China Quietly Bails Out Another Bank With 620 Billion Yuan In Assets

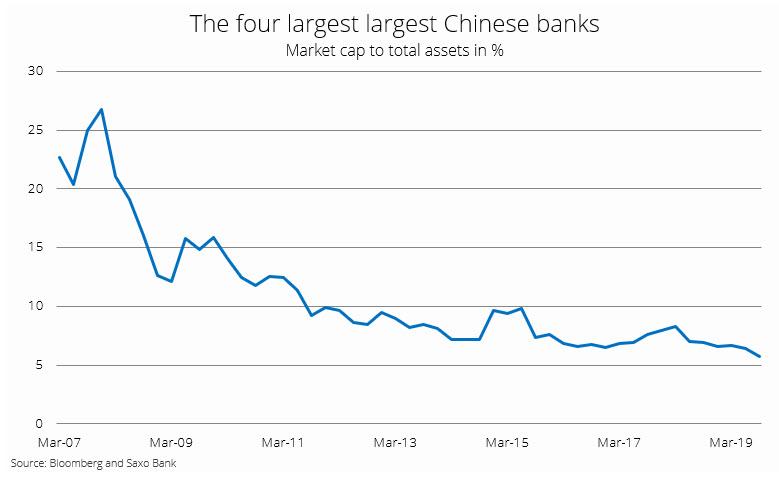

Late last week, we argued that one could ignore China’s sinking retail sales, industrial production, capital expenditures, record low and declining sub-6% GDP and even its fading monthly credit injections and impotent credit impulse, and instead what matters most for the world’s second biggest economy with the world’s biggest financial system (at around $40 trillion, roughly double that of the US) is the following chart showing the market cap to total assets ratio for the four largest commercial banks in China, which as Saxo Bank found, hit a new all-time low of 5.8% in Q3 as total assets grew an annualized 8% in Q3 while market cap of the four banks declined.

This means that Chinese investors – who happen to know best what is truly going on behind the scenes – are not valuing these new assets as high quality, and the dynamic in China right now is that the current credit expansion is just offsetting the surge in bad loans, whose real amount Beijing has been keeping under wraps ever since the great bank debt for equity swap of 1999, but which we know is far higher the propaganda number of around 1.5% The net effect is zero credit transmission to the real economy in China constraining economic growth, which in turn makes banks especially vulnerable to failure as a result of even modest capital outflows.

Confirming that there is something fundamentally broken with China’s debt transmission mechanism and that, by implication, Chinese bad loans are soaring, two weeks after we reported that there was a bank run at Henan Yichuan Rural Commercial Bank which brought the bank to the verge of collapse, the WSJ reported that Harbin Bank, a politically-linked midsize Chinese lender based in the capital of northeast Heilongjiang province, became the latest Chinese financial institution to get a state bailout after its key private shareholders were replaced by government investors.

Harbin Bank, which is one of the biggest banks in China’s northeast with 622 billion yuan in assets as of June 30, 2019, and trades on Hong Kong’s stock exchange, becomes the fifth bank – after Baoshang Bank , Bank of Jinzhou, Heng Feng Bank, and Henan Yichuan Rural Commercial Bank – to be bailed out by the state, and will be 48%-controlled by two government entities after six private shareholders shed their stakes, according to a bank statement issued late on Friday.

Total consideration for the shares involved came to almost 15 billion yuan, or around $2.1 billion, the bank said, though it described the transactions as transfers rather than stock sales, which is to be expected if the bank was being bailed out instead of actually selling a viable stake.

As has been the customary case, the bank didn’t provide any reason for the transactions in the statement, and Chinese bank regulators made no comment on the action.

