Equity Futures Jump On, You Guessed It, “Increased Hope Of Trade Deal”

After two gloomy days for stocks at the start of the month which led to the worst December for the S&P since 2008, markets rebounded around the globe following an unsourced Bloomberg report that said the trade negotiations with China are still very much on track “according to people who wish to remain anonymous” (such as Larry Kudlow), yet who apparently are too worried to reveal that they have a different agenda than the president. In any case, the lack of new trade deal pessimism coupled with a report that Chinese Ministry of Commerce spokesman said officials are in “close contact” with U.S. counterparts, even though China officially reiterated that the US must rollback existing tariffs to agree to a Phase 1 deal, was sufficient for global stocks to extend their levitation for a second day and for Reuters to proclaim that…

Indeed, the latest batch of headlines around trade suggested the world’s two largest economies were closer to agreeing how many tariffs would be rolled back in a “phase one” trade deal, while President Donald Trump said talks with China were going “very well”. This more optimistic tone around trade helped Wall Street’s main indexes snap a three-day losing streak in the previous session, putting the benchmark S&P 500 index just 1% away from an all-time high hit last week. Of course, things could turn sour fast: if no agreement is reached soon, around $160bn in tariffs on Chinese goods would come into effect from Dec. 15.

Or as DB’s Jim Reid put it:

We are living in a pre-December 15th world where one headline or tweet on trade has the ability to turn a good day into a bad one and visa-versa. The same story has the ability to wipe or add hundreds of billions (even trillions) from/to the value of global financial assets. That’s what we’re dealing with at the moment.

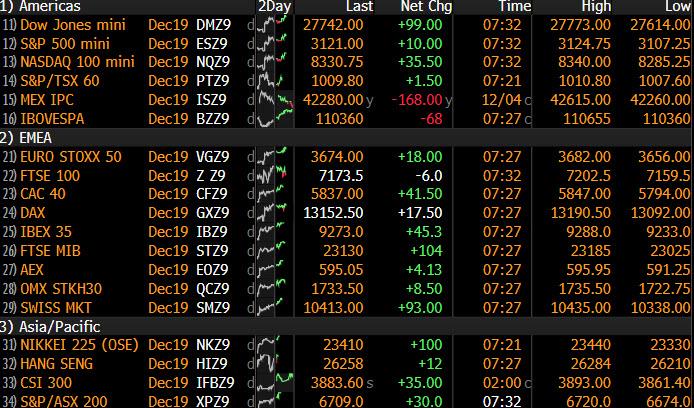

At 7am, Dow e-minis were up 104 points, or 0.38%; S&P 500 e-minis were up 11 points, or 0.35% and Nasdaq 100 e-minis were up 37 points, or 0.45%.

In the US, shares of tariff-sensitive semiconductor companies looked set to rise for the second straight day, with Micron Technology, Advanced Micro Devices and Nvidia gaining between 1% and 1.3% in premarket trading. Among stocks, Dollar General Corp jumped about 5% after the discount store chain raised its full-year profit forecast. Nike shares climbed 2% after a report said Goldman Sachs upgraded the sportswear maker’s stock to “buy” from “neutral”, while Tiffany which is being bought by Louis Vuitton owner LVMH, nudged 0.5% lower after the luxury jeweler fell short of analyst’s estimates for quarterly sales.

European stocks were also a sea of green, as the Stoxx Stoxx Europe 600 rose as much as 0.5%, extending earlier gains, along with U.S. index futures. Most sectors were in the green, led by healthcare +0.9% and retail +0.8%; travel & leisure little changed.

Earlier in the session Asian stocks climbed, led by technology companies; most markets in the region were up, with Australia leading gains and South Korea slipping. Japan’s Topix rose, driven by electronic firms and drug makers, as Prime Minister Shinzo Abe announced a $239 billion stimulus package to support growth. The Shanghai Composite Index closed higher, with China Life Insurance and Foshan Haitian Flavouring among the biggest boosts. The Sensex gained for a second day as India’s central bank defied expectations for a rate cut and kept borrowing costs unchanged

There is other stuff besides trade too: after lackluster readings on domestic services sector activity and private payrolls growth on Wednesday, traders are also awaiting the Labor Department’s non-farm payrolls data due Friday.

