After WeWork Disaster, SoftBank’s Masa Son Says “Bad Judgement” Led To First Loss In Decade

SoftBank Group reported its first quarterly loss in 14 years on Wednesday morning, severely impacted by lousy technology bets with its $100 billion Vision Fund.

The Japanese investment bank wrote down $6.5 billion of losses from its flagship investment fund for Q3. It suffered a massive $4.6 billion loss from WeWork, a startup that as recently as a few months ago was worth $47 billion earlier this year, only to effectively be insolvent just a few weeks ago.

WeWork, formally called We Co., was bailed out by SoftBank last month, when the bank plowed $10 billion into the office space subletting company to save it from bankruptcy.

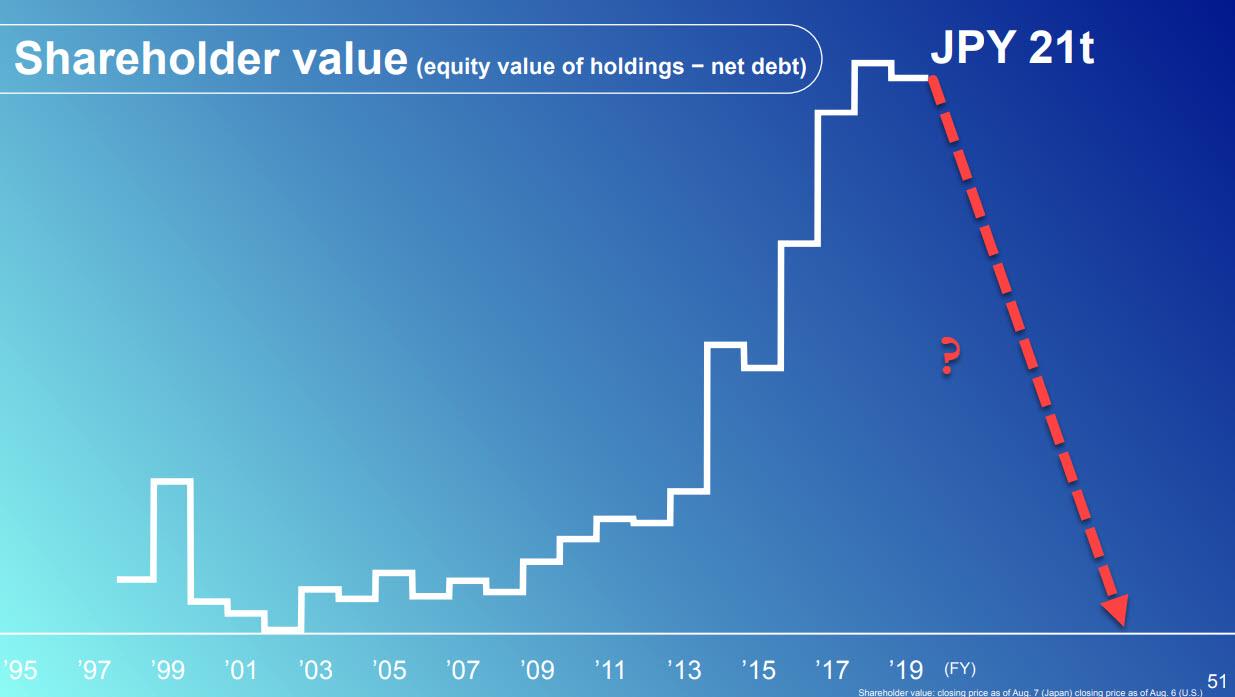

SoftBank CEO Masayoshi Son, 62, has been questioned by the investment community for overlooking valuations and corporate governance issues at WeWork. Son’s judgment in paying top dollar for startup companies that don’t make money has come into question.

