Global Markets Stumble As Fresh Trade Tensions Flare Again

There is a distinct lack of stock market-boosting “trade deal optimism” overnight after Trump signed the legislation that expresses US support for Hong Kong protesters into law. Needless to say, China was furious at Trump’s endorsement of a bill that requires annual reviews of Hong Kong’s special trade status under American law, as well as sanctions against any officials deemed responsible for human rights abuses or undermining the city’s autonomy, and in response China’s Foreign Ministry said US interference unites the Chinese people against Washington’s “sinister intentions & hegemonic nature” and that China country will take strongcounter measures if the US continues this way, adding that US attempts to interfere in HK are doomed to fail.

“The bad news is, the trade war is still on,” Andy Kapyrin, director of research at RegentAtlantic Capital LLC, told Bloomberg TV. “I really don’t see substantial progress on trade with China,” and markets will perceive Trump’s signing of the bill negatively, he said.

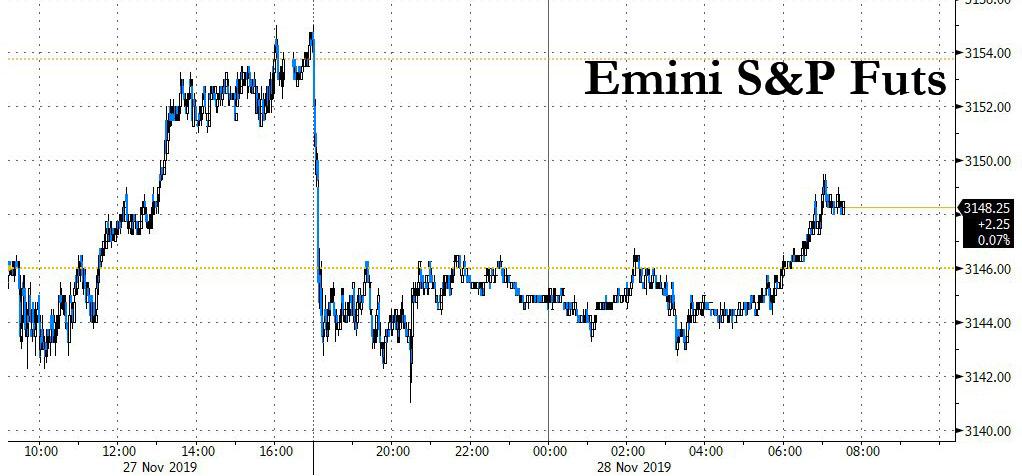

All eyes now on whether this impedes “phase one” negotiations, but until then a four-day rally that had lifted world stocks to near-record highs stalled and S&P futures are on the back foot after hitting a third consecutive record on Wednesday, even if they have managed to recoup almost half the overnight losses as traders clearly do not think the HK bill will hurt the trade deal. As a reminder, US markets are closed today for Thanksgiving holiday.

Fading hopes of a deal between the world’s two biggest economies before additional, potentially damaging tariff hikes kick in has lowered risk appetite, pushing the benchmark German 10-year government yield to its lowest since Nov. 1. The safe-haven yen gained against the U.S. dollar, recovering from six-month lows, while London’s FTSE index fell from two-month highs and Europe’s Stoxx 600 index was down 0.2%, led by trade-sensitive sectors such as autos, down 0.6% and tech, down 0.4%.

Euro zone economic sentiment rebounded more than expected in November, with more optimism in the services sector, data from the European Commission showed. Sentiment in industry, among consumers, and in industry all improved but remain below zero. The euro was little changed by the news. Data released on Thursday also showed that bank lending to euro zone companies in October rebounded, after dropping the month before.

Of course, since nothing can interfere with the goalseeked narrative pushing stocks higher, fears as to the extent of Chinese retaliation started to ease during London trading.

“When you see the optics of siding with Hong Kong against the mainland, that would seem at face value to be intuitively antagonist to the prospect of the trade negotiations,” said Jeremy Stretch, head of G10 FX strategy at CIBC capital markets. However, he said, “It may prove to be the case that despite the threat of a Chinese reprisal they may not be quite as significant or dynamic as feared. It is an external headwind but, for now at least, the markets are starting to take a slightly more sanguine viewpoint of the outcome.”

