“…And You Thought Recession Risk Was A Thing Of The Past…”

Authored by Danielle DiMartino Booth via QuillIntelligence.com,

Rabbit Season! Duck Season! Rabbit Season! Duck Season!

-

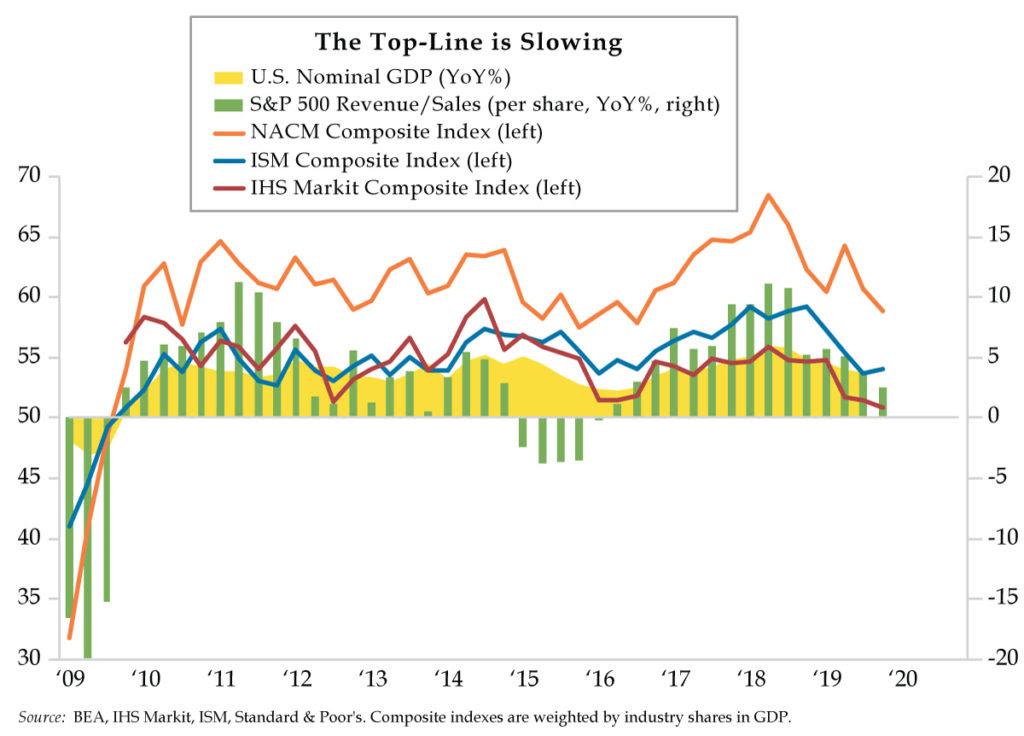

As the third-quarter earnings season comes to a close with a -2.3% showing on EPS, analysts are more bearish going into the fourth quarter; the weakness looks to spread to six sectors vs. five in the third quarter indicating the industrial slowdown has spread to services

-

Third quarter revenue growth has slowed to levels not seen since 2016’s third quarter while expectations are that the year’s final three months slow further; as with earnings, the quarter-on-quarter weakness is expected to broaden to health care and consumer discretionary

-

In the short-run, companies will likely endeavor to cut costs, including labor, to draw a line under earnings as revenues deteriorate; given revenues are a demand proxy, a concurrent slowing in GDP is also foreseeable

Rabbit Fire was a 1951 Looney Tunes cartoon starring Bugs Bunny, Daffy Duck and Elmer Fudd. The Warner Bros. short was the first to feature the classic feud between Bugs and Daffy. In it, Daffy lures Elmer to Bugs’ burrow, calls down to him, then watches as Elmer shoots at the emerged Bugs, parting his ears. As Elmer aims again, Bugs informs him that it’s not rabbit season, but rather duck season. Daffy storms in irate and attempts to convince Elmer that Bugs is lying. Their conversation breaks down into Bugs engaging Daffy in the verbal play illustrated in today’s title. Of course, Daffy fumbles into saying “duck season” and Elmer fires away.

Whether you are a fan of Bugs or Daffy, there’s another season in the financial market world that’s about to come to a close – earnings season.

Ninety-two percent of S&P 500 companies have reported third-quarter earnings results. Last Friday, FactSet reported that earnings per share (EPS) had declined 2.3% versus a year ago. Industry performance was mixed with five sectors – Energy, Materials, Information Technology, Financials and Consumer Discretionary – reporting year-over-year declines and the other six – Utilities, Health Care, Real Estate, Consumer Staples, Industrials and Communication Services – posting year-over-year gains.

Analysts’ fourth-quarter guidance is more bearish for earnings compared to the third quarter. It’s anticipated that six sectors will decline including Energy, Materials, Industrials, Information Technology, Consumer Discretionary and Consumer Staples. This widened breadth carries a broader cyclical narrative beyond the sectors more closely affected by trade war; it bleeds into the entire consumer space. Implicit are hints of contagion from manufacturing to services that introduce broader labor market risks. And you thought recession risk was a thing of the past just because the yield curve un-inverted.

Cue Bugs and Daffy for an encore with a twist: “Earnings season! Revenue season! Earnings season! Revenue season!” The bottom line (earnings) gets all the attention each quarter. But the top line (revenue) should never be overlooked. For cycle chasers and equity strategists alike, revenue growth is the heartbeat of U.S. economic activity. It proxies Gross Domestic Product (GDP).

FactSet reported that revenue growth slowed to 3.1% in the third quarter, the slowest pace since the 2016’s third quarter. Despite the slowing, the breadth of gains revealed eight sectors expanded with only the remaining soft spots of Energy, Materials and Industrials contracting. Analysts projected a further deceleration in revenues to 2.5% with the same three sectors posting another retrenchment in the fourth quarter. Does this mean that top-line headwinds are, and will be contained to the sectors most exposed to the global growth slowdown and will therefore not spread across the economy to more consumer and service-oriented sectors?

Let’s reserve judgement on that. Instead, look at the trend in revenues from the third to fourth quarters. As the inset table above illustrates, the tamping down in demand will be relatively broad-based. The Consumer Discretionary sector is especially prominent.

To see if the storyline holds beyond equity analysts’ models, we recruited three other macro sources in today’s chart to gauge preliminary top-line guidance for the fourth quarter. Composite indexes that weighted manufacturing and services by their respective industry shares in GDP were utilized for credit managers (NACM), purchasing managers (ISM) and C-suite executives (IHS Markit).

In all three cases, a downshift has been in place for multiple quarters and the fourth quarter looks either close to or weaker than the third quarter. What’s important to note about a broadening slowdown in revenue is that over the short run, more companies could face cost cutting decisions, as opposed to the luxury of cost expansion choices.

Central banks are doing their darnedest to stave off the global slowdown with stimulus injections. Ascertaining clarity on the revenue outlook here at home will be a challenge as we head into an election year. Capex budgets are apt to be hamstrung by tight-fisted management so long as concerns about the top line refuse to fade. And that applies whether you’re in a red state or a blue state or you’re a rabbit or a duck.

Tyler Durden

Tue, 11/19/2019 – 20:45

via ZeroHedge News https://ift.tt/2qsPcBP Tyler Durden