Boomers Win Again: Old Americans To Inherit “Unprecedented Amount That Is Incomprehensably Large”

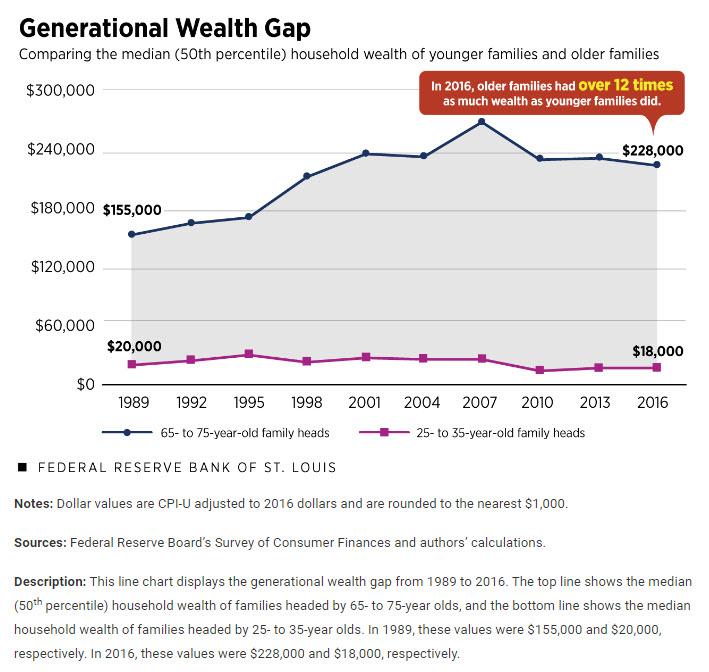

When it comes to the generational conflict at the heart of America’s inequality split, there is no contest: the elderly – those between the ages of 65 and 75 who own the bulk of financial assets – have over 13 times as much wealth as America’s Millennials (see chart below), young people between 25 and 35, who may not be rich, but have come up with a biting, witty response to their much richer elders: “Ok, Boomer.”

Unfortunately for America’s youth, who may have been hoping to get rich quick when they inherit the wealth of their aging parents, we have some very bad news.

While it is true that an unprecedented $36 trillion – roughly a third of total US household wealth – will flow from one US generation to another over the next 30 years with the pace of bequests already surging as Americans inherited $427 billion in 2016, up 119% from 1989, it’s not the Millennials who stand to benefit.

Instead, the beneficiaries of this inheritance tsunami are quite old themselves; according to the the study, from 1989 to 2016 U.S. households inherited more than $8.5 trillion. Over that time, the average age of recipients rose by a decade to 51. Fast forward a few more years, and now, more than a quarter of bequests now go to adults 61 or older.

In other words, America’s again rich are about to get even richer as their parents pass away.

“Wealth equal to nearly two times the size of the U.S. GDP is expected to be gifted to charities and heirs over the next few decades,” said United Income founder Matt Fellowes. “It’s a historically unprecedented amount that is almost incomprehensibly large.” However, “instead of diapers and school, inheritances are increasingly going toward medical bills and retirement savings,” Fellowes said.

The irony is that in addition to virtually every other aspect of US life, one can now add inheritances to the dynamic that’s widening the wealth gap between generations.

As we noted last week, Americans younger than 50 held just 16% of all investable assets in 2016, down from 31% in 1989, the Fed’s latest triennial Survey of Consumer Finances found, leaving the rest to households 50 and older. It also means that the bulk of America’s “Top 1%” also happens to be 50 or older.

However, age inequality is most dramatic when comparing the oldest and youngest adults. In 1989, the median household age 65 to 75 held almost eight times more wealth than families headed by 25- to 35-year-olds. By 2016, according to an analysis by the St. Louis Fed, the median baby boomer had close to 13 times more wealth than the typical millennial.

Even more ironic: while boomers as a group inherited trillions from their parents, most members of the postwar generation got nothing. That’s about to change, however, as about 20% of households have received inheritances, United Income’s analysis shows, a share that while flat over the past 30 years, is set to soar.

These generational gifts are coming in handy, with the median recipient getting about $55,000, which is more than double their typical retirement savings. “Most inheritances are going to older adults who have little in the way of retirement savings,” said Fellowes, a former Brookings Institution scholar. “People receiving inheritances are pretty middle class.”

Except, when they are not, of course.

Meanwhile, the size of the average inheritance received in 2016 was about $295,000, sharply higher from $169,000 in 1989.

Why is this notable? Because contrary to popular opinion, as elderly Americans receive an “unexpected” gift, they don’t rush to spend it, but instead since more Americans live longer without the safety net of a traditional pension, they’re spending frugally to make sure their wealth lasts. The result is more Americans dying before they can spend all of their savings. Amusingly, financial advisers told Bloomberg they often need to encourage affluent clients to enjoy their wealth rather than hoarding it.

Some more details: only about 9% of estates consist entirely of a house or other property; the average estate is 46% stocks, bonds, cash and other liquid investments, giving an immediate boost to recipients’ own retirement planning at a key time.

That said, the data is likely skewed even more in favor of the older rich: according to Bloomberg, United Income’s estimates don’t include gifts made during donors’ lifetimes – a typical move in estate planning for the ultra-high net worth cohort, often using trusts.

Even so, it still found a widening gulf between the super rich and everyone else: the median inheritance has risen only about $15,000 in three decades, while they’ve more than doubled for the 0.3% of Americans receiving at least $1 million. In 1989, their inheritances averaged an inflation-adjusted $2.7 million. By 2016, they were each getting an average of $6.6 million.

To summarize: America’s Millennials may be ridiculing the country’s boomers with the rather nonsensical “Ok, Boomer’ tagline that has gone viral, but not only are the Boomers getting the final laugh, they are getting richer as America’s youth gets progressively poorer.

Tyler Durden

Tue, 11/19/2019 – 18:25

via ZeroHedge News https://ift.tt/2QBM80S Tyler Durden