Stocks & Bond Yields Tumble As China Trade Deal Hope Fades

The so-called “resilience” of US equities overnight as they shrugged off the Washington Democracy Bill vote and the China retaliation threat is more a signal of ignorance (or total complacency) as every negative trade headline was met with a sudden wall of bids to try and get back to even…

As US sources told Reuters that the deal may be delayed, the market began to drop the odds of a trade deal (albeit modestly)

Source: Bloomberg

This was just a fleshwound though for the algos who know only buying matters now…

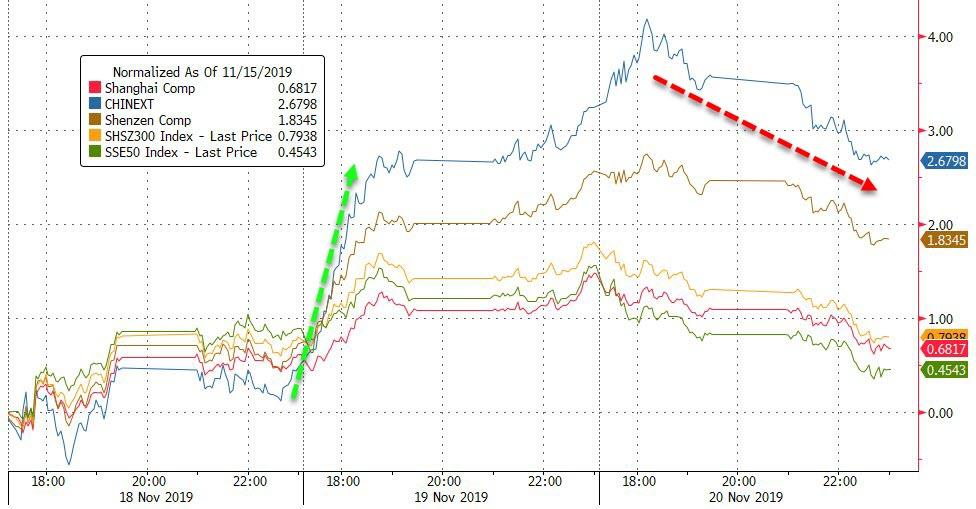

Chinese stocks faded overnight (as they should rationally)…

Source: Bloomberg

European stocks started ugly but were bid all day…

Source: Bloomberg

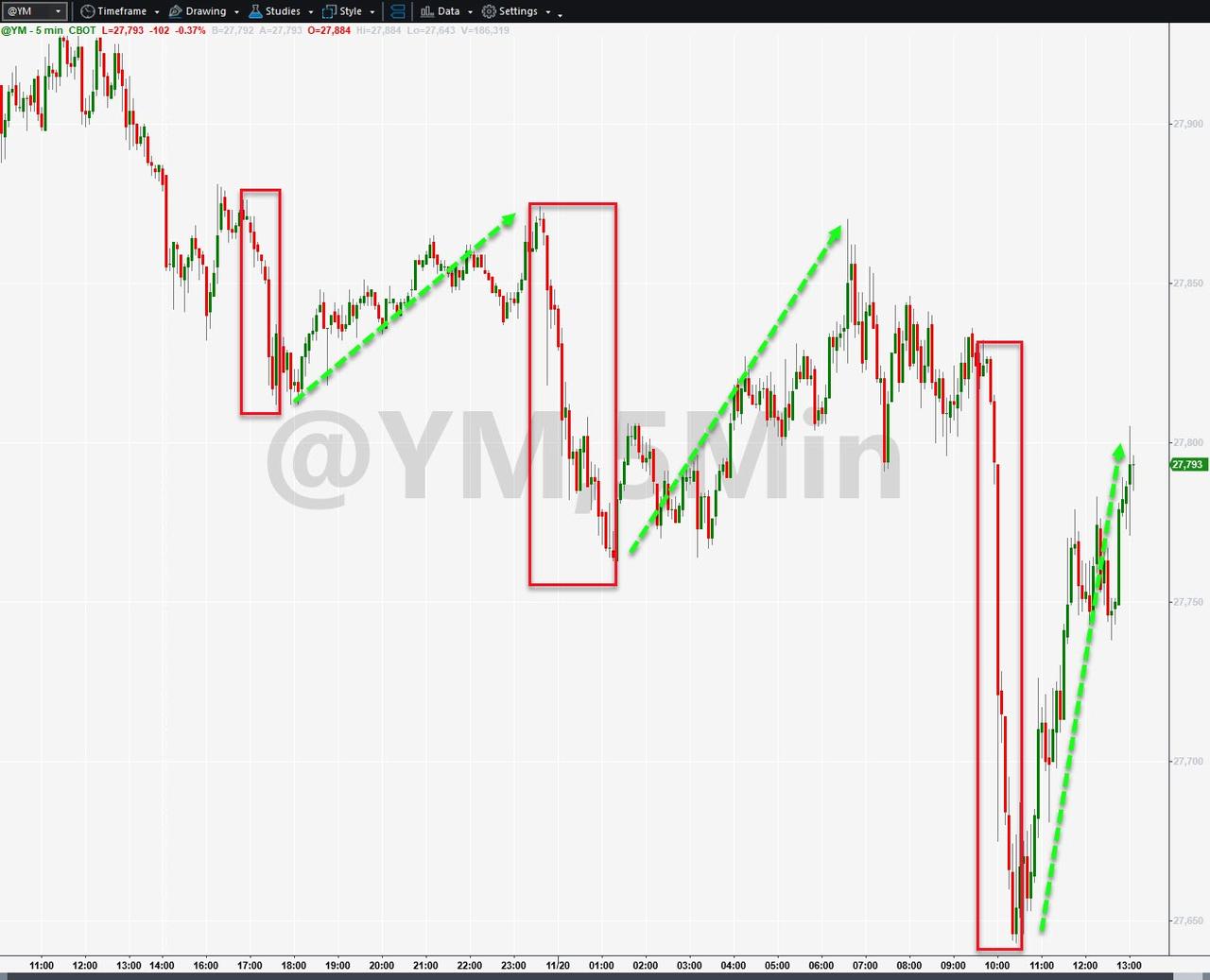

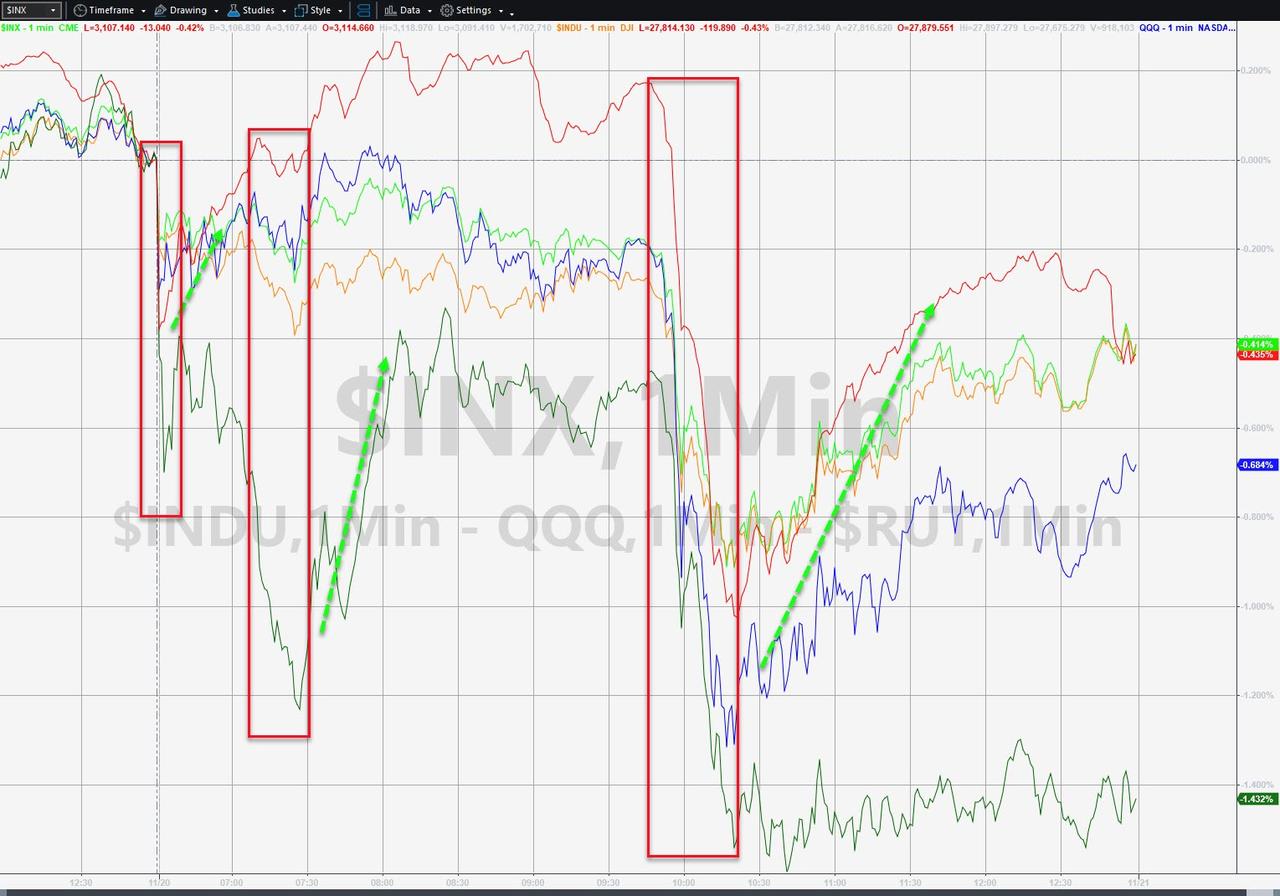

US equities were all lower on the day (Trannies worst) but note the two BTFD efforts…

