China Unexpectedly Cuts Key Interest Rate

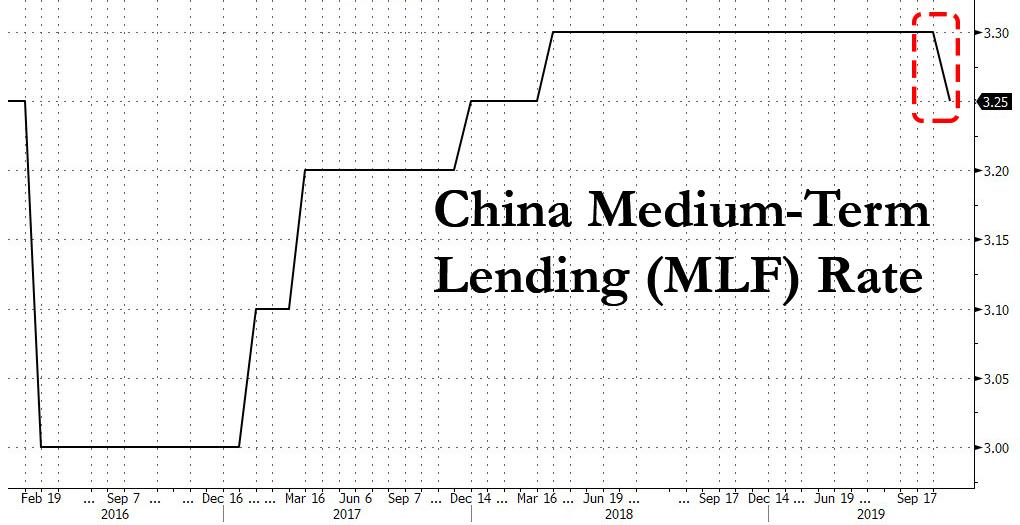

At roughly the same time that China’s Xi Jinping was vowing to “open doors wider” to foreign firms, something he has done on countless times before but this time may really mean it as China desperately needs foreign capital now that its current account is finally set to drop below zero, the PBOC – which had stubbornly refused to follow the Fed’s rate cuts – unexpectedly cut the 1-year Medium-term Lending Facility (MLF) rate by a modest 5bp, the first such cut since February 2016…

… a move that as Goldman put it “surprised the market” even though the impact on liquidity “is roughly neutral”, which one would expect for such a modest cut.

As SocGen notes, this was the very first policy (interest) rate cut in this cycle. The cut, though small in magnitude, sends several big messages:

- China’s central bank can see through supply-driven inflation if the economy needs help,

- the cut is focused squarely on improving policy transmission and easing credit conditions for the real economy, but

- the PBoC still has no appetite for aggressive easing

The cut prompted speculation that a cut could soon follow for China’s “new Libor” rate, i.e., the loan prime rate (LPR) which has been the major focus of the PBOC, even though, as Goldman concedes, short-term rates may have limited further downside in the near term.

Some more observations on today’s surprise cut via Goldman:

The PBOC lowered the 1-year MLF interest rate by a modest 5bp (the last time the PBOC adjusted MLF rates was in April 2018, raising the rates by 5bp). This actually surprised the market, as PBOC did not conduct targeted MLF in Q3 for the first time this year (typically it happens in the following month after each quarter ends) and left MLF rates unchanged recently.

