Global Stock Rally Fizzles On Lack Of Trade Talk Optimism

US futures were unchanged, and global stock markets hit a pause after a torrid three-day rally on Wednesday as traders failed to any new intravenous trade talk “optimism” to offset the deepening global earnings recession. The MSCI All Country World Index was flat on the day, after rallying 1.3% since Friday, while Treasuries rose after dropping for three days and the dollar was flat.

World stock markets rallied on a scaling-back of recession bets amid rising optimism about a U.S.-China trade deal this month and as global business surveys indicate tariff-hit manufacturing sentiment has troughed, although on Wednesday they pared some of the recent upside amid cautious sentiment on multiple reports corroborating the narrative that China will push for further US tariff concessions before it signs off on a Phase 1 trade deal. Additionally, the SCMP reported that Chinese President Xi’s visit to Brazil next week may be too soon to sign a Phase One trade deal with the US., as the two sides are yet to reach a consensus, with sources noting time is very limited to finalize the details in writing for next week; Source notes that one idea was for a meeting in the US, but China disagreed.

European stocks seesawed, opening higher, then fading, then turning green again boosted by gains in financial stocks as were greeted with a mixed bag of earnings reports. The Stoxx 600 index was higher by 0.2% as Britain’s FTSE 100 index was flat, while Germany’s DAX and France’s CAC 40 was up 0.2% each.

Incoming economic data continued to show signs of improvement: German industrial orders rose more than expected in September, rising 1.3% sequentially, well above the exp. 0.1%, if still down substantially on an annual basis, offering some hope for manufacturers in Europe’s biggest economy as they head into a near certain economic recession in the fourth quarter.

Separately, Eurozone business activity expanded slightly faster than expected last month but remained close to stagnation, according to a survey whose forward-looking indicators suggest what little growth there is could dissipate.

Earlier in the session, Asian stocks edged lower with MSCI’s broadest index of Asia-Pacific shares ex-Japan down 0.12%, snapping a four-day rising streak, as Beijing insisted on the removal of some tariffs before agreeing to sign an interim trade deal with Washington. Most markets in the region were down, with the Philippines leading losses and India rising. Consumer staples and utilities were among the weakest sectors. The Topix closed little changed, as Mitsubishi rallied and Nippon Telegraph & Telephone retreated. Bank of Japan Governor Haruhiko Kuroda stepped into the global debate on how governments should support growth, saying the ultra-low interest environment created by his central bank makes fiscal spending more powerful. The Shanghai Composite Index slipped 0.4%, with PetroChina and Kweichow Moutai among the biggest drags. The success of China’s first euro bond offering in 15 years is likely to spur a rush of issuance from the nation’s companies. India’s Sensex rose past Monday’s record-high close in volatile trading, as ICICI Bank and Infosys offered strong support. Strong company earnings for the September-ending quarter helped buoy sentiment

Markets were consolidating gains made over the last three sessions as focus shifted to lingering concerns over the outcome of U.S.-China trade talks. As Reutersx noted, traders and investors are hoping a preliminary Sino-U.S. trade pact will roll back at least some of the punitive tariffs that Washington and Beijing have imposed on each other’s goods, but it is still uncertain when or where U.S. President Donald Trump will meet Chinese President Xi Jinping to sign the agreement. Some suggested markets had already discounted a lot of good news.

“Optimism about a trade deal between the US and China has given a lift to global equities,” wrote Capital Economics’ Simona Gambrani in a note to clients. “But with a lot of good news already discounted and global economic growth likely to remain sluggish, we suspect that any further upside for stock prices will be limited.”

In currencies, the dollar dipped against a basket of currencies, down 0.2%, while the euro was higher by 0.1% at $1.1088 and the pound was roughly unchanged, trading at $1.2880. A survey showed small British manufacturing firms are at their most pessimistic since just after the Brexit referendum in 2016 as they face political uncertainty at home and trade wars abroad. The yuan again strengthened past 7 per dollar for a second day following a stronger than expected PBOC fixing, while the dollar was steady as investors awaited fresh developments on the U.S.-China trade front.

In rates, 10Y yields were modestly lower after a battering in the past three days as European bond markets shrugged off mixed services PMIs from Europe; curves remained around the steepest levels of the week. France’s benchmark 10-year bond yield turned positive on Wednesday for the first time since July, in a further sign that entrenched pessimism in world bond markets is abating.

