Saxo Bank: “So Much Liquidity Has Been Injected In The Market, It Is Now Impossible To Withdraw It”

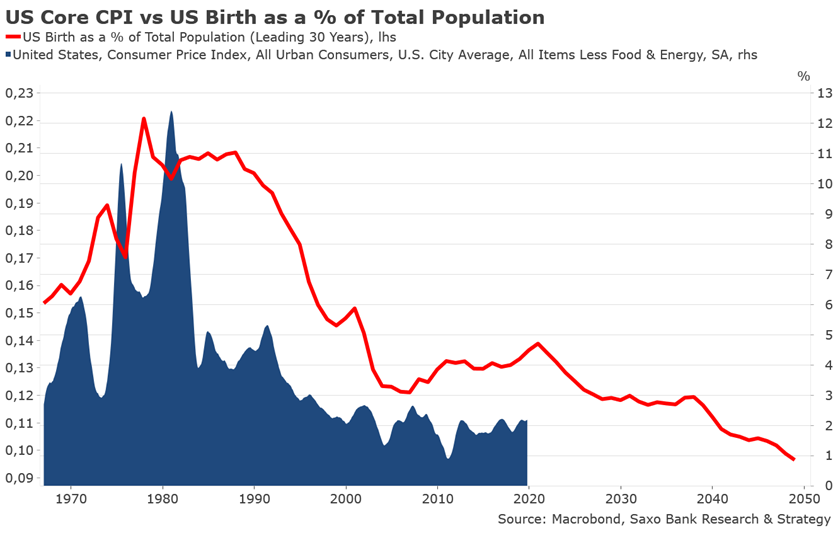

Earlier today we showed why, according to Saxo Bank’s Christopher Dembik, the US will drown in deflation over the next 30 years as the collective forces of demographics, technology, oligopolies and global debt accumulation make higher interest rates virtually impossible.

The Saxo strategist wasn’t finished, however, and then proceeded to lash out at the monetary policy that enable the current dead-end situation, stating that “we are all well-aware that monetary policy is not the right tool to stimulate the economy and the disadvantages of negative rates surpass the advantages, but we are doing more of the same and we are slowly reaching the point where central banks are becoming market makers in some market segments.“

What follows then is one of the most succinct explanations why – in a world in which the stock market is the economy – central banks can never again allow stocks to drop: “We – and I mean mostly policymakers – cannot afford the stock market to fall, as it would lead to contagion effect to the real economy.” And the punchline:

“So much liquidity has been injected in the stock market over the past years, it is now almost impossible to withdraw it.”

And that, in a nutshell, is why the Fed launched QE4 last month when the S&P was at all time highs, and the Fed was cutting rate – the central bank can’t take an even modest risk that stocks will ever again drop, period. Which is why before the current monetary experiment ends in disaster, the Fed will not only unleash negative rates, but it will buy corporate bonds, stocks, and everything else that is not nailed down to preserve the “western way of life.” In the end, it will fail, but not before tearing apart the very fabric of modern society and capital markets as we know them.

The full note from Dembik is below, and we urge everyone to read it:

I used to be skeptical about the risk of Japanisation of the economy but, as a matter of fact, we are facing this issue. Like in Japan, ultra-accommodative monetary policy has little positive effect on growth, negative rates mostly cause financial disruption, inflation is stuck to very low levels and structural factors, such as aging, are becoming the most important drivers of long-term growth. And, like in Japan, the cost of pretend and extend is increasing. We are all well-aware that monetary policy is not the right tool to stimulate the economy and the disadvantages of negative rates surpass the advantages, but we are doing more of the same and we are slowly reaching the point where central banks are becoming market makers in some market segments. This is already the case in the euro area sovereign bond market. Based on our calculations, the ECB owns around 70% of France’s public debt and around 80% of Germany’s public debt.

