Bonds, Stocks, Bitcoin, & Bullion All Drop As Trade-Deal Hope Tumbles

Up, down; buy, sell; impeach, don’t impeach; deal, no deal… it’s enough to make you go full Ari

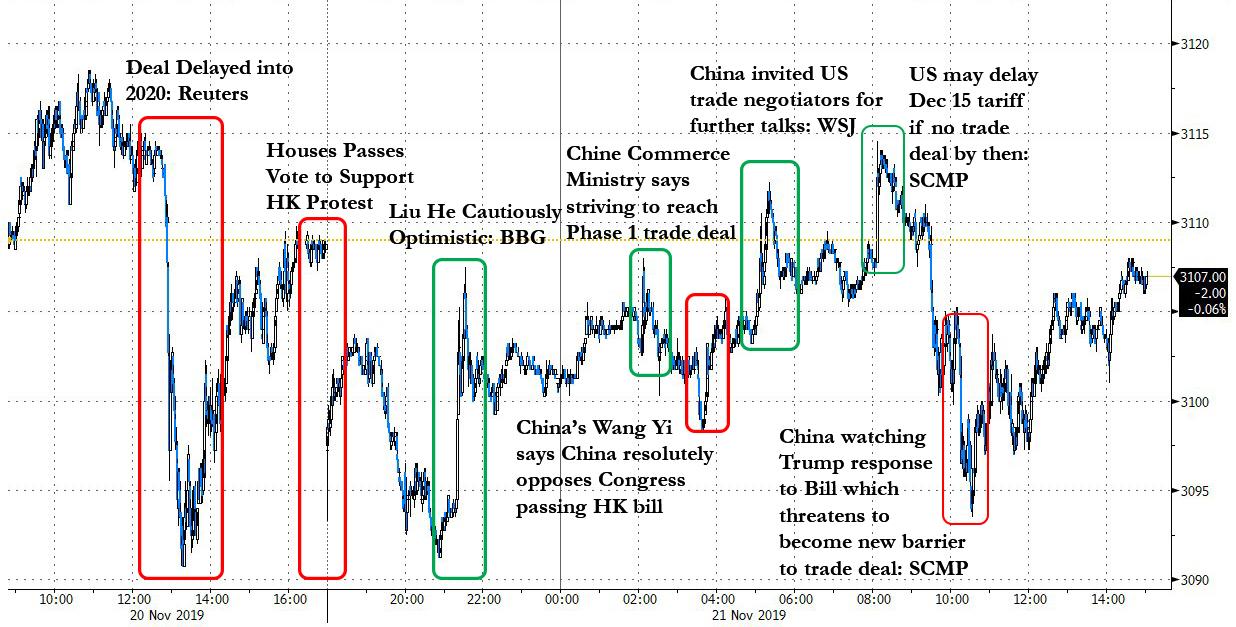

Amid an avalanche of misdrecting headlines and statements on the trade-deal…

Source: Bloomberg

…the market has reduced its odds of a deal happening…

Source: Bloomberg

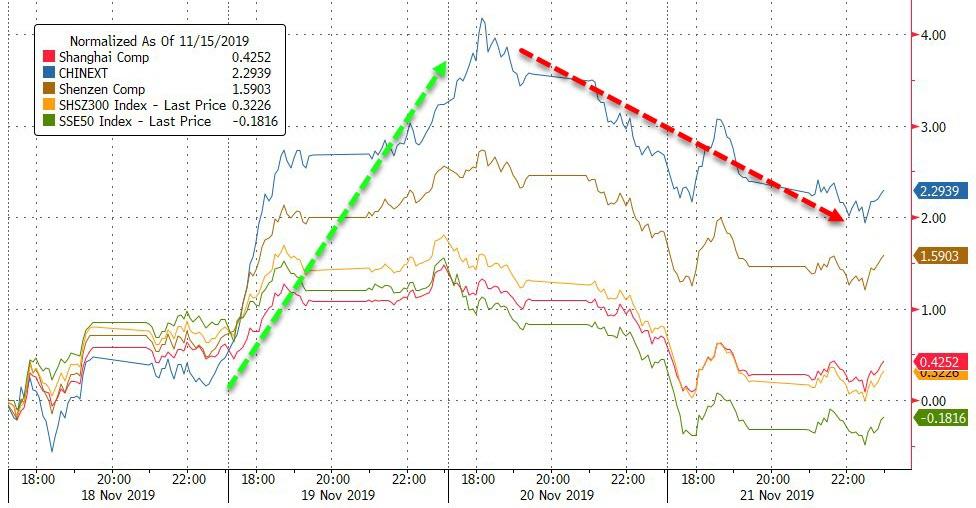

Chinese stocks extended their losses overnight but ChiNext remains green on the week…