Looking at US politics, in an outcome that could offer clues as to how next year’s U.S. presidential election may unfold, U.S. Democrats claimed an upset win in Kentucky on Tuesday and seized control of the state legislature in Virginia. Democrats won both chambers of the Virginia General Assembly from the Republicans which previously had a 1-seat majority in both the state Senate and House of Delegates. In related news, Democrat candidate Beshear defeated Republican and incumbent Bevin in the Kentucky Gubernatorial Election, while Republican Lieutenant Governor Reeves won the election in Mississippi in what was a fairly tight race against Democrat Attorney General Hood.

In commodities, Bloomberg’s gauge of raw-material spot prices climbed to its highest level since April, even as oil prices fell pulled down by a larger-than-expected build in U.S. crude stocks, after gaining for three sessions on expectations of an easing in U.S.-China trade tensions. U.S. crude fell 0.72% to $56.82 per barrel and Brent crude fell 0.92% to $62.38 per barrel. Gold ticked higher following a slump Tuesday.

Economic data include mortgage applications, non-farm productivity. Earnings due from Qualcomm, CVS Health, Fiserv

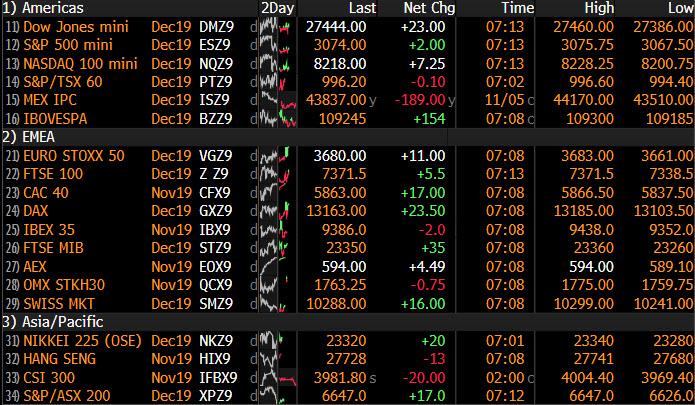

Market Snapshot

- S&P 500 futures up 0.02% to 3,072.50

- STOXX Europe 600 down 0.1% to 403.72

- MXAP down 0.04% to 166.08

- MXAPJ down 0.2% to 534.56

- Nikkei up 0.2% to 23,303.82

- Topix up 0.02% to 1,694.45

- Hang Seng Index up 0.02% to 27,688.64

- Shanghai Composite down 0.4% to 2,978.60

- Sensex up 0.7% to 40,521.87

- Australia S&P/ASX 200 down 0.6% to 6,660.16

- Kospi up 0.07% to 2,144.15

- Brent Futures down 0.7% to $62.53/bbl

- Gold spot up 0.2% to $1,486.78

- U.S. Dollar Index down 0.2% to 97.83

- German 10Y yield rose 0.4 bps to -0.305%

- Euro up 0.1% to $1.1088

- Brent Futures down 0.7% to $62.53/bbl

- Italian 10Y yield rose 3.3 bps to 0.686%

- Spanish 10Y yield fell 1.2 bps to 0.316%

Top Overnight News from Bloomberg

- While IHS Markit’s composite Purchasing Managers’ Index edged up to 50.6 in October, better than the flash reading of 50.2, it signaled the euro-area economy remained close to stagnation last month. The figure indicated a rate of growth that was among the weakest in six and a half years

- Boris Johnson will try to get his U.K. election campaign on track after a stumble Tuesday with one of his best-known ministers in trouble for comments about people killed in a tower-block fire

- British businesses are taking Johnson’s election pitch to ‘Get Brexit Done’ with a pinch of salt: they know that confusion over the U.K.’s exit from the EU is set to carry on through 2020, or longer

- German Finance Minister Olaf Scholz sought to break the deadlock in discussions over European banking integration by signaling the country may drop its opposition to a key part of the plan

- The success of China’s first euro bond offering in 15 years is likely to spur a rush of issuance from the nation’s companies. The Ministry of Finance sold 4 billion euros ($4.4 billion) of notes in maturities of seven, 12 and 20 years on Tuesday

- Rudy Giuliani’s back-channel attempts to pressure Ukraine for investigations linked to Donald Trump’s top political rival deeply unsettled two of the president’s top envoys, providing fresh evidence that undercuts White House efforts to portray the episode as innocent and routine

