut by a cumulative 75bps before holding rates. How it frames such a ‘pause’ will be crucial; will it explicitly state that rate cuts are over? Will it retain a more data-dependent outlook? Within its statement, attention will be on the line that the Fed will “will act as appropriate to sustain the expansion” which in recent months the market has taken as a sign that additional cuts were on the horizon. The prevailing wisdom appears to be that the Fed will pause, whether or not it explicitly states it, and any further rate cuts may push accommodation to levels that implies it is more than a ‘mid-cycle adjustment’. It is worth keeping an eye on the vote of James Bullard, who last month argued for a deeper 50bps rate cut, which could show the appetite among the doves for further lowering of the FFR target (note: Bullard will vote in October and December, and then will next vote on policy in 2021).

REPO OPERATIONS:

Intra-meeting, the Fed announced that it would purchase T-Bills at a rate of USD 60bln per month. The intra-meeting nature of the announcement is understood to be significant as a signal that the Fed considers these operations as only part of the technical aspects of monetary policy implementation, rather than the sort of balance sheet expansion seen during the crisis, which was designed to crowd investors out of safer assets to help stoke economic activity. Since the Fed began overnight repo operations, its balance sheet has grown by USD 200bln as the central bank offers ample liquidity to prevent any jam-up in repo markets. The Fed has and will continue to emphasize that these operations ‘are not QE’. According to a recent newswire survey, 56% of economists surveyed think the Fed will find enough T-bills for its monthly purchases; 22% believe that the US Treasury will raise its bill issuance to accommodate the Fed; some economists also believe that the Fed will need to boost its bill-buying to include coupon-bearing Treasuries with up to three years in maturities (NOTE: The Treasury’s quarterly refunding announcement is due ahead of the FOMC meeting on Wednesday).

SRF ANNOUNCEMENT:

The Fed is expected to announce a more permanent operation in 2020, with the launch of a standing repo facility. There are many facets that still need to be worked-out, according to reports, like access to the SRF as well as the rates used to enable counterparties to engage with the market without any negative perceptions around the health of the banks; the Fed must also ensure that any SRF does not kill the private sector repo market. Accordingly, Chair Powell may allude to the background work being carried out, but may be light on specifics.

Tyler Durden

Tue, 10/29/2019 – 21:45

via ZeroHedge News https://ift.tt/2NlYib6 Tyler Durden