Despite Small Tail, 5Y Auction Comes In Hot With Highest Bid To Cover Since July 2018

One day after an impressive 2Y auction, that stopped well through the When Issued and saw a huge spike in Direct bidder demand, today’s sale of $41 billion in 5Y notes was more lukewarm.

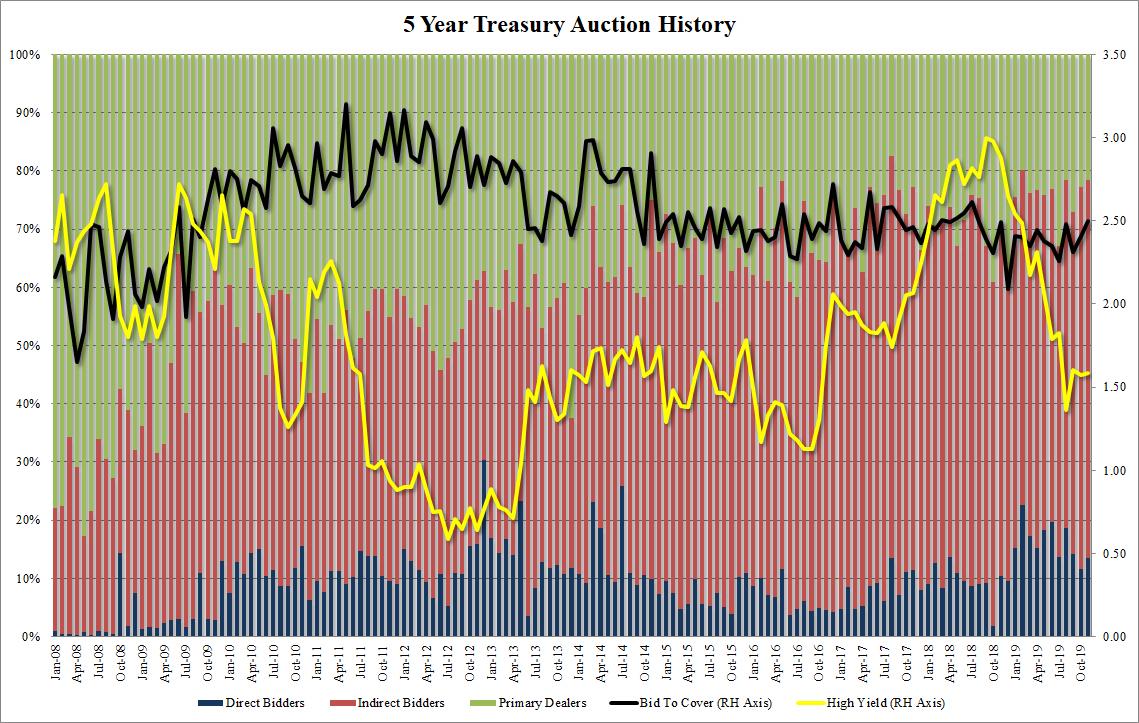

The auction stopped at a high yield of 1.587%, 0.3bps above the 1.584% When Issued and 1.7bps higher than the October auction yield of 1.570%.

Perhaps the most remarkable aspect of today’s auction was the jump in the Bid to Cover, which rose from 2.41 last month to 2.50, which was the highest going back all the way to July 2018.

Finally, the internals were generally in line, with Directs today taking down a far more modest 13.5%, about half of their activity in yesterday’s 2Y paper, and while above last month’s 11.5%, it was below the 6 auction average. And with Dealers taking down 21.6%, or modestly below the 25.3% six auction average, Indirects were left holding 64.8%, which while well above the recent average of 58.7%, was below last month’s 65.7%, the highest since August 2018.

Altogether this was another solid auction, despite the modest tail, and the stable demand made sure that the 10Y yield continues to trade just over 1 basis point lower on the day, if off the session lows.

Tyler Durden

Tue, 11/26/2019 – 13:16

via ZeroHedge News https://ift.tt/2KX131W Tyler Durden