8 Charts To Give Thanks For

Authored by Bilal Hafeez via MacroHive.com,

Today sees Americans celebrate Thanksgiving. It’s a holiday that brings families together, celebrates harmony, and recognizes the bounty of harvest. So what better time to remind ourselves that despite headlines crying out otherwise, not all is bad in the world.

Here are 8 charts with an optimistic take:

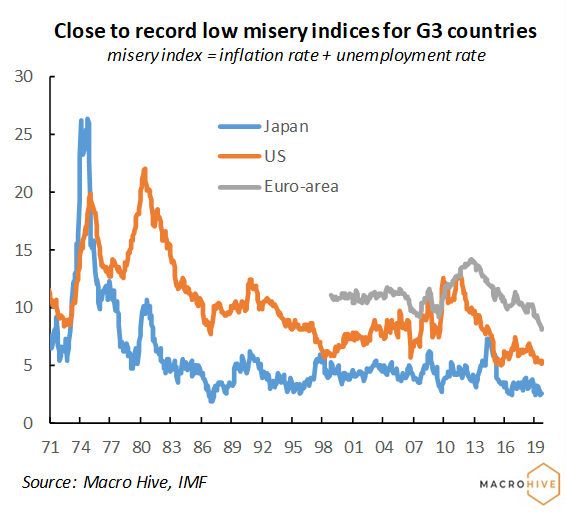

(1) Goldilocks Economic Conditions.

In the 1970s, the scourge of industrialised economies was high unemployment and high inflation. The sum of both indicators made the ‘misery index’. Today, low unemployment rates and equally low inflation have brought that index close to its lowest level ever for the major economies.

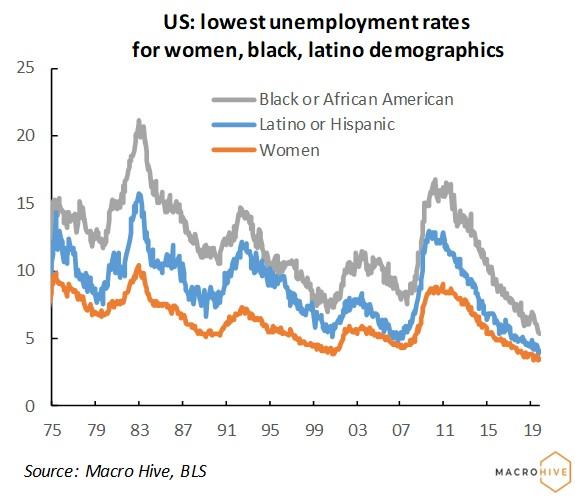

(2) US Jobs Market is Great Again for Neglected Demographics.

For all the rhetoric of increasing polarisation and discrimination in today’s society, one indicator at least has moved in the right direction: the unemployment rates for Women, Black, and Latino segments of the US population. These are at all at low levels – and most at their lowest on record.

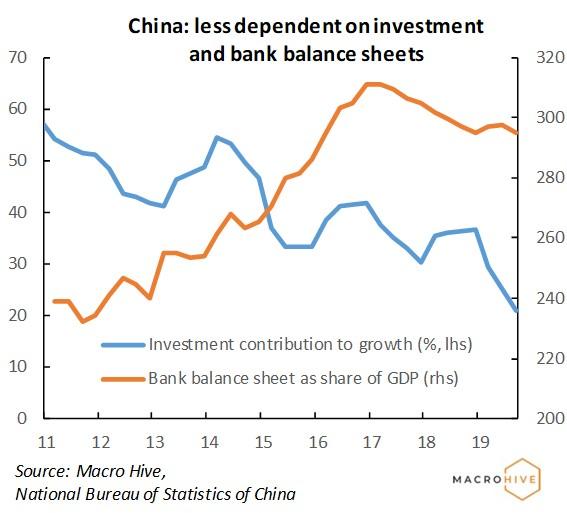

(3) China Finding Balance.

For too long China has relied on investment to generate growth. And often, it’s uneconomic bank lending financing this. Today the picture is different. 2019 has seen the lowest investment contribution to growth for years. And importantly, Chinese bank balance sheets have stopped expanding.

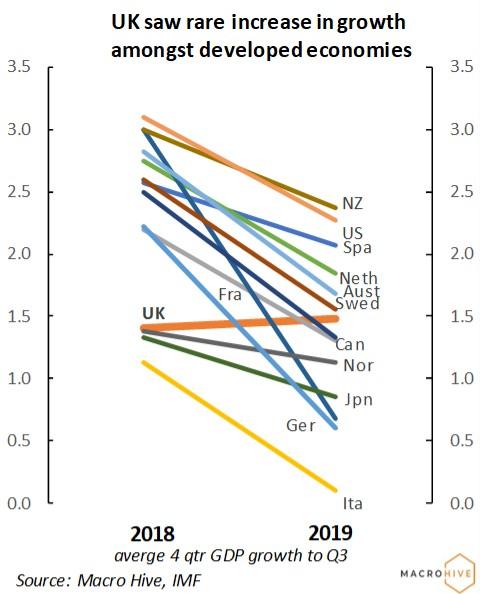

(4) UK Saw Growth Turnaround in 2019.