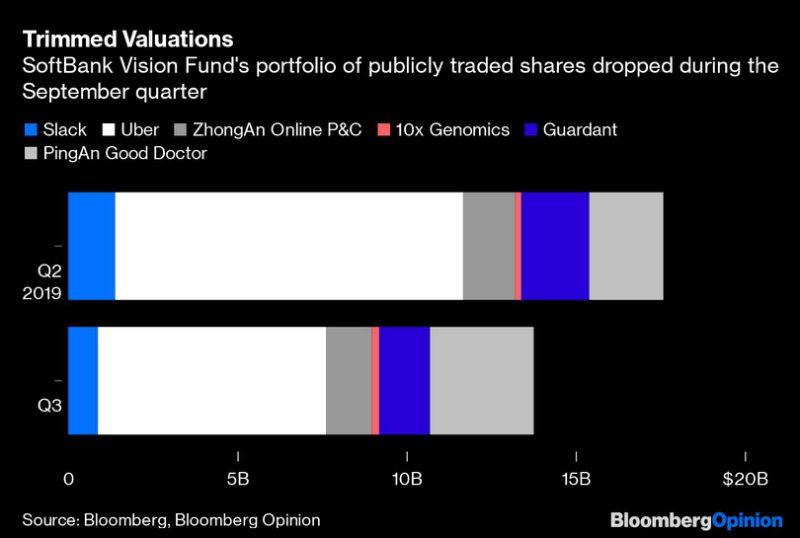

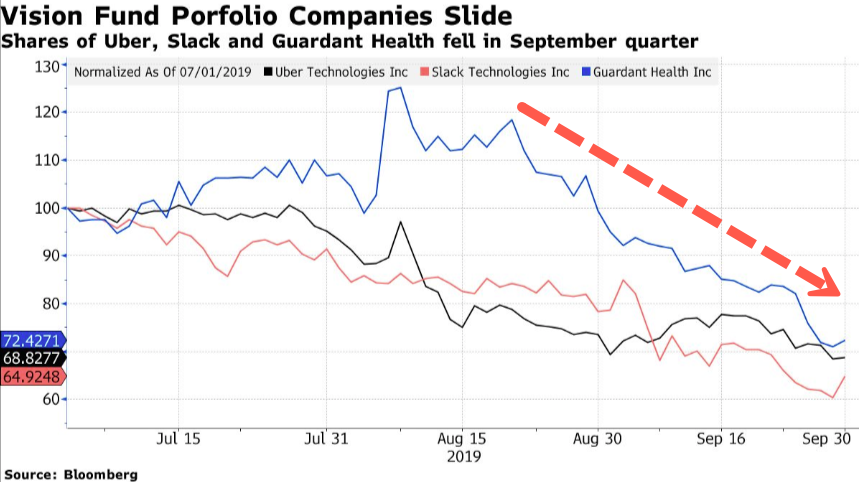

Collapsing valuations of WeWork and Uber, to name a few, have severely dented profit growth at SoftBank.

“The operating loss was 704.4 billion yen in the three months ended Sept. 30, the Tokyo-based company said in a statement. That easily surpassed the 230.8 billion yen average of analysts’ projections, and compared with a 705.7 billion yen profit a year earlier. Its signature Vision Fund — the world’s single largest pool of startup investments — reported a 970.3 billion yen loss in the quarter,” reported Bloomberg.

SoftBank’s Vision Fund has high exposure to technology startups (about 88 startups in its portfolio) that don’t turn a profit was valued around $77.6 billion.

Most of Vision Fund’s technology startups have never operated outside a global synchronized recovery; in fact after the bursting of the dotcom bubble, Masa Son almost went bankrupt.

So today’s global synchronized downturn, with the very real threat of a global trade recession, has forced investors to rotate out of speculative companies into ones that have stable cash flows. This triggered a valuation reset for speculative companies and a massive headache for Vision Fund who is now seen holding the bag.

Son on Wednesday was quoted as saying, “there was a problem with my judgment; that’s something I have to reflect on.”

The trend is clear for SoftBank: more write-downs are ahead as its investments in Vision Fund implode one by one, something we discussed in depth in “Is SoftBank The Bubble Era’s “Short Of The Century“.

Tyler Durden

Wed, 11/06/2019 – 06:46

via ZeroHedge News https://ift.tt/2NJ7J4x Tyler Durden