The Dow is down two days in a row, and less than 1%, but that is still the biggest such drop in 6 weeks!!

Source: Bloomberg

The VIX term structure continues to steepen dramatically…

Source: Bloomberg

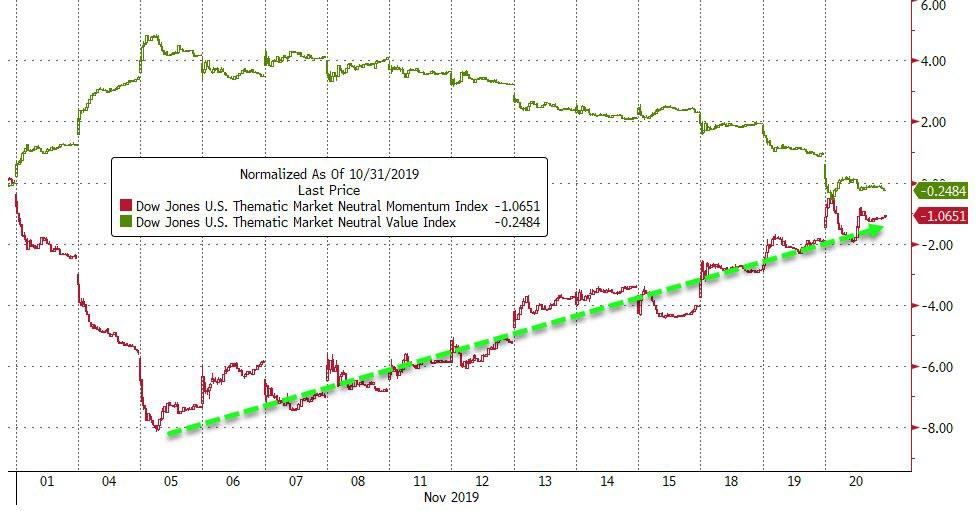

Momo has erased almost all the month’s losses (as bond yields have tumbled)…

Source: Bloomberg

Treasury yields were all lower once again today with the long-end notably outperforming…