Source: Bloomberg

European stocks ended the day lower despite a desperate rally effort after the early tumble…

Source: Bloomberg

US equities were red on the day led by Small Caps

S&P Futs pinned around 3100 once again as gamma dominates…

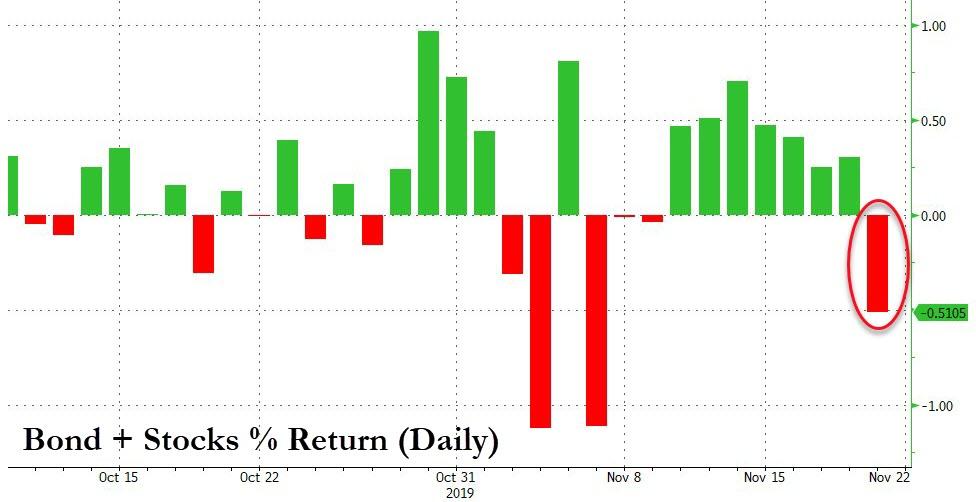

Rather notably, the aggregate return of bonds and stocks was negative today…

Source: Bloomberg

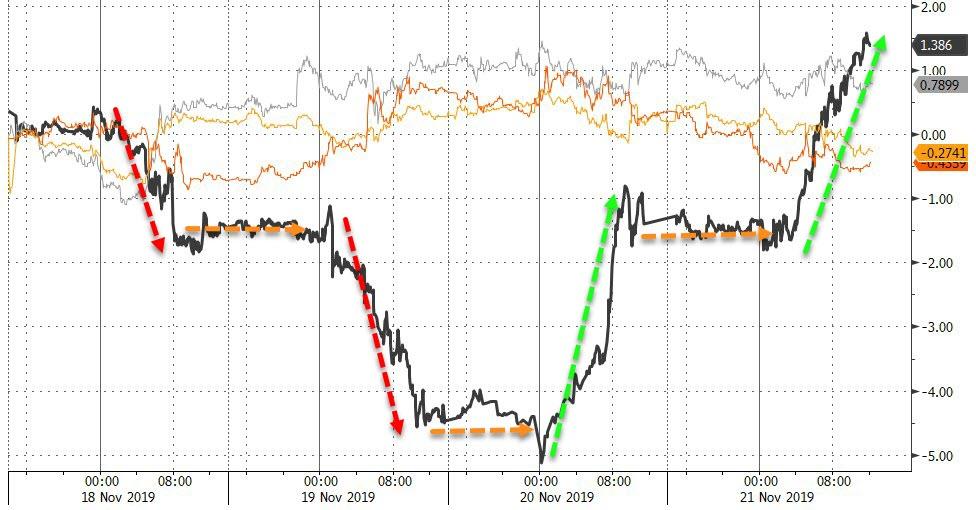

Each trade headline was met with a rapid momo ignition as algos attempted to squeeze shorts…

