Trader Warns “Something Stinks”

Authored by Sven Henrich via NorthmanTrader.com,

New highs every day or so now. Investors are chasing the new highs, the president celebrates on twitter almost every day. Things are great. Melt-up talk is the rage.

Hate to be the seemingly lone voice of caution here, but something smells. Look, I get narratives are changing all the time to suit the price action of the day, but I distinctly remember how no weakening data has mattered this year as people kept citing how strong the consumer remains despite all the trade war uncertainties and the manufacturing recession.

And even just during the recent rate cut meeting in October Jerome Powell insisted that the U.S. consumer continues to stay strong and that the economy is in a good place. Seems a bit optimistic with a mere 0.73% Q4 GDP growth downward projecting coming out today by the New York Fed Nowcast. But hey.

This week the Fed’s Barkin had something similar to say (with a little qualifier added) and as markets jumped to new highs I noted a curious divergence on the side of the consumer sector:

Earlier – Fed’s Barkin: As Long As US Consumers Continue Spending, The US Economy Is In A Good Place

I’m a curious fella:

If things are so great why is the consumer discretionary sector suddenly no longer leading, but lagging, not making new highs but making lower highs? pic.twitter.com/yGwAsicQ7A— Sven Henrich (@NorthmanTrader) November 5, 2019

Let’s dig a little deeper and update the charts.

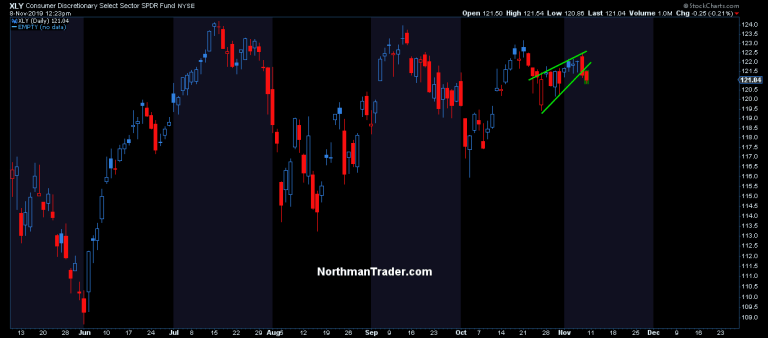

Firstly here’s the $XLY now, it has formed a bear flag and actually broke below this week:

As I noted in the tweet $XLY has not participated in the market rally to new highs, in fact it has put in a series of lower highs.

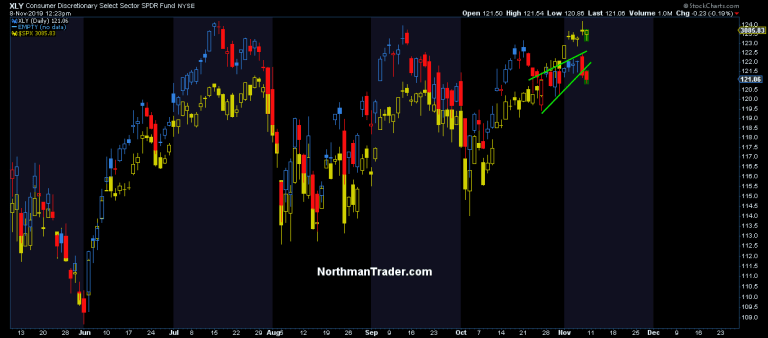

The disconnect to $SPX is very pronounced on this latest rally to new highs:

Note how the consumer sector has led the past rallies in 2019, and now it is distinctly lagging.

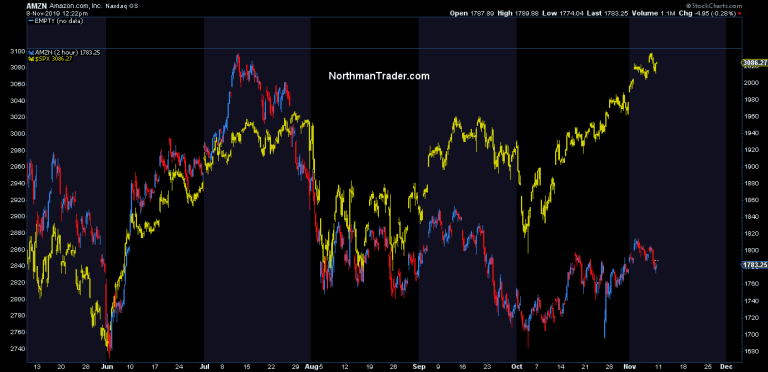

But it’s not only $XLY. Who else is massively involved in the retail trade? $AMZN of course.

New market highs without $AMZN? Unthinkable, being one of the key $FAANGs. But no, $AMZN is showing the same sudden weakness:

Something smells and the stench may come from the consumer.

