Trader: What We’ve Seen In The Past Two Years Is At Odds With Everything

Global equities are gliding serenely into the end of 2019, even in the face of a dire economic landscape. To justify an exuberance that looks anything but rational, global activity will need to turn around dramatically.

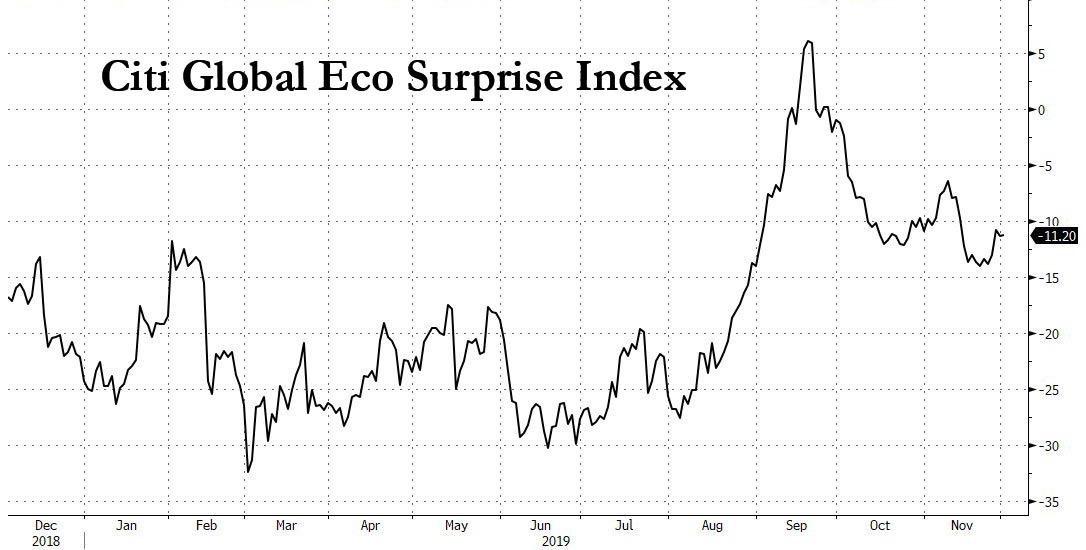

After a brief moment back above zero, Citigroup’s global economic surprise gauge has dropped back into negative territory

Maybe that’s why markets have been so eager to celebrate data beats such as U.S. GDP and China Caixin PMIs, despite indicators remaining at anemic levels. Shockingly poor releases last week like the South Korean and Japanese industrial output, or the Chicago PMI were shrugged off as revealing nothing new. [ZH: today’s dreadful ISM however was not as easily overlooked].

While the overall tone of the data being released is far more stable, the tinge of green in the economic landscape is more redolent of a stagnant swamp than shoots ready to sprout.

Just look at 3Q U.S. GDP. The 2.1% second reading beat expectations, sure, but it isn’t anything to get hugely excited about. Economists forecast the U.S. will expand less than 2% in each of the next two years — the slowest pace since the 2009 recession.

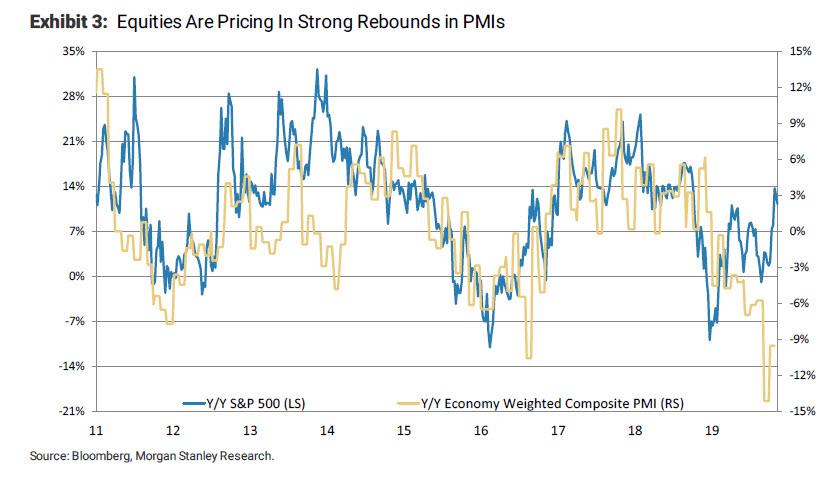

Meanwhile, global GDP sagged dramatically last year as stocks melted down. Since then, activity has stayed depressed even as equities rebounded. This behavior is at odds with past episodes – typically growth and stocks bounce back together after such a decline.

Hence the stubborn bid for bonds, which have been reflecting a fragile global economy all year. That’s why swaps are still pricing in rate cuts for many major central banks.

Recent equity rallies were largely driven by optimism the U.S. and China will reach a phase-one deal, so much of the trade upside has been priced in. A milquetoast accord, or more prevarication could lead to a savage reversal. Even a strong agreement would leave stocks still in need of a data rebound to justify further gains.

If economic prospects darken, central banks are just about out of ammunition. Further Fed easing from here would signal the previous insurance cuts failed to head off recession. The 2019 FOMO rally’s resilience has taken it far enough in the face of a cloudy forecast.

Any declines from here could get very steep indeed.

Tyler Durden

Mon, 12/02/2019 – 14:45

via ZeroHedge News https://ift.tt/2OEDddA Tyler Durden