Your Last Minute FOMC Preview: Here Is What The Fed Will Say Today

As we said in our FOMC preview last night, the simplest summary of what to expect from the Fed in just one hour’s time is “If The Fed Doesn’t Cut, Brace For Impact; If The Fed Cuts… Then What?” A slightly more expanded take on today’s main event came from Curvature’s Scott Skyrm who cut to the chase:

Given the Fed is in easing mode and dumping liquidity into the market, it is unlikely they will NOT ease tomorrow. With over $200 billion in RP operations and $60 billion a month of QE Lite, it would throw the markets in turmoil if the Fed did not ease. For tomorrow, look for guidance about future rate cuts.

Below, courtesy of Saxo Bank’s Peter Garnry, is a somewhat more detailed preview of today’s Fed announcement, which notes that the market is pricing in a 95% probability of a rate cut “which means that the Fed will deliver this to the market.” But as the FX strategist notes, two main questions will drive price action tonight:

- First, many questions will be raised on the current money market operations currently expanding the balance sheet. Initially these activities were communicated as temporary and insignificant but the programme has been extended and increased in size indicating something is not working as expected by the Fed.

- Second, analysts will be scrutinizing any guidance on the FOMC meeting in December as clues to how the Fed views the situation. The market is currently pricing a 28% probability of another cut in December, so any guidance that indicates a higher probability will most likely lift equities in the short-term. Alternatively, as Jefferies warned earlier this week, should the Fed not cut rates today to leave itself December optionality, watch out for a “market tantrum.”

That said, cutting rates today may result in a potentially interesting – if not troubling – dynamic. While the initial rate cuts were widely seen as positive, conditioned on the market believing its an adjustment before growth resumes back to trend growth, however, “at one point if rates are cut further it signals an economic deterioration that is beyond the scope of the Fed to rectify before it turns into a vicious negative feedback loop.” In other words, another rate cut in December may suddenly go from being positive to negative for equity sentiment, although most of the equity decline would have happened leading into a December cut.

In other words, the prevailing consensus is for a September rate cut, with December “data dependent.” That’s why Goldman expects the FOMC to deliver “a third and final 25bp rate cut at the upcoming meeting” as strong signaling from Fed leadership indicates that the modest trade war de-escalation since September has not deterred them from completing a 75bp, 1990s-style “mid-cycle adjustment.”

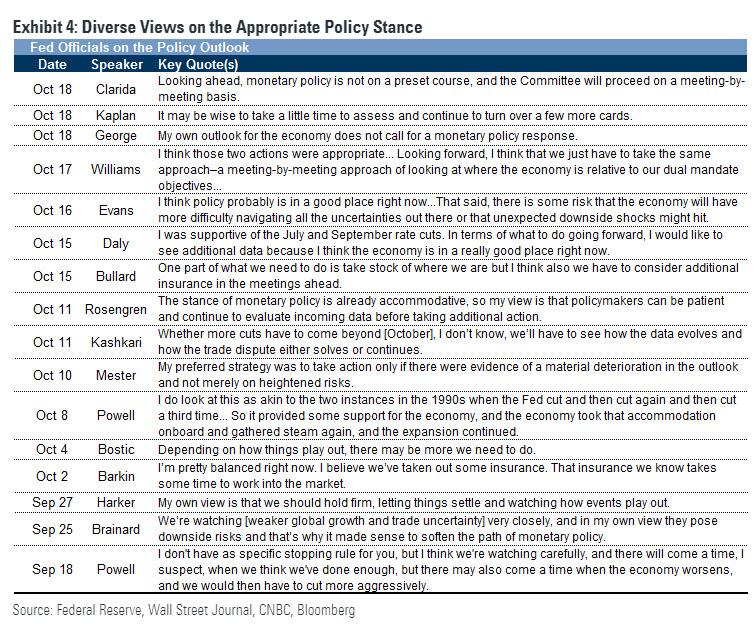

That said, the committee is painfully fragmented, with rising divisions already visible in September, as 2 members voted against that cut and another 3 participants lodged a soft dissent via the dot plot. Most of the committee has subsequently self-identified their respective views of appropriate policy, and the chart below shows the most likely dot plot for 2019 labeled with Goldman’s working assumptions for its contributors.

And while the September dot plot showed only seven participants in favor of a third 25bp cut in the fourth quarter of 2019, this minority likely included the Chair and Vice-Chair. Reflecting this, and strong signaling from leadership that that outlook remains in place, the market (and Goldman) places 95% subjective odds of a 25bp cut today.

So barring a funds rate surprise – i.e. no cut, which would promptly send the market careening lower – Goldman also expects market participants to primarily focus on the policy outlook section of the statement and Powell’s subsequent characterization of the conditions under which additional easing might be considered. As shown in the next chart, comments from Fed officials continue to indicate a diverse set of opinions about the appropriate policy stance, with many implying scope for additional cuts beyond October’s, but others professing skepticism about the easing already delivered.