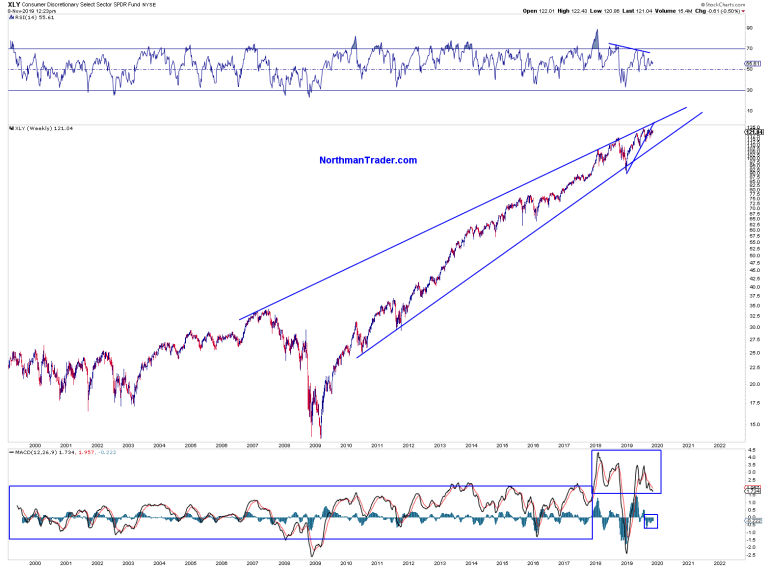

And it’s not just a few days of relative weakness, look at $XLY on a long term weekly chart:

Massive MACD blow-off top in January 2018, then progressive weakening from rally to rally even this year as $XLY made new highs earlier in the year. But then $XLY broke its 2019 trend and the weekly MACD points straight down. Not a lot of strength evident there, which would be fine if the market were correcting, but in context of new market highs this development is notable.

So what’s up?

Well, if the consumer is so strong as the Fed insists what’s up with these data points:

Someday, US retail traffic will grow again. Maybe.

(via @CowenResearch) pic.twitter.com/Zw9pNU7iK6

— Carl Quintanilla (@carlquintanilla) November 5, 2019

Not so impressive.

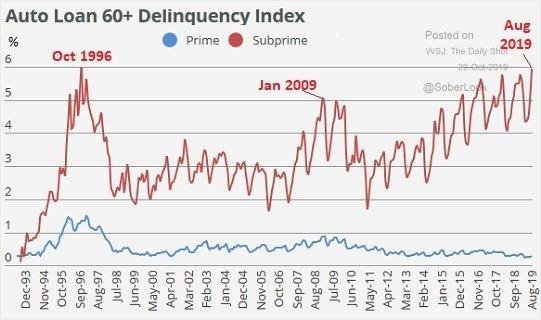

And then there are subprime delinquencies in the auto sector:

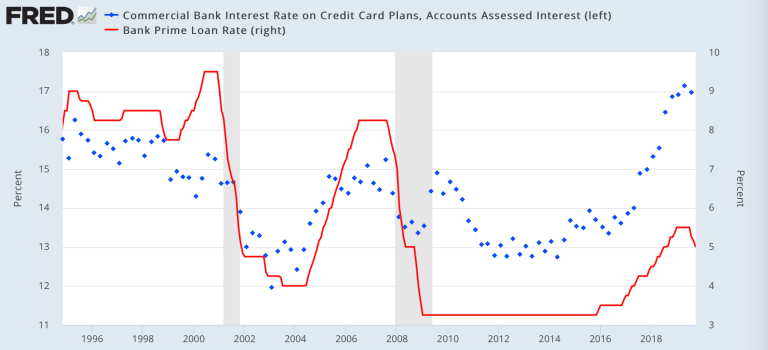

Other signs of potential trouble: Consumers have been busy loading up on credit card debt in the past couple of years and even more so this year:

While at the same time credit card interest rates have jumped to the highest levels while the bank prime loan rate has meandered near historic lows compared to previous cycles:

The Fed’s three successive rate cuts may have put a ceiling to these credit card interest rates for now, but clearly they remain sky high. Record credit card debt and record interest rates, what a winning combination! All this with the Fed only 6 rate cuts away from zero. Sounds like consumers are getting screwed.

And perhaps this is what we’re seeing in these consumer related charts that are suddenly lagging markets in a very profound way.

In 2018 the Fed insisted things were looking so good they could raise rates further this year and maintain their balance sheet roll-off on autopilot. The Fed was of course completely wrong and now has cut rates 3 times and has increased their balance sheet by over $270B:

Print it like you mean it. @federalreserve pic.twitter.com/9eZUbAXOoz

— Sven Henrich (@NorthmanTrader) November 8, 2019

And now in 2019 the Fed insists the consumer is strong. We’ll see about that. The charts suggest something smells.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

Tyler Durden

Fri, 11/08/2019 – 13:58

via ZeroHedge News https://ift.tt/2p4nXNk Tyler Durden