Amid Record Positioning, Something Just Snapped In The ‘Short-Vol-To-Zero’ Trade

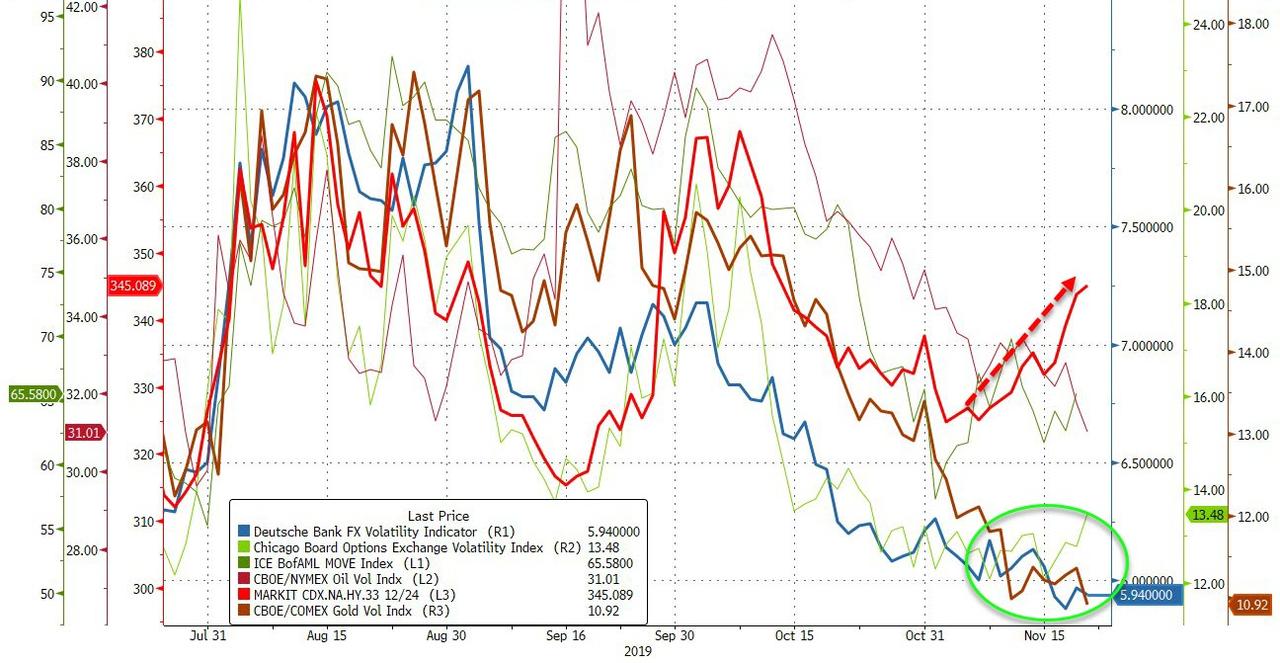

Since The Fed unleashed ‘NotQE’, stocks have soared higher – ignoring every piece of bad news and clinging to the narrative that better-than-feared Q3 earnings, cherry-picked upside-surprises in economic data, and optimism that the worst of trade tensions could be behind us are driving the next leg in the ‘secular’ bull market. At the same time, amid soaring uncertainty, volatility expectations across multiple asset-classes have utterly collapsed.

FX, Equity, and Gold vols are crashing…

Source: Bloomberg

Despite an explosion in global policy uncertainty…

Source: Bloomberg

All thanks to global central banks’ boots on the throats of market uncertainty…

Source: Bloomberg

And as volatility expectations collapsed, so the greatest FOMO trade ever has emerged as traders have never been so short VIX futures…

Source: Bloomberg

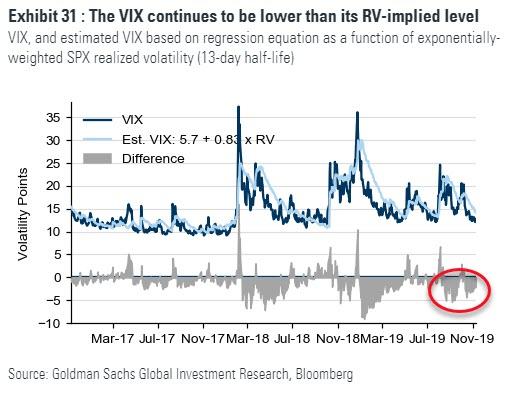

Notably, however, Goldman points out that while the VIX has been low (closing at 12.7 on Monday), it has failed to drop below 2019’s low of 12, in part because of call-buying to chase the rally (falling short-dated skew is further evidence of this).

