Automakers Offer Record Incentive Spending As Trillion Dollar Auto Bubble Becomes Unsustainable

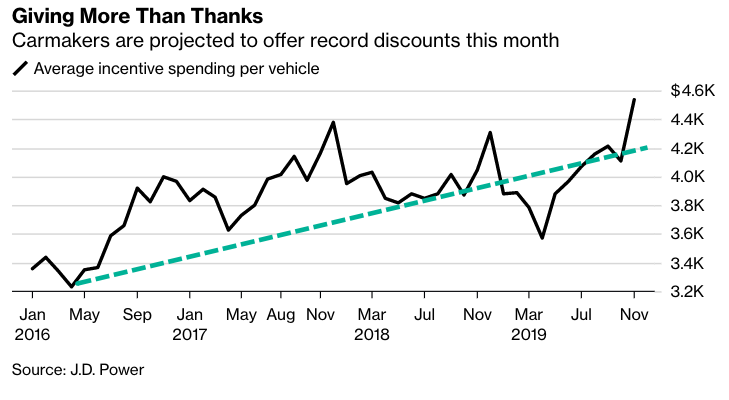

Early last month, we outlined how automobile sales deteriorated in late summer and prophesized how “this would set the stage for increased incentive spending by carmakers, who will be desperate to clear inventory heading into the end of the year.”

It seems that we were right. Automakers are now offering the most discounts on record to entice deadbeat consumers in November, according to a new report from JD Power.

The average incentive spending per vehicle is $4,538, an increase of 12% YoY. The previous high for the industry was $4,378 in 4Q17.

Inventories for older model-year vehicles have soared in 2H19, forcing automakers to boost incentive spending to clear excess inventory.

With the average APR to finance a vehicle around 5.3% for the month, the average transaction price remained above $34,000, down from $179 from last month but up $622 over the year.

As a result of low rates and record-high incentives, consumers spent $40.3 billion on new vehicles in November. This figure is up $2.7 billion from 2018.

Thomas King, Senior Vice President of the Data and Analytics Division at JD Power, said, manufacturers will offer even greater incentives through December, and the trend could continue into early 2020.

“Incentive spending typically rises by 3-4% in December, which would continue to drive overall spending to unprecedented territory,” King said.

King warned: “This [incentive trend] is concerning for the health of the industry when combined with rising sub-prime sales, which are growing at the highest rate since August 2018.”

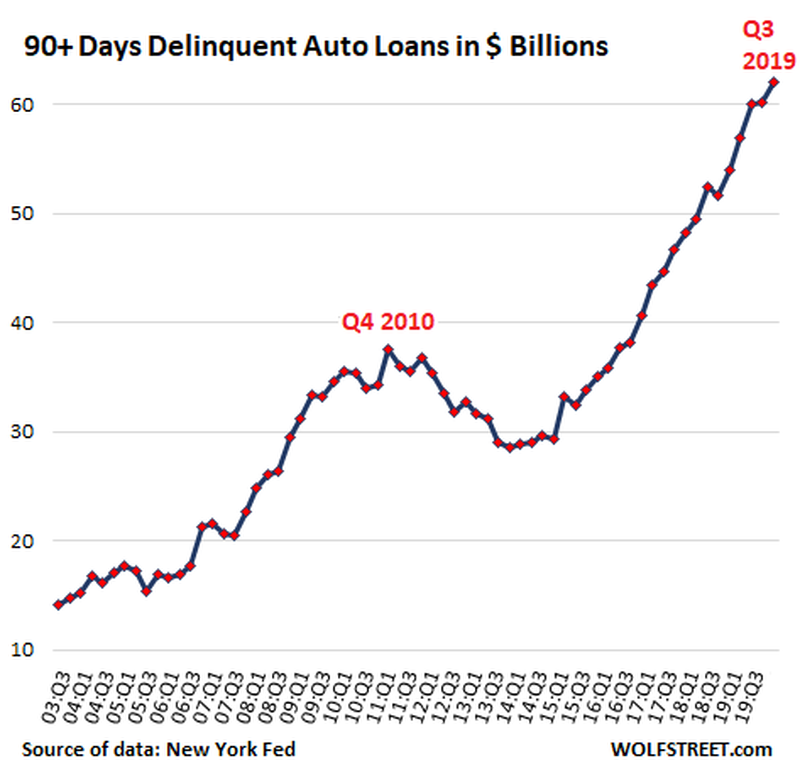

We recently noted serious auto-loan delinquencies (more than 90 days past due) in Q3 hit a historic high of $62 billion.

“This $62 billion of seriously delinquent loan balances are what auto lenders, particularly those that specialize in subprime auto loans, such as Santander Consumer USA, Credit Acceptance Corporation, and many smaller specialized lenders are now trying to deal with. If they cannot cure the delinquency, they’re hiring specialized companies that repossess the vehicles to be sold at auction. The difference between the loan balance and the proceeds from the auction, plus the costs involved, are what a lender loses on the deal,” wrote Wolf Richter via WolfStreet.com.

Automakers are recklessly blowing up a $1.32 trillion bubble, by ramping up subprime loans to deadbeat consumers. Recent incentive increases have taken the bubble blowing to an entirely new level that is not sustainable.

Tyler Durden

Sat, 11/30/2019 – 15:00

via ZeroHedge News https://ift.tt/2q5taor Tyler Durden