Source: Bloomberg

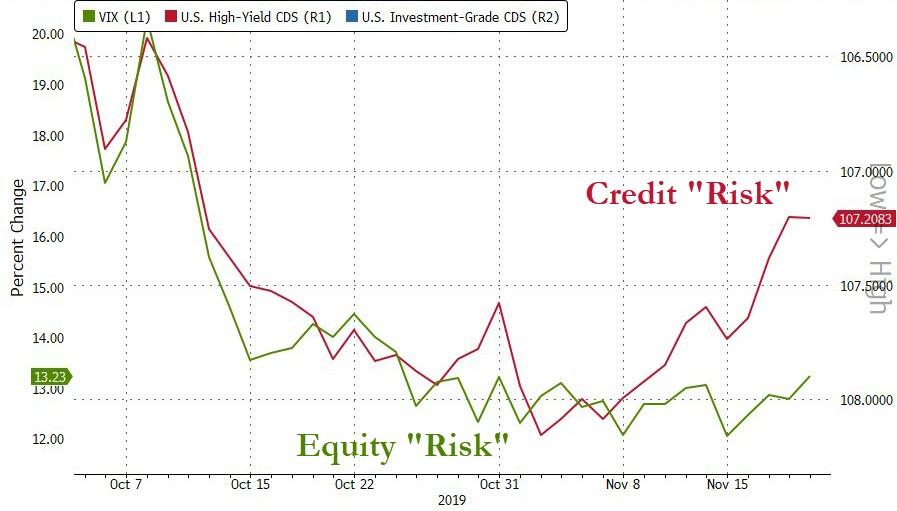

Vol has been collapsing of late but today we saw the VIX term structure notable flatten…

Source: Bloomberg

Is Equity risk starting to catch up to credit risk’s break?

Source: Bloomberg

Treasury yields rose 2-3bps across the curve today – despite equity weakness…

Source: Bloomberg

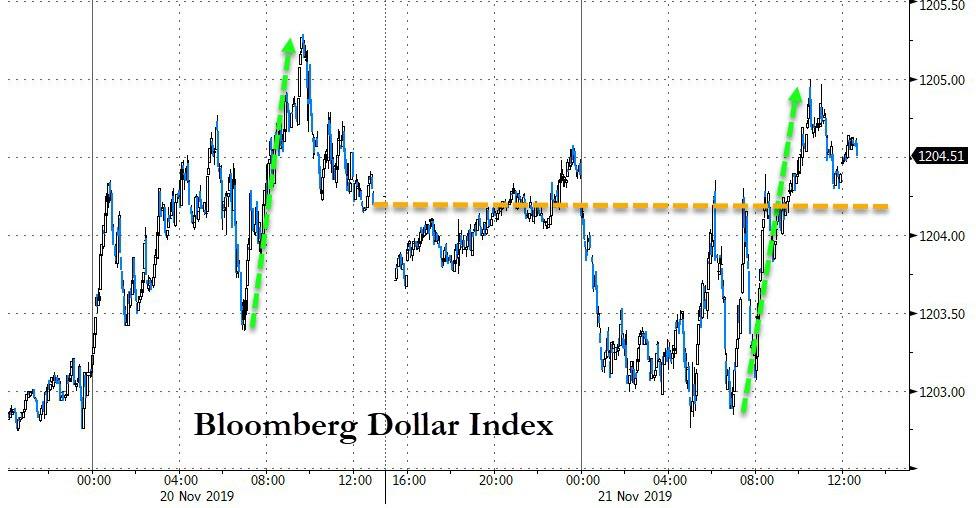

The Dollar managed gains for a second day, reversing overnight weakness during the US session once again…

