Full Week-Ahead Preview; It’s Supposed To Be A Quiet Post-Payrolls Week, But It Won’t Be

While it is traditionally the case that the week post payroll tends to be quiet for data, as DB’s Jim Reid notes, this week is different as given payrolls was released on the 1st (Friday), and that Europe had a part holiday on the same day, we have the rare situation where European manufacturing PMIs (today) and European (Wednesday) /US non-manufacturing PMIs/ISM (Tuesday) are released after payrolls.

As Reid continues, there’s a raft of Fedspeak due this week and the first speech from new ECB President Lagarde today. Expect the UK election campaign to gain momentum. The polls (YouGov, Opinium, Orb) over the weekend showed some interesting developments as 1) the Conservatives ranged from an 8-16pc lead, 2) both the Conservatives and Labour are gaining support since the election was announced and 3) Labour seem to be gaining a little more of it from a low base but the Lib Dems and the Brexit Party and getting squeezed. The early signs are that this could be more of the traditional two party race than many thought.

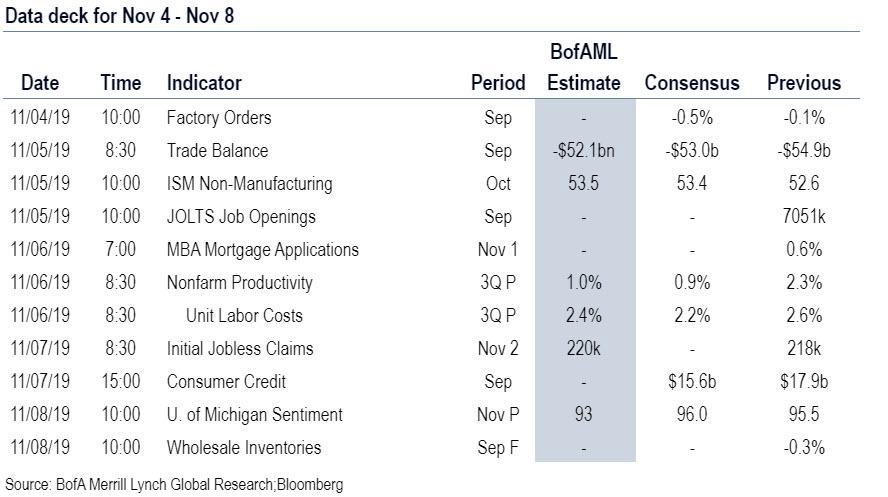

In terms of other US data we have the final September durable and capital goods orders revisions today, Q3 non-farm productivity and unit labor costs on Wednesday and the preliminary November University of Michigan consumer sentiment survey on Friday. There are a slew of Fed speakers including voters: Evans, Williams and Brainard. We expect them all to reiterate that policy is at an appropriate level. ISM nonmanufacturing should edge up to 53.6 in October from 52.6 in September

In Europe we’ve also got the September industrial production prints in Germany on Thursday and France on Friday, while the European Commission will also publish its latest economic forecasts on Thursday. Finally in China we’ll get the services and composite Caixin PMIs for October on tomorrow and the October trade data on Friday.

As for policy meetings this week, the BoE meet on Thursday. No policy changes are expected. DB’s economists expect the BoE to sound dovish, dropping its tightening bias and instead moving towards an easing policy stance. They note that domestically data have deteriorated sufficiently to warrant more supportive monetary policy. Growth has slowed and is tracking below the Bank’s “speed limit” of 1.5% with uncertainty likely weighing further on the near-term growth outlook. Equally, the UK supply side story is also turning softer, with labor market indicators pointing to downside risks for both pay and jobs by Q4-2019 and inflation now expected to remain below target in 2020. There is also an increasing risk of a rate cut at the January Inflation Report – Governor Carney’s final MPC meeting.

