Dismal 2019 Numbers Show Why Illinois Pensions Will Continue To Fail

Authored by Ted Dabrowski and John Klingner via Wirepoints.org,

The Commission on Government Forecasting and Accountability’s special pension report released this week shows yet again how strong markets and ever-more taxpayer funds can’t fix the flaws in the state’s politician-run pension system.

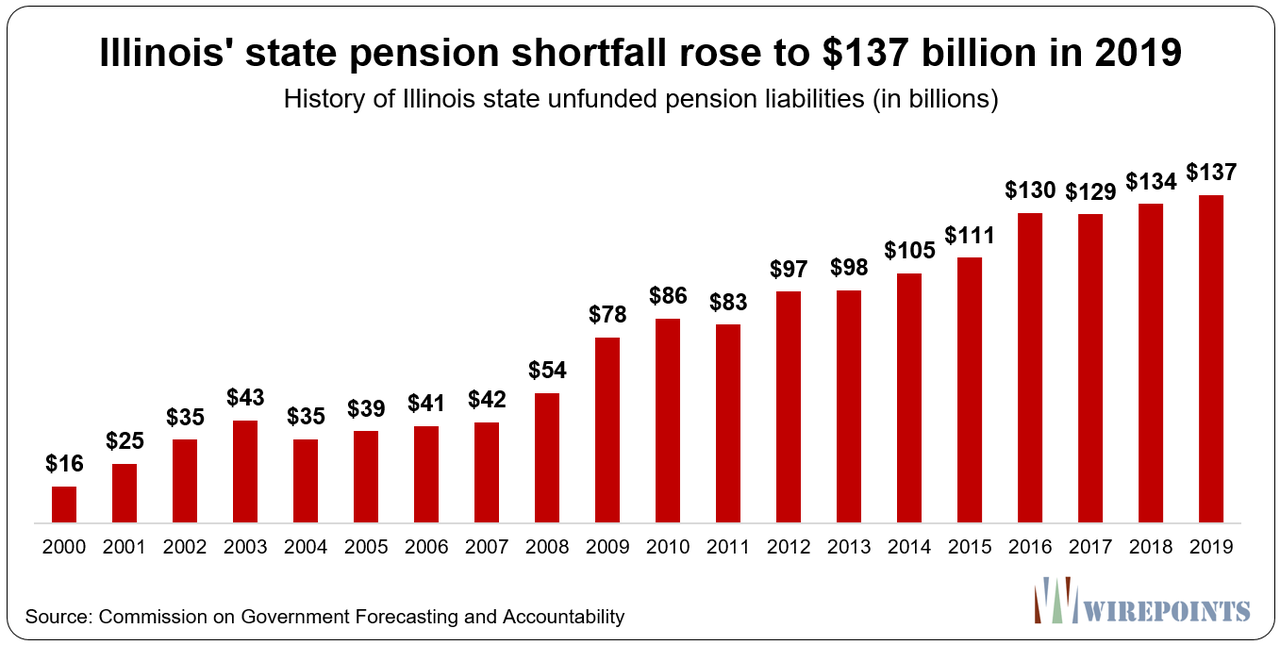

Illinois’ pension shortfall grew to a record $137 billion in 2019, up from $134 billion the year before. That increase continues a near unabated increase in pension liabilities since 2000, when the state’s shortfall was just $16 billion. Given Illinois politicians have shown no appetite to amend the constitution to reform pensions, the shortfall is likely to continue its upward trend.

