Where The October Jobs Were: Who Is Hiring And Who Isn’t… And Those Amazing Restaurant Jobs

As noted earlier, today’s payrolls report was a far stronger than expected 128K (exp. 85K), even with the negative impact of the GM strike and the unwind of census hiring, which subtracted 41,600 and 20,000 workers from the headline print. In any case, October marked the 109th straight month of U.S. job growth, the longest such streak on record; we for one, can’t wait to deconstruct this fabrication during the next recession when the truth behind these number will finally emerge but we digress.

And while the quantitative aspect of today’s jobs report was stronger than expected, what about the qualitative?

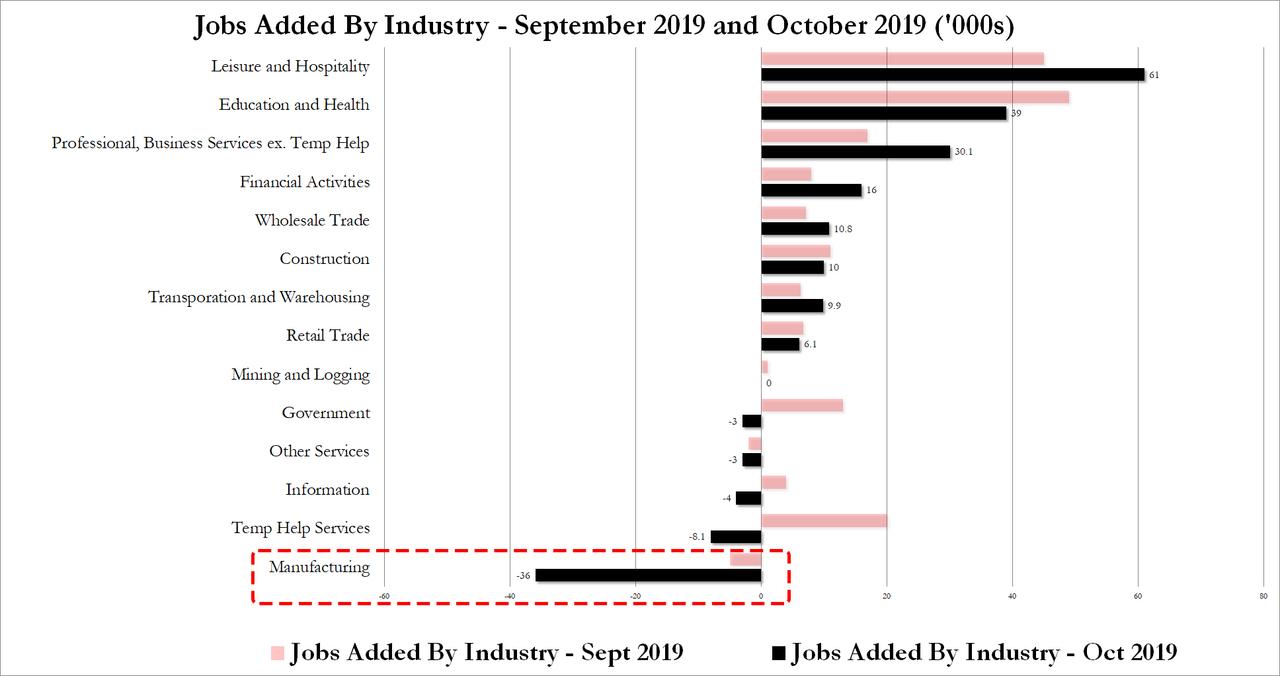

Here, as has been the case for much of the past decade, job gains were led by low-wage jobs in leisure and hospitality, education and health services as well as the somewhat better paying professional and business services. Construction and finance also posted modest gains. Even retail jobs rose, registering back-to-back gains for the first time in more than a year following seven straight declines.

While we present the full breakdown of jobs by sector below, it is worth noting that food services and drinking places added 48k jobs in October, as job growth in the industry has averaged 38k over the past three months, compared with an average monthly gain of 16k in the first seven months of 2019. And something even more remarkable: since February 2010 – a period covering nearly 10 years – the US “food service and drinking places”, i.e. restaurant industry, has added jobs every single month with just 4 exceptions!

Booming – supposedly – restaurant industry aside, this is who else hired in October and 2019:

- In October, food services and drinking places added 48,000 jobs.

- Employment in social assistance increased by 20,000 in October and by 139,000 over the last 12 months.

- Employment in financial activities rose by 16,000, with gains in real estate and rental and leasing (+10,000) and in credit intermediation and related activities (+6,000). Financial activities has added 108,000 jobs over the last 12 months.

- Employment in professional and business services continued to trend up in October (+22,000).

- Health care employment continued on an upward trend in October (+15,000). Health care has added 402,000 jobs over the last 12 months.

- Manufacturing employment decreased by 36,000 in October. Within manufacturing, employment in motor vehicles and parts declined by 42,000, reflecting strike activity.

- Federal government employment was down by 17,000 over the month, as 20,000 temporary workers who had been preparing for the 2020 Census completed their work.

The chart summarizing the above is below, with the sharp drop in manufacturing jobs, a direct result of the GM strike, highlighted. It is expected that most of this drop will reverse in November.

Finally as Bloomberg notes, blow are the industries with the highest and lowest rates of employment growth for the most recent month. Additionally, monthly growth rates are shown for the prior year. The latest month’s figures are highlighted.

Tyler Durden

Fri, 11/01/2019 – 10:31

via ZeroHedge News https://ift.tt/2N9FWeB Tyler Durden