Asian equity markets traded lacklustre following a flat finish on Wall St where the major indices remained near record highs on US-China trade optimism, but with some caution seeping through amid Chinese demands for the removal of tariffs which is seen as a sticking point for the ‘phase one’ deal. ASX 200 (-0.6%) and Nikkei 225 (+0.2%) were mixed with underperformance in Australia’s gold miners after the precious metal slipped below the psychological key USD 1500/oz level, while trade in Tokyo was stable amid a mixed currency and as the local benchmark took a breather from the prior day’s surge to a fresh yearly high. Hang Seng (+0.1%) and Shanghai Comp. (-0.4%) were tentative after the PBoC refrained from open market operations and as participants await the next developments in the trade saga such including whether the US succumbs to China’s demands to roll-back tariffs. Finally, 10yr JGBs declined significantly overnight as the benchmark 10yr JGB yield rose to its highest in around 5 months, while the pressure in JGBs was later exacerbated following mixed 10yr auction results and after prices collapsed through a key support area around 153.60 which previously held up during the last 3 months.

Top Asian News

- Thailand Cuts Interest Rate to Record Low to Rein in Currency

- SoftBank Reveals $6.5 Billion Loss From Uber, WeWork Turmoil

- U.S. Sees Japan-South Korea Thaw as Last Hope to Save Intel Pact

- Aberdeen Sees a Turning Point for Malaysia’s Battered Market

Major European bourses (Euro Stoxx 50 +0.3%) are choppy with the indices off having pared earlier upside amid cautious sentiment on multiple reports corroborating the narrative that China will push for further US tariff concessions before it signs off on a Phase 1 trade deal. Earlier in the session, the DAX and Euro Stoxx indices managed to again eke out fresh YTDs highs; the former was halted by resistance at 13170 (15th June 2018 high), ahead of further resistance at the 13200 level (22 May 2018 high). US equity futures are relatively flat intra-day and are yet to fully recover from Monday’s modest losses, which saw the contracts pull back slightly from YTD highs. “The tape is overbought, buyers seem “tired”, valuations are stretched, and trade expectations are elevated (the removal of the 9/1 tariffs is quietly becoming consensus thinking)” JPM noted yesterday, and “that this is making buyers reticent to aggressively chase at present levels.” The FTSE 100 underperforms amid weakness in large cap stocks. Sectors are mostly in the red, barring Consumer Staples (+1.0%) and Financials (+0.5%), with the latter supported by the continued rise in yield, which is also supporting SocGen (+5.3%) despite the firm reporting a net decline of 34.8% YY and a 20% drop in equities trading revenue in Q3. Co. CEO noted that the bank “delivered resilient net income in an unfavourable environment without yet benefitting from the positive effects of ongoing restructuring which is ahead of its 2020 objectives.” Sticking with earnings, solid numbers from Marks & Spencer (+2.1%) and Alstom (+3.8%) saw their respective shares moved higher. Conversely, weaker than forecast earnings from Wirecard (-1.1%), Dialog Semiconductors (-8.8%) and Adidas (-3.2%) sees their shares under pressure. Meanwhile, BT (-3.5%) have been hit by reports that Virgin Media dealt the company a “blow” by striking a deal to switch its 3mln mobile phone customers from the BT over to Vodaphone. Finally, Fincantieri (-1.6%) shares initially slumped amid reports that the Italian finance police are undertaking searches 19 shipbuilding companies working with the Co.

Top European News

- ECB’s Guindos Sees Scope for Higher ‘Releasable’ Capital Buffers

- BMW Profit Jumps on Cost Cutting in New CEO’s Debut Quarter

- Aston Martin Shareholder Deal Limits Options for Raising Cash

- M&S Provides Glimmer of Hope as U.K.’s Retail Woes Deepen

In FX, the Dollar has lost some of its post-US services ISM vigour after the DXY managed to scale 98.000 and match the knee-jerk high notched in wake of last week’s FOMC policy meeting precisely. The index topped out just ahead of Fib resistance at 98.085, but also amidst broad consolidation in rival G10 currencies and especially safer-havens that have been underperforming on the positive US-China Phase 1 trade vibe alongside encouraging developments on proposed US auto tariffs. The DXY has slipped back below the big figure, but is holding well above recent lows and 97.500.

- JPY/EUR/AUD/NZD – All marginally firmer vs the Greenback, as the Yen contained losses beyond 109.00 to 109.25 and did not threaten technical support around 109.37, while the Euro also defended a key chart level and Fib retracement circa 1.1064 before regrouping with the aid of some decent German data and mostly encouraging Eurozone PMIs. Elsewhere, the Aussie has crept back up to 0.6900 as the Aud/Nzd cross attempts to form a base above 1.0800 and Kiwi labours just under 0.6400 following fractionally weaker than forecast NZ jobs data overnight.