The UK has been in the doldrums since the Brexit vote. But this year saw every other industrialised economy hit by a trade-war-affected decline in the global cycle. Who bounced back during this decline? The UK.

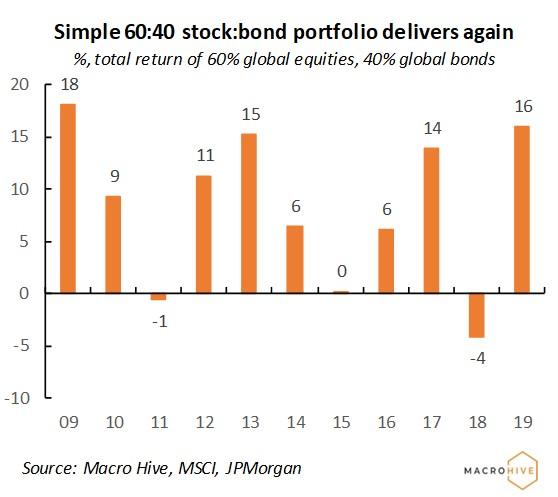

(5) The Simplest Investment Strategy Delivered Double Digit Returns.

While VC returns, smart beta, and macro hedge funds struggled in 2019, the plain vanilla 60:40 strategy came good. It delivered returns of over 15%.

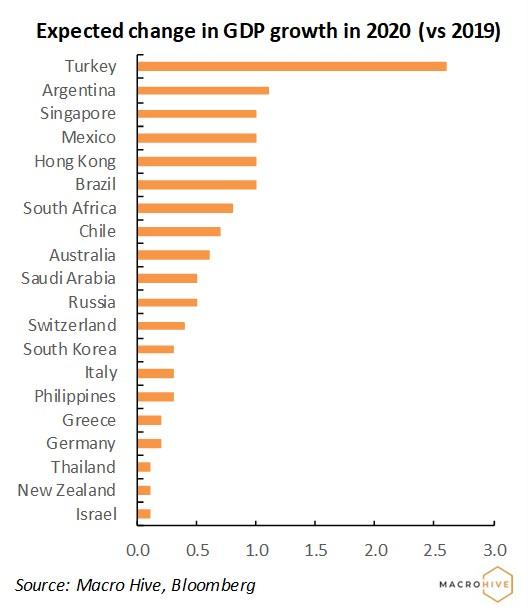

(6) Many Countries are Expected to See a Pick-up in Growth in 2020.

Global narratives can easily bog you down – seeing the whole world shifting one way or another. Instead, look at individual country growth forecasts. There we find many countries expecting higher growth next year compared with 2019: Argentina, Singapore, Mexico, Hong Kong, and standing out especially, Turkey.

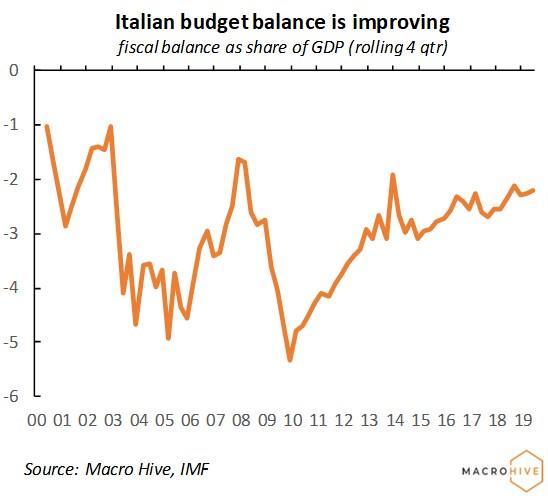

(7) Italy is Fiscally Responsible.

Everyone was worried that an anti-EU populist government in Italy would break all the fiscal rules. But looking at the actual numbers, Italy has been the exemplar of fiscal prudence.

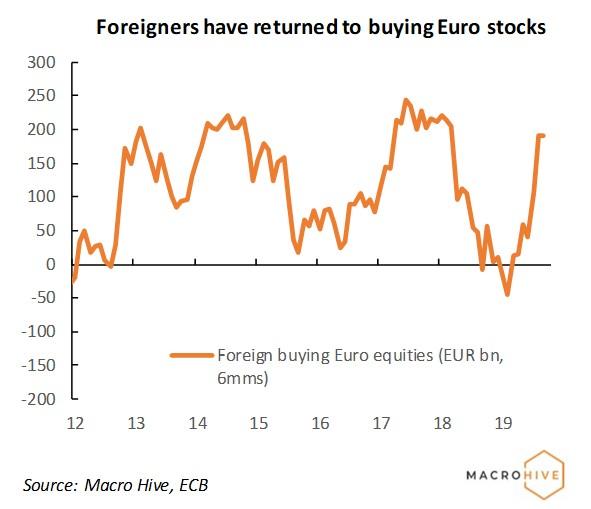

(8) Equity Investors See Value in Europe.

It’s easy to dislike the Euro-area: stagnant growth, weak banks, and a lack of innovation. However, equity investors are less dismissive. After selling Euro-area equities in 2018, they have entered the region with force. Clearly they see something others are missing.

Optimism? How long will that last?

Tyler Durden

Thu, 11/28/2019 – 11:15

via ZeroHedge News https://ift.tt/33uF60O Tyler Durden