Stocks Jump To Record Highs As Bond Yields, Economic Data Dump

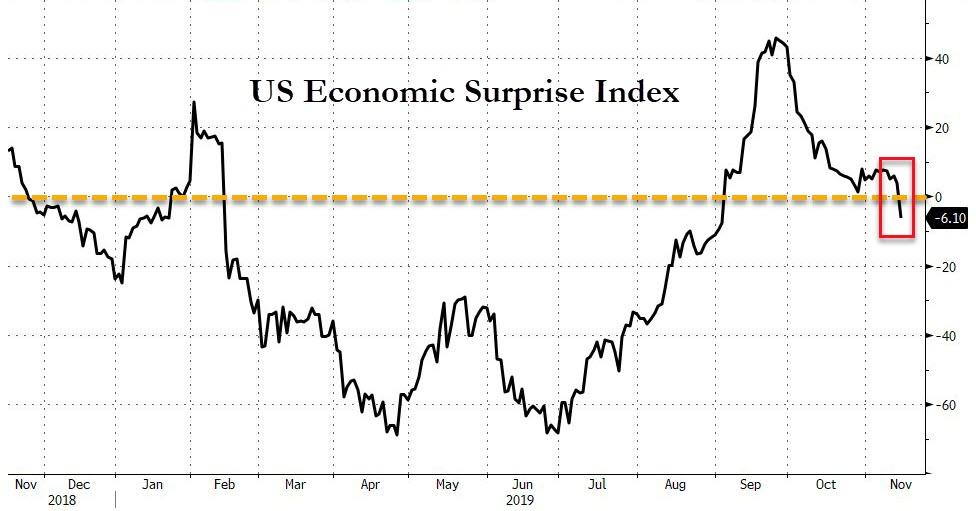

Ugly retail sales and dismal industrial production capped a gravely disappointing week for US macro data, tumbling into the red for the first time in 3 months…

Source: Bloomberg

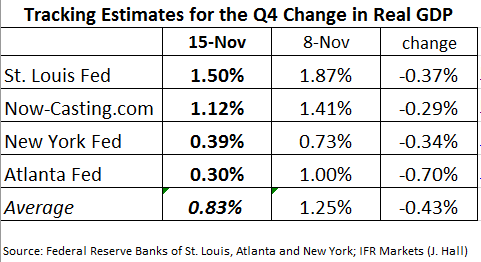

As four GDP-tracking estimates came down an average 0.43-pp between last Friday and today.

And by the end of the week, stocks had pushed to record highs and Treasury yields had collapsed to two-week lows (an implied 500-Dow-point divergence)…

Source: Bloomberg

How will that end?

Dow led on the week as multiple “trade deal is close” comments juiced the markets again and again (Trannies lagged)…

Source: Bloomberg

Chinese stocks were ugly this week…

Source: Bloomberg

European stocks were more mixed with Spain lower and the rest marginally higher…

Source: Bloomberg

The US equity market open appears to be a very bullish event…

Vol was crushed at the close to force The Dow to close above 28,000 for the first time…