Treasuries added to their losses from Wednesday, and were modestly cheaper across the curve, dragged lower by wider losses across bunds and gilts over early European session. Yields were higher by at least 1bp vs Wednesday’s close, 10-year by 1.7bp to ~1.79%; 10-year gilts and bunds underperformed by ~1bp. Indian government bonds tumbled after its central bank unexpectedly left interest rates unchanged.

In FX, the Bloomberg Dollar Spot Index headed for a fifth day of losses. The pound rose for a fifth day against the greenback as expectations grow for a Conservative victory in next week’s election, while the euro stayed near $1.11 as real money interest lent support.

Market Snapshot

- S&P 500 futures up 0.1% to 3,115.50

- STOXX Europe 600 up 0.1% to 403.67

- MXAP up 0.5% to 163.97

- MXAPJ up 0.6% to 521.04

- Nikkei up 0.7% to 23,300.09

- Topix up 0.5% to 1,711.41

- Hang Seng Index up 0.6% to 26,217.04

- Shanghai Composite up 0.7% to 2,899.47

- Sensex up 0.02% to 40,857.88

- Australia S&P/ASX 200 up 1.2% to 6,682.95

- Kospi down 0.4% to 2,060.74

- German 10Y yield rose 1.3 bps to -0.302%

- Euro up 0.1% to $1.1092

- Brent Futures down 0.08% to $62.95/bbl

- Italian 10Y yield rose 0.4 bps to 0.942%

- Spanish 10Y yield rose 1.6 bps to 0.458%

- Brent Futures down 0.08% to $62.95/bbl

- Gold spot up 0.02% to $1,474.91

- U.S. Dollar Index down 0.1% to 97.52

Top Overnight News from Bloomberg

- Japan announced a stimulus package amounting to around 26 trillion yen ($239 billion) spread over the coming years, with fiscal measures around half that figure

- ECB Governing Council members, who collectively lowered the key rate to minus 0.5% shortly before Draghi’s term ended, are increasingly portraying it as a necessary evil that shouldn’t be compounded

- Federal Reserve officials won’t allow the 2020 presidential election to sway their monetary policy decisions and will keep interest rates on hold for the next two years, according to economists surveyed by Bloomberg

- German factory orders unexpectedly declined, suggesting Europe’s largest economy is still struggling to overcome a manufacturing slump and fend off recession

- India’s central bank defied expectations for an interest rate cut, keeping borrowing costs unchanged to assess the effect of its policy after five reductions this year

- Chinese officials are in “close contact” with U.S. counterparts on trade negotiations, Ministry of Commerce spokesman Gao Feng said, while reiterating that tariffs should be reduced proportionately as part of a phase-one accord

- Adrian Lee & Partners, among the largest active currency management firms with over $14 billion in assets, announced Wednesday the launch of a Global Macro Alpha Fund, which will invest in equities and fixed-income alongside currencies at a time when historically-low levels of volatility are making it difficult for some in the industry to make profits from foreign exchange

Asian equity markets were mostly positive as they took their cue from global peers after the trade mood flip-flopped once again to a more positive tone yesterday. ASX 200 (+1.2%) was led by outperformance in the tech and energy sectors amid the trade optimism and recent 4% surge in crude prices, with banks also welcoming the RBNZ’s increased capital requirements as some now expect a lower impact than they had previously anticipated. Nikkei 225 (+0.7%) was underpinned by recent currency moves and with Japan set for a multi-trillion stimulus package, as well as talks with South Korea this month to address the trade spat. Elsewhere, Hang Seng (+0.6%) and Shanghai Comp. (+0.7%) were also lifted on the trade hopes and following the announcement of measures to support the Hong Kong economy, but with gains capped given the lack of actual meaningful breakthrough on the trade front and amid continued PBoC liquidity inaction. Finally, 10yr JGB were initially lower on spill-over selling from USTs and as demand was sapped by the gains across equities, although prices were later rebounded which was helped after the results of the 30yr JGB auction showed slight improvements across all metrics.

