“It’s Obviously Disturbing” – Mortgage Market Reopens To Subprime Borrowers

After more than a decade since the subprime mortgage market triggered the 2008 financial meltdown, the strict lending standards placed on new homeowners post-crisis have disintegrated in the last three years.

Homebuyers with low credit scores, gig-economy jobs, and high-debt loads (sounds like millennials), can now obtain mortgages and participate in the American dream of owning a home.

Putting unqualified people back into homes is the latest example of stupidity from Wall Street, but the lack of oversight from the Federal Reserve and government.

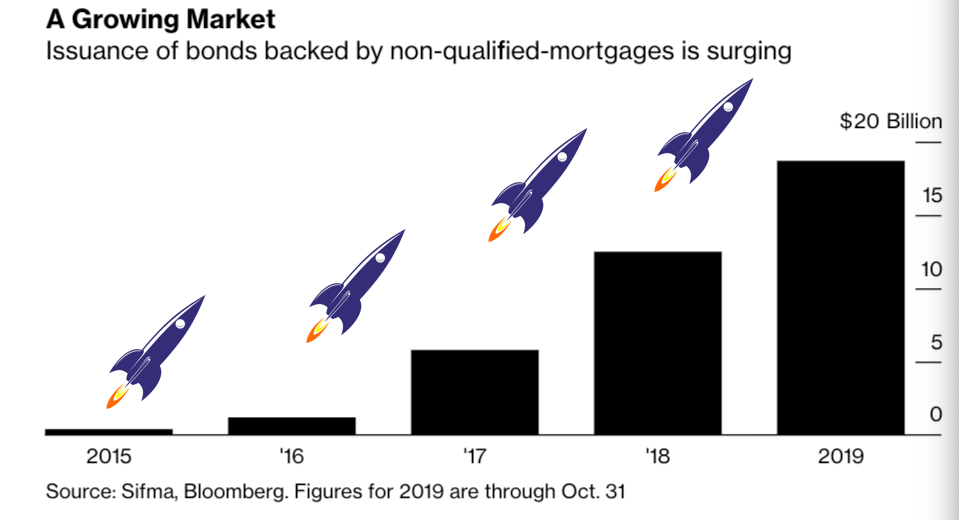

The rapid surge of non-qualified, or non-QM bonds, is happening as cracks in the housing market have appeared. For instance, the housing price growth of major cities in the S&P CoreLogic Case-Shiller Index has stalled. Delinquency rates of these unconventional loans have also started to tick higher.

“It’s obviously disturbing this late in the cycle to see originations for these loans at the kind of level they’ve kicked up to,” Daniel Alpert, managing partner at Westwood Capital, told Bloomberg. “The housing market is not quite ready for a big infusion of this product.”

Banks, who are underwriting these unconventional loans, are doing so through weakening standards very late in an economic expansion. The expectation is that a recession could arrive as early as next year, could lead to a further tick up in delinquency rates.

The non-QM bond market is nowhere near the size of the subprime bond market of 2007/08.

“It’s not the subprime we remember from 2006 to 2007,” said Mario Rivera, managing director of the Fortress Credit Funds business, which has bought non-QM bonds. “It’s more of a second or third inning of non-QM. We’re getting the best collateral before the more aggressive lending comes in.”

Bloomberg says the size of the non-QM bond market is about $27 billion, a tiny fraction compared to the $10 trillion mortgage-bond market. Back in 2007, the subprime mortgage bond market was approximately $1.8 trillion right before it imploded.

Nonbank mortgage lenders have largely underwritten these unconventional loans, but large banks like JPMorgan Chase & Co., Credit Suisse Group AG, and Citigroup Inc. have been entering the space since 2016.

Recent non-QM borrowers have had credit scores at or below 700, many have provided income statements rather than tax returns. Fitch Ratings analysis warns non-QM borrowers are susceptible to income fluctuations.

Fitch added that non-QM bonds have a lot more safeguards than the subprime ones did in 2007.

“There’s a lot more cushion, as there should be,” said John Kerschner, head of U.S. securitized products at Janus Henderson Group Plc. “You can get some comfort that even if defaults inch up, the losses from those defaults aren’t going to be egregious.”

And while the non-QM bond market won’t lead to the next financial armageddon like what was seen a decade ago, it certainly demonstrates that Wall Street is willing to create the same financial products that led up to the last crisis.

Tyler Durden

Tue, 11/05/2019 – 18:25

via ZeroHedge News https://ift.tt/2NIQP67 Tyler Durden