Hedge Funds Suffer 8 Straight Months Of Redemptions: Longest Stretch Since The Financial Crisis

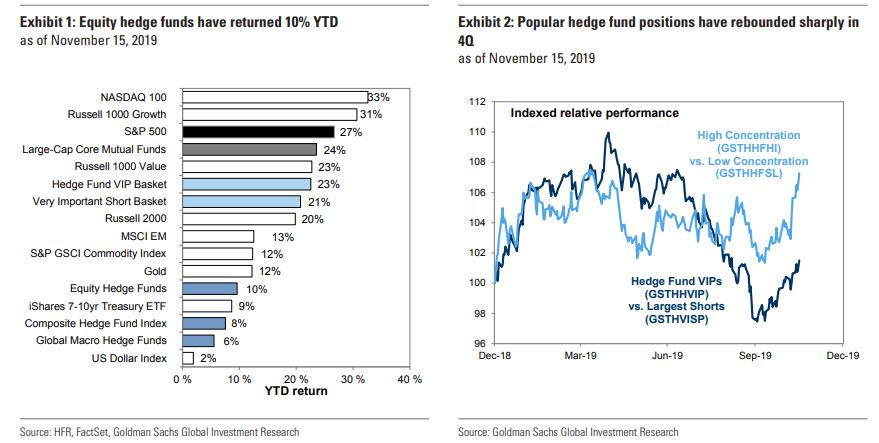

All things considered, it hasn’t been a terrible year for hedge funds, which unlike 2018 when by late November the average hedge fund was down almost double digits on the year, are up roughly 10% YTD according to the latest Goldman hedge Fund Trend monitor (and up only 6.7% YTD according to Bloomberg).

The only problem is that when compared to the broader market, which is up over 23% YTD, hedge funds are once again underperforming what over the past ten years has emerged as a risk-free benchmark (courtesy of central banks that step in any time there is even a modest drop). And since hedge fund investors get to pay roughly 2 and 20 (in reality, more like 1 and 12) for the privilege of failing to keep up with the free S&P500 for the 10th consecutive year (coincidentally, ever since the DOJ busted the “expert network” insider trading scheme in 2010) they are not happy.

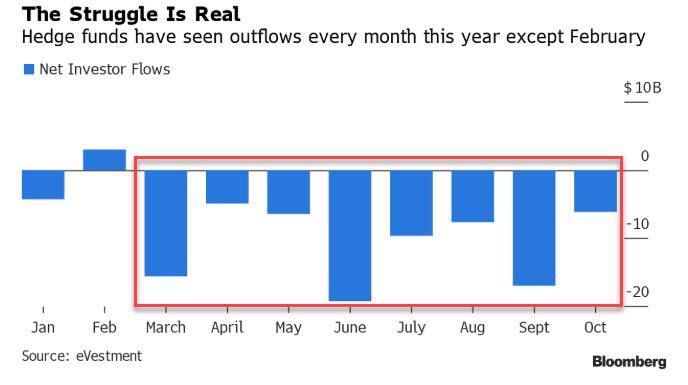

The result is that according to the latest monthly eVestment data, hedge fund managers suffered a record eighth straight month of client redemptions in October, the longest stretch of withdrawals since the 2008 financial crisis.

Most affected this year were long-short equity funds which had about $41 billion in redemptions, followed by macro managers who saw outflows of $23 billion.

And while investors pulled a total of $6.2 billion from their hedge fund last month, an improvement from September and the lowest monthly redemption since May, the overall trend is clear – redemptions for a year when the S&P is set to post its best return since 2013, have now hit a whopping $87.9 billion, more than double last year when stocks tumbled as more and more investors clearly capitulate on the idea of handing their money to the “smartest men in the idea dinner room” when they can generate higher returns just by buying and holding the SPY.

Meanwhile, the industry which once was a short cut to fame and fortune for any 30-year-old associate who made it to the buiyside, continues to contract as closures outpaced new entrants for four straight years, and several marquee names have shut funds or returned investor capital, most recently billionaire Louis Bacon, who as noted earlier, is set to shutter his Moore Capital after 30 years.

Yet while the majority of hedge funds have suffered redemptions, not everyone is hurting and as Bloomberg reports, about 45% of funds have posted net inflows, according to eVestment: event-driven funds have been a bright spot with inflows of $13.6 billion through October. Managed futures (i.e. CTAs) also saw allocations for a third consecutive month.

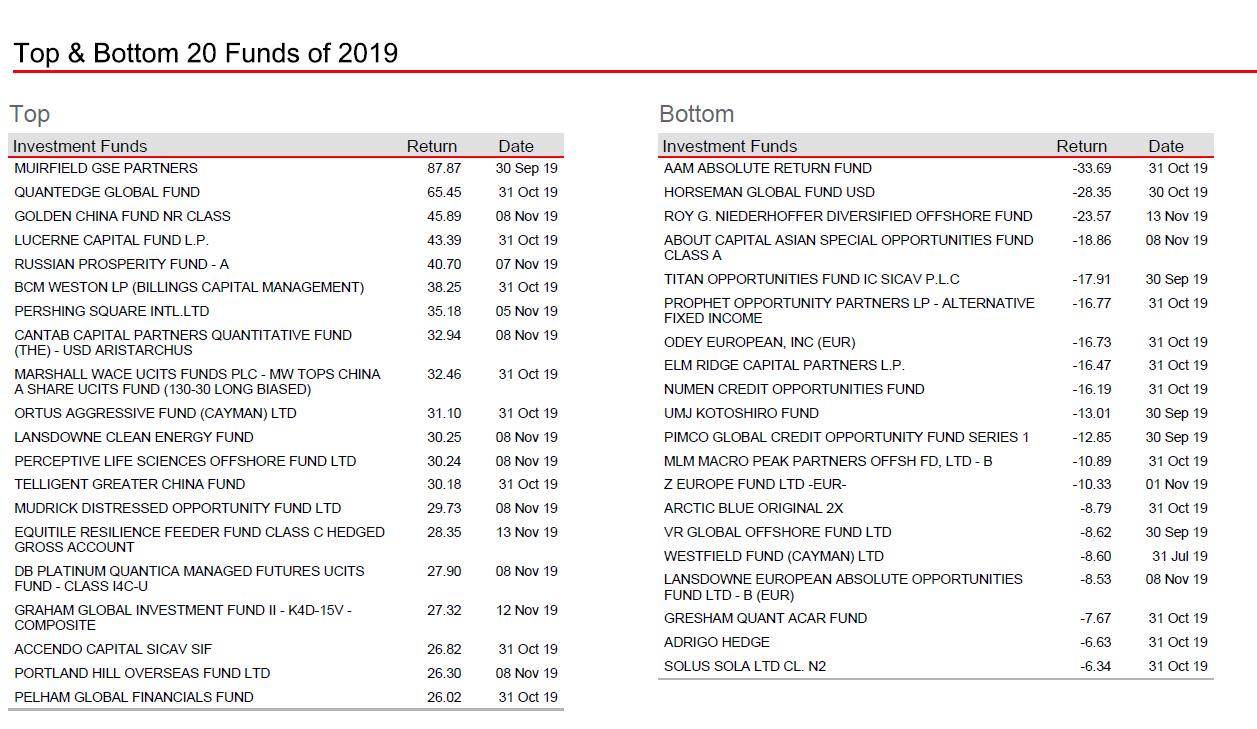

Finally, courtesy of HSBC, here is a list of the Top 20 best and worst performing hedge funds of 2019.

Tyler Durden

Thu, 11/21/2019 – 14:41

via ZeroHedge News https://ift.tt/35yh1aX Tyler Durden