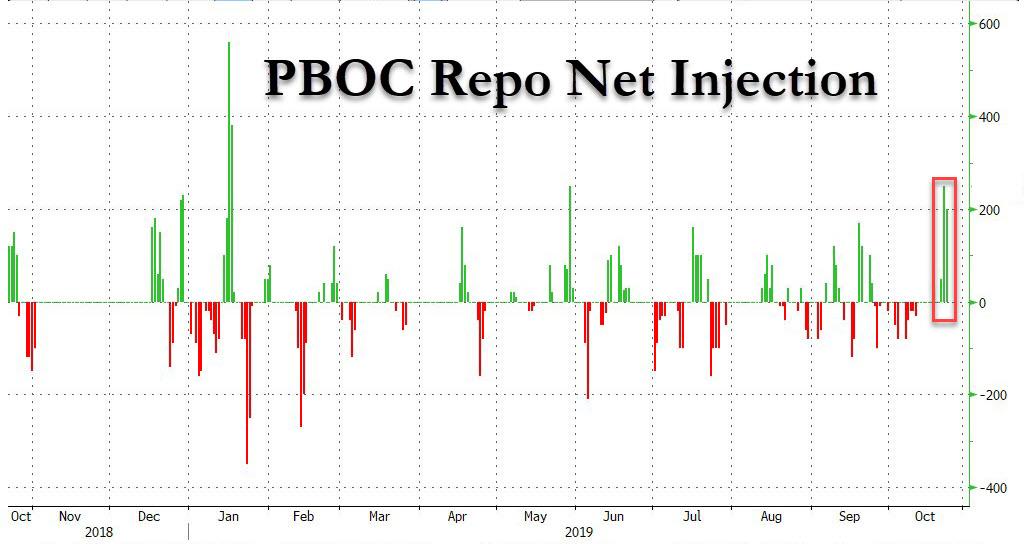

The rate cut followed two weeks after the PBOC’s largest 3-day net repo injection since January.

However, as we noted in “China Just Injected The Most Liquidity Since January… And It’s Not Enough“, the injection failed to put a dent on repo rates, which had been trending up since late August.

As such, the MLP cut was somewhat telegraphed, even though once again the impact on systemwide liquidity was roughly neutral, with today’s CNY400BN MLF operation rolling over the matured loans of CNY403.5BN.

According to strategists, the main rationale for today’s cut is to guide LPR lower. As we pointed out on Oct 22, the response of effective lending rates to monetary policy in China has been surprisingly mild, due to factors such as lack of benchmark lending rates, higher risk aversion of banks and capital constraint. Furthermore, as we noted in August, one of the major measures taken by PBOC to improve monetary policy transmission was LPR reform, with Beijing encouraging banks to use LPR as the new benchmark rates. As such, Goldman wrotes, “if the PBOC can guide the LPR further down, this could be more effective in lowering funding costs than reducing the repo rate further.”

That said, the MLF rate is just one factor determining the LPR; other factors such as banks’ financing costs and risk premium also matter. For instance, the RRR cut in September, which lowered banks’ financing costs, was one factor behind the lower 1-year LPR (MLF rates had been unchanged). But the LPR was unchanged in October, as there was no major RRR cut, and repo rates even rose on average.

As such, today’s cut in MLF rate could help guide LPR lower as it indicates that the PBOC is concerned about liquidity, though the impact of this single cut on effective lending rate could be pretty limited. There would be another two batches of MLF to expire in December (4th and 16th), and as such the PBOC may lower the MLF rate by another 5-10bps to full impact the LPR. Finally, Goldman – which expects another 50bps in RRR cuts this year – notes that the PBOC could also continue to cut the RRR to release low-cost funding for banks, especially if China’s GDP dips ominously below 6%.

SocGen proposes an alternative explanation for today’s surprise cut: namely the PBOC is using it to slip in one easing move before the hurdles to easing rise significantly higher, i.e. over the next few months, as the headline CPI will likely surge further – possibly towards 6% – given the record pork supply shortage. And if the US and China manage to reach a “phase one” deal and the business sentiment stabilizes as a result, pauses on further RRR and rate cuts seem likely until CPI is able to resume a downward trend (expected in late 1Q20).

Pause or not, neither bank sees any chance of monetary tightening by the PBOC given the ongoing economic contraction, and the PBoC probably also intended for the surprise rate cut to dispel any lingering tightening scare, especially in light of the recent surge in bank failures and corporate defaults.

Tyler Durden

Tue, 11/05/2019 – 11:50

via ZeroHedge News https://ift.tt/2WLz369 Tyler Durden