Asian markets mostly traded lower on this news, snapping a four-day rising streak with Indonesia leading declines, while Australia climbed. Technology and industrial shares were among the weakest. Japan’s Topix slipped 0.2%, as Keyence and Honda Motor weighed on the gauge. Japanese retail sales plunged 7.1% in October after a sales tax hike and a super typhoon kept shoppers at home. The decline in retail sales comes at a time when the Japanese government is mulling the size of a fiscal stimulus. An economy ministry official said after the release that sales were also hurt by a drop in overseas tourists, including visitors from South Korea, while car and appliance purchases slid by double-digits.

The Shanghai Composite Index closed 0.5% lower, dragged down by Kweichow Moutai and Industrial & Commercial Bank of China. A scorching rally in pork prices, which pushed China’s inflation to the highest level in seven years, is cooling. India’s Sensex fluctuated after closing Wednesday at a record, as investors awaited the country’s quarterly economic report due Friday.

This kept MSCI’s world equity index flat, after it approached the record reached in January 2018. However, the index is up almost 3% so far in November and is on track for the best month since June as investors flit in and our depending on the trade news.

With 10Y Treasuries closed for trading, European sovereign bonds were mixed, with British and Swiss notes edging up and Italian debt falling.

In FX, the pound held Wednesday’s gain against the dollar following a poll suggesting the U.K. election will deliver a large majority for the Conservative Party. However, the currency failed to build on its gains, trading steady against the dollar at $1.2910. It was little changed versus the euro after surging to its highest in nearly seven months at 85 pence in early London trading. Implementing Brexit by the end of January, as Johnson had promised, would leave him a “miniscule” 11 months to agree a trade deal with the European Union, analysts at Societe Generale told clients.

A drop in Latin American currencies turned into a rout Wednesday as Chile’s peso, Brazil’s real and Colombia’s peso all hit record lows following political unrest in the region.

In commodities, WTI crude oil prices are down -0.43% while, spot gold prices are up +0.16%.

Top US News from Bloomberg

- President Trump signed legislation that requires annual reviews of Hong Kong’s special trade status under American law, as well as sanctions against any officials deemed responsible for human rights abuses or undermining the city’s autonomy. A second Hong Kong measure also bans the export of crowd-control items such as tear gas and rubber bullets to the city’s police. China’s foreign ministry reiterated a threat of retaliation without offering any details

- Boris Johnson’s Conservative Party is on course to win a large majority of 68 seats in the Dec. 12 vote, according to a YouGov poll, which used a technique that more closely predicted the 2017 election than standard surveys

- Japanese retail sales plunged in October after a sales tax hike and a super-typhoon kept shoppers at home, a worse- than-expected outcome the government will need to consider as it mulls the size of a spending package to support growth

- Oil fell for a second day after U.S. crude production rose to a record and Trump signed a bill into law expressing support for the Hong Kong protesters

- China has ordered local governments to speed up the issuance of debt earmarked for infrastructure projects, so that the proceeds can be invested early in 2020 to help shore up the slowing economy

