Deutsche Sells $50 Billion Debt Portfolio To Goldman In “Bad Bank” Wind-Down

So far, Deutsche Bank’s efforts to offload troubled assets included in its ‘bad bank’ have been successful. The troubled German lender has already unloaded some assets to rivals including Goldman Sachs and BNP Paribas, and now Goldman is reportedly coming back for more.

Now, Goldman’s coming back for what Bloomberg described as a “$50 billion book of assets.” According to BBG, the assets are “tied to emerging market debt,” and were housed in DB’s ‘wind-down’ unit (or the ‘bad bank’, as it’s otherwise known, which was initially set up over the summer).

It’s difficult to tell whether the sale involved part of the derivatives portfolio, since BBG doesn’t include any information about the nature of the assets being sold.

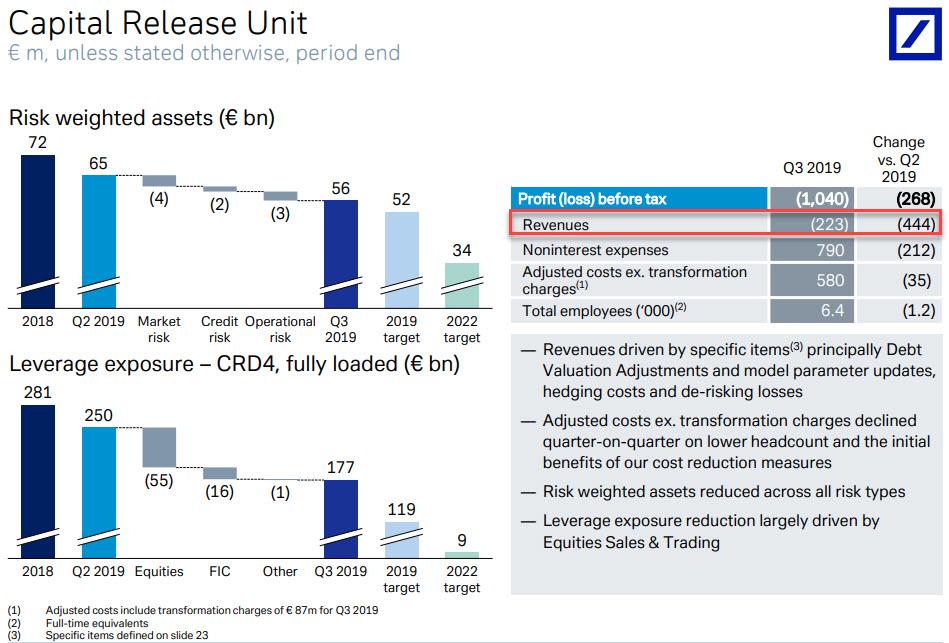

But even though DB managed to offload some of its most troubled assets, the unit still managed to book a €1 billion loss for Q3 (and there will undoubtedly be more losses as more assets are sold).

Still, investors reacted positively to the news since the toxic assets are a major obstacle to DB’s return to profitability. DB shares jumped 2% in European trade, cutting their YTD loss to 3.6%.

The asset sales are part of a broader turnaround effort announced by CEO Christian Sewing over the summer. To help reduce overhead, the bank has already begun cutting some 18,000 jobs around the world, contributing to some of the industry’s worst job losses since the financial crisis.

As the above graphic shows, when it comes to the bad bank, Sewing has promised to cut the leverage exposure, a critical risk metric used by regulators, to 119 billion euros ($131 billion) at the end of the year (from 177 billion euros as of the end of Q3). The portfolio sales are an important part of this plan.

It’s difficult to say how much this latest sale, or the earlier sales, will contribute to Sewing’s goal since notional value is different from the market value included on a balance sheet. When the unit was first set up, it was said to house €74 billion in risk-weighted assets, and there have reportedly been discussions about adding more, according to CNBC.

Tyler Durden

Wed, 11/27/2019 – 09:25

via ZeroHedge News https://ift.tt/33r6sEZ Tyler Durden