UK Election – What To Look For In The Next Six Weeks

Authored by William Dining, CIO, Waverton Investment Management,

We continue to think that there remains a “political risk” discount on UK assets and on the currency. The combination of it being very unlikely that we have a No Deal Brexit; the part passage by the House of Commons of the revised deal (“Withdrawal Agreement Bill”) last week and the polling suggesting a Conservative victory in this election are all consistent with the political risk discount being at least diminished if not removed. This implies outperformance by UK assets in coming months. But when we recommended increasing exposure to sterling and to UK assets last week we did say:

“There are still many risks to sterling during an election campaign. Many of the issues that truly concern the electorate—the NHS; schools; student debt; housing shortages; general malaise about living standards—are seen normally as “Labour issues” by which I mean that opinion polls tend to indicate that Labour is seen as better at dealing with them. But we do not live in normal electoral times and the Labour party’s divisions are a headwind for the party which may diminish their traditional strength in those policy areas. It is therefore all to play for in a campaign.”

If we start from the proposition that, whatever your own politics, the best outcome for markets would be a Conservative Overall Majority, what factors will effect market confidence about that outcome in the next 43 days?

1. Opinion Polls:

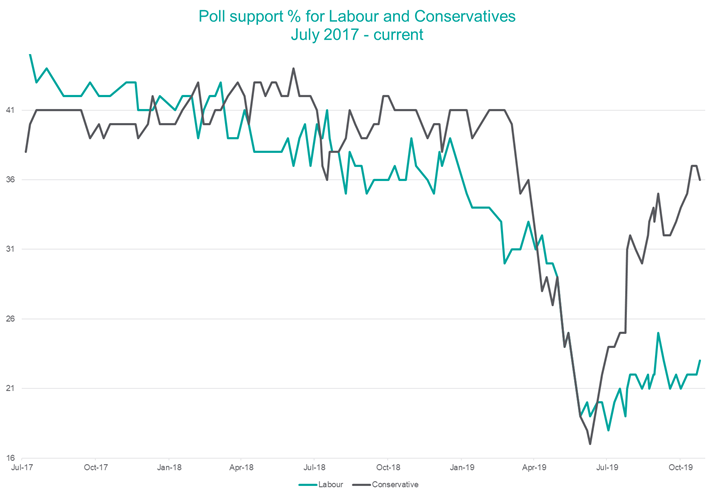

Polling has been unreliable in recent elections but taking YouGov data the current situation (October 24-25 polling) is as below with Conservative 36%, Labour 23% (other parties are Lib Dem 18%, Brexit 12%, Green 6%, other 6%).

Source: https://yougov.co.uk, Waverton

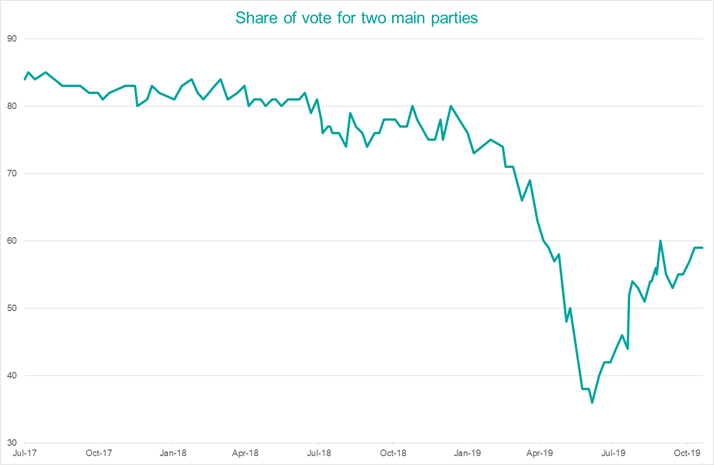

It remains the case that the combined vote share of 59% for the major parties is much lower than historically normal and makes modelling how many seats that support translates into harder than normal. So polling data will probably not be seen as reliable again in this election but a big Tory lead over the campaign will keep confidence high.

Source: https://yougov.co.uk, Waverton

2. Betting markets:

The bookies have also not been right in recent elections but they start this one with the Conservatives at 1/6 to be the next governing party (Labour are 15/2). Odds on a Conservative overall majority are 5/6. No overall majority is 6/5.

There is clearly a risk that this level of confidence could dip at some point during the campaign.