Source: Bloomberg

With 10Y back below the key 1.75% level…

Source: Bloomberg

The yield continues to flatten dramatically back towards inversion…

Source: Bloomberg

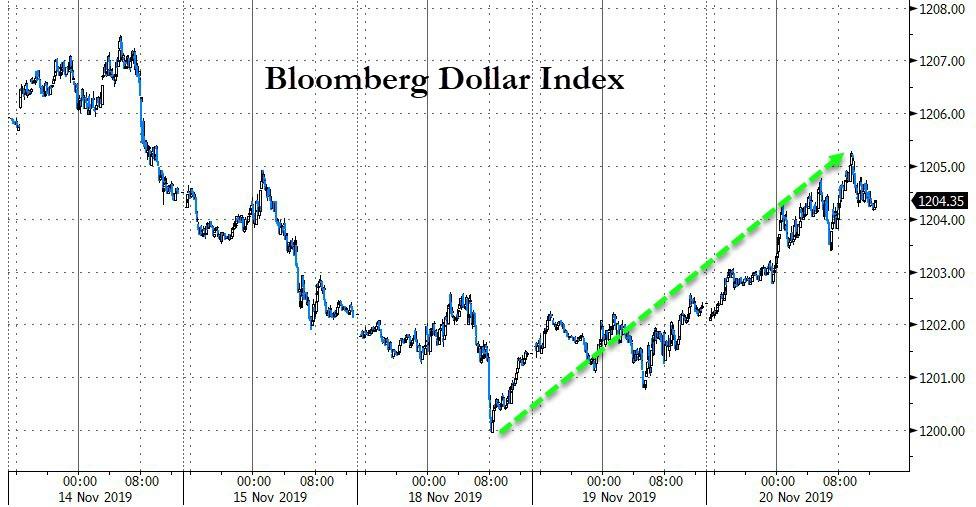

The dollar rallied for the 2nd day in a row…

Source: Bloomberg

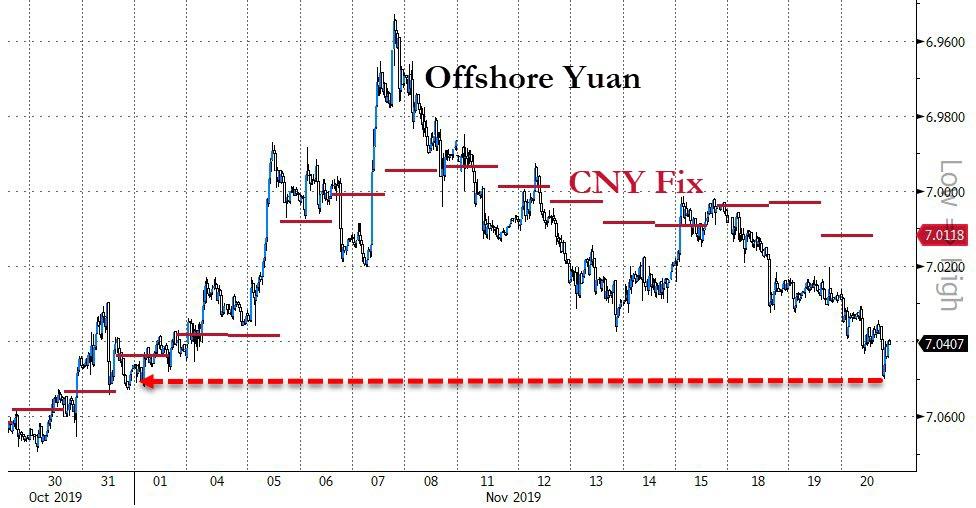

Offshore Yuan fell to three-week lows…

Source: Bloomberg

Cryptos ambled modestly lower today…

Source: Bloomberg

Bitcoin was choppy intraday but ended marginally lower…

Source: Bloomberg

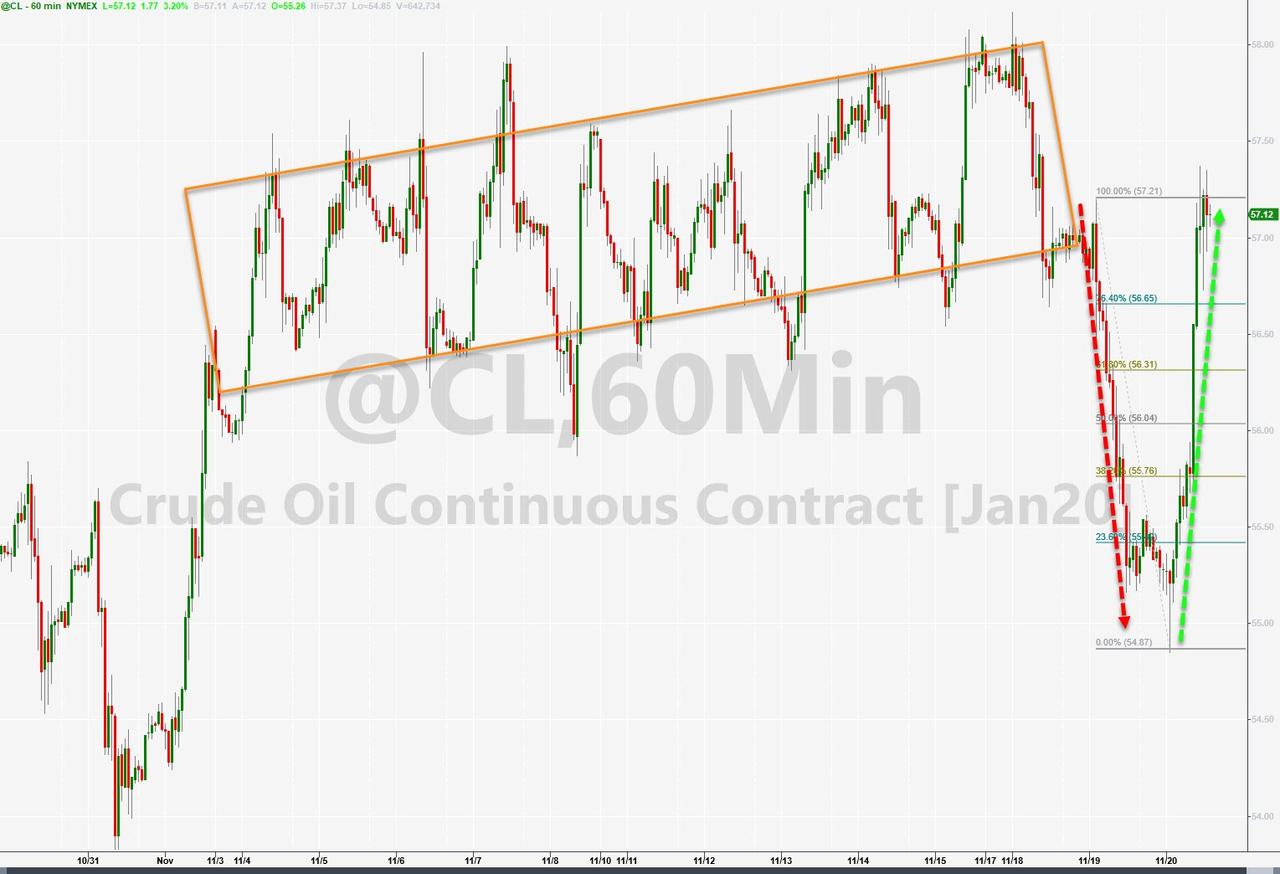

