Bitcoin Flash-Crash Renews Manipulation Fears As Study Suggests One Whale Was Behind 2017 Bull Run

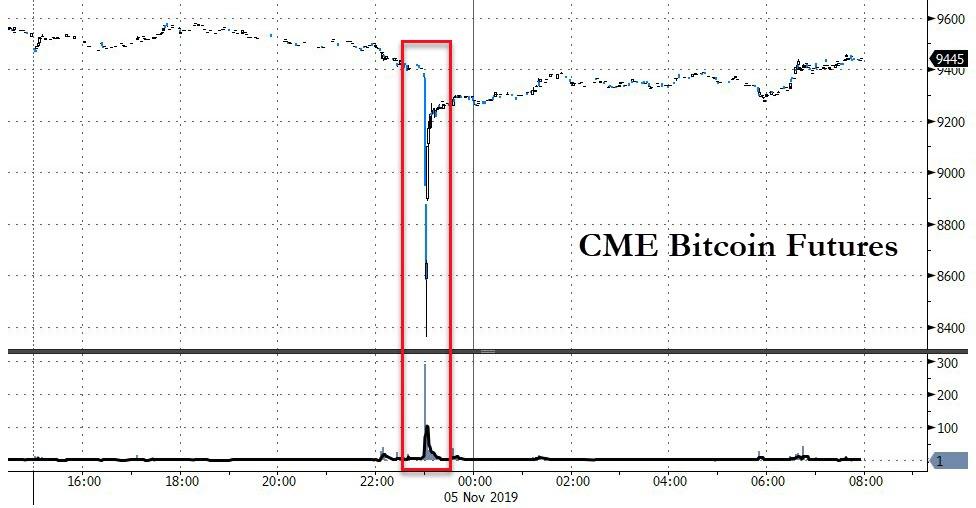

Bitcoin Futures flash-crashed this morning – plunging $1000 in seconds on massive volume…

Source: Bloomberg

For Twitter analyst lowstrife meanwhile, the behavior was a “good example” of market manipulation.

“If you look at my original tweet, all the volume printed before the actual dump. But on the 1 minute chart it looks like it was part of the entire move. This is called painting the tape,” the account wrote.

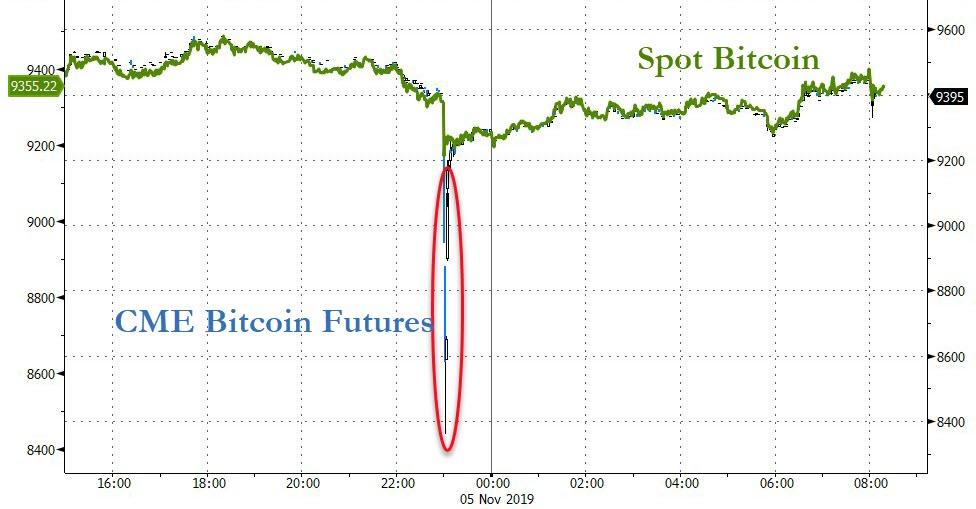

The crash filled the gap to $8500 from last week…

Source: Bloomberg

“I cannot believe how crazy trading BTCUSD on the short term is right now. The gap on the CME has filled already. It’s thinly traded yes. But man, I’m highly suspicious of the price action across all the exchanges of late, more so than usual,” one trader summarized.

But spot bitcoin was far less affected…

Source: Bloomberg

And this just renews fears over broader manipulation, as CoinTelegraph’s Marie Huillet notes, researchers have escalated their claims about market manipulation in winter 2017, now claiming that a single whale was responsible for Bitcoin’s historic price surge. The development was reported by Bloomberg on Nov. 4.

image courtesy of CoinTelegraph

John M. Griffin and Amin Shams – of the universities of Texas and Ohio respectively – have updated their previous research, which made the case that market misconduct was allegedly behind Bitcoin’s bull run to an all-time high of $20,000 in December 2017.

“Clairvoyant market timing” or manipulation

Griffin and Sham’s analysis, first published in a research paper in June 2018, had argued that transaction patterns on the blockchain suggested Tether had been used to provide price support and manipulate the Bitcoin market:

“Purchases with Tether are timed following market downturns and result in sizable increases in Bitcoin prices. The flow is attributable to one entity, clusters below round prices, induces asymmetric autocorrelations in Bitcoin, and suggests insufficient Tether reserves before month-ends.”

Rather than indicating demand from cash investors, they argued that these patterns aligned with a “supply-based hypothesis of unbacked digital money inflating cryptocurrency prices.”

In an update to their previous research, the academics are intensifying their argument, which is set to be formally published in a forthcoming peer-reviewed paper for the Journal of Finance.

They reportedly argue that an analysis of Tether and Bitcoin transactions from March 1, 2017 through March 31, 2018 consolidates their view that a single entity — transacting via Tether’s sister firm, crypto exchange Bitfinex — is behind the manipulation:

“This pattern is only present in periods following printing of Tether, driven by a single large account holder, and not observed by other exchanges.”

The academics continue to claim that:

“Simulations show that these patterns are highly unlikely to be due to chance. This one large player or entity either exhibited clairvoyant market timing or exerted an extremely large price impact on Bitcoin that is not observed in aggregate flows from other smaller traders.”

Bitfinex rebuffs allegations

Tether’s General Counsel Stuart Hoegner has rebuffed the academics’ claims, releasing a statement that their research is “foundationally flawed” and derives from an insufficient data set.

He has further alleged that the research was motivated to bolster a “parasitic lawsuit” against Tether, Bitfinex and the latter’s operator, iFinex.

Tyler Durden

Tue, 11/05/2019 – 11:18

via ZeroHedge News https://ift.tt/2JQHx6E Tyler Durden