WTI Erases Early Gains After Large Crude Build, Record Production

A bigger than expected crude build reported by API overnight sparked selling in oil prices but since the US equity market opened, WTI has been panic-bid presumably on yet another round of optimism that trade tensions between the U.S. and China are easing, potentially alleviating downward pressure on the global economy.

API

-

Crude +4.26mm (+2mm exp)

-

Cushing +1.3mm

-

Gasoline -4.0mm

-

Distillates -1.6mm

DOE

-

Crude +7.929mm (+2mm exp)

-

Cushing +1.714mm

-

Gasoline -2.828mm

-

Distillates -622k

For the second week in a row, crude inventories rose significantly (along with stocks at Cushing) as product inventories dropped for the 6th straight week…

Source: Bloomberg

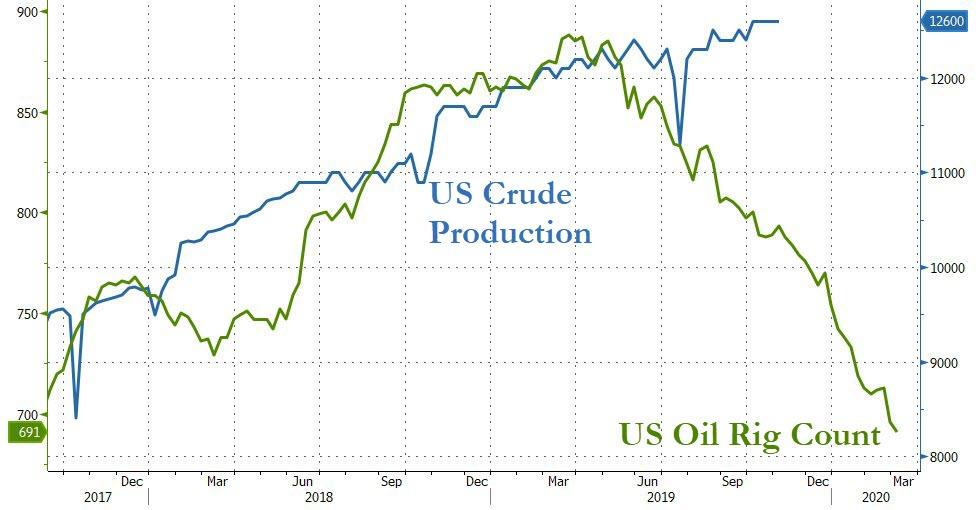

US crude production hovered near record highs despite the rapid decline in US oil rig counts…

Source: Bloomberg

WTI traded around $57.60 ahead of the DOE data but tumbled on the big build…

Bloomberg Intelligence’s Senior Energy Analyst Vince Piazza has some words of warning:

“Optimism on trade, economic growth and decelerating supply is supporting crude benchmarks, but we believe that enthusiasm is premature to say the least. WTI remains mired below $60, and efficiency gains combined with cost deflation could keep U.S. output elevated without requiring additional spending by E&Ps.”

Finally, as a reminder, the U.S. registered its first petroleum trade surplus in over four decades in September as production surged to a record.

Source: Bloomberg

Better keep those rates low Mr.Powell to keep the shale dream alive.

Tyler Durden

Wed, 11/06/2019 – 10:34

via ZeroHedge News https://ift.tt/2ClgV9X Tyler Durden