Major European bourses (Euro Stoxx 50 -0.2%) are broadly lower, with risk sentiment dented in wake of US President Trump’s signing of the Hong Kong Human Rights Bill to the consternation of China, who have threatened counter measures. “While this worsens the negotiation climate for a trade deal” note Danske Bank, “it is still our belief that the sides will be able to keep the Hong Kong issue separate and land a phase 1 deal before the 15 December when US-China import tariffs are scheduled to rise by 15%.” Elsewhere, FTSE 100 (-0.4%) is weighed on as a firmer Pound weighs on large-cap exporters after the YouGov MPR model predicted a healthy Conservative majority at the upcoming election, whilst heavy-weight miners bear the brunt on unfavourable base metal price action. However, Italy’s FTSE MIB (-0.7%) stands as the underperformer thus far, with domestic banks all pressured by unwelcomed action in the Italian fixed income complex. Sectors are mostly in the red, with only Energy (+0.2%) and Materials (+0.1%) modestly in positive territory. Moving on to the stock specific movers; Telefonica (+1.5%) shares advance after the Co. revealed a major overhaul to its business; it will focus more on its domestic market, Brazil, UK and Germany, whilst its remaining 8 Latin American businesses will form a separate unit which could potentially be sold. Moreover, two new businesses, Telefonica Tech and Telefonica Infra, will be created as part of the overhaul, with profits expected to be boosted by EUR 2.0bln by 2022. Elsewhere amongst the gainers, Ambu (+1.2%) and Red Electrica (+1.3%) shares are bid after the Cos received upgrades at Handelsbanken and Citi respectively. In terms of the laggards; declining net earnings and revenue see Remy Cointreau (-3.2%) shares come under pressure. Elsewhere, Proximus (-2.1%) shares are lower after the Co. appointed Guillaume Boutin as its new Chief Executive, effective on December 1st.

In FX, Sterling has extended its recovery rally from recent lows on the back of the latest UK election poll from YouGov that signals a relatively big win for PM Johnson and his Tory party at the forthcoming GE, albeit with the standard statistical error margins that could crimp the actual number of seats predicted to be claimed by the Conservatives. Cable has run into some resistance around 1.2950 and Eur/Gbp support circa 0.8500, but in thinner US Thanksgiving Holiday trade and with more month end models pointing to Dollar selling for portfolio rebalancing 1.3000 remains a realistic objective for the former, while a breach of the round number in the cross exposes 0.8475-70.

- EUR/NZD/JPY/CHF – All firmer against the Greenback as the DXY topped out just ahead of 98.500 following yesterday’s post-US data rebound amidst slightly less friendly US-China ties on HK lines compared to the Phase 1 trade accord that is said to be increasingly close to completion. However, the single currency continues to struggle above the 1.1000 level and faces more option expiry-related supply due to 1.1 bn rolling off between 1.1025-30 at today’s NY cut with little impetus via any of the latest Eurozone data ranging from encouraging economic sentiment indicators and M3 metrics to benign German state CPIs. Similarly, the Kiwi is still finding the air rare over 0.6400 even with a more pronounced, while the Yen and Franc are paring some declines from 109.50+ and near parity troughs respectively regardless of contrasting macro releases (Japanese retail sales weak vs stronger than forecast Swiss GDP). Note, Usd/Jpy could maintain its upward trajectory on technical grounds if the pair settles above another Fib (109.37) after breaching 109.20 on Wednesday.

- CAD/AUD/NOK/SEK – The G10 laggards, with the Loonie retreating further through 200 DMA resistance towards 1.3300 and Aussie meandering within a 0.6778-60 range following conflicting Q3 Capex figures overnight and as Aud/Nzd hovers near the bottom of 1.0558-24 parameters. Elsewhere, the Scandi Crowns have reversed course after failing to maintain bullish momentum through key chart levels yesterday against the Euro, as Eur/Nok bounces off sub-10.0750 lows to 10.1150+ and Eur/Sek to almost 10.5700 from around 10.5300 at one stage. Soft crude prices may be a factor hampering the Norwegian Krona, but its Swedish counterpart is not deriving any support from decent business sentiment or retail sales.

In commodities, crude markets are lower, with prices weighed by a combination of trade concerns after US President Trump signed the Hong Kong Bill and yesterday’s surprise build in crude inventories and larger-than expected build in gasoline stocks revealed by the EIA. Front month WTI and Brent contracts for now trade just above support in the form of yesterday’s post EIA data lows at the USD 57.50/bbl and USD 62.45/bbl marks. Elsewhere in crude specific news; Russia said that the exclusion of Russian gas condensate production from their output calculations for OPEC+ is going to be a topic of discussion regarding agreements post March 2020 at the upcoming OPEC+ meeting on December 6th, confirming overnight reports. The report noted that given the growth that the country has seen in gas output, condensate production has increased in tandem, leading ING to conclude that “this would help to explain why Russia has failed to fully comply with the production cut deal for much of this year.” Elsewhere, Libya’s El Feel oil field (70k BPD) is said to have resumed production, after violence in the region which disrupted production yesterday. Looking at the metals, gold is slightly firmer, but struggling to gain impetus despite the more downbeat macro backdrop and slightly softer buck; the precious metal is off yesterday’s USD 1452/oz lows, but struggling to break above the USD 1458/oz level, which has capped the price action so far this morning. Meanwhile, the return of Hong Kong related US/China trade jitters has hit copper prices, which have continued to slide during European trade.