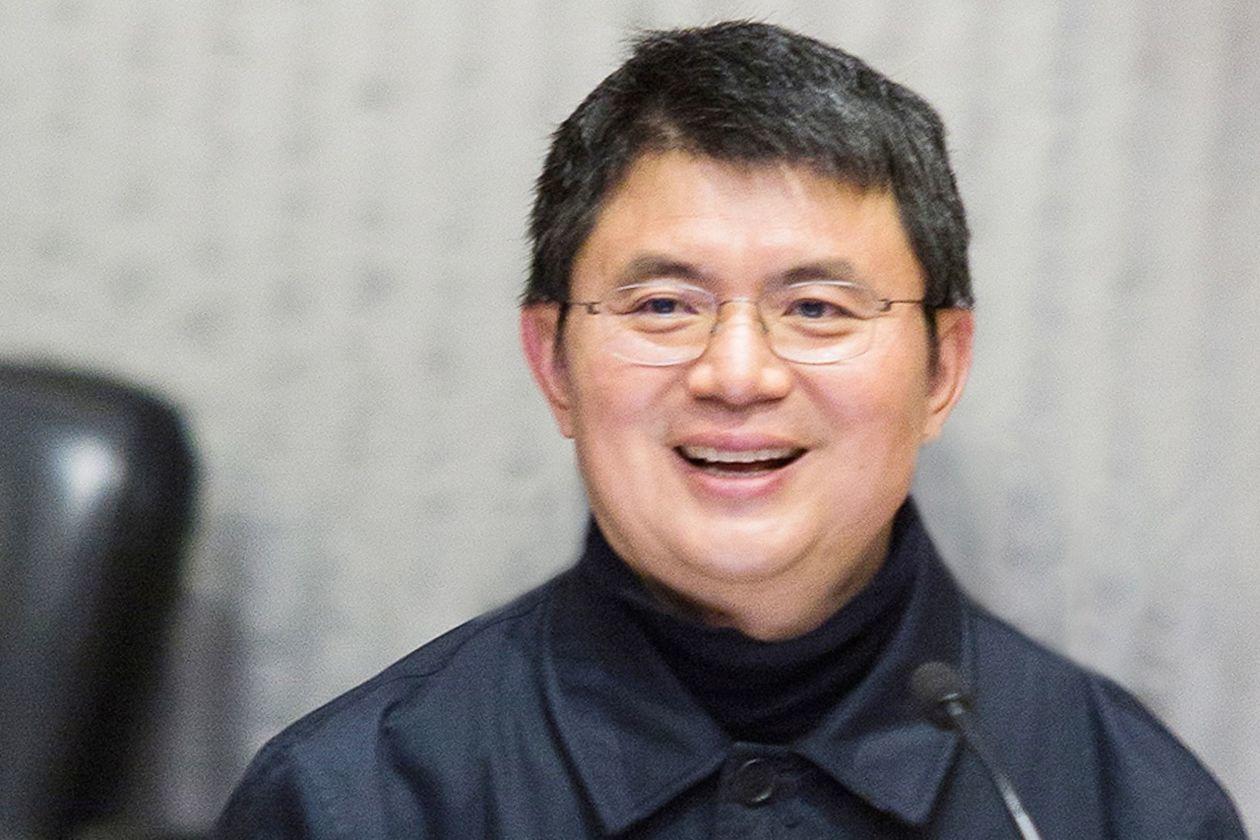

And, as was the case with at least one previous bank “rescue”, Harbin Bank was connected to a former oligarch who disappeared not that long ago amid allegations of massive fraud. Indeed, as the WSJ reports, the bank is among a handful of financial businesses in China linked to once-powerful tycoon named Xiao Jianhua who in early 2017 disappeared amid a wave of prosecutions of big private investors. Businesses owned by some of those people, including Wu Xiaohui’s Anbang Insurance Group Co., have also since become government-owned.

Incidentally, the first of the year’s bailouts of a troubled small lenders was that of Baoshang Bank, which as we reported at the time, was also linked to Xiao. Its government takeover in May sparked a funding crisis for many other small banks in China and helped send Harbin Bank’s shares sharply lower. The stock has fallen more than 16.5% in 2019. Incidentally, when discussing the failed lender, China’s PBOC said that Baoshang was being restructured and that the takeover was designed to “stop bleeding” at the bank and contain risks to the financial sector.

So why did Harbin Bank fail?

