More Records For Stocks As Yield Curve Flattens, Dollar Rises For 7th Straight Day

“What’s your prediction for how this ends?”

China has been very quiet this week (despite the biggest collapse in industrial profits ever)…

Source: Bloomberg

UK’s FTSE leads Europe on the week…

Source: Bloomberg

Most US majors ended the day higher led by Small Caps and Tech (but Trannies underperformed)

VIX ended the day higher along with stocks…

Shorts were squeezed at the open for the 4th day in a row…

Source: Bloomberg

The odds of a trade deal slipped lower today…

Source: Bloomberg

Treasury yields rose across the curve today, but the long-end outperformed (2Y +4bps, 30Y +1bps) and 30Y remains lower in yield on the week…

Source: Bloomberg

The yield curve flattened significantly with 2s30s now at its flattest in almost 2 months…

Source: Bloomberg

The dollar is up again today – the 7th straight day of gains (to highest since Oct 11th)…

Source: Bloomberg

Cryptos had a big day today, with most scrambling back into the green for the week…

Source: Bloomberg

It seems $7k is a floor for now in Bitcoin…

Source: Bloomberg

PMs were lower on the day as copper managed very modest gains. Oil was chaotic again…

Source: Bloomberg

Gold gave back most of yesterday’s spike…

WTI dropped on the inventory and production data but the algos bid it back…

Probably nothing…

Source: Bloomberg

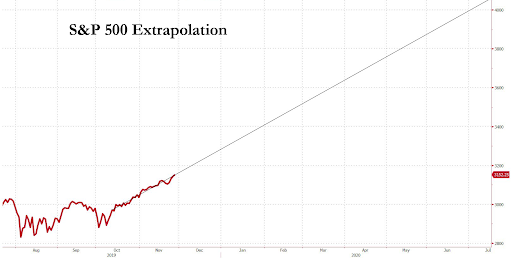

Finally, this is easy… 2013 deja vu all over again…

Source: Bloomberg

…And S&P 500 at 4,000 by June 30th?

Source: Bloomberg

Why not! Well they better start printing money faster or else!!

Source: Bloomberg

Because it’s all about the fun-durr-mentals…

Source: Bloomberg

In The Fed We Trust!

Congratulations to the @FederalReserve! 😀 You’ve successfully created the most extreme, pre-collapse yield-seeking bubble in U.S. history! With lower return prospects than Aug 1929! While encouraging a debt bubble where half of all “investment grade” debt is one step above junk! pic.twitter.com/GHVdekrJWl

— John P. Hussman (@hussmanjp) November 27, 2019

Tyler Durden

Wed, 11/27/2019 – 16:01

via ZeroHedge News https://ift.tt/2Dz5AUt Tyler Durden