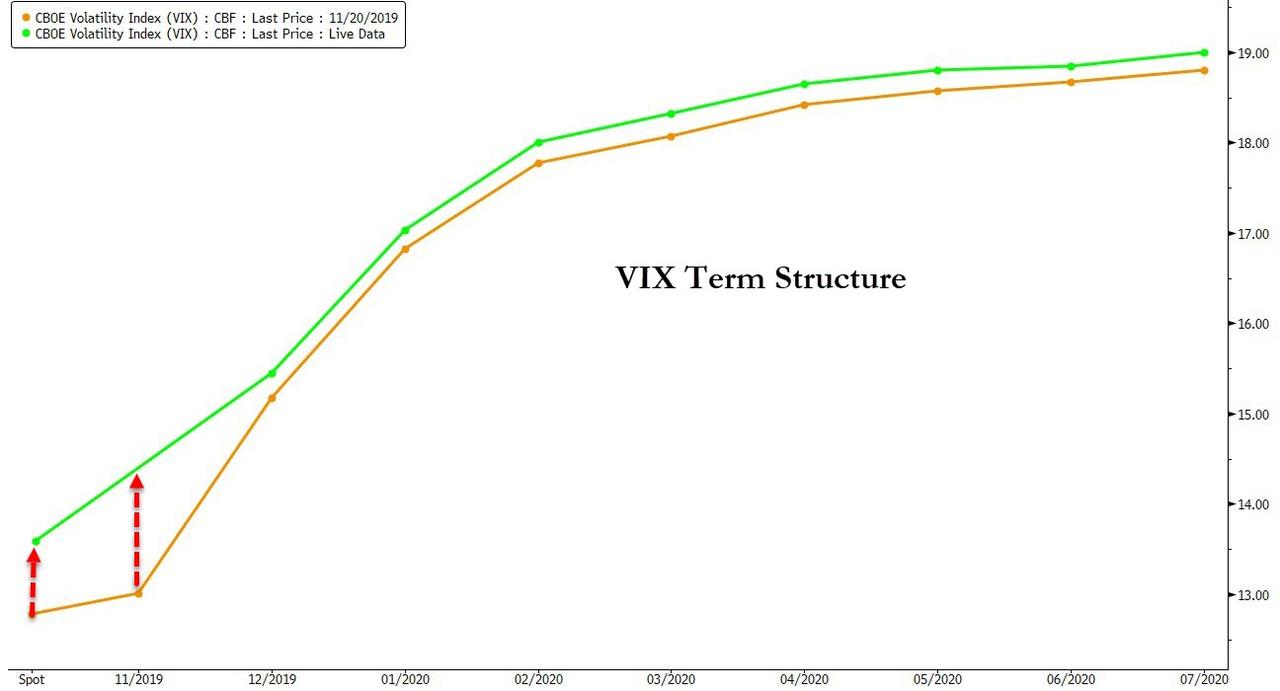

But that hasn’t stopped traders chasing the vol curve carry trade…

Sending the VIX term structure to its steepest since right before the XIVmageddon volpocalypse in early 2018…

Source: Bloomberg

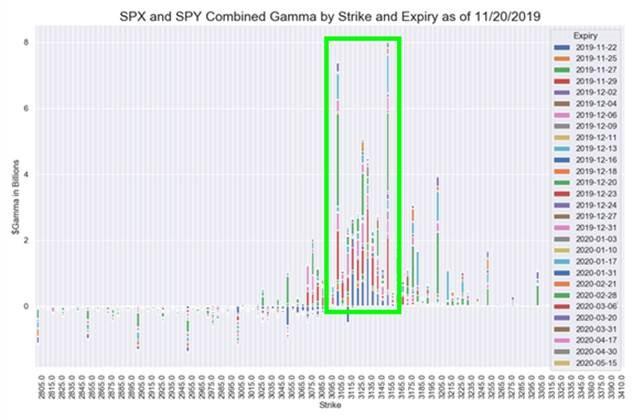

As Nomura’s Charlie McElligott recently noted, a lot of this range-bound, low-vol trading has been driven by massive gamma exposures between S&P 3100 and 3150:

per SPX / SPY consolidated options, we see the $Gamma move incrementally lower as a function of yday’s lower close (from yesterday’s 94.0th %ile since 2013 to today’s 86.5th %Ile) but still stuck very “long,” while $Delta remains very “long” as well at +$427B and 97.5th %ile (barely adjusting lower from yesterday’s 99.0th %ile)—which is a “purge” risk alongside the 99th %ile $notional “long” held across US Equities futures (SPX, NDX, RTY) from Asset Managers.