Gold, Silver, and Copper were relatively flat today but oil prices surged (despite the odds of a trade deal fading and a build in crude stocks)….

Source: Bloomberg

But the rebound was purely technical in nature…

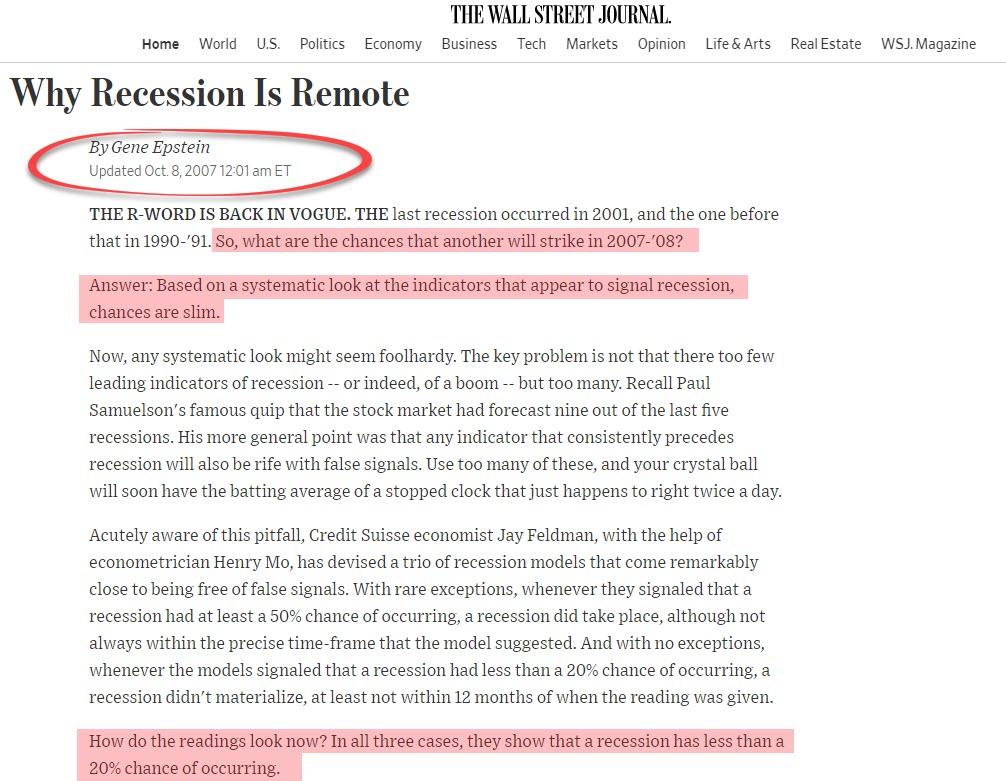

And finally, whatever you do, don’t worry about there being a recession anytime soon, the ‘experts’ know better…

And this was notable, Warren has collapsed in the betting to equal Biden as Buttigieg is surging…

Source: Bloomberg

Who’s right – the FX markets or the equity markets?

Source: Bloomberg

Tyler Durden

Wed, 11/20/2019 – 16:00

via ZeroHedge News https://ift.tt/336Jump Tyler Durden