US Event Calendar

- US closed due to Thanksgiving holiday

Happy Thanksgiving to all our US readers but in reality I hope you’re not reading this and enjoying time with your family instead. I’m in Holland at our annual outlook presentation for Dutch clients that is held on this day every year. Expect markets to be quiet today although the reality is that things have already slowed to a crawl in the last 24 hours.

Having said that, the key headline overnight has been that President Trump has signed the legislation that expresses US support for Hong Kong protesters into law. As we have mentioned before, the bill requires annual reviews of Hong Kong’s special trade status under American law, as well as sanctions against any officials deemed responsible for human rights abuses or undermining the city’s autonomy. China’s Foreign Ministry said in response that the country will take strong counter measures if the US continues this way and added that US attempts to interfere in HK are doomed to fail. All eyes now on whether this impedes “phase one” negotiations.

Asian markets are trading lower on this news with the Nikkei (-0.10%), Hang Seng (-0.24%), Shanghai Comp (-0.38%) and Kospi (-0.28%) all down. Elsewhere, futures on the S&P 500 are trading -0.28% and in commodities, WTI crude oil prices are down -0.43% while, spot gold prices are up +0.16%. As for overnight data releases, Japan’s October retail sales fell by -7.1% yoy (vs. -3.8% yoy expected) as a planned sales tax hike came into effect and a super-typhoon kept shoppers at home. The decline in retail sales comes at a time when the Japanese government is mulling the size of a fiscal stimulus. An economy ministry official said after the release that sales were also hurt by a drop in overseas tourists, including visitors from South Korea, while car and appliance purchases slid by double-digits.

Before this, at 10pm GMT last night, the much anticipated YouGov MRP model was released. This model correctly predicted a hung parliament in 2017, 9 days before the election when normal polls were still showing a Conservative majority. This model covers more than 100,000 potential voters and is much more seat by seat in its projections than normal polls. It projected a 68-seat Conservative majority, with 359 seats compared to Labour’s 211. The model predicts the SNP will control 43 seats and the Liberal Democrats 13 seats. Sterling rallied a few tenths of a percent on the news and it is trading +0.09% this morning. Just before the MRP model, a SavantsComRes Poll showed a Tory lead at 7pts down 3pt since last Thursday, but the market is clearly following the more statistically rigorous poll for now. Interestingly, the press release for the MRP suggested that if the current 11 point lead was cut to 7pt (as a couple of rival polls have shown this week) then it could lead to a hung parliament. So a healthy lead for the Tories but they need to maintain it if they want to win.

Staying with politics, it’s interesting to see that PredictIt now puts Elizabeth Warren’s odds for the 2020 democratic nomination below that of both Biden and more notably Buttigieg now. Warren led both as of just 5 days ago so there’s been a fairly significant shift away from her and towards the two more moderate candidates since her betting odds peaked on October 4th. This move has been mirrored in opinion polls, where Warren has lost 6pp of support since early October (to 15%) while Buttigieg has gained 4pp to (to 9%), while Biden has stayed steady at 30%. Demographically, Warren and Buttigieg draw most of their support from similar groups, namely college-educated white voters, who have apparently shifted their preferences recently. Partially, the fall in support for Warren has been driven by a weaker debate performance in early October, where multiple candidates attacked her over her expensive health care plan. It’s also notable that since her odds peaked on October 4th the S&P 500 has returned +6.83%. That was after markets struggled through August and them limped in September when her support was gaining. There were other things going on but there might be some correlation. All that said, the first primary is still far away on February 3, and the outcome remains tight and changeable.

