Asian Economic Avalanche: The Good (China), The Bad (Japan), & The Really Really Ugly (Hong Kong)

A smorgasbord of data from AsiaPac tonight poured a big bucket of cold water on the hopes for a trough in global growth.

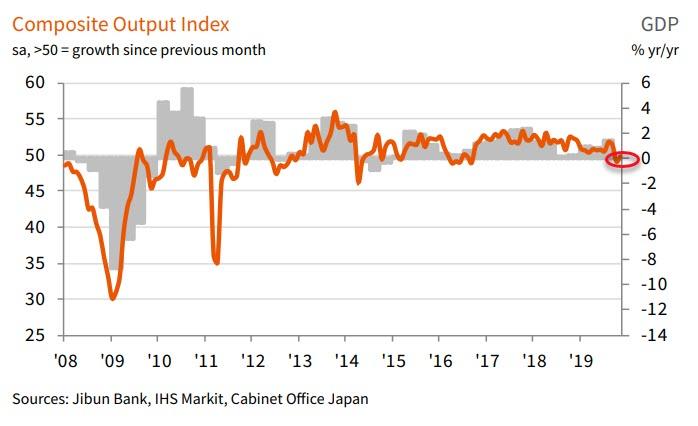

Japan was first out of the gate with its Services PMI (slightly better than expected) but the Composite PMI remains below 50 (in contraction)

Source: Bloomberg

A typhoon and bad weather in October have also made it hard to discern the economy’s underlying strength. Economists have long forecast a contraction in the last three months of this year as the sales tax increase hits domestic consumption.

Commenting on the latest survey results, Joe Hayes, Economist at IHS Markit, said:

“November data is highly discouraging for the Japanese economy. October was difficult to interpret as a consequence of the consumption tax hike and powerful typhoon. A rebound was to be expected in November, but disappointingly, the strength of the recovery was limited, with activity growing only marginally.

“No notable acceleration in new business growth was also seen, suggesting that underlying demand conditions in Japan’s service sector have weakened so far in the fourth quarter.

“Japan’s service sector has been robust in 2019 so far, doing a good job at offsetting the strong drag from manufacturing.

However, based on survey data so far in the fourth quarter, a contraction in economic output seems highly plausible as we head into year-end.”

Additionally, rubbing salt in the already sore wounds of the Japanese economy, Japanese car sales in South Korea collapsed 56.4% YoY as tensions between the two nations spark backlash.

But, all will be fixed soon as Japan is preparing an economic stimulus package worth 13 trillion yen (S$163 billion) to support fragile economic growth, two government officials with direct knowledge of the matter told Bloomberg yesterday, complicating government efforts to fix public finances.

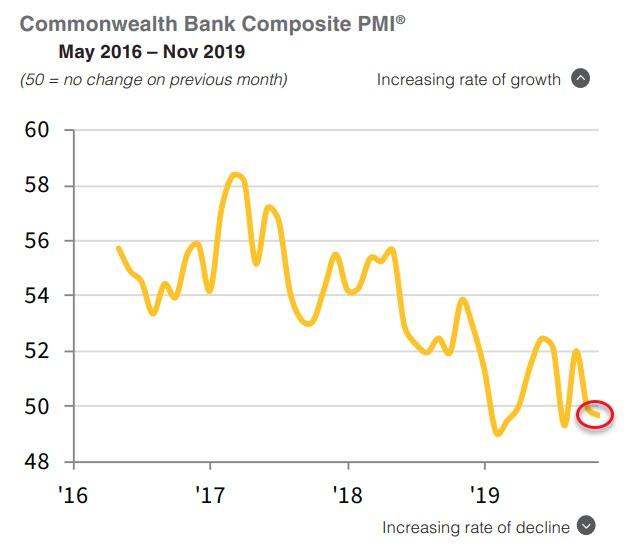

Next up was Australia, where GDP grew at only 0.4% QoQ, weaker than the expected 0.5% with consumption remaining very weak (+0.1%). As a reminder, Australia has gone 28 years without a (formal) recession.