Staying with central banks, as discussed earlier it’s another busy week for Fedspeak. Indeed today we’ll hear from Daly, Tuesday will see Barkin, Kaplan and Kashkari speak, Wednesday will see Evans, Williams and Harker speak, Thursday will see Kaplan speak and on Friday we’ll hear from Bostic and Daly.

Meanwhile, earnings season starts to slow down with just 66 S&P 500 companies reporting. The highlights include Sysco and Berkshire Hathaway on Monday, CVS on Wednesday, and Walt Disney and Cardinal Health on Thursday. Away from the US we’ll also get results from Telefonica, Softbank, BMW, Toyota, Siemens, Allianz and Honda.

Day-by-day calendar of events, courtesy of Deutsche Bank

Monday

- Data: US final September durable and capital goods revisions; Europe final manufacturing PMIs for October; Euro Area Sentix investor confidence for November.

- Central Banks: ECB’s Lagarde and Hernandez de Cos speak; Fed’s Daly speaks.

- Politics: ASEAN summit begins in Bangkok; UK House of Commons votes for new speaker; French President Macron visits China.

- Earnings: Uber, Sysco, Occidental.

Tuesday

- Data: US final services and composite PMIs for October, October ISM non-manufacturing, September JOLTS survey; UK final services and composite PMIs for October, Euro Area September PPI; China services and composite PMIs for October.

- Central Banks: Fed’s Kaplan and Kashkari speak; ECB’s Villeroy speaks; BoJ September meeting minutes; Riksbank meeting minutes from October meeting; RBA policy meeting.

- Politics: China’s Xi Jinping speaks.

- Earnings: Allergan, Telefonica.

Wednesday

- Data: US preliminary Q3 nonfarm productivity and unit labour costs; Europe final services and composite PMIs for October; Germany September factory orders, Euro Area September retail sales; Japan final October services and composite PMIs.

- Central Banks: Fed’s Williams, Harker and Evans speak; ECB’s Mersch and Guindos speak; policy decisions due in Thailand, Iceland, Poland and Romania. Politics: Campaign season officially begins for UK general election.

- Earnings: Qualcomm, CBS, Softbank, BMW.

Thursday

- Data: US initial jobless claims, September consumer credit; Germany industrial production for September; EU Commission Economic Forecasts; China foreign reserves for October.

- Central Banks: Policy decision from the BoE, Peru, Czech Republic and Serbia; Fed’s Kaplan speaks.

- Earnings: Walt Disney, Toyota, Siemens.

Friday

- Data: US preliminary November University of Michigan consumer sentiment survey, September wholesale inventories; France September industrial production, Q3 wages; Germany September trade balance; China October trade balance.

- Central Banks: Fed’s Bostic and Daly speak.

- Earnings: Allianz, Enbridge, Honda.

* * *

Finally, looking at just the US, Goldman notes that the key event this week is the ISM non-manufacturing index on Tuesday and the University of Michigan consumer sentiment report on Friday.

Monday, November 4

- 10:00 AM Factory orders, September (GS -0.5%, consensus -0.4%, last -0.1%); Durable goods orders, September final (consensus -1.1%, last -1.1%); Durable goods orders ex-transportation, September final (last -0.3%); Core capital goods orders, September final (last -0.5%); Core capital goods shipments, September final (last -0.7%): We estimate factory orders decreased by 0.5% in September following a 0.1% decline in August. Durable goods orders declined in the September advance report, and core measures were weak as well.

- 05:00 PM San Francisco Fed President Daly (FOMC non-voter) speaks; San Francisco Fed President Mary Daly will speak at an event at New York University. Advance text is not expected. Audience and media Q&A is expected.

Tuesday, November 5

- 08:00 AM Richmond Fed President Barkin (FOMC non-voter) speaks; Richmond Fed President Thomas Barkin will speak at a conference in Baltimore. Audience and media Q&A is expected.

