Core CPI Cools But Recreation Costs Surge

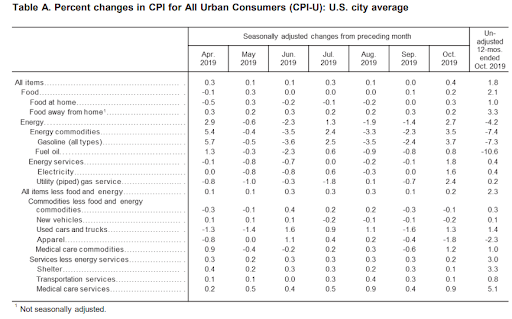

With The Fed reportedly on hold – but data-dependent – October’s consumer price gains were expected to mimic September’s in both headline and core, but the actual data saw a divergence.

Headline CPI rose 1.8% YoY (hotter than the +1.7% expected) but core CPI rose just 2.3% YoY (below the +2.4% expectation)

Source: Bloomberg

Along with the indexes for medical care and for recreation, the indexes for used cars and trucks, for shelter, and for personal care all rose in October, though the increase in the shelter index was the smallest since October 2013 (but YoY remains elevated – Rent was 3.74%, vs 3.83% last month, Shelter was 3.34% vs 3.51% last month).

The apparel index fell in October, as did the indexes for household furnishings and operations, for new vehicles, and for airline fares.

The recreation index rose 0.7 percent in October, its largest increase since February 1996. Most of its major component indexes rose, including admissions (2.1 percent) and cable and satellite television services (0.7 percent). The index for used cars and trucks rose 1.3 percent in October after falling 1.6 percent in September.

Source: Bloomberg

The energy index increased 2.7 percent in October after recent monthly declines and accounted for more than half of the increase in the seasonally adjusted all items index; increases in the indexes for medical care, for recreation, and for food also contributed. The gasoline index rose 3.7 percent in October and the other major energy component indexes also increased. The food index rose 0.2 percent, with the indexes for both food at home and food away from home increasing over the month.

The recent resurgence in Goods CPI has stalled…

Source: Bloomberg

So something there for everyone.

Tyler Durden

Wed, 11/13/2019 – 08:38

via ZeroHedge News https://ift.tt/2qSJGIk Tyler Durden