Top Asian News

- Japan’s Abe Says Stimulus Opens Path to Future Growth

- India Central Bank Surprises With Pause as Inflation Spikes

- Hedge Fund Sends Letter to Korea Lawmakers on Stock Value Boost

Major European bourses (Euro Stoxx 50 +0.6%) are higher as the market maintains a positive risk tone as it awaits further news on the US/China trade front and the outcome of today’s OPEC & JMMC meetings. The FTSE 100 (-0.1%) is again the laggard, amid a firmer Pound. Elsewhere, the CAC 40 (+0.4%) is holding up well despite France being hit by nationwide strikes, as workers across a range of professions protest French President Macron’s proposed pension reforms. Subsequently, a walk out by air traffic controllers has however resulted in some airlines being hit; Air France (-1.0%) said it was axing 30% of internal flights and 15% of short-haul international routes and easyJet (-0.8%) reportedly cancelled 223 domestic and short-haul international flights and warned that others risk being delayed, although yesterday’s approximate 4% rally in crude oil prices is also likely weighing on airlines in general – other names including IAG (-1.1%) and Deutsche Lufthansa (-1.2%) are also lower. Elsewhere, luxury names including Hermes (+1.6%) and Swatch Group (+1.6%) are on the front foot after Kering (+1.6%) reportedly held explanatory talks with Moncler (+9.2%) regarding a potential combination, which would mark continued consolidation within the sector following LVMH’s (+0.9%) buyout of Tiffany & Co. last month. Sectors are mostly in the green, barring Tech (unch.), Materials (unch.) and Telecoms (-0.1%), the latter weighed by continued underperformance in Orange (-0.7%), with the Co. still suffering following yesterday’s disappointing dividend outlook. In terms of other individual movers; Novartis (+0.7%) shares are underpinned by the news that around 90 innovative new molecular entities are emerging from the Co.’s institutes for BioMed research. Elsewhere, Fiat Chrysler (-0.9%) shares are under pressure after reports that the Co. is in talks with Italian tax authorities regarding an audit, which added that the Co. may be liable for up to USD 1.5bln in “exit tax”. Metro Bank (+0.6%) shares are supported following the resignation of its CEO Donaldson, who will be replaced by Frumkin on an interim basis. Finally, negative broker moves for Siemens (-0.7%), Berkley Group (-0.6%), Vinci (-0.5%) and Tullow Oil (-0.2%) weighs on their shares.

Top European News

- Credit Suisse Wins Order Keeping Critical Report From Prosecutor

- New CEO of U.K.’s Worst Stock of 2019 Will Have Work Cut Out

- Surging Green-Bond Demand Starts Tempting East Europe Borrowers

- Telecom Stocks Drop as Italian Finance Probe, Orange Weigh

In FX, sterling remains on a firmer footing in early EU trade, with the latest poll (Savana/ComRes) showing the market-friendly Conservatives maintaining its lead over Labour vs. the prior survey as election day looms. Aside from that, little pertinent news flow thus far to influence price action. GBP/USD extends gains above 1.3100 before hitting a wall just under the 1.3150 mark, ahead of resistance in the form of a Fib level at 1.3168 followed by 1.3185. Meanwhile, the EUR derives support from a marginally softer USD and largely side-lined a slump (and significant miss) in German industrial orders, albeit the country’s construction PMI indicated a decent rebound. EUR/USD continues to eke modest gains to session highs just under the 1.1100 mark (1.1078-93 intraday range thus far), with hefty options eyeing today’s NY cut – EUR 1.0bln between 1.1090-1.1100 and EUR 2.4bln around 1.1110-25.

- NZD, AUD, CAD – Mixed trade down under with the Kiwi buoyed by the RBNZ’s attempt to bulletproof its financial system via a capital requirement hike in order to withstand economic volatility. The Central Bank also gave lenders an extra two years to raise the required capital and flexibility on how they raise it. NZD/USD remains underpinned but has subsided a bulk of its overnight gains with the pair still in the green but back below its 200 DMA (~0.6540), having hit resistance around 0.6562-65. Meanwhile, the Aussie remains lacklustre on the back of further sub-par data, this time in the form of retail sales and trade balance, with the former printing flat and the latter a smaller surplus than had hoped. AUD/USD remains in the red and closer to the bottom of the current intraday band (0.6855-31) with the pair’s 100 and 50 DMAs (0.6814 and 0.6811 respectively) in the way of the psychological 0.6800. Elsewhere, the CAD remains modestly firmer in the aftermath of yesterday’s BoC hawkish hold and upbeat view on the economy, although traders will be eyeing BoC’s Lane on the docket later today (1245GMT) who is likely to speak on the economy. USD/CAD remains sub-1.3200 having touched a base around 1.3180.