In the US, defensives dominated the market gains…

Source: Bloomberg

Healthcare surged to new record highs on President Trump’s statement…

Source: Bloomberg

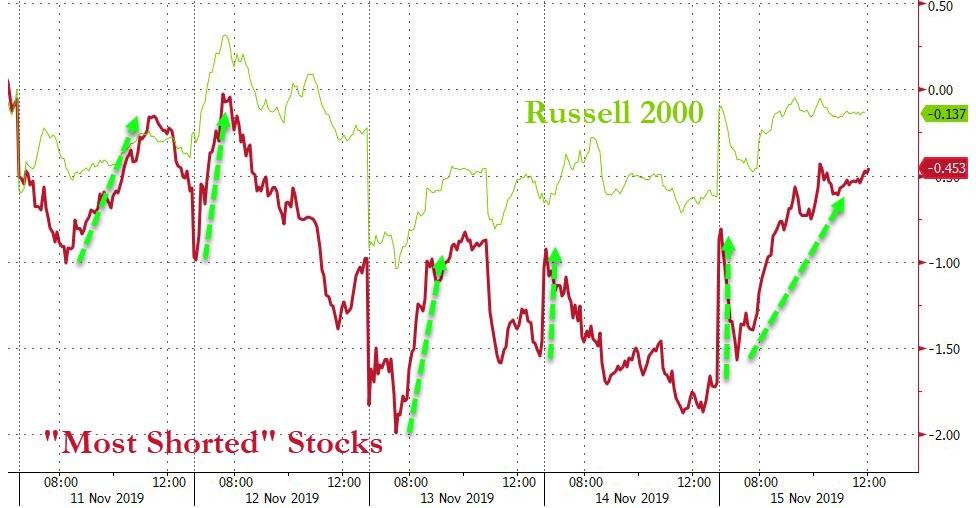

Short squeeze after short squeeze were ignited this week on the heels of various “trade deal is close” bullshit headlines…

Source: Bloomberg

The S&P is now at its most overbought since late April…

Source: Bloomberg

Buybacks continue to dominate…

Source: Bloomberg

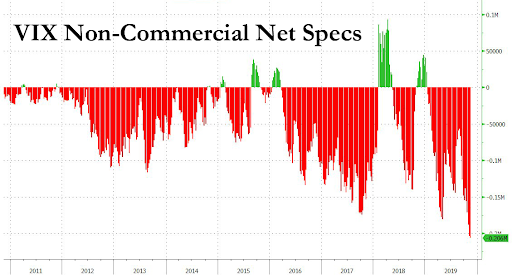

VIX continued its collapse this week…

..crashing to an 11 handle…

…and sending the term structure to its steepest since just before the VIXmageddon as XIV imploded…

Source: Bloomberg

But that doesn’t stop the world and their pet rabbit shorting vol – to yet another new record short (5th week in a row)…

Source: Bloomberg

Credit markets continue to decouple from stocks…

Source: Bloomberg

Especially in CLO-land…

Source: Bloomberg

Treasury yields all tumbled on the week with the short-end underperforming…

Source: Bloomberg

This was the biggest weekly yield compression since September…

Source: Bloomberg

The Dollar ended the week lower (with the last two days saw the biggest drop in a month)

Source: Bloomberg

Yuan ended the week marginally lower (but rebounding back above the Yuan fix overnight)…

Source: Bloomberg

Cryptos all drifted lower this week after a big surge last weekend…

Source: Bloomberg

Gold and Silver both rallied this week while copper dropped (and crude played insane ping pong on trade/OPEC headlines)…

Source: Bloomberg

WTI continues to swing between rails in a tight range…

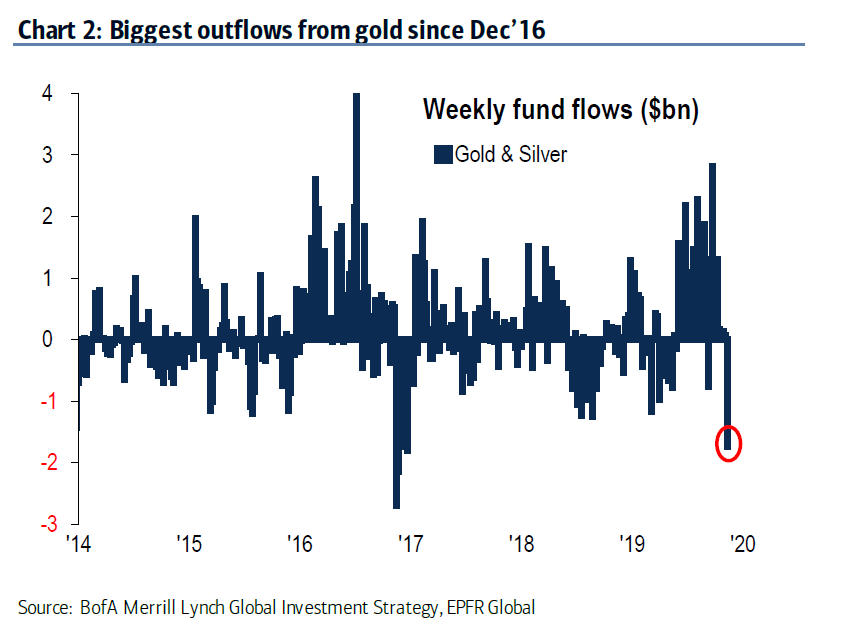

Notably, precious metals rallied this week amid the biggest outflows since Dec 2016…