- GBP/CHF/CAD – The Pound, Franc and Loonie are struggling to take advantage of the Buck’s fade, with Cable unable to reclaim 1.2900, Usd/Chf still elevated on the 0.9900 handle and Usd/Cad pivoting 1.3150 after Tuesday’s somewhat contrasting Canadian compared to US trade balances (relative to consensus), and ahead of today’s Ivey PMIs.

- EM – The Rand has retraced quite sharply from sub-14.7400 vs the Dollar to 14.8000+ on renewed Eskom strife as the company suffers more severe power supply issues and concedes that output will not meet demand even though certain generation sites have resumed production after maintenance. Investors also waiting on tenterhooks to hear from SA President Ramaphosa at a conference aimed at drumming up foreign funds.

In commodities, crude markets are modestly softer but off intraday lows, with downside seen following last night’s larger than expected headline API stocks builds, with crude inventories rising by 4.26mln BDP (vs. Exp. +1.5mln), whilst the cautious tone around the market provides little by way of sentiment-driven upside. Both the WTI Dec’ 19 and Brent Jan’ 19 contracts sit above October’s USD 56.90/bbl and USD 62.30/bbl highs – greater expectations for a US/China Phase 1 trade deal breakthrough combined with a better backdrop of macro data (i.e. US jobs data last Friday) seemingly continue to provide a base for now. In terms of crude specific news flow, the WSJ reported that the Saudis are to set to press OPEC members for production cuts ahead of its Aramco IPO, although the push would be more aimed at “laggards” to comply with current curbs, rather than pushing for deeper trims in output, the article caveated. Quoting sources, the WSJ added that Russia had privately told the group it wants to maintain the current targets until March whilst noting that Saudi wants to refrain from taking a bulk of the cuts – in fitting with recent separate source reports. Further, the article noted that the oil giant’s growth assumptions, as well as the dividend it promises investors, are predicated on oil prices around USD 65/bbl, according to an investor document. Looking ahead on the docket, oil traders will be eyeing the EIA crude stocks release as a scheduled catalyst with headline crude expected to print a build of 1.5mln barrels. In terms of the metals; gold is staging a tepid recovery after yesterday’s slide, which saw the precious metal slip briefly beneath the USD 1480/oz mark. Copper, meanwhile, is subdued after pulling back somewhat from yesterday’s 4-month highs around of USD 2.716/lbs.

US Event Calendar

- 7am: MBA Mortgage Applications, prior 0.6%

- 8:30am: Nonfarm Productivity, est. 0.9%, prior 2.3%

- 8:30am: Unit Labor Costs, est. 2.25%, prior 2.6%

Central Banks

- 8am: Fed’s Evans Speaks in New York

- 9:30am: Fed’s Williams Takes Part in Moderated Q&A in New York

- 3:15pm: Fed’s Harker Discusses Innovation and the Future of Work

DB’s Jim Reid concludes the overnight wrap

I’m in the US at the moment and on the flight over on Monday I watched the original Blade Runner (from 1982) for the first time as my wife wants to watch the recently released sequel. I was a bit shocked that the opening scene tells you it’s set in November 2019. From watching the rest of the film I’m pretty pleased that this vision of the future didn’t pan out. It makes this year’s long term study ( link ) on the future of debt look wildly optimistic by comparison. The other highlight of the trip so far is being in a lift lobby yesterday and hearing this conversation between two people. Person A “So you’re interviewing him now? What are you going to ask him” Person B “I’ll keep it simple. I’ll ask him what 36×36 is. I’ll get all I need to know from that”. I then went away working out how I’d reply if that were me. I thought the best response would be to get my iPhone out and let the calculator work it out. Anyway just in case you’re being interviewed today in NY and you get the same guy the answer is 1296 (thanks iPhone).

The US was buzzing yesterday from higher yields, interesting trade headlines and the split outcome from the services PMI (disappointing) and the arguably more important ISM (positive). Indeed the October ISM non-manufacturing improved 2.1pts to 54.7 (vs. 53.5 expected) with encouraging improvements also for new orders (+1.9pts to 55.6) and more significantly the employment (+3.3pts to 53.7) components. The latter had fallen by nearly 6pts over the previous three months before yesterday and is more consistent with what we saw from the payrolls report last Friday.