The fact remains that SPX index will stay “sticky” up here btwn the enormous 3100- ($9.4B $Gamma) and 3150- ($8.4B $Gamma) strikes until the introduction of a fresh macro “shock-down” catalyst, as the current “Long $Gamma” does not “flip” until down at 3055, while the current “Long $Delta” would flip until even lower at 3030 (both including this week’s expiries).

But, as one strategist puts it: “Even when you throw a ball against a wall, there’s a brief period when it stops.”

And today we are seeing something change… the volatility term structure has suddenly flattened…

Source: Bloomberg

Most notably at the short-end…

Source: Bloomberg

As it appears the market’s expectations for a trade deal are starting to fade…

Source: Bloomberg

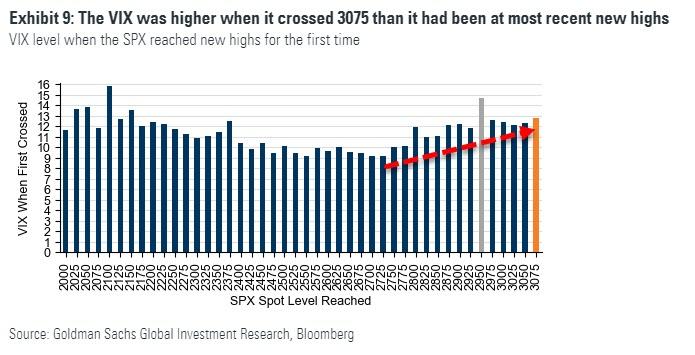

For short vol positioning, the takeaway from this is that short vol can have its highest upside into year-end, but also carries above-normal risk, and as Goldman notes, each new high in the SPX has been coming with the VIX at a higher point, as the floor in SPX implied volatility has been drifting up.

The VIX was close to 13 when it crossed 3075, above its level when most new highs were set over the last three years.

Goldman expects a continued increase in the floor in vol over the coming months given the strong calendar of market-driving political developments.

And perhaps today’s sudden shift in the curve is the start of that repricing as VIX remains stubbornly below its realized vol…

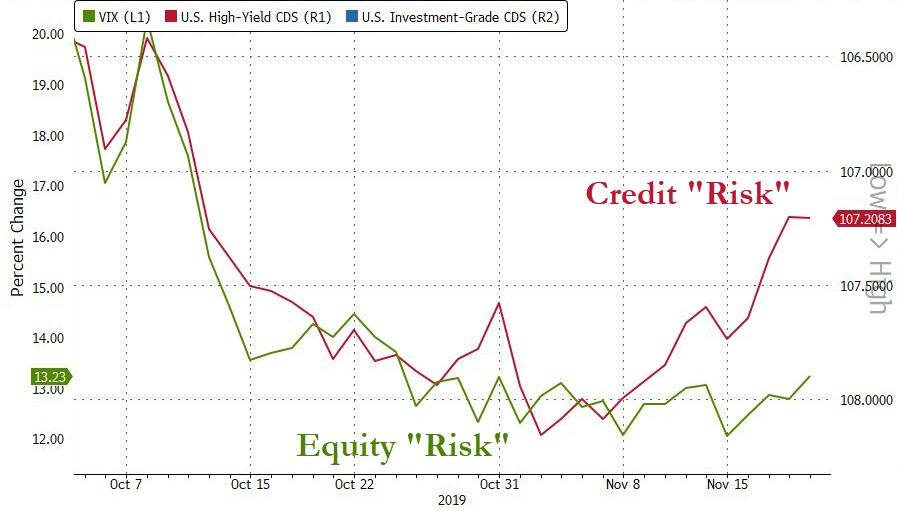

HY risk is starting to signal a change also…

Source: Bloomberg

And with the massive extreme short-positioning, the next inflection could be very fast.

Tyler Durden

Thu, 11/21/2019 – 15:40

via ZeroHedge News https://ift.tt/348eOlX Tyler Durden