Source: Bloomberg

Offshore Yuan also rallied today…

Source: Bloomberg

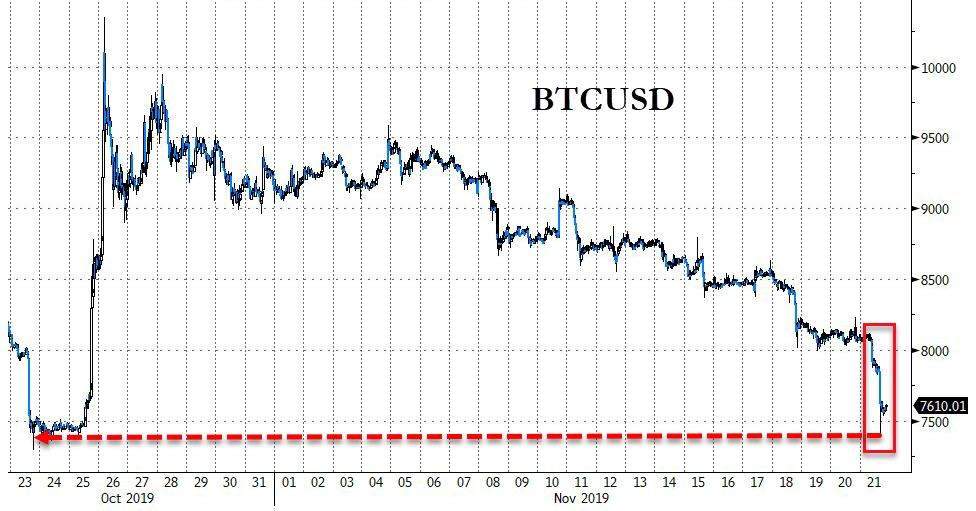

Cryptos were pummeled lower today…

Source: Bloomberg

With Bitcoin crashing below $7500 briefly intraday…

Source: Bloomberg

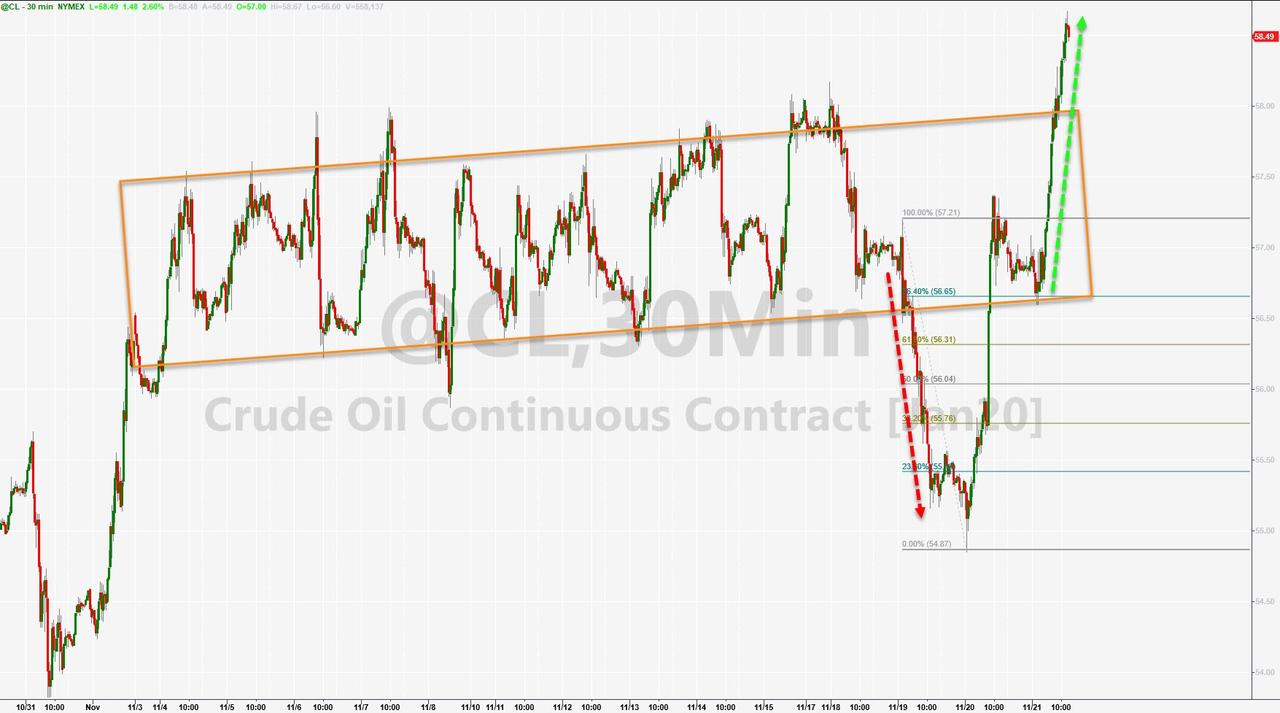

PMs drifted modestly lower today (USD strength) despite trade deal hope fading but oil prices continued to rip…

Source: Bloomberg

WTI surged above $58 on the heels of a Reuters report that OPEC and its allies, including Russia, are likely to agree to extend crude production cuts until mid-2020 when they meet next month…

And finally, we note that Buttigieg has overtaken Biden…

Source: Bloomberg

And just in case you heard someone claiming the equity rally is in tact because credit hasn’t shown any signs of cracking… that’s not true… the junkiest debt is blowing out drastically…

Source: Bloomberg

And then there’s the fun-durr-mentals – Bloomberg reports that The Conference Board’s index of leading economic indicators has fallen three straight months, the worst streak since 2016.

Source: Bloomberg

“The major difference this month is the softening in the labor market, whereas conditions in manufacturing remain weak and show no signs of improvement yet,” Ataman Ozyildirim, senior director of economic research, said in a statement.

Tyler Durden

Thu, 11/21/2019 – 16:02

via ZeroHedge News https://ift.tt/35suEIB Tyler Durden