- DXY, JPY – The broad Dollar and Index remain under pressure given the recent string of downbeat data and ahead of the monthly US jobs report tomorrow. DXY manages to stay afloat above 97.50 (just about) having clocked in a current range of 97.49-60 with little in terms of scheduled data/speakers to influence price action. Finally, USD/JPY is relatively flat and just a whisker away from the 109.00 mark, albeit above its 200 DMA at 108.87, with USD 1.4bln in options set to expire around 109.00-15.

In commodities, crude markets eke mild gains as the complex consolidates following yesterday’s strong price action and with participants cautious as they await the outcome of today’s JMMC and OPEC meetings; the former has already begun, while the latter is scheduled to begin at 14:00 GMT. Tomorrow OPEC+ will meet and the final decision on the cartels production cuts will be made. Sources this morning suggested that OPEC+ are to discuss deeper oil output cuts of more than 400k BPD as the main scenario, news which triggered some fleeting upside in crude markets and something which has been alluded to by the Iraqi oil minister on multiple occasions in recent days. This contrasts somewhat with the reported consensus amongst OPEC minister yesterday that a deeper cut will “be harder to pull off this time”. Russian Oil Minister Novak has so far declined to reveal the country’s stance for the upcoming OPEC+ meeting, but the country is expected to resist any push for further cuts; “Russia’s reluctance to deepen the cuts at the risk of compromising its market share and undermining the predictability of its oil rent is now well-known,” said Aperio Intelligence, adding “Russia’s strategy will be to seek to preserve the status quo without either overplaying its hand or overreaching”. Moreover, the country is also pushing to have its condensate output to become exempt from its quota, a request which may prove contentious, especially with Iranian Energy Minister stating that condensates of gas in the OPEC quota system is not a OPEC discussion. In terms of other crude specific news flow; the latest Platts Oil Survey revealed that OPEC pumped 29.65mln BPD of crude in November, with 11 quota members achieving cut compliance of 145%. The survey found that Iraq and Nigeria are still supplying in excess of the cap but are moving closer to compliance. Poor compliance by these members is a point of frustrations for the Saudis; just yesterday, it was reported that the Saudis are threatening to increase production back to its quota level, rather than reducing production by more than is required, due to growing frustration with those not complying with the existing OPEC cut agreement. Thus far, the Saudi’s have shouldered the bulk of the cuts, with recent analysis suggesting that without the Saudi’s overcompliance, OPEC+ compliance would be just 70%. On a different note, Goldman and Barclays provided some updates oil market forecasts; Goldman expects a Brent-WTI differential of USD 4.50/bbl in 2020, from the YTD levels of close to USD 7.0/bbl, while Barclays forecasts Brent to average USD 62/bbl and WTI to average USD 57/bbl for Q4 2019 and 2020. Moving over to metals; gold is slightly lower, amid a lack of demand for havens, but is relatively rangebound about the USD 1480/oz level. Meanwhile, positive risk tone has underpinned copper, which has this morning managed to eclipse yesterday’s USD 2.6655/lbs high, albeit only slightly.

US Event Calendar

- 7:30am: Challenger Job Cuts YoY, prior -33.5%

- 8:30am: Initial Jobless Claims, est. 215,000, prior 213,000; Continuing Claims, est. 1.66m, prior 1.64m

- 8:30am: Trade Balance, est. $48.5b deficit, prior $52.5b deficit

- 10am: Factory Orders, est. 0.3%, prior -0.6%

- 10am: Factory Orders Ex Trans, prior -0.1%

- 10am: Cap Goods Ship Nondef Ex Air, prior 0.8%; Cap Goods Orders Nondef Ex Air, prior 1.2%

- 10am: Durable Goods Orders, est. 0.6%, prior 0.6%; Durables Ex Transportation, est. 0.6%, prior 0.6%

DB’s Jim Reid concludes the overnight wrap

We are living in a pre-December 15th world where one headline or tweet on trade has the ability to turn a good day into a bad one and visa-versa. The same story has the ability to wipe or add hundreds of billions (even trillions) from/to the value of global financial assets. That’s what we’re dealing with at the moment.