This follows a drop in Australian services business activity in the middle of the fourth quarter, accompanied by subdued sales growth, which remained constrained by a further fall in export demand. Job creation was marginal.

November data indicated that the decline in business activity occurred amid subdued demand conditions.

Then came the real fun as Hong Kong’s Composite PMI crashed to a record low of 38.5 in November, with the sharpest drop in new business since the trough of the crisis in Nov 2008…

The average PMI reading (38.9) for October and November combined indicates the economy is on course for its weakest quarter since the survey’s inception over 21 years ago.

Commenting on the latest survey results, Bernard Aw, Principal Economist at IHS Markit, said:

“November PMI data indicated that Hong Kong’s private sector suffered its worst downturn since the 2003 SARS crisis, with the latest survey indicators painting a picture of gloom for the Special Administrative Region.

“The survey showed that the escalating political unrest saw business activity shrinking at the steepest rate since the survey started in July 1998. This occurred concurrently with the sharpest decline in new sales since the depths of the global financial crisis.

“The business outlook unsurprisingly remained gloomy, with confidence still stuck among the lowest levels seen in the survey history. In a further sign of pessimism, firms continued to make deep cuts to purchasing activity and inventories, reducing both at a survey record pace.”

And finally, Aw notes, “The average PMI reading for October and November combined showed the economy on track to see GDP fall by over 5% in the fourth quarter, unless December brings a dramatic recovery.”

And then came the big kahuna – China Services (and Composite) PMI. After China’s government-provided PMI surged magnificently out of nowhere (despite a record collapse in industrial profits), all eyes are on the Caixin data tonight, which also surged dramatically from 51.1 to 53.5 (smashing expectations of 51.2)

Source: Bloomberg

But, oddly, employment fell to 51.0 – the weakest since July 2019.

Commenting on the China General Services PMI™ data, Dr. Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group said:

“The Caixin China General Services Business Activity Index edged up to 53.5 in November, a marked increase from 51.1 in the previous month, marking the highest growth rate since April this year. The reading indicates a recovery in activity across the services sector.

1) The gauge for new business picked up from a recent low in October with a solid rebound in the measure for new export business, indicating domestic and foreign demand both improved.

2) The measure of outstanding business fell back into contractionary territory after two straight months of expansion, suggesting a strengthening capability on the supply side in the services sector. The employment gauge fell marginally in November from the previous month, which marked the most modest expansion since July.

3) The gauge for prices charged by service providers rose marginally, but the reading for input costs edged down, indicating greater company profitability. In the meantime, the measure for business expectations picked up strongly, but was still lower than the long-term average, reflecting depressed business confidence.

This surprising surge in Services sent the China Composite PMI to its highest since Feb 2018…

Source: Bloomberg

“The Caixin China Composite Output Index rose to 53.2 in November from 52 in the previous month, the highest since February 2018. The employment gauge bounced back into positive territory, reflecting easing pressure on the labor market. The measures for new orders and new export orders remained at relatively high levels, reflecting a continuous improvement in demand. The gauge for input prices edged down, pointing to easing pressure on the costs of companies. But business confidence was still weak, with the measure for future output expectations down from October.

“China’s economy continued to recover in November, as domestic and foreign demand both improved. But business confidence remained subdued, reflecting the impact from uncertainties generated by the China-U.S. trade conflicts. That will restrain a recovery in economic growth. The trade dispute is the major reason behind the slowing economic growth this year, and will become a key factor affecting the stabilization and recovery of China’s economy next year.”

PBOC fixed the Yuan notably weaker tonight as the plunge in offshore yuan accelerated after Washington voted on the China Human Rights bill.

Source: Bloomberg

This summed things up rather perfectly…

Their numbers are getting better even during a trade war, a global slowdown, and HK falling into the abyss #ChineseMagic https://t.co/WFbR9otGCE

— Jin SEO (@JTSEO9) December 4, 2019

Do you believe in miracles?

Tyler Durden

Tue, 12/03/2019 – 20:56

via ZeroHedge News https://ift.tt/2OMWjhH Tyler Durden