In its financial report for H1 2019, Harbin Bank cited deteriorating asset quality – read surging bad loans – as well as intensified competition for deposits and higher borrowing costs in money markets as China’s economy slows. Yet, paradoxically, the near-insolvent lender also said it recorded a profit of 2.18 billion yuan, or about $311.1 million, though that was off about 16% because of, drumroll, more-aggressive write-offs of bad debts. Which goes to show that corporate earnings reports in China are as “credible” as all other Chinese economic “data.”

As for the oligarch behind not one but two bank failures in the country so far this year, Chinese authorities have publicly said nothing about Xiao since he abruptly left Hong Kong and entered mainland China in early 2017. He has made no public comment and can’t be reached.

Another curious fact: a little over a year ago, Harbin Bank, which in March 2018 had abandoned plans to list its shares in China, announced it would raise over $2 billion in perpetual bonds to replenish its capital after regulators in early 2018 allowed lenders to sell such instruments to bolster their balance sheets. Incidentally, a perpetual bonds is effectively the same thing as equity, but for some bizarre reason sells much better in China where the investing population is apparently stupid enough to be fooled by the clever change in designation. As such, Harbin Bank was the first Chinese lender to announce its intention to sell perpetual bonds to increase its Additional Tier 1 (AT1) capital. We now know what prompted the bank’s rush.

Harbin Bank’s exiting shareholders are business entities owned by a number of individuals, according to the company’s latest annual report. The biggest holder among them, Heilongjiang Keruan Software Technologies owned a 6.55% stake and is identified in the annual report as the subsidiary of another business primarily owned by two individuals.

Who are the bank’s new owners?

Under the transactions disclosed Friday, an entity controlled by Harbin city’s financial bureau, Harbin Economic Development & Investment, will control 29.63%, compared with 19.65% at the end of June. A second, new shareholder will have a 18.55% stake: Heilongjiang Financial Holdings Group Co., which was established in January by the province of Heilongjiang. Combined, these state-owned enterprises would own nearly 50% of the bailed out bank.

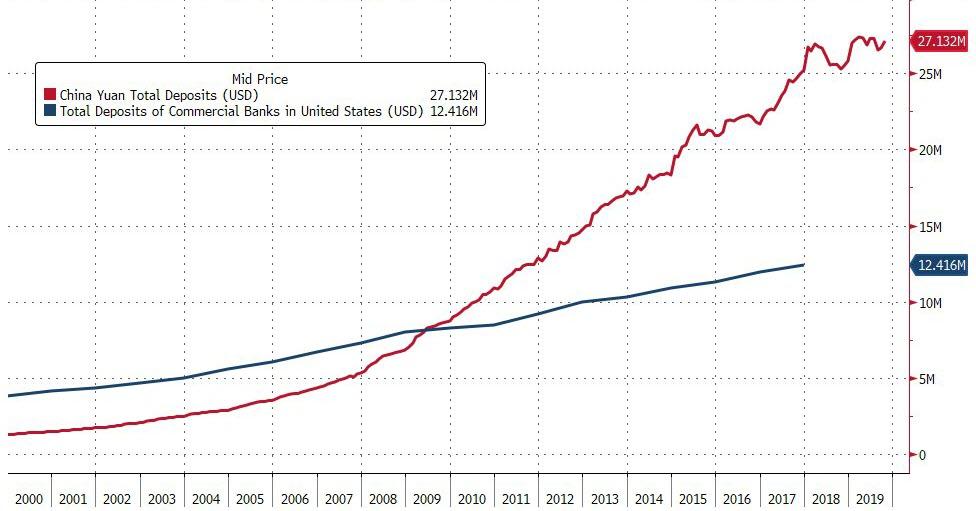

Meanwhile, since the PBOC refuses to admit or acknowledge that it has an unprecedented bad loan problem, and thus nothing can be done to address the underlying cause at the heart of China’s failing bank problem, expect more and ever bigger Chinese bank bailouts until eventually a bank fails and its depositors are impacted, sparking a furious scramble by Chinese depositors across the country to redeem their roughly $27 trillion (190 trillion yuan) in bank deposits, which as a reminder, is more than double the total amount of US commercial bank deposits.

They are in for an unpleasant surprise.

Tyler Durden

Sun, 11/17/2019 – 22:05

via ZeroHedge News https://ift.tt/2Xp8JyU Tyler Durden