Indeed it was another see-saw day for markets yesterday as investors took heart from a Bloomberg report that said the US and China were moving closer towards a trade deal, even amidst the tougher rhetoric between the two sides over non-trade issues in recent days. So carrying on the theme, a couple of journalists writing this story basically helped add around $561 billion to global equity markets yesterday given the market cap of global equities.

Citing “people familiar with the talks”, the article said that the US negotiators thought a phase-one deal would be finished before December 15, when US tariffs on China are scheduled to increase, and that President Trump’s comments the previous day that a deal could wait until after the US election next year shouldn’t be taken as an indication the talks were stalling. Meanwhile, China’s Foreign Minister Wang Yi has said on whether the trade talks can be finished this year that “it depends. China’s stance is very clear. There is hope, as long as it is based on mutual respect and equal consultations.” Elsewhere, Mr Trump has now said that talks with China are going very well before adding, “We will make a lot of progress.” Overnight, CNBC also reported, citing people familiar with the talks, that President Trump’s son-in-law Jared Kushner, who helped bring the US-Mexico-Canada trade agreement to fruition, has increased his direct involvement in the negotiations with China over the past two weeks.

The situation remains highly changeable, but markets nevertheless rallied with the S&P 500 up +0.63% to end a run of 3 successive declines. Trade-sensitive stocks led the advance, with the Philadelphia semiconductor index up +1.55%, its strongest performance in over a week, while the NASDAQ (+0.54%) and the Dow Jones (+0.53%) also closed higher. Energy stocks were the strongest performers among US equities thanks to oil’s advance, with WTI (+3.98%) and Brent Crude (+3.60%) experiencing their best day since the aftermath of the Saudi drone strike in September that saw Brent rally +14.61% in a single session. The move was partially driven by expectations that OPEC will announce an expanded cut to output at today’s meeting, plus US inventories later in the day showed a larger-than-expected drawdown. It was a similar bullish equity story in Europe, with the STOXX 600 up +1.18% to end a run of 4 successive moves lower.

With the risk-on attitude, sovereign bonds sold off on both sides of the Atlantic, with 10yr Treasuries +5.5bps to 1.771%, while the 2s10s curve steepened by +2.1bps.Canadian bonds were the worst performer, +9.5bps after the Bank of Canada’s decision (more on which below), while in Europe 10yr Bunds (+3.3bps), OATs (+3.7 bps) and Gilts (+7.2bps) all lost ground. Higher rates helped bank stocks however, with the S&P 500 banks industry group +1.31% in its best performance for a month, while the STOXX Banks index in Europe was also up +2.08%.

In overnight news, Japan’s PM Shinzo Abe announced a total stimulus package amounting to JPY 26tn (c. $239 bn) spread over the coming years to support the economy. Remember that without a package fiscal would be tightening with tax increases. The total is perhaps bigger than expected but the fresh fiscal measures are not. Of the total, JPY 13.2 tn would be fiscal measures, according to a draft stimulus document seen by Bloomberg. Despite the big headline figure, the initial reaction to the package has been muted given that the headline stimulus figure for such announcements in Japan are typically inflated with promised loans and private-sector assistance and as details indicated that the actual central government spending is just JPY 7.6tn (per Bloomberg). Yields on 10y JGBs are up +1.3bps to -0.045%.

Asian markets are following Wall Street’s lead this morning with the Nikkei (+0.79%), Hang Seng (+0.36%) and Shanghai Comp (+0.41%) all up. The Kospi is down -0.45%. Elsewhere, futures on the S&P 500 are trading flat while the yield on 10y USTs is down -1.6bps.