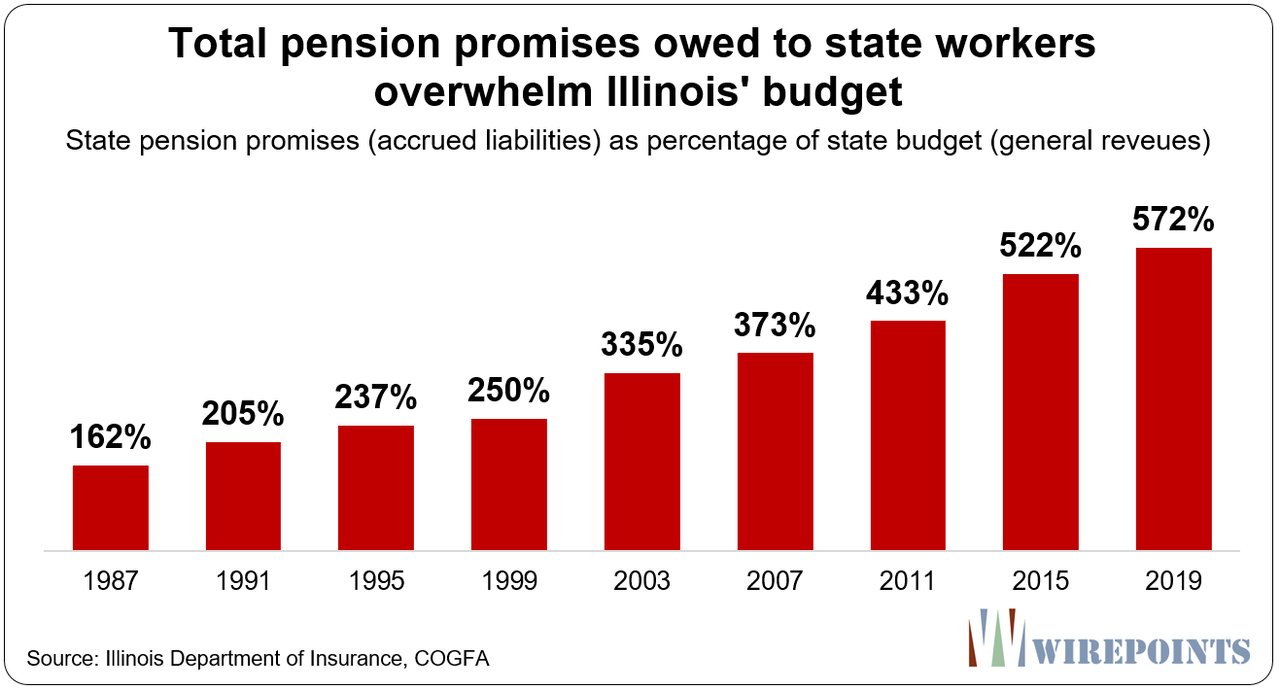

A lack of reform has taken a real toll on taxpayers and the ability of the state to meet its obligations to teachers, state workers, university employees, judges and lawmakers. The state’s accrued liabilities – the sum of the state’s yet-to-be-paid obligations to pensioners and active workers – has grown so quickly that they have overwhelmed the state’s finances.

That stress becomes quickly evident when those total pension obligations are compared to the state’s available tax revenues over time. Wirepoints covered that in our report Illinois state pensions: Overpromised, not underfunded.

In 1987, obligations to members of the five state-run pension funds was $18 billion, or 1.6 times more than the state’s then-general fund budget of $11 billion.

Today, the state’s obligations total $229 billion, or 5.7 times the state’s budget of $40 billion.

That growth in pension obligations has dwarfed the ability of state taxpayers to fund them.

The lack of reform has also forced Illinoisans to contribute a record $10.1 billion in 2019 to pay for state pensions and the debt service on pension obligation bonds. Retirement costs now consume more than a quarter of the budget. No other state in the nation spends that much of their budget on pensions.

In contrast, Illinois taxpayers in 2009 paid just $3.2 billion toward pensions, or 10 percent of the budget.

Taxpayer contributions to pay for pensions have grown by about 13 percent annually since 2009, more than four times the rate of inflation.

What’s most damning about the current pension system is that the nation’s longest-ever bull market (along with billions in additional state contributions) has done nothing to improve the nation’s worst pension crisis. The funded ratio for the state’s five plans has stayed virtually flat – at 40 percent – since 2009, even though markets are now almost four times higher compared to their lows of the Great Recession.

Illinois has the nation’s third-worst funded rate for pensions in the nation, according to Pew Charitable Trusts.

Contributing to this year’s failure was the pension systems inability to meet their investment goals in 2019. The Teachers Retirement Fund’s investments performed the worst, achieving a return of 5 percent compared to the fund’s assumed 7 percent return. And the State Universities’ Retirement System only managed a 6.1 percent return versus a target of 6.75 percent.

It’s worse than what they say

The state’s unfunded liabilities are now at a record $137 billion, nearly three times higher than when the Great Recession started in 2007. But the official numbers are far lower than what Moody’s Investors Service says Illinois’ true shortfall is.

Using more realistic investment assumptions, Moody’s calculates the shortfall for the five state-run funds at $241 billion. That’s the biggest pension shortfall in the nation.

What Moody’s says matters since it currently rates Illinois’ credit risk at just one notch above junk. Illinois has the worst credit rating of any state in the country, according to the agency. On top of that, Moody Analytics, a sister company, also recently found Illinois to be the nation’s second-least prepared state for a recession.

That’s particularly troublesome considering Illinois has another $121 billion in local retirement shortfalls, according to Moody’s, and $73 billion in retiree health debts, too.

Stark warning

Collectively, Illinois’ five pension systems have just 40.2 percent of the funds they need today to be able to meet their obligations in the future, up slightly from 39.8 percent the year before. The university employee fund, SURS, is the best funded of the five, at 42.3 percent, but its funded ratio fell by nearly 2 percentage points this year.

Most notable is the funding ratio for the state lawmaker pensions. Embarrassingly, it’s just 15.9 percent funded.

Wirepoints has remarked several times in the past about the stark warning the state’s pension trend shows: if retirement shortfalls in Illinois continue to grow during a period of remarkable stock market returns, imagine how those funds will fare when the next recession inevitably hits.

Politicians can continue to ignore the crisis, but ordinary residents are seeing their tax bills go up to pay for pensions – both at the state and local level. Just this week, Howmuch.net released a report highlighting the fact that Illinoisans now pay the nation’s highest combined state and local taxes.

Illinois lawmakers must reform pensions, cut retirement debts and roll back collective bargaining laws, or Illinoisans will continue to flee from the taxes imposed to “fix” the crisis.

Read more about Illinois’ worst-in-nation pension crisis:

Tyler Durden

Thu, 12/05/2019 – 17:25

via ZeroHedge News https://ift.tt/38aYxze Tyler Durden