Fed Braces For Year End Repo Turmoil: Announces $55 Billion In 28, 42-Day Repos To Flood System With Cash

Just moments after we reported that according to Bank of America, the US financial system’s reliance on repos could “short-circuit the market’s ability to accurately price the supply and demand for leverage as asset prices rise”, and implicitly, facilitate the next financial crisis because “the Fed has entered unchartered territory of monetary policy that may stretch beyond its dual mandate”, the Fed confirmed just how reliant both it, and the entire US financial system is on the repo market, when it released its latest term repo schedule, one which for the first time included 28 and 42-day repos which would mature into the new, 2020 year, yet which amount to just a total of $55 billion collectively, an amount which we fear will be far too little to meet year-end liquidity demands, and represents just the first shot in the Fed’s scramble to flood the system with year-end liquidity. Meanwhile, the NY Fed is maintaining its $120BN in overnight repos indefinitely.

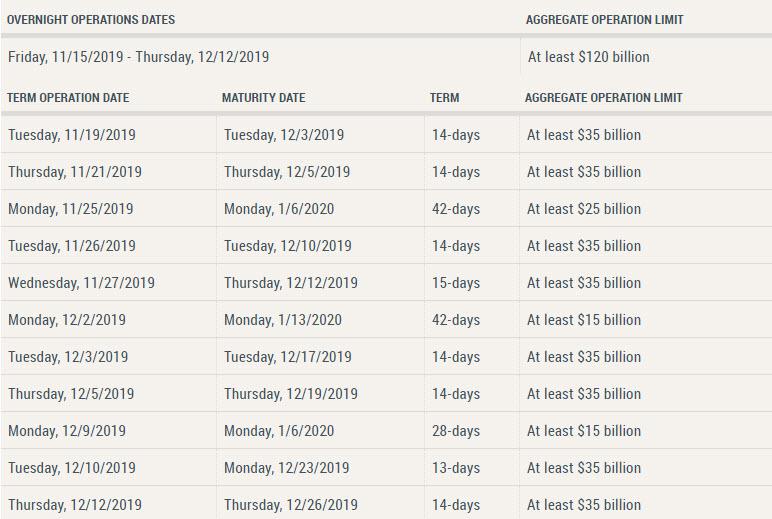

This is what the Fed released today at 3pm:

The Open Market Trading Desk (the Desk) at the Federal Reserve Bank of New York has released the schedule of repurchase agreement (repo) operations for the monthly period from November 15, 2019 through December 12, 2019. In accordance with the most recent FOMC directive, the Desk will continue to offer at least $35 billion in two-week term repo operations twice per week and at least $120 billion in daily overnight repo operations.

The Desk will also offer three additional term repo operations during this calendar period with longer maturities that extend past the end of 2019. These additional operations are intended to help offset the reserve effects of sharp increases in non-reserve liabilities later this year and ensure that the supply of reserves remains ample during the period through year end. They are also intended to mitigate the risk of money market pressures that could adversely affect policy implementation. The Desk will adjust the timing and amounts of repo operations as necessary to maintain an ample supply of reserve balances over time and based on money market conditions, consistent with the directive from the FOMC.

The calendar of specific term repos is below:

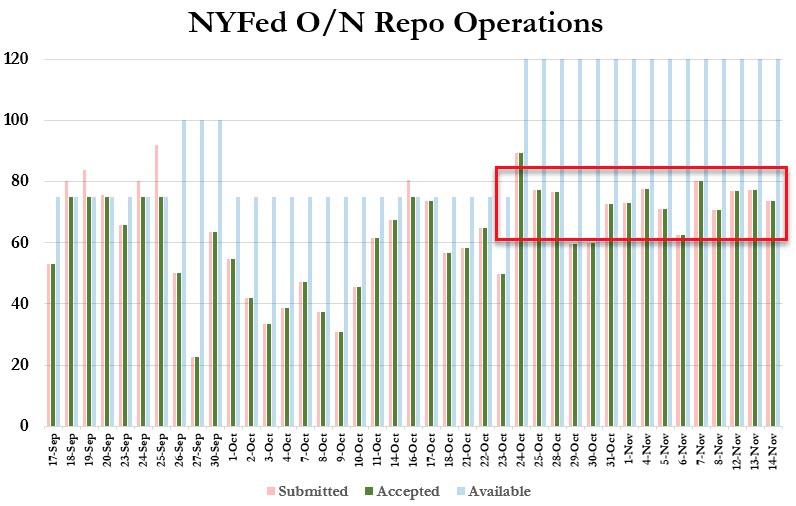

Indicatively, this is just how “temporary” the Fed’s overnight repos…

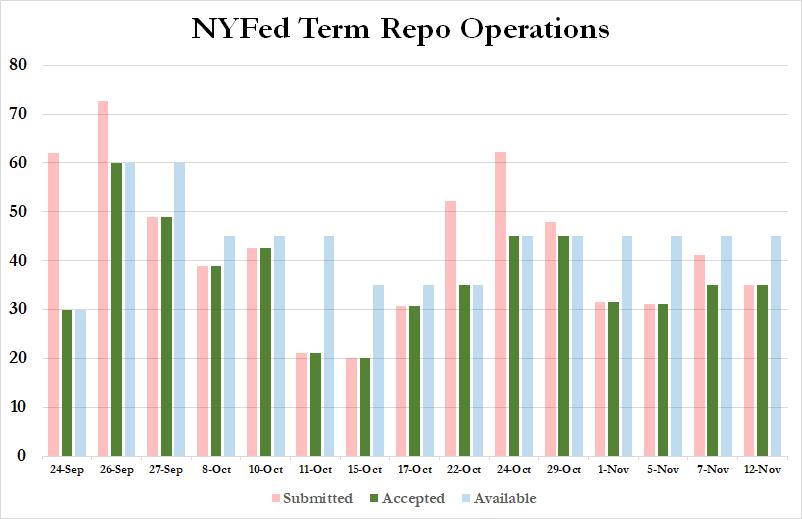

… and term repos have become:

Appropriately, the Fed admitted that it is starting to freak out about year-end liquidity just minutes after we published a scathing critique of the Fed’s “repo regime” by BofA, which among other things said the following:

Repo matters more than ever

The repo channel, which is one ingredient within overall financial conditions, is becoming more important as reliance on overnight funding and leverage continues to rise. While banks and security brokers have greatly reduced reliance on overnight funding as a result of Dodd-Frank, the rest of the market has approximately doubled its reliance on overnight funding since the 2008 crisis.

While one can argue that the proper metric is repo funding as a percentage of Treasuries and MBS outstanding, we think that such a ratio misses the bigger picture. The bigger picture is that if repo markets stopped functioning today, the amount of Treasury and MBS securities held outside of banks-dealers requiring liquidation (for lack of funding) would be about twice as large as 2008, and with today’s surprisingly low levels of liquidity in the “liquid markets” the impact could be massive. In this context, we view the Fed’s purchase program as integral to the promotion of easy financial conditions and supportive of asset prices, which is Chair Powell’s second criterion for QE.

Why is the above a problem? Because as BofA concluded, “Everything has a cost”

In our view, the most worrying part of the Fed’s current asset purchase program is the realization that an ongoing bank footprint in repo markets is required to maintain control of policy rates in the new floor system. While we are confident that beyond year-end, the additional reserves will have the required soothing effect, what is less clear is that the Fed can make sure the bank repo lending footprint is resilient to dips in the bank credit cycle. While repo is fully collateralized and therefore contains negligible counterparty credit risk, there may be a situation in which banks want to deleverage quickly, for example during a money run or a liquidation in some market caused by a sudden reassessment of value as in 2008. In this environment, it seems implausible to expect banks to maintain their level of repo lending. If repo lines were drawn down far enough and for long enough in time, it could lead to deleveraging at institutions that were otherwise healthy. The new monetary policy regime therefore may increase systemic financial risk by making repo markets more vulnerable to bank cycles. This increases interconnectedness, which is something regulators widely recognize as making asset bubbles and entity failures more dangerous.

Some have argued, including former NY Fed President William Dudley, that the last financial crisis was in part fueled by the Fed’s reluctance to tighten financial conditions as housing markets showed early signs of froth. It seems the Fed’s abundant-reserve regime may carry a new set of risks by supporting increased interconnectedness and overly easy policy (expanding balance sheet during an economic expansion) to maintain funding conditions that may short-circuit the market’s ability to accurately price the supply and demand for leverage as asset prices rise.

When the time comes for the Fed to unwind its “temporary” repos, we hope it will be more successful then when it tried to “renormalize” monetary policy, which lasted for a few months and then the Fed admitted defeat in a dramatic U-turn, and is now cutting rates instead.

Tyler Durden

Thu, 11/14/2019 – 15:38

via ZeroHedge News https://ift.tt/2XjsoQT Tyler Durden