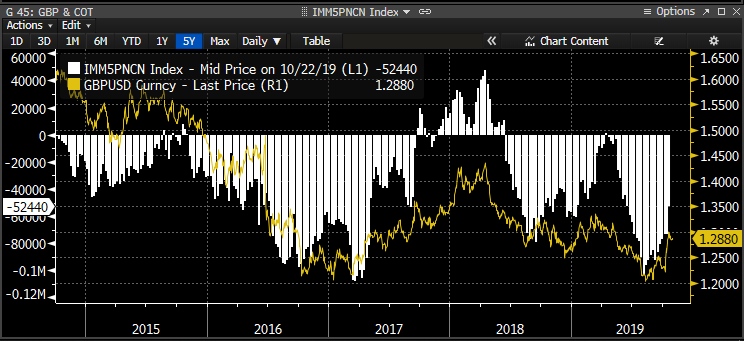

3. Positioning:

The above may suggest that investors have moved back into sterling and UK assets in a big way but that is not necessarily the case. The below from Bloomberg suggests that positioning on sterling is less bearish but that it remains a long way from being bullish. This will be worth watching as an indication of investor confidence in the election in coming weeks.

Source: Bloomberg

4. Which economic issues are getting the most focus:

The Labour Party will, as their video released last night clearly shows, want to run on the issues that concern the electorate away from Brexit. That video promises “To get Brexit sorted” but has no other mention of it. It majors though on the things that are traditionally seen as areas where Labour is trusted more than the Conservatives. So there will be emphasis on the NHS, investing in education, housing, climate change (”green industrial revolution”), All under the umbrella slogans of “For the many, not the few” and “It’s time for real change”.

If Labour can turn the campaign away from Brexit and onto these issues then I do think it’s polling numbers will improve although whether it can come back from this far behind (again) does seem unlikely. Part of the reason it did so much better than expected in 2017 was (a) the Tories ran a terrible campaign and (b) no one expected Labour to win so voting for Corbyn was a “free” protest vote.

This time, whatever your view of Johnson, the Tories are led by someone who is (a) ruthless in the pursuit of power and (2) has a good record as a campaigner. Meanwhile we have had over two years of Corbyn as a credible leader of the opposition who has managed to block things in Parliament but who has faced a pretty disastrous collection of news stories away from Westminster. Hence his low personal poll ratings. We are a long way from “Oh Jeremy Corbyn” at Glastonbury 2017.

5. Which political issues are the focus:

If the Tories can keep the campaign about “delivering Brexit” then they are in a good position. The Lib Dems are running a risk in focusing on reversing the 2016 referendum as their main policy plank. And Labour is divided. A risk to the Conservatives is from traditional Labour voters not coming over to the Tories but instead abstaining or voting for the Brexit Party. But generally I would suggest that the more the campaign is about “delivering Brexit” then the better it is for the Tories.

There is a real possibility that the SNP will do better again in Scotland, certainly at the expense of Labour. Scots who are pro the union will be less willing to vote SNP given the real risk of a second referendum if the party does as well as it did in 2015 when it won 56 of the 59 Scottish seats (it has 35 currently). If the Tories do lose seats in Scotland it has a negative effect on their chances of an overall majority.

Northern Ireland will also be interesting on the margin. If there is a greater than usual turnout and widespread support for the DUP and Unionist parties who are of the view that Johnson’s new deal with the EU undermines Ulster’s Union with Great Britain, that could again be a problem for the Conservatives if they do not win an overall majority. The DUP may not be willing to enter another agreement to support a minority Tory government.

6. Election fatigue:

This is the 3rd general election in four and half years. We have also had referendums in Scotland in 2015 and across the UK in 2016. This is the most times the electorate has been asked to vote in such a short period of time in UK history. (There were three elections between June 1970 and October 1974 but not the two referenda). As famously said by Brenda of Bristol, a lot of the electorate could be saying “not another one”. There is disillusionment with conventional politics and politicians which is a threat to the Conservatives.

Conclusion

We enter the campaign with the Conservatives looking to be in a strong position. But all campaigns bring risks and they can take unexpected turns. This 6-week one is lengthy by UK standards so a lot of things can and will happen. The main ones to keep an eye on are which issues are dominating the debate and how engaged the electorate appear to be. If Brexit remains front and centre then the Conservatives should do well and meet current expectations. If though Labour can turn the debate, then things could get difficult for the Tories.

We will obviously keep clients appraised of our view on these matters as the campaign unfolds. But greater exposure to sterling and UK assets still seems appropriate. Weakness in either could be a buying opportunity. It may well be too that an actively managed UK equity fund might be best able to respond to market sentiment ‘flip-flopping’ between the FTSE 100- FTSE 250 and overseas- domestic earners if there is some volatility in coming weeks.

Tyler Durden

Wed, 11/06/2019 – 05:00

via ZeroHedge News https://ift.tt/2rb7iYX Tyler Durden