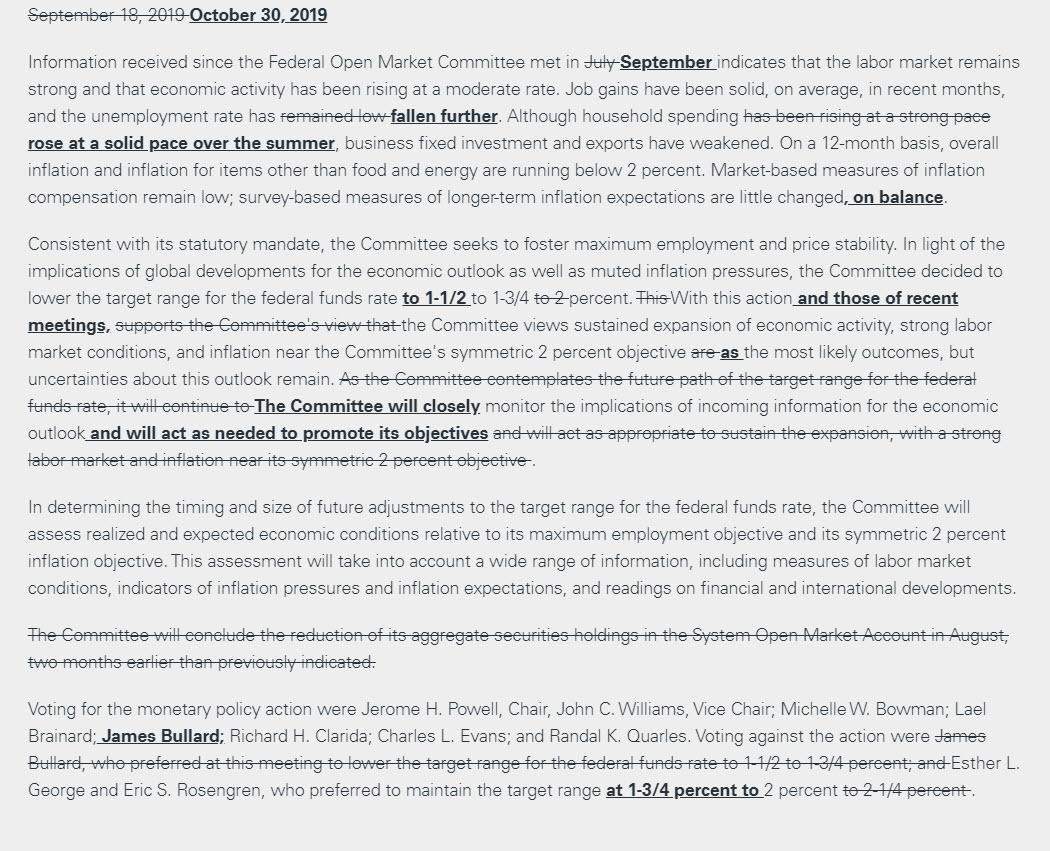

And so, because even the leadership does not appear to view a fourth cut in December as the default outcome, economists now expect the Fed statement to drop the pledge “will act as appropriate,” a phrase that the market interprets as signaling a cut at the next meeting. At the same time, policymakers may want to convey some downward asymmetry in their funds rate outlook, in order to prevent a large FCI tightening after the meeting. Accordingly, the market will expect the “act as appropriate” sentence to be replaced with a reference to the easing actions already delivered (mirroring the language in October 2007 and June 2008) coupled with the following less committal guidance: “will act as needed to promote its objectives.”

Putting all of this together, Goldman expects the following changes to today’s statement:

- Expect a downgrade to the consumption characterization (to “solid” from “strong,” in part reflecting soft September retail sales) but an unchanged characterization of overall growth (“moderate”) and job gains (“solid, on average”).

- Expect an acknowledgement of the “further decline” in the unemployment rate.

- Given mixed inflation data and continued focus on downside risks on that side of the mandate, Goldman does not expect changes to the inflation characterization. However, it does expect a tacit acknowledgement of softer intermeeting inflation expectations information (addending “little changed” with “on balance”).

- Expect hawkish dissents from Presidents Esther George and Eric Rosengren. But despite rising divisions, no other voters are expected to join the dissenters.

- Unlike in July, Goldman does not expect St. Louis Fed President James Bullard to dissent in favor of a 50bp cut, as his September dots were not consistent with a 1.4% funds rate.

- Do not expect a reference in the statement to the intermeeting balance sheet actions, because they do not represent monetary policy actions and because no formal changes are required. However, Powell will once again address funding pressures and the Fed’s response in the press conference.

In summary, Powell will have a fine line to walk during the press conference if he hopes to satisfy market participants projecting additional easing as well as the critics of insurance cuts—both on and off the Committee. Reflecting this, we expect a slightly hawkish tone, hence a “hawkish cut”, with Powell alluding to a baseline of unchanged policy but emphasizing data-dependence and the ability to respond quickly if the outlook deteriorates.

Finally, this is what the FOMC statement redline will like, according to Goldman.

Tyler Durden

Wed, 10/30/2019 – 13:05

via ZeroHedge News https://ift.tt/2WsOOPl Tyler Durden