How TV Affects Traders

Authored by Bilal Hafeez via MacroHive.com,

You’d think traders are so focused on making money they pay little attention to TV. But that’s not the conclusion of Joel Peress and Daniel Schmidt in their recently published Journal of Finance paper, Glued to the TV: Distracted Noise Traders and Stock Market Liquidity. They find that sensational, non-market related news headlines distract amateur traders, and this ends up impacting the behaviour of small stocks.

The Data

The researchers collected data for retail traders from an online broker and for institutional investors from a transaction processing firm for the period 1964-2014. This allows them to capture the behaviour of 78,000 households and 835 asset managers for certain sub-periods within the sample. Otherwise, they use overall transaction data from the major US stock exchanges.

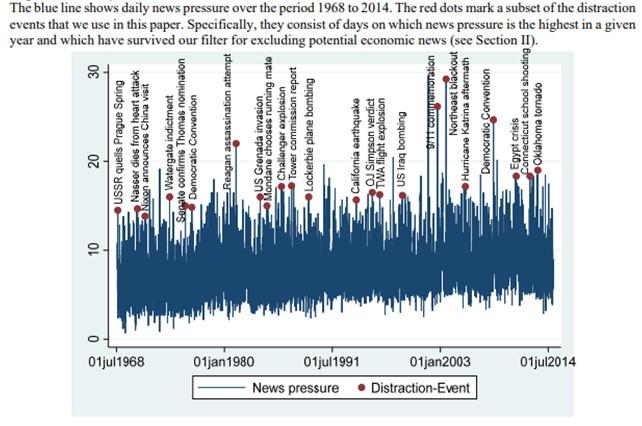

The critical news indicator they developed is based on what they call ‘news pressure’. This variable measures the median number of minutes that US news broadcasts devote to the first three news segments. They focus on only the top decile of news pressure, excluding news related to markets. They end up with 551 days of distraction events from 1968 to 2014 (Chart 1 below, or Figure 2, c.f. paper). Distracting events included:

-

The O. J. Simpson trial verdict

-

The Cessna plane crashing on the White House lawn

-

The Challenger space shuttle explosion

-

Terrorist attacks (Lockerbie plane bombing, Oklahoma City bombing, London bombing)

-

11 assassination attempts (on President Reagan, on Pope John Paul II)

-

Shootings (Littleton school shooting, Virginia Tech massacre, Tucson shooting)

-

Celebrity deaths (Lady Diana, Michael Jackson)

Chart 1: Daily News Pressure and Distraction Events

Source: Glued to the TV: Distracted Noise Traders and Stock Market Liquidity, Page 41.

How Distracted Do Retail and Institutional Traders on Big News Days?

Generally, retail traders get distracted by the news and trade less (i.e. trading volumes fall). Institutional investors are also affected but to a lesser degree. The strongest reaction was found, though, for biased investors – whether retail or institutional.

Biased investors were defined as ones that are typically overconfident, over-traded, and typically loss-making. Such investors would most easily get distracted by sensational news and reduce their trading activity. Ironically, by trading less they often lost less money.

Does Distraction News Affect Market Returns?

For the overall market, Peress and Schmidt find that distraction days do not affect returns. However, when stocks are broken down by retail ownership, they found that the turnover for more retail-owned stocks was statistically affected: volumes fell by around 2.4%. They proxied retail ownership by looking at the market cap and institutional ownership of stocks. Lower values for both would suggest more retail ownership. That is, the effects are more pronounced for small stocks.

They also found that volatility for such stocks fell on distraction days, there were less price reversals, and liquidity (bid-offer) worsened in the stocks.

Has the Effect Changed Over Time?

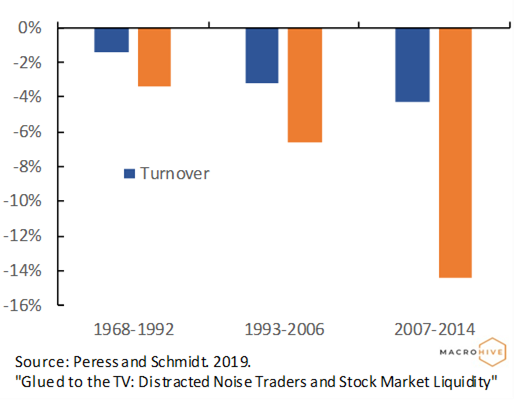

They split the sample into three periods: 1968-1992, 1993-2006, and 2007-2014. The first period corresponds to more ‘traditional’ phone-based markets, the second to the rise of the internet, and the third to the rise of algorithmic trading.

The most striking result is that the negative impact of distraction news days on small stocks has become more pronounced in terms of turnover and price range (Chart 2). The one change, though, is that in the most recent period, market liquidity has not worsened. This is perhaps due to the efficiency of algorithmic trading.

Chart 2: Impact of Distraction News Days on Small Stocks

Bottom Line

That sensational news distracts the less professional traders is an important finding; that this ‘distraction’ impacts the behaviour of small stocks is significant, too. The question is, can we use this insight to develop a trading strategy? No one’s saying we can predict sensational news headlines, but once they occur we might expect lower volatility in small stocks on that day. If the effect persists over the day, rather than lasting just the first few minutes, then a plausible move could be to sell volatility.

Tyler Durden

Thu, 12/05/2019 – 13:05

via ZeroHedge News https://ift.tt/2YqE9Wj Tyler Durden