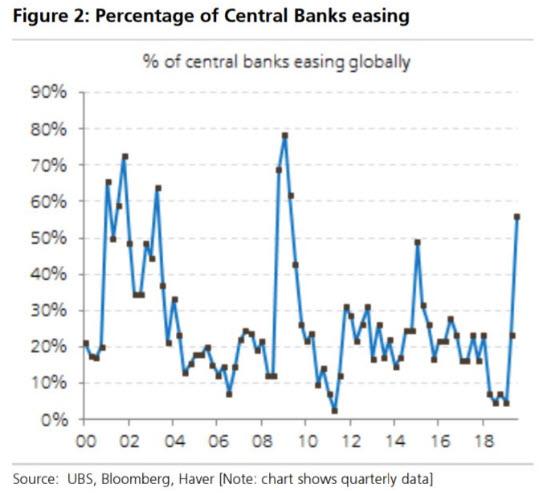

To some extent, I tend to agree with some of my colleagues that consider the stock market is the economy. We – and I mean mostly policymakers – cannot afford the stock market falls, as it would lead to contagion effect to the real economy. So much liquidity has been injected in the stock market over the past years, it is now almost impossible to withdraw it. The only solution is to keep injecting liquidity, which explains why around 60% of central banks are easing globally.

This is the highest level since the GFC. Higher interest rates and QT are virtually impossible in a world of debt. Looking only at USD-denominated EM debt, it is reaching 3.7 trillion USD, which represents an increase of 156% since 2008. This debt burden is not manageable if interest rates considerably increase. Policymakers are not ready to accept the social cost resulting from the end of the expansionary monetary policy.

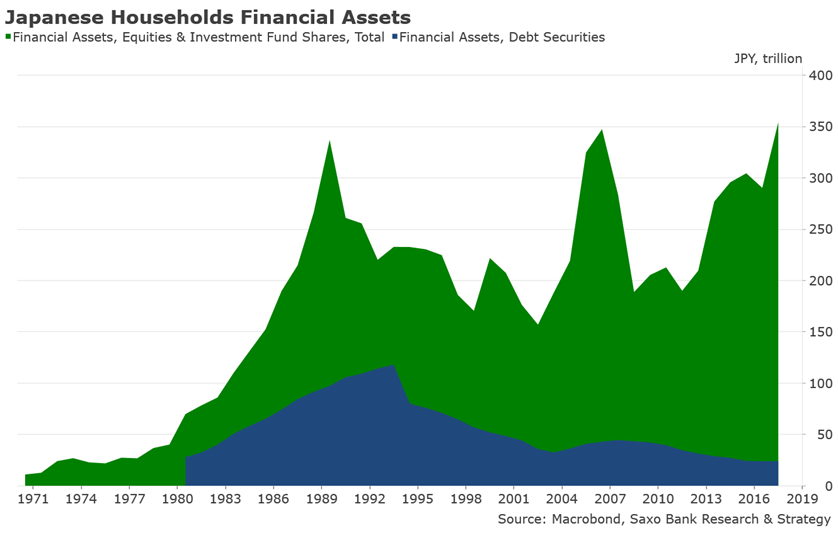

What does it mean for investors? If Japan is an example of what the future may hold for many countries, notably in Europe, it is likely that investors will favor the equity market over the bond market. In the chart below, you can see that equities have become the most attractive investment over the past 30 years in Japan.

It is easily explained by the fact that the BoJ’s monetary policy has fueled the stock market, especially export companies that have benefited from lower JPY. This may sound paradoxical but, in coming years, it is highly probable that the stock market will continue to perform quite well, and that PER will keep increasing. It does not mean that financial imbalances do not matter anymore.