In other positive news for trade, the House Democrats said overnight that a deal on the stalled U.S.-Mexico-Canada free-trade agreement is within reach and urged Mexico to accept a compromise on labor-rights enforcement. Mexico’s top trade negotiator, Jesus Seade, met yesterday in Washington with his US counterpart, Robert Lighthizer, in an attempt to resolve final details and they are again going to meet today. Elsewhere, in France, unions representing a broad sweep of workers across the country are going on an indefinite “greve,” or strike, starting today in opposition of Prime Minster Macron’s plan for an overhaul of the pension system. So one to watch.

Bloomberg also reported overnight that Elizabeth Warren is drafting a bill that would call on regulators to retroactively review about two decades of “mega mergers” and ban such deals going forward. According to a draft of the bill reviewed by Bloomberg, the proposal would expand antitrust law beyond the so-called consumer welfare standard to also consider the impact on entrepreneurs, innovation, privacy and workers.

Back to yesterday, and the main data releases were the final services and composite PMIs for November from around the world. In terms of the numbers, the Euro Area composite PMI was revised up to 50.6 (vs. flash 50.3), although this strength was somewhat dependent on the country, with Germany revised up to 49.4 (vs. 49.2 flash) while France was revised down to 52.1 (vs. 52.7 flash). In the periphery, where we didn’t have the flash readings as a guide, Italy’s composite PMI fell into contractionary territory at 49.6, its lowest level in 7 months, while Spain saw an increase to 51.9, a 3-month high. On the services PMI for the Euro Area, this was also revised up, now at 51.9 (vs. 51.5 flash).

Turning to the US, and the non-manufacturing ISM index for November fell to 53.9 (vs. 54.5 expected). In a more promising sign, the employment component rose to a 4-month high of 55.5, but this was a contrast to the more negative message from the ADP report of private payrolls, which saw the weakest employment gain in 6 months, at just +67k (vs. +135k expected).

Here in the UK, with just one week now until the general election, sterling was the strongest performing G10 currency for the second day running, up +0.85% against the dollar at its highest level since May. In fact against the euro, sterling was at its highest level since May 2017, way back when the country was in the midst of the last general election campaign. In recent weeks, sterling has been supported by investor hopes that a Conservative majority at the election will support a smooth ratification of the Withdrawal Agreement through Parliament, taking away some of the short-term uncertainty over the Brexit process. The sole poll yesterday came last night and showed a 10pt lead for the Tories – unchanged from the previous poll and in-line with the poll of polls. Sterling was also helped by the PMI revisions, with the composite PMI revised up to 49.3 (vs. flash 48.5).

The Canadian dollar took 2nd place to sterling yesterday, up +0.73% against the US dollar after the Bank of Canada left rates unchanged yesterday at 1.75%. Although in line with expectations, the market took the message to be somewhat hawkish, with the statement from the BoC saying that there was “nascent evidence that the global economy is stabilising”. Looking forward, they said that future decisions would “be guided by the Bank’s continuing assessment of the adverse impact of trade conflicts against the sources of resilience in the Canadian economy”.

Elsewhere, US Treasury Secretary Mnuchin sent a letter to the OECD arguing against unilateral digital services taxes like France’s recent measure. This follows Friday’s report from the USTR which said that the French proposal is discriminatory against US firms. Mnuchin’s letter pushed for multilateral measures via the OECD. For more on the OECD plans see our report on the future of corporate taxes from a few weeks back here .

To the day ahead now, and we’ve got a number of data releases, starting this morning with German factory orders for October, along with the country’s construction PMI for November. We’ll also get the Euro Area’s retail sales figures for October, as well as the final GDP and employment readings for Q3. Then from the US, there’s the October trade balance and factory orders data, along with the final reading for October durable goods orders and non-defence capital goods orders. Finally, there’ll be the weekly initial jobless claims, and from Canada October’s international merchandise trade. In terms of central banks, we’ll hear from the ECB’s Makhlouf, while the Fed’s Quarles will be testifying before the Senate Banking Committee on supervision and regulation.

Tyler Durden

Thu, 12/05/2019 – 08:00

via ZeroHedge News https://ift.tt/2RmrGBr Tyler Durden