- 08:30 AM Trade balance, September (GS -$52.3bn, consensus -$52.5bn, last -$54.9bn); We estimate the trade deficit decreased by $2.6bn in September, reflecting a decline in the goods trade deficit.

- 10:00 AM ISM non-manufacturing index, October (GS 54.0, consensus 53.6, last 52.6); We expect the ISM non-manufacturing index to rebound by 1.4pt to 54.0 in the October report, reflecting solid service sector job growth in October and a rebound in the Goldman Sachs Analyst Index.

- 10:00 AM JOLTS Job Openings, September (last 7,051k)

- 12:40 PM Dallas Fed President Kaplan (FOMC non-voter) speaks; Dallas Fed President Robert Kaplan will speak at an event in Dallas. Advance text is not expected. Audience and media Q&A is expected.

- 06:00 PM Minneapolis Fed President Kashkari (FOMC non-voter) speaks; Minneapolis Fed President Neel Kashkari will participate in a moderated Q&A at an event in Minneapolis. Advance text is not expected. Audience and media Q&A is expected.

Wednesday, November 6

- 08:00 AM Chicago Fed President Evans (FOMC voter) speaks; Chicago Fed President Charles Evans will speak at the Council on Foreign Relations in New York. Advance text is not expected. Audience and media Q&A is expected.

- 8:30 AM Nonfarm productivity (qoq saar), Q3 preliminary (GS +1.1%, consensus +0.9%, last +2.3%); Unit labor costs, Q3 preliminary (GS +2.0%, consensus +2.2%, last +2.6%): We estimate non-farm productivity growth slowed to +1.1% in Q3 qoq ar (1.7% yoy), just above the trend achieved on average during this expansion. This reflects firmer business output growth in Q3, but a greater acceleration in hours worked. We expect Q3 unit labor costs—compensation per hour divided by output per hour—to decelerate to +2.0% qoq ar (+2.7% yoy).

- 09:30 AM New York Fed President Williams (FOMC voter) speaks; New York Fed President John Williams will participate in a moderated Q&A at an event hosted by the Wall Street Journal in New York. Advance text is not expected. Audience and media Q&A is expected.

- 03:15 PM Philadelphia Fed President Harker (FOMC non-voter) speaks; Philadelphia Fed President Patrick Harker will give a speech on the workforce at a conference in Philadelphia. Advance text is expected. Q&A is not expected.

Thursday, November 7

- 08:30 AM Initial jobless claims, week ended November 2 (GS 210k, consensus 215k, last 218k); Continuing jobless claims, week ended October 26 (consensus 1,660k, last 1,690k); We estimate jobless claims declined by 8k to 210k in the week ended November 2, following a 5k rise in the prior week.

- 01:05 PM Dallas Fed President Kaplan (FOMC non-voter) speaks; Dallas Fed President Robert Kaplan will speak at an event in Dallas. Advance text is not expected. Q&A is expected.

- 07:10 PM Atlanta Fed President Bostic (FOMC non-voter) speaks; Atlanta Fed President Raphael Bostic will discuss monetary policy at a Money Marketeers event in New York. Advance text is expected as well as audience and media Q&A are expected.

Friday, November 8

- 10:00 AM University of Michigan consumer sentiment, November preliminary (GS 93.5, consensus 96.0, last 95.5); We expect the University of Michigan consumer sentiment index declined by 2.0pt to 93.5 in the preliminary November reading, following a pullback in other consumer confidence measures.

- 10:00 AM Wholesale inventories, September final (last -0.3%)

- 11:45 AM San Francisco Fed President Daly (FOMC non-voter) speaks; San Francisco Fed President Mary Daly will speak at a conference on climate change at the Federal Reserve Bank of San Francisco. Advance text is expected. Q&A is not expected.

Source: Deutsche Bank, BofA, Goldman

Tyler Durden

Mon, 11/04/2019 – 09:15

via ZeroHedge News https://ift.tt/2oPSKxi Tyler Durden