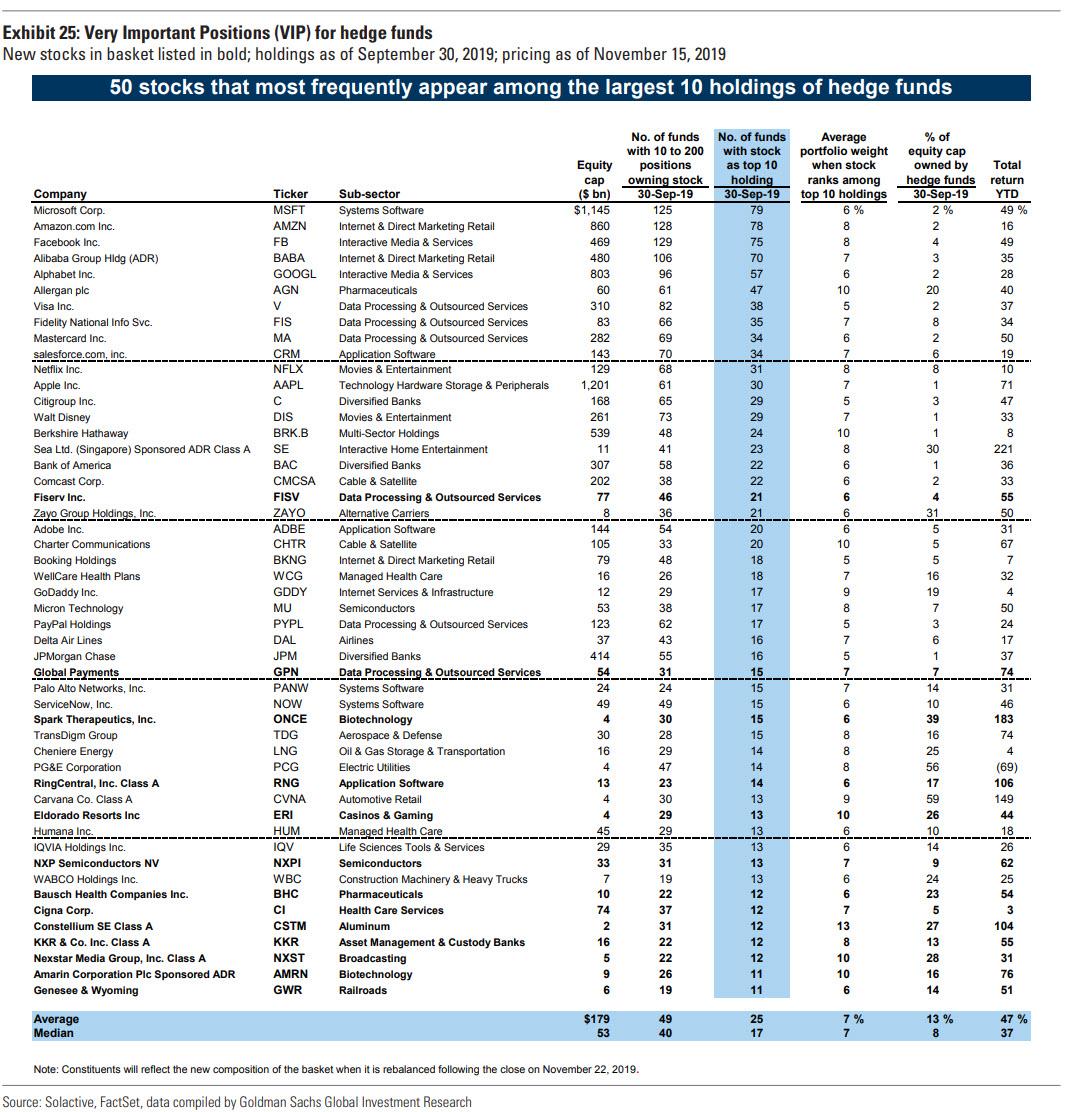

For instance, it is worrying that hedge funds continue to be crowded into just the same 5 tech stocks (Microsoft, Amazon, Facebook, Alibaba and Alphabet)…

… but, in a world of QE infinity and lowflation, there is no other alternative than stocks for investors seeking yields.

Tyler Durden

Sat, 11/23/2019 – 09:55

via ZeroHedge News https://ift.tt/35snK5V Tyler Durden