That being said it did go against what the Markit PMI data showed just 15 minutes before the ISM was released. The services PMI was revised down 0.4pts to 50.6 and is now at the lowest since February 2016. On top of that, the employment component slid to 47.5 and the lowest since December 2009. So, a very different story to the employment report and perhaps more importantly what the ISM survey data is showing. The ISM tends to be more closely followed but the divergent pictures is no doubt confusing. Europe’s final services PMIs are out this morning and they will be very important. So all eyes on them.

The S&P 500 never really got going yesterday and ultimately finished slightly lower at -0.12%. It was the moves in bond markets which were the bigger talking point though. Indeed the 10y Treasury sold off +8.1bps to take it to 1.858% and approaching the September highs again. A reminder that it was only back in early September that it traded at 1.427%. At the short end 2y yields (+4.2bps) didn’t sell off quite so much which steepened the 2s10s curve to 22.7bps. That is actually the steepest since July and it’s worth flagging that the steepest the curve has been this year was 29bps back in June so we’re not all that far from that level. Markets are now pricing just a 9% probability of a cut at the December meeting. That compares to a 27% probability just under a week ago. I’ve had a lot of questions about the US yield curve while I’ve been in the US with most asking whether this recent steepening reduces the recession risk. I answered that the problem is that it’s a lagging indicator (plus or minus 18 months) so the damage might have already been done prior to this steepening with most of the yield curve inverted for much of this year until very recently. So if the yield curve is to be the usual lead indicator then late 2020/early 2021 might be a worrying time for the US economy regardless of what happens in the next 0-6 months in the economy or the yield curve. Indeed with the trade picture looking better it’s possible we could get a near term data bounce and the yield curve signal still proving accurate over the medium-term.

More on trade below but back to bonds and it was the same story in Europe where 10y Bunds closed up +4.0bps and at the highest since early July while OATs closed at -0.017% and are closing in on positive territory again for the first time since July. The move in rates did help banks to post decent gains yesterday with the S&P and STOXX bank sub-indices up +0.69% and +1.39% respectively.

There’s not much to report this morning in Asia with a small loss for the Shanghai Comp (-0.25%) versus modest gains for the Nikkei (+0.14%) and Kospi (+0.20%). The Hang Seng is flat while bond markets are also weaker in Asia including a +6.0bps rise for 10y JGBs which has pushed them up to -0.078% and the highest yield since May. That comes despite Japan’s final October services PMI coming in 0.6pts lower than initial read to 49.7.

Back to those trade headlines where initially the focus was on the FT story that we referred to this time yesterday about the US side contemplating dropping some tariffs on China. However later in the afternoon China’s Global Times Editor Hu Xijin tweeted that “to reach a deal, China and the US must simultaneously remove the existing additional tariffs at the same ratio, which means that tariffs to be removed should be in proportion to how much agreement has been reached”. I had to read this a few times before my mind could catch up. I think it was frazzled by trying to work out 36×36. Anyway, it puts a little tension back into the “phase one” signing.

As for the other data out yesterday, the September trade deficit narrowed to $52.5bn from $55.0bn, and broadly in line with expectations. The limited revisions in the trade data also mean Q3 GDP estimates should be little changed. Here in Europe the only data came from the UK where the October services PMI rose 0.5pts to 50.0, meaning the composite also printed at 50.0 following a 49.3 print in September.

Staying with the UK, a YouGov poll released yesterday gave the Conservatives a 13pt lead over Labour (38% versus 25%). That means the last three YouGov polls have showed the Tories with a lead of 15pts, 13pts and 15pts – so, fairly consistent but YouGov has been at the very top of the range for Tory leads. Sterling was little changed yesterday while for completeness there wasn’t much going on in European equity markets either where the STOXX 600 finished +0.20%.

In other news, the Fed’s Barkin said yesterday with respect to the Fed that “I think it is a good time to pause”. He added that “we have decided to take rates down 75bps to protect against weakening coming from this uncertainty…so if we get either no weakening or the modest kind of weakening that we expect, then I think we have taken out the insurance that we would take”.

Looking at the day ahead, this morning we get September factory orders print in Germany followed by the final October services and PMIs in Europe. Also out this morning is September retail sales for the Euro Area. In the US this afternoon it’s fairly quiet for data with just the preliminary Q3 nonfarm productivity and unit labour costs prints due. Away from that we’re due to hear from the Fed’s Evans, Williams and Harker at various points, as well as the ECB’s Guindos, Mersch and Holzmann.

Tyler Durden

Wed, 11/06/2019 – 07:46

via ZeroHedge News https://ift.tt/2JSZzoW Tyler Durden