Also overnight we heard from Bank of France governor Francois Villeroy de Galhau and he said that as a first step in a strategic evaluation the ECB should be clarifying the inflation goal. He said, “First, about the definition of our primary objective of price stability, we have to clarify in particular our various time horizons as well as our commitment to symmetry,” while adding a second step would be that the review should look into whether a separation between monetary and macroprudential policies should be lifted. He also added that third step of the overhaul should be to look at how climate change can be incorporated into the ECB’s monetary-policy analysis. The symmetry line will be the key take-away today.Whether markets believe the ECB could ever achieve this is another matter.

Back to yesterday and at the margin sentiment leaned a bit more positive with the heavy slate of data releases in the end not doing much to change the narrative for the Fed outlook. We’ll come to that further down but just in terms of markets, the S&P 500 and NASDAQ nudged up +0.42% and +0.66% on low volumes, which sent both to another round of all-time highs. For the S&P that also means that of the 19 trading days in November, the index has seen a positive return in all but 5 of those sessions. The positive-leaning sentiment also saw US 10y yields nudge a bit higher, +2.8bps to 1.769% with 2yrs up 4bps, helping the 2s10s curve to flatten -1.5bps to 14.1bps. Meanwhile, in Europe the STOXX 600 gained +0.32%, taking it to just 1.03% away from its all-time high from April 2015. The DAX and FTSE100 both gained similar amounts, up +0.38% and +0.36%. Fixed income was more muted, with bund yields down -0.1bps and OATs up +0.3bps.

In other news, Colombia’s anti-government demonstrations lost steam yesterday as fatigue set in after seven straight days of protests. Elsewhere, the Chile’s peso (-2.39%), Brazil’s real (-0.50%) and Colombia’s peso (-0.92%) all hit record lows yesterday as the region continues to be marred by elevated political risks.

Onto the details of the US data now. In order of relative importance, the preliminary October durable and capital goods orders data broadly beat expectations with most notable being the readings for durable goods ex transport (+0.6% mom vs. +0.1% expected) and core capex orders (+1.2% mom vs. -0.2% expected). The latter helped the six-month annualised trend also bounce back into positive territory while the year-over-year rate also appears to be stabilising, which should encourage the Fed.

As for the GDP data, the second reading for Q3 was revised up two-tenths to 2.1% qoq saar, helped by inventories, business sentiment and slightly stronger consumer data. The lone weakness was Q3 core PCE prices, which were revised down to 2.1%, albeit still growth friendly, while growth in corporate profits essentially slowed to a halt, rising just +0.2% qoq versus +3.8% in Q2. It’s worth noting that corporate profits are now down -0.8% yoy so the trend has been much weaker, even though we’re a long way from the energy crisis lows. It highlights how well the S&P 500 has done to rally hard this year. Although a different subset of firms, the S&P has obviously benefited more from buybacks and liquidity than raw earnings.

Not long after this data we got the November Chicago PMI, which improved +3.1pts to 46.3 even if that was a shade disappointing relative to expectations for 47.0. While this reading is off the lows it still remains weak and the ISM adjusted Chicago PMI at 46.9 is only just above the cycle lows in September. The remaining data was a bit of a wash with softer personal income data for October (0.0% mom vs. +0.3% expected) offset by slightly stronger-than-expected real personal spending data (+0.1% mom vs. 0.0% expected) while the core PCE deflator for October was in line at +0.1% mom, though the yoy figure was weaker at 1.6% versus expectations for 1.7%. That will likely force the Fed to lower their inflation forecasts for the fourth quarter.

Meanwhile, in Germany the October import price index matched expectations at -0.1% mom and November consumer confidence in France ticked up 2pts to 106 (vs. 104 expected) putting it at the highest since June 2017.

Looking at the day ahead, given the holiday in the US, data releases will be focused in Europe with preliminary November CPI due in Germany, October money and credit aggregates data due for the Euro Area and November confidence indicators for Europe. Away from the data we’re due to hear from the ECB’s Villeroy de Galhau, Coeure and Lane.

Tyler Durden

Thu, 11/28/2019 – 08:09

via ZeroHedge News https://ift.tt/2L1yT65 Tyler Durden