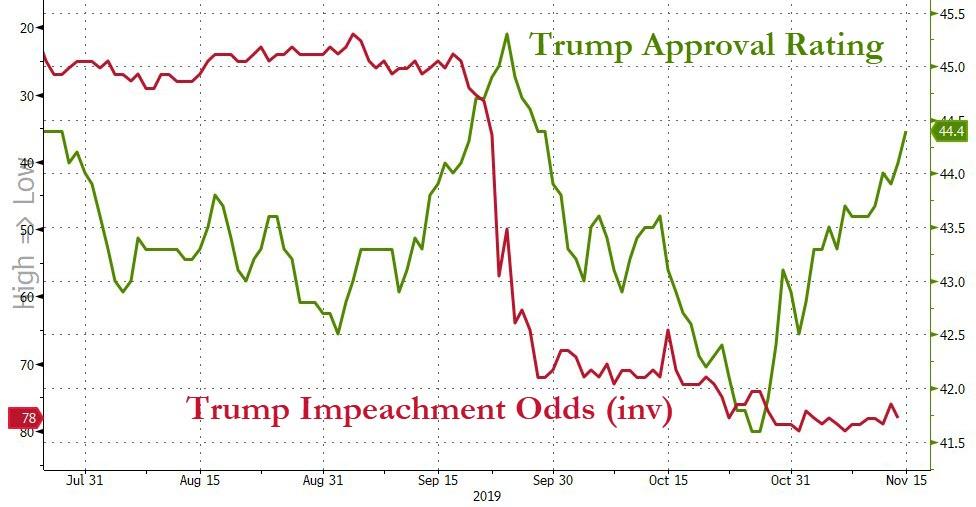

And finally, amid all the political circus this week, President Trump’s approval rating surged to a 5-week high…

Source: Bloomberg

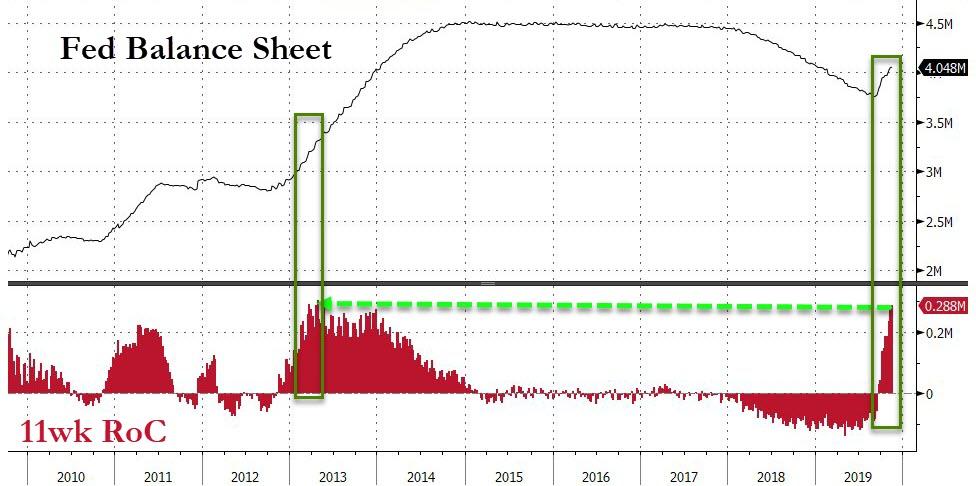

And in case you wondered why stocks just keep rising despite dismal earnings and deteriorating macro data…

Source: Bloomberg

It’s simple – the Fed is expanding its balance sheet at the fastest pace since the very peak of QE3 money-printing…

Source: Bloomberg

Tyler Durden

Fri, 11/15/2019 – 16:02

via ZeroHedge News https://ift.tt/37a8gFp Tyler Durden